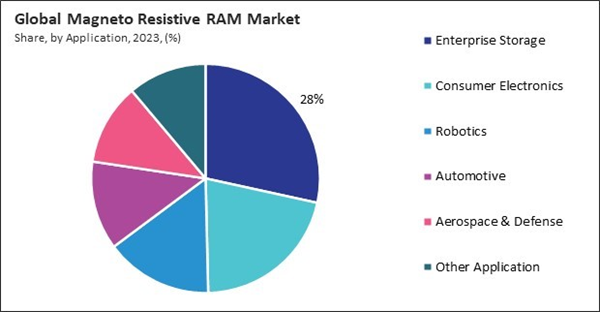

MRAM's characteristics, like fast data access speeds, low power consumption, and high endurance, make it a suitable option for these devices, which require reliable memory to manage complex tasks and high-speed data processing. As consumer expectations for faster, more capable, and more energy-efficient devices increase, the adoption of MRAM in the consumer electronics segment continues to expand.

Consequently, the consumer electronics segment recorded 21% revenue share in the market in 2023. As the demand for memory solutions that may increase performance and extend the battery life of portable devices, such as smartphones, tablets, and wearables, continues to rise, the expansion of the consumer electronics sector is being driven by this demand.

The rise of autonomous driving has amplified the need for memory solutions that can operate reliably in extreme conditions, such as high temperatures and constant vibration. MRAM's robustness and durability make it well-suited for autonomous vehicles, where continuous data storage and retrieval are required for navigation, environment sensing, and decision-making. Additionally, beyond funding and research support, governments have created a conducive environment for MRAM innovation through favorable policies, such as tax incentives and subsidies for semiconductor manufacturing.

These measures have encouraged the scaling up MRAM production, reducing costs and making it more accessible for broader use in industries like automotive and industrial automation. Thus, by focusing on building domestic semiconductor capabilities and supporting new memory solutions, these initiatives are helping to shape the future of MRAM technology, driving the expansion of the market.

However, MRAM remains relatively expensive, especially when compared to more established memory types like DRAM and SRAM, which have benefited from economies of scale and long-standing process optimization. The higher costs make MRAM less appealing for mass adoption, particularly in applications where cost is critical, such as consumer electronics. For industries and applications with tight budget constraints, the high price point of MRAM becomes a barrier, slowing down its broader implementation despite its technical advantages like non-volatility and high endurance. Hence, reducing manufacturing costs remains a significant challenge for the widespread commercialization of MRAM.

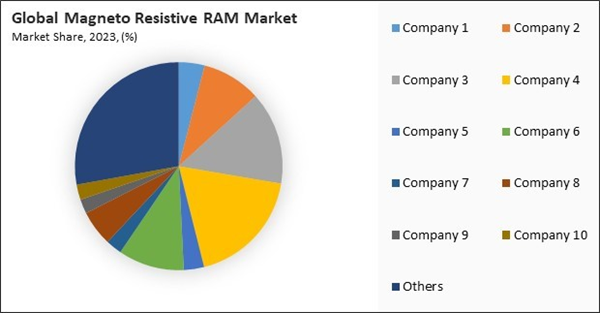

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Growing Adoption in the Automotive Industry

- Extensive Support from Government Initiatives

- Expansion of Data Centers Globally

Restraints

- Complex Manufacturing Processes and the Need for Specialized Equipment

- Competition From Established Memory Technologies

Opportunities

- Rising Demand for Industrial Automation

- Rapid Advancements in MRAM Technology

Challenges

- Difficulty of Scaling Down MRAM to Smaller Process Nodes

- Limited Awareness and Adoption

Application Outlook

On the basis of application, the market is classified into automotive, consumer electronics, robotics, enterprise storage, aerospace & defense, and others. The enterprise storage segment acquired 28% revenue share in the market in 2023. The enterprise storage segment leads the market due to the increasing demand for fast, energy-efficient, and reliable memory solutions in data centers and cloud infrastructure. As enterprises manage ever-growing volumes of data, memory that provides low latency, high endurance, and non-volatility becomes crucial for ensuring quick data retrieval and seamless performance.Material Outlook

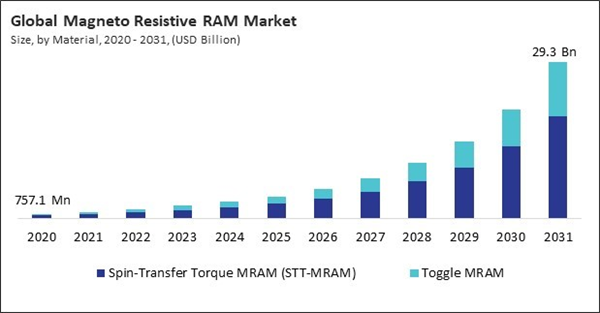

Based on material, the market is bifurcated into toggle MRAM and spin-transfer torque MRAM (STT-MRAM). The toggle MRAM segment procured 32% revenue share in the market in 2023. The toggle MRAM segment continues to maintain a strong presence in the market due to its reliability, robustness, and simpler design architecture. Toggle MRAM uses magnetic field switching, making it well-suited for applications prioritizing durability over density, such as industrial automation, aerospace, and defense.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America segment garnered 36% revenue share in the market in 2023. This growth is driven by the strong demand for advanced memory solutions in sectors such as data centers, aerospace, and defense, as well as the presence of significant technology companies and extensive research and development activities. Government initiatives and substantial investments in the semiconductor industry have facilitated the region's status as a critical market, which is a result of its emphasis on innovation and the incorporation of next-generation technologies.List of Key Companies Profiled

- Honeywell International, Inc.

- Infineon Technologies AG

- Intel Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

- Renesas Electronics Corporation

- Micron Technology, Inc.

- Everspin Technologies, Inc.

- NVE Corporation

- Avalanche Technology Inc.

- Crocus Technology, Inc.

Market Report Segmentation

By Material

- Spin-Transfer Torque MRAM (STT-MRAM)

- Toggle MRAM

By Application

- Enterprise Storage

- Consumer Electronics

- Robotics

- Automotive

- Aerospace & Defense

- Other Application

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Honeywell International, Inc.

- Infineon Technologies AG

- Intel Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

- Renesas Electronics Corporation

- Micron Technology, Inc.

- Everspin Technologies, Inc.

- NVE Corporation

- Avalanche Technology Inc.

- Crocus Technology, Inc.