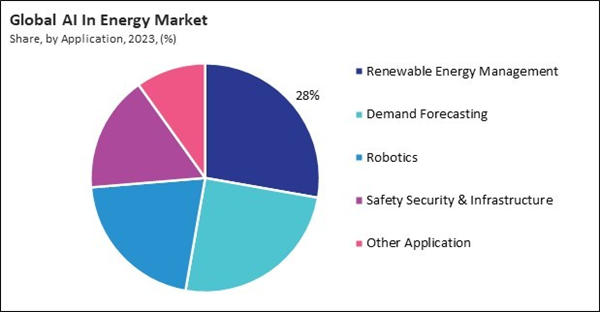

As the energy industry continues to evolve and embrace automation, the robotics segment is expected to grow significantly, driven by the need for innovative solutions to address complex energy management and infrastructure development challenges. Thus, in 2023, the robotics forecasting segment held 21% revenue share in the AI in energy market. Robotics applications in the energy sector are becoming increasingly prevalent, focusing on automating tasks that enhance operational efficiency and safety. For instance, robotic systems can conduct inspections, perform maintenance on infrastructure, and facilitate the deployment of renewable energy technologies. By integrating AI with robotics, energy companies can achieve higher accuracy in operations, reduce labour costs, and minimize risks associated with human error in hazardous environments.

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In October, 2024, Honeywell International has teamed up with Chevron, a leading energy company, to develop advanced AI-assisted solutions aimed at enhancing refining operations. This collaboration will introduce new alarm management technologies that guide operators in decision-making, improving efficiency, safety, and reliability within industrial automation. The integration of AI into Honeywell’s Experion® distributed control system will help address workforce shortages and enhance operational effectiveness, marking a significant step forward in refining processes and industry innovation. Additionally, In October, 2024, Amazon Web Services partnered with Dominion Energy, a leading utility company, to explore the use of small modular reactors for powering data centers. This collaboration aims to enhance clean electricity sourcing amid surging demand for AI and data processing.

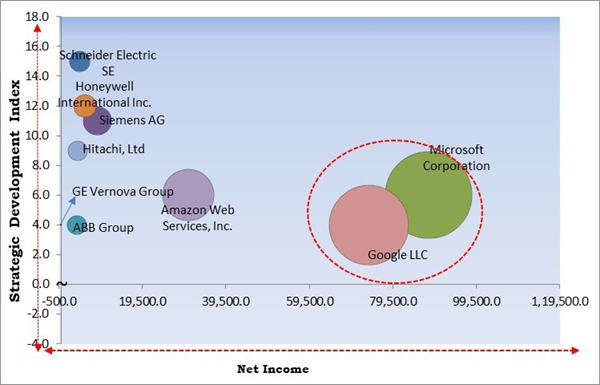

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Microsoft Corporation and Google LLC are the forerunners in the AI In Energy Market. Companies such as Amazon Web Services, Inc., Siemens AG, Schneider Electric SE are some of the key innovators in AI In Energy Market. In October, 2024, Google has partnered with Kairos Power, a nuclear power developer, to develop small modular reactors aimed at supporting its AI operations with a target of 500 megawatts by 2035. This partnership seeks to diversify energy sources to meet the increasing demands of AI technologies, ensuring a reliable and sustainable power supply for Google's ambitious AI initiatives.Market Growth Factors

Growing awareness of climate change and its adverse impacts has prompted individuals, corporations, and governments to prioritize sustainability. The quest for cleaner energy sources and reduced greenhouse gas emissions has led to a fundamental shift in how energy is produced and consumed. AI technologies are instrumental in identifying inefficiencies and optimizing processes, enabling energy companies to meet sustainability targets while maintaining profitability.Additionally, the impacts of climate change are becoming more evident, with extreme weather events such as hurricanes, floods, wildfires, and heat waves occurring more frequently. These events can severely disrupt the energy supply and compromise the integrity of the grid. As a result, energy providers are compelled to invest in technologies that enhance the resilience of their infrastructure. Thus, the rising need for grid resilience and disaster recovery solutions propels the market's growth.

Market Restraining Factors

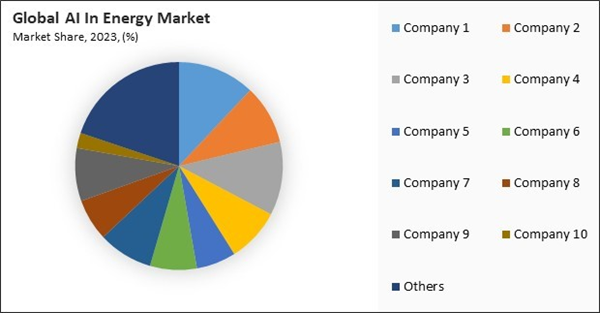

Implementing AI solutions in energy production and management often requires substantial upfront capital investments. These investments encompass costs related to advanced hardware, software licenses, system integration, and the training of personnel to operate and maintain new technologies. Many energy companies, particularly smaller players, may find it challenging to allocate the necessary funds, limiting their ability to adopt AI solutions. Therefore, high initial investment costs and economic viability concerns hamper the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Increased demand for energy efficiency and sustainability in energy production

- Rising need for grid resilience and disaster recovery solutions

- Growing investment in renewable energy sources and infrastructure

Restraints

- High initial investment costs and economic viability concerns

- Data privacy and security concerns in energy management

Opportunities

- Growing awareness of the benefits of AI technologies among energy stakeholders

- Development of AI-enabled virtual power plants

Challenges

- Technical limitations and challenges in AI model accuracy and reliability

- Volatile energy market conditions and economic uncertainties

Application Outlook

Based on application, the market is categorized into robotics, renewable energy management, demand forecasting, safety security & infrastructure, and others. In 2023, the renewable energy management segment registered 28% revenue share in the market. This segment focuses on utilizing AI technologies to optimize integrating and managing renewable energy sources, such as solar and wind power.Type Outlook

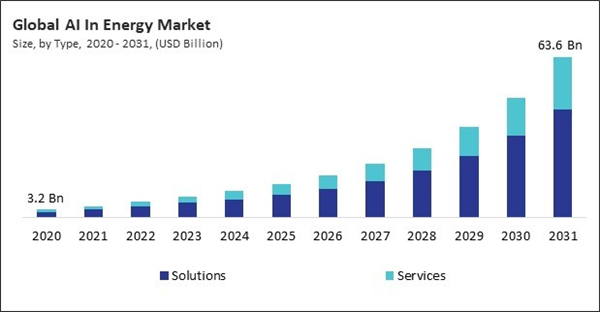

On the basis of type, the market is segmented into solutions and services. In 2023, the services segment attained 30% revenue share in the market. This segment includes consulting, implementation, and support services vendors provide to help organizations adopt and integrate AI technologies effectively.Market Competition and Attributes

The AI in energy market is highly competitive, driven by rapid innovation and an increasing focus on sustainable energy solutions. Key attributes include advanced analytics, predictive maintenance, and energy optimization, enabling companies to reduce costs and carbon emissions. Competition revolves around developing efficient, scalable AI-driven solutions for energy management, grid automation, and demand forecasting. Market players prioritize partnerships, R&D, and regulatory compliance to secure a competitive edge, as well as user-friendly platforms that simplify AI integration in energy systems.

By Regional Analysis

Region-wise, the is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Europe region generated 30% revenue share in the market. The European market is characterized by aggressive policies to transition to renewable energy sources and reduce greenhouse gas emissions. Countries across Europe invest heavily in AI technologies to facilitate this transition, focusing on applications such as renewable energy management, demand forecasting, and energy efficiency optimization.Recent Strategies Deployed in the Market

- Oct-2024: Honeywell International has teamed up with Chevron, a leading energy company, to develop advanced AI-assisted solutions aimed at enhancing refining operations. This collaboration will introduce new alarm management technologies that guide operators in decision-making, improving efficiency, safety, and reliability within industrial automation. The integration of AI into Honeywell’s Experion® distributed control system will help address workforce shortages and enhance operational effectiveness, marking a significant step forward in refining processes and industry innovation.

- Oct-2024: Honeywell International is collaborating with Qualcomm Technologies, Inc., a leader in semiconductors, to develop AI-enabled solutions for the energy sector. This partnership will integrate Qualcomm's connectivity products and AI chipsets into Honeywell's applications, enhancing operational efficiency and real-time feedback. The initiative aims to support industrial digital transformation, improve efficiencies, and facilitate automation, leveraging intelligent handheld devices and low power wireless sensors to monitor critical systems and enhance decision-making.

- Oct-2024: Hitachi, Ltd. has launched the R2O2.ai framework through its subsidiary, Hitachi Digital Services, aimed at building and scaling trustworthy AI solutions. This framework enables enterprises to efficiently deploy AI models that enhance operational efficiency and reduce downtime. By leveraging over 20 years of AI expertise, R2O2.ai addresses critical industry challenges, positioning Hitachi to deliver responsible AI solutions for sustainable energy and other sectors.

- Oct-2024: Honeywell International has introduced AI-enabled solutions to enhance efficiency in the energy sector. By integrating AI technologies like Honeywell Forge, the company aims to optimize plant operations and accelerate the workforce's path to autonomy. Honeywell's new offerings include the Experion Operations Assistant, which uses explainable AI to assist operators in addressing production issues. This initiative aligns with the growing demand for intelligent solutions to improve productivity and address workforce challenges in the energy industry.

- Oct-2024: Amazon Web Services partnered with Dominion Energy, a leading utility company, to explore the use of small modular reactors for powering data centers. This collaboration aims to enhance clean electricity sourcing amid surging demand for AI and data processing.

- Oct-2024: Google has partnered with Kairos Power, a nuclear power developer, to develop small modular reactors aimed at supporting its AI operations with a target of 500 megawatts by 2035. This collaboration seeks to diversify energy sources to meet the increasing demands of AI technologies, ensuring a reliable and sustainable power supply for Google's ambitious AI initiatives.

List of Key Companies Profiled

- Siemens AG

- ABB Group

- Schneider Electric SE

- GE Vernova Group

- Hitachi, Ltd

- Honeywell International Inc.

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Google LLC

- Microsoft Corporation

- AutoGrid Systems, Inc.

Market Report Segmentation

By Type

- Solutions

- Services

By Application

- Renewable Energy Management

- Demand Forecasting

- Robotics

- Safety Security & Infrastructure

- Other Application

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Siemens AG

- ABB Group

- Schneider Electric SE

- GE Vernova Group

- Hitachi, Ltd

- Honeywell International Inc.

- Amazon Web Services, Inc. (Amazon.com, Inc.)

- Google LLC

- Microsoft Corporation

- AutoGrid Systems, Inc.