The North America segment witnessed 34% revenue share in the network security sandbox market in 2023. The United States and Canada are home to many of the world’s leading technology companies and cybersecurity solution providers, fostering continuous innovation in security practices. This region has seen a marked increase in cyberattacks targeting critical infrastructure, including healthcare, financial services, and energy sectors, prompting organizations to adopt more advanced cybersecurity solutions like these sandboxes.

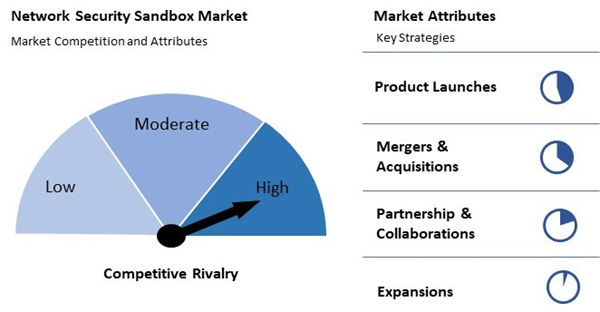

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2024, Fortinet, Inc. unveiled updates to its generative AI portfolio, introducing the first AI-powered IoT security assistant. Addressing a cybersecurity skills gap of nearly 4 million, FortiAI aids SecOps and NetOps teams in managing networks and responding to threats more efficiently through a user-friendly, natural language interface.

Moreover, In October, 2024, Juniper Networks, Inc. unveiling its security services into an AI-centric framework with its new Secure AI-Native Edge and cloud-based Security Assurance. These offerings aim to provide a unified view of network health and security, leveraging Mist AI and Marvis virtual assistant to detect anomalies and resolve issues efficiently.

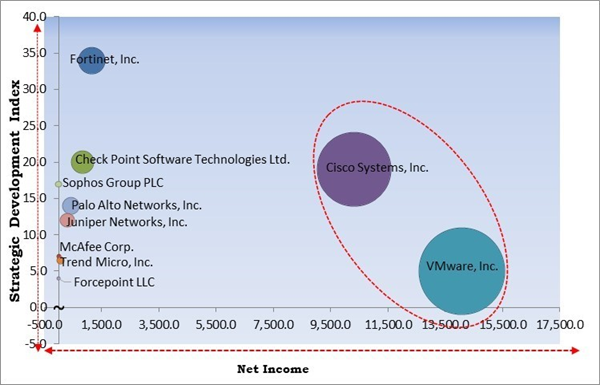

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Cisco Systems, Inc., VMware, Inc. (Broadcom Inc.) are the forerunners in the Network Security Sandbox Market. In August, 2024, Cisco Systems, Inc. unveiled Multiple vulnerabilities in Cisco NX-OS Software's Python interpreter that could allow a low-privileged, authenticated attacker to escape the Python sandbox and execute arbitrary commands on the underlying OS. Exploitation requires Python execution privileges. Companies such as Fortinet, Inc., Check Point Software Technologies Ltd., and Palo Alto Networks, Inc. are some of the key innovators in Network Security Sandbox Market.Market Growth Factors

The rising sophistication of cyberattacks has become a significant challenge, with threats such as zero-day attacks, Advanced Persistent Threats (APTs), and ransomware becoming more common and dangerous. Zero-day attacks exploit unknown software vulnerabilities, making them difficult to detect until a patch is available, leaving systems exposed. Hence, these factors will aid in the growth of the market.Additionally, the expansion of digital transformation has become a global priority for businesses seeking to enhance efficiency, improve customer engagement, and remain competitive. Across various industries, organizations are adopting cloud services, deploying Internet of Things (IoT) devices, and embracing remote work models. For instance, in the United States, retail giants like Walmart have invested heavily in cloud-based platforms to streamline inventory management and improve the online shopping experience. Thus, as digital transformation continues to expand globally, the role of these sandboxes becomes increasingly crucial in safeguarding the growing attack surface.

Market Restraining Factors

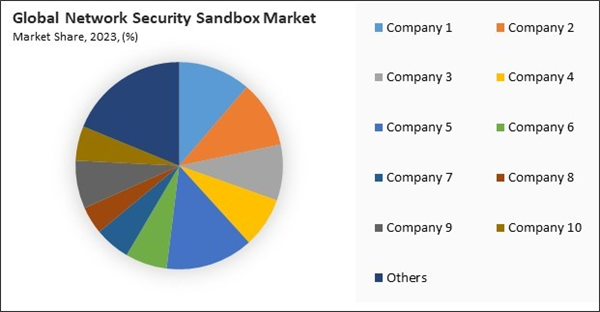

However, Deploying sandbox solutions often requires a substantial initial investment, which can be a deterrent for many organizations. This investment includes acquiring the necessary hardware to run the sandbox environment, such as high-performance servers and storage systems, which are crucial for processing and analyzing potentially malicious files and traffic. Hence, such high costs may hamper the growth of the market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Driving and Restraining Factors

Drivers

- Rising Sophistication Of Cyber Attacks

- Expansion Of Digital Transformation

- Increased Adoption Of Cloud-Based Security Solutions

Restraints

- High Implementation Costs Associated With Network Security Sandbox Solutions

- Complexity Of Integration With Existing Security Frameworks

Opportunities

- Advancements In Artificial Intelligence And Machine Learning

- Increasing Focus On Endpoint Security

Challenges

- Demand For A High Level Of Expertise In Cybersecurity

- Growing Use Of Evasion Techniques By Cybercriminals

Enterprise Size Outlook

By enterprise size, this market is divided into SMEs and large enterprises. The SMEs segment garnered 45% revenue share in this market in 2023. Network security sandboxes offer a cost-effective solution for SMEs to strengthen their defenses without building large-scale security operations centers. As cloud adoption among SMEs rises, these businesses increasingly turn to sandbox solutions to secure their cloud environments and remote work setups.End Use Outlook

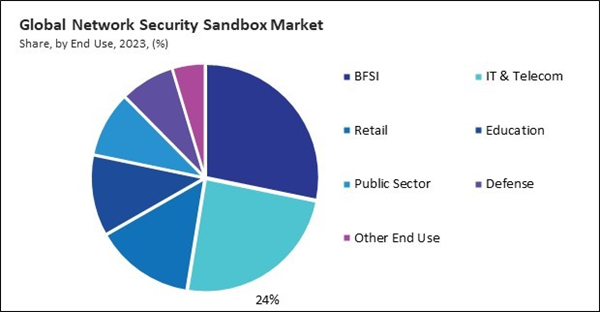

Based on end use, this market is segmented into BFSI, IT & telecom, retail, education, public sector, defense, and others. The public sector segment recorded 9% revenue share in this market in 2023. As governments increasingly digitize public services and engage in e-governance initiatives, their digital infrastructure has become a target for cybercriminals seeking to disrupt public services or steal sensitive data.Component Outlook

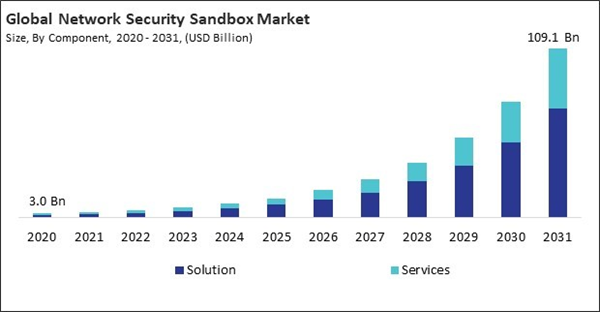

Based on component, this market is bifurcated into solution and services. The services segment procured 33% revenue share in this market in 2023. Many organizations lack in-house cybersecurity expertise, making professional services valuable to their security strategies. Services such as initial setup, ongoing monitoring, and customization of sandboxing tools help businesses leverage these solutions more effectively.Regional Outlook

Region-wise, this market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment garnered 32% revenue share in this market in 2023. European Union regulations, most notably the General Data Protection Regulation (GDPR), have placed strict requirements on how organizations handle and protect personal data. As a result, there has been a rise in investment in sophisticated security solutions to prevent data intrusions and guarantee adherence to these regulations.Market Competition and Attributes

In the Network Security Sandbox Market, competition without top key players focuses on smaller, niche providers offering specialized or cost-effective solutions. These players often emphasize innovation, agility, and customization to cater to specific industry needs, competing on technological advancements, enhanced threat detection, and affordability to gain market share.

Recent Strategies Deployed in the Market

- Aug-2024: Fortinet, Inc. announced the acquisition of Lacework, a cloud security leader. The move enhances Fortinet's commitment to delivering unified security across on-premises and cloud environments. Integrating Lacework’s cloud-native platform strengthens Fortinet's AI-driven, full-stack security offerings.

- Aug-2024: Fortinet, Inc. announced the acquisition of Next DLP, a leader in insider risk and data protection, to enhance its data loss prevention (DLP) capabilities. This acquisition strengthens Fortinet’s position in the standalone enterprise DLP market and aligns with its strategy to provide top-tier security solutions for enterprises across SASE and endpoint deployments.

- Jun-2024: Trend Micro announced a partnership with Nvidia, an American software company, to provide cybersecurity tools safeguarding private AI clouds, emphasizing data privacy, real-time analysis, and swift threat response.

- May-2024: Fortinet, Inc. unveiled a new next-generation firewall (NGFW) appliance, the FortiGate 200G series. Featuring FortiOS and the fifth-generation SP5, it enhances firewall throughput and supports FortiGuard AI-Powered Security Services and 5GE ports, catering to modern campus networking and security needs.

- May-2024: Palo Alto Networks, Inc. unveiled new security solutions to combat AI-generated attacks and secure AI-designed systems. Utilizing Precision AI, which integrates machine learning, deep learning, and generative AI, the company aims to provide proactive, AI-driven security that can outpace adversaries and safeguard networks and infrastructure effectively.

List of Key Companies Profiled

- Cisco Systems, Inc.

- VMware, Inc. (Broadcom Inc.)

- Fortinet, Inc.

- McAfee Corp.

- Palo Alto Networks, Inc.

- Trend Micro, Inc.

- Forcepoint LLC (Francisco Partners)

- Juniper Networks, Inc.

- Check Point Software Technologies Ltd.

- Sophos Group PLC (Thoma Bravo)

Market Report Segmentation

By Component

- Solution

- Services

- Product Subscription

- Professional Consulting

- Support & Maintenance

- Training & Education

By Enterprise Size

- Large Enterprises

- SMEs

By End Use

- BFSI

- IT & Telecom

- Retail

- Education

- Public Sector

- Defense

- Other End Use

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Cisco Systems, Inc.

- VMware, Inc. (Broadcom Inc.)

- Fortinet, Inc.

- McAfee Corp.

- Palo Alto Networks, Inc.

- Trend Micro, Inc.

- Forcepoint LLC (Francisco Partners)

- Juniper Networks, Inc.

- Check Point Software Technologies Ltd.

- Sophos Group PLC (Thoma Bravo)