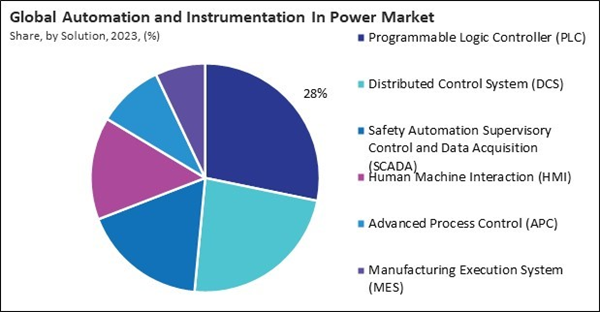

PLCs are essential for ensuring efficient and stable operations, providing real-time monitoring, and improving overall system performance. The demand for PLCs is driven by the need for modernization and upgrading of existing power infrastructure, along with new installations in power plants and substations. Thus, in 2023, the programmable logic controller (PLC) segment procured more than 1/4th revenue share in the market. This prominence can be attributed to the extensive adoption of PLCs for their reliability, ease of programming, and ability to handle complex automation tasks in power generation and distribution systems.

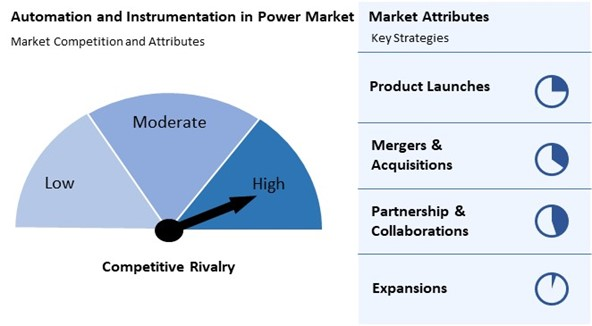

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2024, Honeywell International, Inc. and Danfoss partnered to develop innovative automation solutions with integrated architecture, enhancing data integration and interoperability.

Additionally, in June, 2024, Emerson partners with Syzygy Plasmonics to automate its light-driven catalyst reactor technology for sustainable chemical manufacturing. This collaboration leverages Emerson’s automation expertise, aiming to reduce greenhouse gas emissions and enhance efficiency in decarbonizing carbon-intensive chemical production processes.

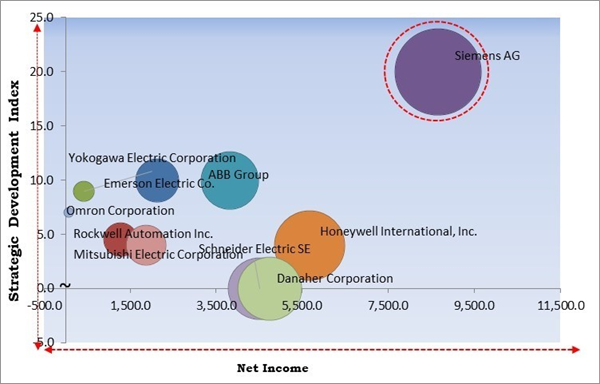

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Siemens AG is the forerunners in the Automation and Instrumentation In Power Market. In October, 2022, Siemens came into partnership with Eplan to optimize solutions for power distribution and switchgear construction. Together, they aim to integrate software tools to automate and streamline workflows, benefiting electrical planners, switchgear manufacturers, and the broader infrastructure and industry markets. Companies such as Honeywell International, Inc., ABB Group and Emerson Electric Co. are some of the key innovators in Automation and Instrumentation In Power Market.Market Growth Factors

Automation ensures optimal use of resources such as fuel, water, and raw materials by fine-tuning operational parameters. This leads to more efficient and sustainable power generation. Advanced instrumentation helps balance the load effectively, ensuring power plants operate optimally without overloading or underutilizing resources. Automation systems collect vast amounts of data from various power plant parts. Advanced analytics tools process this data to provide actionable insights, helping managers make informed decisions. Operators can monitor and control power plant operations remotely, making managing multiple facilities easier and responding quickly to issues. Thus, the need for operational efficiency is driving the market's growth.Many regions are facing the challenges of aging power infrastructure that requires upgrades and retrofitting. Investment in automation and instrumentation is critical for modernizing these systems, improving their efficiency, and extending their operational lifespan. Upgrading legacy systems with automated solutions can enhance reliability and reduce maintenance costs. Therefore, rising investments in power infrastructure are driving the market's growth.

Market Restraining Factors

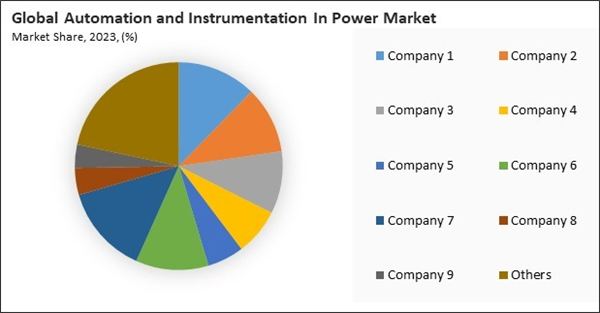

Existing power infrastructure may need significant upgrades to support new automation and instrumentation technologies. This can include enhancing power grids, upgrading legacy systems, and ensuring compatibility with modern equipment. Upgrading infrastructure often requires downtime, disrupting power supply and leading to revenue losses. The costs associated with planned outages and reduced operational capacity during upgrades add to the overall expense. This long payback period can deter companies from making the initial investment, especially under short-term financial pressure. In conclusion, the high initial costs are impeding the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

Driving and Restraining Factors

Drivers

- Increasing Demand for Power Worldwide

- Increasing Need for Operational Efficiency in Power Sector

- Rising Investments in Power Infrastructure Globally

Restraints

- High Initial Costs of Advanced Technology

- Concerns Related to Shortage of Skilled Workforce

Opportunities

- Growing Integration of Renewable Energy

- Quantum Computing for Grid Optimization

Challenges

- Cyber Security Concerns Related to Automation

- Intellectual Property Concerns

Solution Outlook

Based on solution, the automation and instrumentation in the power market is divided into advanced process control (APC), distributed control system (DCS), human-machine interaction (HMI), manufacturing execution system (MES), programmable logic controller (PLC), and safety automation supervisory control and data acquisition (SCADA).In 2023, the safety automation supervisory control and data acquisition (SCADA) segment held 18% revenue share in automation and instrumentation in the power market. SCADA systems play a vital role in the remote monitoring and control of power systems, enabling operators to quickly respond to faults and optimize performance. The increasing emphasis on safety, security, and efficiency in power systems, along with the rising complexity of power grids, has driven the adoption of SCADA systems. The integration of advanced technologies such as IoT and AI in SCADA solutions has further propelled the growth rate of this segment, making it a key component in the automation and instrumentation landscape of the power market.

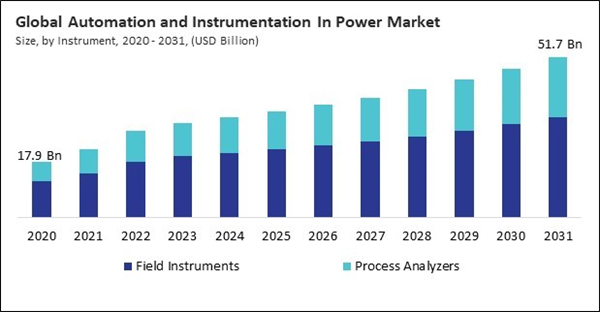

Instrument Outlook

Based on instrument, market is divided into field instruments and process analyzers. In 2023, the process analyzers segment procured 35% revenue share in the market. Process analyzers are vital for ensuring compliance with environmental regulations, optimizing process efficiency, and maintaining product quality within power plants. These analyzers provide real-time analysis of various chemical and physical properties of process streams, enabling operators to make informed decisions and improve operational efficiency.Market Competition and Attributes

The Automation and Instrumentation in Power Market is highly competitive, driven by the need for enhanced operational efficiency, reliability, and safety in power generation and distribution. Providers are focusing on offering advanced automation solutions that integrate control systems, sensors, and instrumentation to monitor and optimize energy production. The rising demand for smart grid technologies and renewable energy sources further fuels competition, as companies strive to deliver innovative solutions that meet the evolving needs of the energy sector. Scalability, precision, and adaptability are key factors in maintaining a competitive edge.

By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region witnessed 38% revenue share in the market in 2023. This dominance can be attributed to the rapid industrialization and urbanization in countries like China, India, and Japan, which have led to increased investments in power infrastructure. The region's strong focus on enhancing power generation capacity, coupled with the adoption of advanced automation technologies to improve efficiency and reliability, has driven significant market growth.Recent Strategies Deployed in the Market

- Aug-2024: ABB acquired the Födisch Group, a developer of advanced measurement solutions, to enhance its Continuous Emission Monitoring Systems (CEMS) and strengthen its position in emission measurement technology within the energy and industrial sectors.

- Jun-2024: Yokogawa Electric Corporation has acquired BaxEnergy, a provider of renewable energy management solutions, enhancing its ability to optimize operations across diverse renewable energy facilities. This acquisition aims to leverage BaxEnergy's expertise and solutions to improve profitability for global energy asset owners.

- May-2024: Rockwell Automation is expanding its operations by constructing a new 98,000-square-foot manufacturing facility in Chennai, India. The company is also launching the FLEXLINE 3500 low-voltage motor control center and partnering with Mahindra University to develop a climate-focused curriculum.

- May-2024: Siemens has introduced the Simatic Automation Workstation, a software-defined solution that replaces traditional hardware PLCs and HMIs for enhanced factory control. Ford Motor Company will be the first to implement this technology, improving scalability and management in manufacturing operations.

- Apr-2024: Omron Corporation and Neura Robotics have partnered to advance cognitive robotics in industrial automation. Their collaboration aims to integrate AI and advanced sensor technologies, enhancing operational safety and efficiency. Neura's MAiRA robots are designed for labor-intensive tasks, boosting productivity in various sectors.

List of Key Companies Profiled

- Siemens AG

- ABB Group

- Emerson Electric Co.

- Rockwell Automation Inc.

- Omron Corporation

- Honeywell International, Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Yokogawa Electric Corporation

- Danaher Corporation (Beckman Coulter, Inc.)

Market Report Segmentation

By Instrument

- Field Instruments

- Process Analyzers

By Solution

- Programmable Logic Controller (PLC)

- Distributed Control System (DCS)

- Safety Automation Supervisory Control and Data Acquisition (SCADA)

- Human Machine Interaction (HMI)

- Advanced Process Control (APC)

- Manufacturing Execution System (MES)

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Siemens AG

- ABB Group

- Emerson Electric Co.

- Rockwell Automation Inc.

- Omron Corporation

- Honeywell International, Inc.

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Yokogawa Electric Corporation

- Danaher Corporation (Beckman Coulter, Inc.)