This report comes with 10% free customization, enabling you to add data that meets your specific business needs.

1h Free Analyst TimeSpeak directly to the analyst to clarify any post sales queries you may have.

The industrialization of the pulp and paper sector began in the late 18th century, with the introduction of mechanized processes. The first mechanized paper machine was installed in 1803, which revolutionized production methods and significantly increased efficiency. The 19th century saw the development of chemical pulping processes, such as the soda and Kraft processes, which allowed for the use of wood as a primary raw material. These innovations made paper more affordable and widely available, leading to a boom in the publication of newspapers, books, and other printed materials. Various government regulations aim to mitigate the industry's ecological impact, including laws mandating recycling and sustainable forestry practices.

Unsustainable practices have led to significant environmental degradation in some regions, prompting advocacy groups like the World Wildlife Fund (WWF) to push for more responsible practices. The WWF works with industry stakeholders to promote sustainable sourcing and reduce the ecological footprint of pulp and paper production. In the United States, for instance, states like California and Connecticut have implemented specific recycling requirements for paper products. Additionally, organizations such as the Forest Stewardship Council (FSC) promote responsible forest management and certification, encouraging companies to source wood from sustainably managed forests.

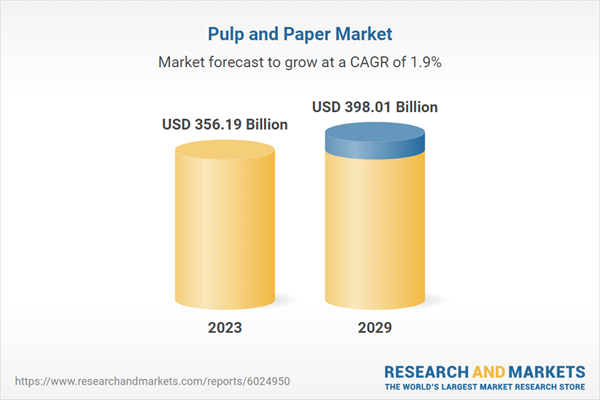

According to the research report, “Global Pulp and Paper Market Outlook 2029” the market is anticipated to cross USD 395 Billion by 2029, increasing from USD 356.19 Billion in 2023. The market is expected to grow with a 1.91% CAGR from 2024 to 2029. The growth of e-commerce and online retail has significantly increased the demand for packaging materials, such as corrugated boxes and paper-based wraps. As global trade continues to expand, the need for sustainable and efficient packaging solutions has become a major driver of market growth.

This has led to innovations in packaging technology, including the development of lightweight and recyclable materials that meet both functional and environmental requirements. Technological developments have also played a crucial role in the market’s growth. Innovations such as the development of advanced pulping techniques, digital printing technologies, and automated production processes have enhanced efficiency and product quality. The shift towards digitalization has enabled better monitoring and control of production processes, reducing waste and improving overall sustainability.

The market also faces some challenges, such as the shifting trend towards digitalization and the insufficient supply of raw materials due to factors like the COVID-19 pandemic. The growing popularity of electronic versions of magazines, newspapers, and books has led to a decline in demand for some print components. Moreover, the rise of new market segments, such as biodegradable and compostable papers, has responded to growing environmental concerns and regulatory requirements. These developments are driven by both consumer demand for greener products and legislation aimed at reducing plastic waste and promoting sustainable materials.

Market Drivers

- Growing E-Commerce and Packaging Demand: The surge in e-commerce and online shopping has significantly impacted the global pulp and paper market. As more consumers purchase goods online, there is a higher demand for packaging materials such as corrugated boxes, paper-based wraps, and protective materials. This trend is particularly strong in regions with booming retail sectors, such as North America and Asia-Pacific. The need for sustainable packaging solutions, driven by consumer preferences and regulatory pressures, is further accelerating the demand for paper-based packaging.

- Sustainability and Environmental Regulations: Environmental concerns and regulatory requirements are major drivers shaping the pulp and paper industry. Governments worldwide are implementing stricter regulations to mitigate the environmental impact of industrial processes, including emissions, waste management, and water usage. In response, the industry is investing in technologies and practices that promote sustainability. This includes using recycled fibers, adopting energy-efficient processes, and reducing the use of hazardous chemicals.

Market Challenges

- Raw Material Supply: One of the significant challenges facing the pulp and paper industry is the volatility in the supply and cost of raw materials. The industry relies heavily on wood pulp, which is subject to fluctuations in supply due to factors such as deforestation, climate change, and regulatory changes affecting forestry practices. Additionally, the cost of raw materials can be influenced by global market dynamics, including trade policies and geopolitical tensions.

- Environmental Impact: Despite advancements in sustainability, the pulp and paper industry continues to face challenges related to its environmental footprint. The production process can be resource-intensive, involving significant water and energy consumption, and generating substantial waste and emissions. Managing these environmental impacts requires ongoing investments in cleaner technologies and waste management practices.

Market Trends

- Digitalization and Technological Innovation: The pulp and paper industry is undergoing a technological transformation, driven by digitalization and automation. Innovations such as advanced data analytics, artificial intelligence (AI), and machine learning are being integrated into production processes to enhance efficiency, optimize resource use, and improve product quality. Digitalization also supports better supply chain management and predictive maintenance, reducing downtime and operational costs. The adoption of Industry 4.0 technologies is helping companies adapt to changing market demands and improve their competitive edge.

- Shift towards Circular Economy: The concept of a circular economy is gaining traction within the pulp and paper industry, focusing on reducing waste and maximizing resource efficiency. This trend involves increasing the use of recycled materials, designing products for longer life cycles, and implementing closed-loop production systems. Companies are exploring ways to close the loop by recycling paper products back into the production process and reducing reliance on virgin fibers.

The wrapping and packaging segment has absorbed the largest share of pulp and paper applications today attributed to accelerating demand from various industries seeking sustainable packaging solutions driven mainly by environmental concerns and consumer preference shifts.

Wrapping and packaging happened to be one of the major segment in pulp and paper markets that emerged as the leader for all those reasons that speak for sustainability and efficiency. Increasing concern over the deteriorating environment has made consumers and industries look green in their packaging. This trend is more pronounced in food and beverages, pharmaceuticals, and FMCG industries wherein sustainable packaging has long ceased to be a trend but a need. E-commerce has further increased the intensity of demand for this requirement as it suggests that products are shipped over long distances with a greater risk of transit damage.Corrugated boxes and paper bags protect commodities while appealing to the environmentally sensitive consumer who chooses to use recycled products instead of plastics. Paper-based packaging solutions have been encouraged by the regulation policies of governments to reduce plastic usage in waste. The pulps are sourced from renewable sources in comparison with traditional plastics. Advancements in manufacturing technologies have also seen quality improvement and functionality for paper packaging to compete well with plastic substitutes.

The recycling and reuse of the product make a vital contribution to reducing waste, since it is well aligned with the vision of global sustainability efforts. Growth in the wrapping and packaging segment would likely be sustained through innovative developments in biodegradable materials and recycling processes as companies embrace greener practices.

The highest demand seen in the pulp and paper market today is being driven by the food and beverage sector, mainly because of the increasing demand for sustainable packaging solutions that align with growing environmental concerns.

As a primary consumer of packaging materials, the consumption by the food and beverage industry has noticeably paved the way for the pulp and paper market as a whole to favor paper-based packaging over traditional plastic. Paper packaging is recyclable; it is also biodegradable, thus being more environmentally friendly. This has made manufacturers to invest more in innovative paper packaging that is both functional and enviro-friendly. E-commerce has also heightened demand because online retailers need efficient and protective packaging to keep goods safe during delivery. More seriously, however, regulatory pressures to reduce plastic consumption have pushed companies in the food and beverage industry toward paper-based alternatives as well.Applications such as takeout containers and beverage cartons are not excluded from this trend, whereby paper products receive preference over others owing to their ability to mitigate carbon footprints and enhance brand image through some sustainability initiatives. The Asia-Pacific region has emerged as a significant player in this market; even countries like China and India have seen vast growth in the food processing and packaging industries. Urbanization and consumer incomes are huge drivers of this growth, also significantly increasing the demand for packaged food products.

Asia-Pacific is leading the pulp and paper industry primarily due to rapid industrialization, robust economic growth, and a growing population, which collectively drive the demand for paper products, especially in packaging.

The rapid industrialization in countries like China and India has significantly increased the demand for paper products across various sectors. As these economies continue to expand, there is a heightened need for packaging materials, printing papers, and specialty papers, which are essential for supporting the burgeoning retail and manufacturing industries. For instance, China has become the largest consumer and producer of paper globally, primarily driven by its extensive manufacturing base and export-oriented economy. The country’s demand for sustainable packaging solutions has also surged, reflecting a global shift towards eco-friendly alternatives to plastic.The region's robust economic growth is another critical factor contributing to its dominance in the pulp and paper industry. As disposable incomes rise, consumers are increasingly inclined to purchase packaged goods, personal care items, and educational materials, all of which rely heavily on paper-based products. The expanding middle class in many Asia-Pacific countries is driving this trend, as consumers seek higher-quality products and are willing to spend more on sustainable and aesthetically pleasing packaging. The Asia-Pacific region benefits from a rich supply of raw materials, including wood, bamboo, and agricultural residues, which are crucial for pulp production. The availability of these resources, combined with advancements in technology and manufacturing processes, allows for efficient production and cost-effective operations.

- On April 10, 2024, Georgia-Pacific Investing More than $150 Million to Grow the Consumer Tissue Business This investment is to rebuild a 1965-vintage paper machine into a world-class machine to make paper for Angel Soft® and strategic private label bath tissue. This modernization project helps position the mill and the overall business to continue to be competitive in the market.

- On April 15, 2024, this spring, UPM launched a new service package, UPM Nature Management Services, to provide Finnish forest owners with more options to enhance biodiversity. The first nature management services to be offered are assisting forest owners in applying for an environmental subsidy and a controlled burning service. More new services are available later this year.

- In August 2023, Atlas Holdings ("Atlas") has closed the previously announced acquisition of the pulp, newsprint, and directory paper mill operations in Thunder Bay, Ontario from Resolute FP Canada Inc.

Considered in this report

- Historic year: 2018

- Base year: 2023

- Estimated year: 2024

- Forecast year: 2029

Aspects covered in this report

- Pulp & Paper market Outlook with its value and forecast along with its segments

- Various drivers and challenges

- On-going trends and developments

- Top profiled companies

- Strategic recommendation

By Category

- Wrapping & Packaging

- Printing & Writing

- Sanitary

- News Print

- Others

By End User

- Food and Beverages

- Personal Care and Cosmetics

- Healthcare

- Consumer Goods

- Education and Stationary

- Others

The approach of the report:

This report consists of a combined approach of primary and secondary research. Initially, secondary research was used to get an understanding of the market and list the companies that are present in it. The secondary research consists of third-party sources such as press releases, annual reports of companies, and government-generated reports and databases.After gathering the data from secondary sources, primary research was conducted by conducting telephone interviews with the leading players about how the market is functioning and then conducting trade calls with dealers and distributors of the market. Post this; we have started making primary calls to consumers by equally segmenting them in regional aspects, tier aspects, age group, and gender. Once we have primary data with us, we can start verifying the details obtained from secondary sources.

Intended audience

This report can be useful to industry consultants, manufacturers, suppliers, associations, and organizations related to the Pulp & Paper industry, government bodies, and other stakeholders to align their market-centric strategies. In addition to marketing and presentations, it will also increase competitive knowledge about the industry.Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- International Paper Company

- Kimberly-Clark Corporation

- UPM-Kymmene Oyj

- Oji Holdings Corporation

- Sappi Limited

- Suzano S.A.

- Kemira Oyj

- Georgia-Pacific LLC

- Nippon Paper Industries Co., Ltd.

- Nine Dragons Paper Limited

- DS Smith plc

- Sylvamo

- Verso Corporation

- Rengo Co Ltd

- Metsä Board Oyj

- Holmen AB

- Stora Enso Oy

- JK Paper Ltd.

- Celulosa Argentina S.A.

- Klabin S.A.

- Empresas CMPC S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | October 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 356.19 Billion |

| Forecasted Market Value ( USD | $ 398.01 Billion |

| Compound Annual Growth Rate | 1.9% |

| Regions Covered | Global |