Benzoates, derived from benzoic acid, are extensively used as preservatives in the food and beverage sector, ensuring the safety and longevity of products by inhibiting microbial growth. They are particularly effective in preventing spoilage in products like soft drinks, fruit juices, and pickled items. Beyond food applications, benzoates are integral to the cosmetics and personal care industries, where they enhance the stability and shelf life of formulations. The increasing consumer demand for safe, high-quality products drives the utilization of benzoates. Thus, the Chian market is expected to utilize 41.08 kilo tonnes of benzoic acid in benzoates application by 2031.

The China market dominated the Asia Pacific Benzoic Acid Market by Country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of $211.2 Million by 2031. The Japan market is registering a CAGR of 4.1% during 2024-2031. Additionally, the India market is expected to showcase a CAGR of 5.6% during 2024-2031.

The widespread use of benzoic acid in numerous sectors - including pharmaceuticals, personal care products, food preservation, and industrial processes - has propelled it to become a substantial market segment within the chemical industry. Benzoic acid (C6H5COOH), classified as a simple aromatic carboxylic acid, possesses a wide range of chemical applications, including preservative, antifungal, and antibacterial.

Additionally, the benzoic acid market is experiencing substantial growth as a result of heightened demand from diverse end-use sectors, technological advancements in production, and increased awareness regarding the advantageous properties of benzoic acid in prolonging product shelf life and ensuring safety.

The benzoic acid market in the Asia Pacific region is undergoing substantial expansion as a result of the expanding food and beverage, pharmaceutical, and industrial sectors. Prominent market contributors include China and India, whose substantial populations, rising disposable incomes, and expanding needs for processed foods and personal care products all contribute to the market's expansion. In China, in 2021, major beverage producers saw their output rise 12 percent year-on-year to over 183 million tons, according to the Ministry of Industry and Information Technology. In December alone, the beverage output amounted to 13.59 million tons, up 8.3 percent year-on-year.

List of Key Companies Profiled

- Merck KGaA

- Eastman Chemical Company

- Foodchem International Corporation

- Spectrum Chemical Mfg. Corp.

- BASF SE

- Huntsman Corporation

- Lanxess AG

- Haihang Industry Co., Ltd. (Haihang Group)

- Polysciences, Inc.

- Tokyo Chemical Industry Co., Ltd.

Market Report Segmentation

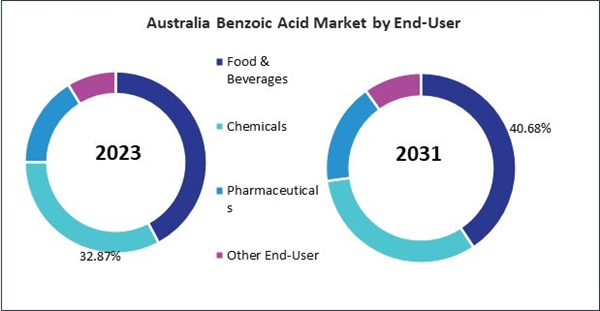

By End User (Volume, Kilo Tonnes, USD Billion, 2020-2024)

- Food & Beverages

- Chemicals

- Pharmaceuticals

- Other End-User

By Application (Volume, Kilo Tonnes, USD Billion, 2020-2024)

- Benzoates

- Benzoates Plasticizers

- Benzoyl Chloride

- Alkyd Resins

- Animal Feed Additives

By Country (Volume, Kilo Tonnes, USD Billion, 2020-2024)

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Merck KGaA

- Eastman Chemical Company

- Foodchem International Corporation

- Spectrum Chemical Mfg. Corp.

- BASF SE

- Huntsman Corporation

- Lanxess AG

- Haihang Industry Co., Ltd. (Haihang Group)

- Polysciences, Inc.

- Tokyo Chemical Industry Co., Ltd.