The North America segment procured 37% revenue share in this market in 2023. This leadership is attributed to the region's advanced technological infrastructure, significant investments in security solutions, and strong regulatory frameworks to protect critical infrastructure. The United States, in particular, has prioritized securing key sectors such as energy, transportation, and financial services against physical and cyber threats.

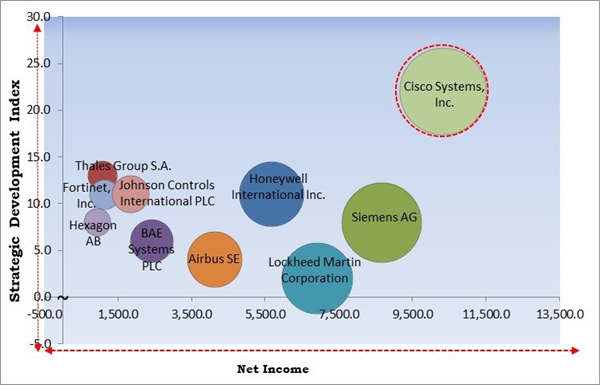

The major strategies followed by the market participants are Acquisitions as the key developmental strategy to keep pace with the changing demands of end users. For instance, In July, 2023, Honeywell International Inc. announced the acquisition of SCADAfence, a leader in OT and IoT cybersecurity. This acquisition enhances Honeywell's capabilities in asset discovery, threat detection, and security governance, helping customers protect critical industrial systems from cyberattacks.

Moreover, In September, 2024, BAE Systems PLC announced the acquisition of Kirintec, a UK-based cyber and electromagnetic activities (CEMA) company to enhance protection against cyber and electromagnetic threats, complementing BAE’s capabilities. It will join BAE’s Digital Intelligence division, expanding its electronic warfare and force protection portfolio.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Cisco Systems, Inc. is the forerunner in the Critical Infrastructure Protection Market. In March, 2024, Cisco Systems Inc. took over Splunk Inc., boosting security and observability through a unified digital perspective. This merger ensures improved security, observability, networking, AI, and economic benefits, delivering transformative solutions for customers across diverse industries. Companies such as Siemens AG, Lockheed Martin Corporation, and Honeywell International Inc. are some of the key innovators in Critical Infrastructure Protection Market.Market Growth Factors

The increasing number of cyber-attacks has become a significant concern for critical infrastructure sectors such as energy, transportation, and utilities. These threats range from traditional attacks like viruses and malware to more complex exploits, including advanced persistent threats (APTs), ransomware, and phishing schemes. As the Federal Bureau of Investigation (FBI) and International Monetary Fund (IMF) data indicate, the average annual cost of cybercrime will increase from $8.4 trillion in 2022 to over $23 trillion in 2027. Hence, such factors are propelling the growth of the market.Additionally, Critical infrastructure - such as energy grids, water supply systems, transportation networks, and communication frameworks - forms the backbone of modern society. Disrupting these sectors could affect public safety, economic stability, and national security. In North America, the NERC CIP standards have become a cornerstone of the regulatory framework for the energy sector. Thus, as threats to these sectors become more complex, organizations must align with these regulations, aiding the market's growth.

Market Restraining Factors

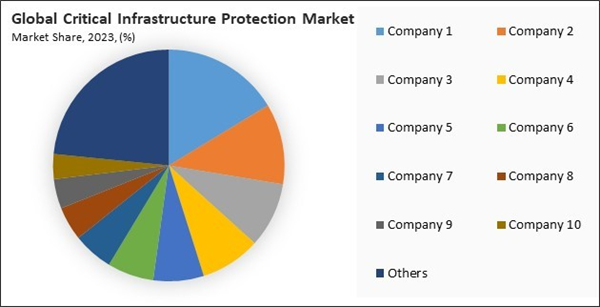

Moreover, these CIP solutions often require advanced technologies like sophisticated surveillance systems, robust cybersecurity infrastructure, and physical security measures. For instance, deploying state-of-the-art surveillance systems can involve purchasing high-resolution cameras, integrating AI-driven analytics software, and maintaining data storage capabilities. Hence, the high costs associated with implementing and maintaining CIP solutions can deter organizations from adopting these critical measures, ultimately impacting the growth of the market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Mergers & Acquisition.

Driving and Restraining Factors

Drivers

- Growing Threat Of Sophisticated Cyber-Attacks

- Implementation Of Strict Regulations And Compliance Requirements

- Growing Importance Of Iot And Automation

Restraints

- High Initial Investment And Operational Costs

- Constant Cybersecurity Threat Evolution

Opportunities

- Rising Terrorist Threats And Geopolitical Tensions

- Expansion Of Smart Cities And Critical Infrastructure Projects

Challenges

- Substantial Lack Of Skilled Professionals

- Challenges In Integrating New CIP Solutions

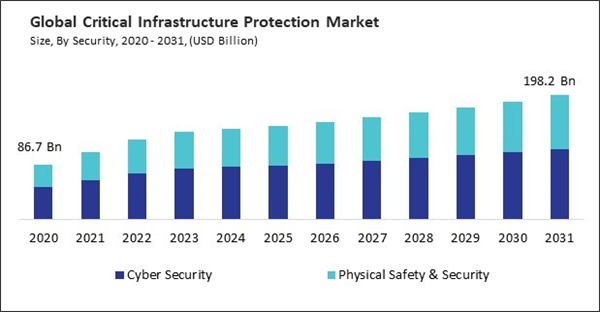

Security Outlook

On the basis of security, the critical infrastructure protection market is classified into physical safety & security and cyber security. The physical safety & security segment acquired 42% revenue share in this market in 2023. This segment includes technologies and solutions to safeguard physical assets and facilities, such as surveillance systems, access control, perimeter protection, and emergency response systems. The demand for these solutions is driven by the need to protect critical sites like power plants, transportation hubs, and water treatment facilities from physical intrusions, vandalism, and terrorism.End Use Outlook

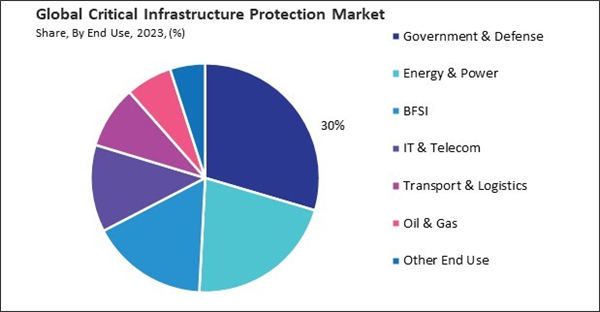

By end use, the critical infrastructure protection market is divided into BFSI, energy & power, government & defense, IT & telecom, transport & logistics, oil & gas, and others. The energy & power segment witnessed 21% revenue share in this market in 2023. This dominance is due to the critical nature of energy infrastructure, including power facilities, smart grids, and distribution networks, which are highly susceptible to physical attacks and cyber threats. Events like cyber-attacks on power grids, exemplified by incidents in Ukraine, have highlighted the need for robust security measures.Type Outlook

Based on type, the critical infrastructure protection market is bifurcated into solutions and services. The services segment procured 34% revenue share in this market in 2023. The services segment is fueled by the necessity for professional assistance in the implementation and maintenance of intricate CIP solutions. Organizations frequently require assistance in customizing solutions to meet their specific requirements and guarantee that their systems are compliant with the most recent security updates and compliance standards.Market Competition and Attributes

The Critical Infrastructure Protection (CIP) market, excluding top players, remains competitive with numerous emerging and mid-sized firms driving innovation in cybersecurity, physical security, and data analytics. These companies focus on niche solutions, targeting sectors like energy, transportation, and healthcare, often delivering specialized, agile responses to complex security needs. Intense demand for customized, budget-friendly solutions sustains vibrant competition and continuous technological advancements.

By Regional Analysis

Region-wise, the critical infrastructure protection market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Europe segment acquired 31% revenue share in this market in 2023. European countries have actively invested in protecting critical infrastructure, particularly energy, transportation, and water management. The region faces stringent regulations such as the EU's NIS Directive (Network and Information Systems), which mandates high levels of cybersecurity for operators of essential services.Recent Strategies Deployed in the Market

- Oct-2024: Honeywell International Inc. partnered with the European Space Agency (ESA) to launch QKDSat, an ultra-secure telecommunications satellite for safeguarding sensitive information. Led by Honeywell UK and supported by the UK Space Agency, the project involves a multi-country consortium and targets civil, military, and commercial data protection needs.

- Sep-2024: Thales Group S.A. announced a partnership with SEL, a global leader in power system solutions, to enhance the cybersecurity of next-generation technologies. They launched a cutting-edge smart grid lab at Thales’ UK Cyber Resilience Lab in South Wales, addressing the growing cyber threats faced by critical national infrastructure (CNI) like smart grids.

- Aug-2024: Thales Group S.A. unveiled the Luna T-Series Tablet Hardware Security Module (HSM) for protecting data, applications, and cryptographic keys offline. The Luna T-Series HSM version 7.13.2 and the new TCT T-Series Backup HSM are both FIPS 140-3 compliant for enhanced security.

- Aug-2024: Fortinet, Inc. announced the acquisition of Lacework, a leading cloud security and cloud-native application protection platform (CNAPP). This move strengthens Fortinet’s commitment to providing seamless security across on-premises and cloud environments through its AI-driven, full-stack cloud security platform.

- Aug-2024: Fortinet, Inc. announced the acquisition of Next DLP, a prominent insider risk and data protection provider. This acquisition enhances Fortinet’s position in the enterprise data loss prevention (DLP) market and strengthens its leadership in integrated DLP solutions for endpoint and SASE, supporting its strategic goals.

List of Key Companies Profiled

- BAE Systems PLC

- Lockheed Martin Corporation

- Honeywell International Inc.

- Thales Group S.A.

- Fortinet, Inc.

- Airbus SE

- Hexagon AB

- Johnson Controls International PLC

- Siemens AG

- Cisco Systems, Inc.

Market Report Segmentation

By Type

- Solutions

- Services

By Security

- Cyber Security

- Network Access Controls & Firewalls

- Threat Intelligence

- Encryption

- Other Cyber Security Types

- Physical Safety & Security

- Video Surveillance Systems

- Perimeter Intrusion Detection Systems

- Physical Identity & Access Control Systems

- Screening & Scanning

- Other Physical Safety & Security Types

By End Use

- Government & Defense

- Energy & Power

- BFSI

- IT & Telecom

- Transport & Logistics

- Oil & Gas

- Other End Use

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- BAE Systems PLC

- Lockheed Martin Corporation

- Honeywell International Inc.

- Thales Group S.A.

- Fortinet, Inc.

- Airbus SE

- Hexagon AB

- Johnson Controls International PLC

- Siemens AG

- Cisco Systems, Inc.