The Asia Pacific region witnessed 41% revenue share in this market in 2023. This growth can be attributed to the rapid expansion of the food and beverage industry in countries like China and India, where this gum is increasingly used as a thickening and stabilizing agent. Additionally, the region's booming pharmaceutical sector is driving demand for this gum in drug formulations. Thus, the Asia Pacific region consumed a volume of 17,635.16 Tonnes in 2023.

Increasing awareness of gluten intolerance and celiac disease has led many consumers to adopt gluten-free diets. People with these conditions experience adverse reactions to gluten, a protein found in wheat, barley, and rye. As a result, there is a heightened demand for gluten-free products, prompting food manufacturers to innovate and expand their gluten-free offerings. This gum, being a popular ingredient in gluten-free formulations, helps improve texture, viscosity, and overall product quality. Therefore, the rising prevalence of gluten-free products is driving the market’s growth.

Additionally, There is a marked increase in consumer awareness regarding the ingredients in cosmetics and their potential impact on health and the environment. Many consumers are becoming more educated about the benefits of natural and organic ingredients, leading them to prefer products that are perceived as safer and more environmentally friendly. As a result, cosmetic brands are reformulating their products to meet this demand, often incorporating this gum as a natural thickening and stabilizing agent. thus, driving its demand in the cosmetics market. Thus, the rise in natural and organic cosmetics drives the market’s growth.

However, this gum production primarily relies on raw materials such as corn and soy, which are key inputs for the fermentation process. These agricultural commodities are subject to price fluctuations based on various factors, including weather conditions, crop yields, and changes in supply and demand. Adverse weather conditions like droughts, floods, and storms can negatively impact crop yields. Poor harvests lead to shortages in the supply of corn and soy, driving up their prices. Therefore, fluctuations in the prices of raw materials are impeding market expansion.

Driving and Restraining Factors

Drivers

- Rising Prevalence Of Gluten-Free Products

- Rise In Natural And Organic Cosmetics

- Expansion Of Pharmaceutical Industry Worldwide

Restraints

- Price Volatility Of Raw Materials

- Increasing Competition From Substitutes

Opportunities

- Rising Health And Wellness Trends

- Expansion Of The Processed Food Industry

Challenges

- Microbial Contamination Risk In Xanthan Gum

- High Energy Consumption In Production

Form Outlook

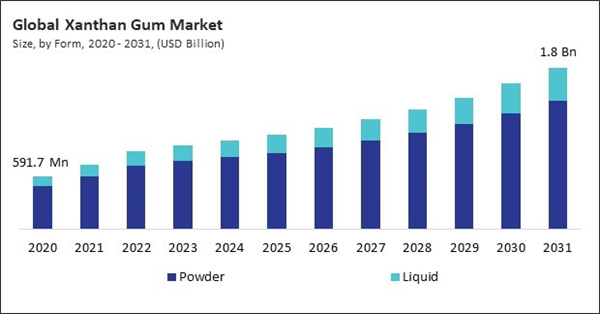

Based on form, this market is divided into powder and liquid. The liquid segment attained 19% revenue share in this market in 2023. Liquid xanthan gum ensures better homogeneity in formulations than powdered forms. This is particularly important for products where a smooth and consistent texture is desired, such as beverages and sauces. Also, liquid forms eliminate the risk of dust generation during handling and mixing. In terms of volume, the segment would register 28,356.55 Tonnes in 2023.End Use Industry Outlook

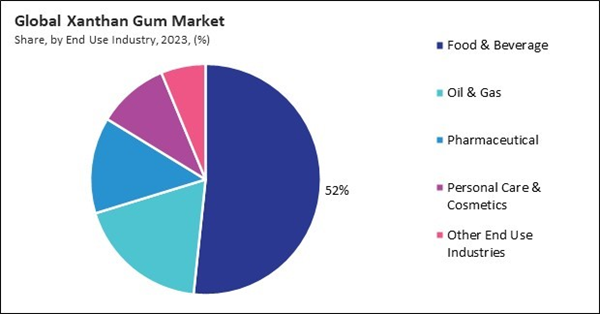

Based on end use industry, this market is categorized into food and beverage, oil & gas, pharmaceutical industry, and personal care & cosmetics, and others. The oil & gas segment witnessed 19% revenue share in this market in 2023. This gum is widely used in drilling fluids due to its ability to increase viscosity and stabilize the mixture during the drilling process. Its effectiveness in controlling fluid loss and improving the overall efficiency of drilling operations makes it essential in this industry. The increasing exploration and production activities in the oil and gas sector contribute to the growing demand for this gum.Grade Outlook

On the basis of grade, this market is segmented into food grade, industrial grade, pharmaceutical grade, and others. In 2023, the industrial-grade segment attained a noteworthy revenue share in this market. This grade is used in various industrial applications such as oil and gas, cosmetics, and personal care products. In the oil and gas industry, this gum is employed as a drilling fluid additive due to its ability to increase viscosity and stabilize the drilling process. In terms of volume, the segment would register 28,356.55 Tonnes in 2023.Regional Outlook

Region-wise, this market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the North America region generated 28% revenue share in this market. The region's well-established food and beverage sector is a significant driver, with manufacturers leveraging this gum for its functional properties in various products. Additionally, the pharmaceutical industry in North America is robust, with an increasing focus on developing advanced drug delivery systems that utilize this gum as an excipient.List of Key Companies Profiled

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- Archer Daniels Midland Company

- Foodchem International Corporation

- Desosen Biochemical (Ordos) Ltd.

- Tate & Lyle PLC

- Ingredion Incorporated

- Solvay SA

- Bob's Red Mill Natural Foods, Inc.

- Meihua Holdings Group Co, Ltd

Market Report Segmentation

By Form (Volume, Tonnes, USD Billion, 2020-2031)

- Powder

- Liquid

By End Use Industry (Volume, Tonnes, USD Billion, 2020-2031)

- Food & Beverage

- Oil & Gas

- Pharmaceutical

- Personal Care & Cosmetics

- Other End Use Industries

By Grade (Volume, Tonnes, USD Billion, 2020-2031)

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

- Other Grades

By Geography (Volume, Tonnes, USD Billion, 2020-2031)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Cargill, Incorporated

- DuPont de Nemours, Inc.

- Archer Daniels Midland Company

- Foodchem International Corporation

- Desosen Biochemical (Ordos) Ltd.

- Tate & Lyle PLC

- Ingredion Incorporated

- Solvay SA

- Bob's Red Mill Natural Foods, Inc.

- Meihua Holdings Group Co, Ltd