LiDAR and stereo cameras are increasingly integrated into automotive systems to enhance collision avoidance, adaptive cruise control, and self-parking. As the automotive industry shifts towards electric and autonomous vehicles, the reliance on sophisticated 3D sensing solutions is expected to rise, positioning the automotive segment as a key player. Consequently, the automotive segment held 21% revenue share in the market in 2023. The growing focus on safety, automation, and advanced driver-assistance systems (ADAS) has driven the demand for 3D sensors in vehicles.

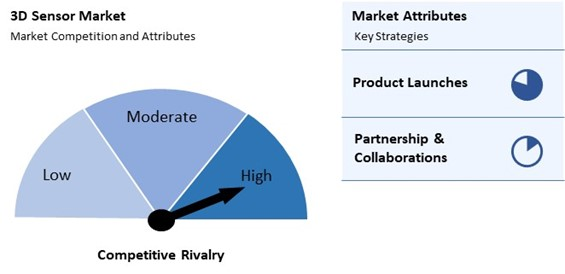

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, Sep-2024: Intel Corporation unveiled its Intel RealSense depth module line with the entry-level D421, designed for robotics applications. This all-in-one module integrates the D4 vision processor and offers a 75° × 50° field of view, 0.2 to 3 m range, and broad compatibility. Additionally, Jul-2024: STMicroelectronics N.V. unveiled the VL53L4ED, a high-accuracy Time of Flight proximity sensor with a temperature range of -40°C to 105°C. It measures distances up to 1300 mm with an 18° FOV and features a compact design, 940 nm laser emitter, and full C software driver compatibility, including Linux support.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal matrix; Apple, Inc. is the forerunners in the 3D Sensor Market. Companies such as Texas Instruments, Inc., Samsung Electronics Co., Ltd., and Sony Corporation are some of the key innovators in 3D Sensor Market. In March, 2024, Samsung Electronics Co., Ltd. unveiled its 3D Map View feature in SmartThings, enhancing home management by converting floor plans into virtual . This upgrade allows users to easily monitor and control connected devices like lighting and temperature in real-time, improving smart home usability and spatial understanding through Spatial AI and LiDAR technology.Market Growth Factors

In security applications, detecting and tracking objects accurately is crucial. 3D sensors can identify shapes, sizes, and movements of objects, allowing for advanced tracking capabilities in crowded or complex environments. This feature is particularly beneficial for monitoring critical infrastructure, public transportation systems, and high-security areas, where precise tracking can prevent unauthorized access or detect suspicious behaviour. Hence, growing focus on enhanced security and surveillance solutions is propelling the growth of the market.Modern manufacturing processes often involve complex tasks that traditional 2D sensors cannot effectively handle. 3D sensors provide depth perception and spatial awareness, essential for robotic pick-and-place operations, where robots must identify and handle items of varying shapes and sizes. This capability expands the range of applications for automation and robotics in manufacturing, driving further adoption of 3D sensor technologies. This interconnectivity improves the adaptability of manufacturing processes to changing conditions, further boosting the demand for 3D sensors. In conclusion, increasing demand for advanced automation and robotics in manufacturing processes is driving the growth of the market.

Market Restraining Factors

Different industries have varying budget constraints, impacting their ability to adopt new technologies. Sectors with tight profit margins, such as small-scale manufacturing, construction, or retail, may struggle to justify the high initial costs of 3D sensors. As a result, organizations in these industries might prioritize other investments over advanced sensing technologies, limiting market growth. Organizations may be cautious about investing in 3D sensor technologies due to uncertainty regarding their return on investment.The high initial costs can create hesitance, as businesses want to ensure that the benefits gained from implementing these technologies will justify the financial outlay. If the ROI is unclear or takes too long, companies may delay or forgo investments in 3D sensing solutions altogether. In conclusion, high initial costs of 3D sensor technologies are impeding the growth of the market.

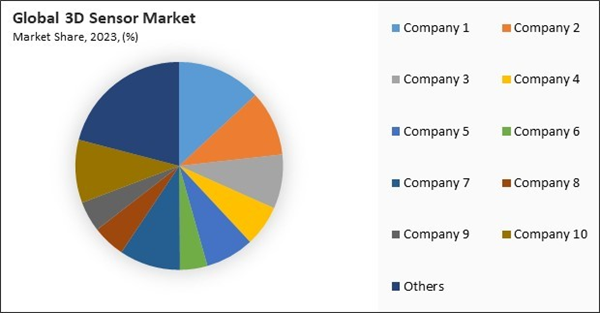

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

Driving and Restraining Factors

Drivers

- Increasing Demand for Advanced Automation and Robotics in Manufacturing Processes

- Growing Focus on Enhanced Security and Surveillance Solutions

- Evolution of Smart Cities and The Internet of Things (IoT)

Restraints

- High Initial Costs of 3D Sensor Technologies

- Vulnerability to Environmental Conditions Affecting Sensor Performance

Opportunities

- Supportive Government Initiatives and Investments in Technological Development

- Rising Adoption of 3D Sensing Technology in Consumer Electronics

Challenges

- Competition From Alternative Sensing Technologies And Methods

- Data Privacy And Security Concerns Associated With 3d Sensing Technologies

Type Outlook

Based on type, the market is divided into image sensor, accelerometer sensor, position sensor, and others. The position sensor segment witnessed 30% revenue share in the market in 2023. Position sensors are essential for the precise determination of the position of objects in space, rendering them indispensable in applications such as industrial apparatus, automotive systems, and robotics. The rise of automation and smart manufacturing has driven the demand for position sensors, as they play a key role in enhancing precision and efficiency.Technology Outlook

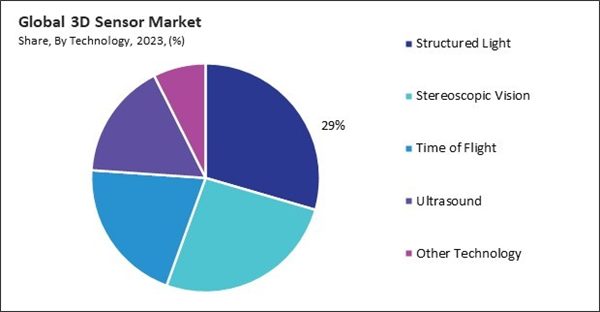

On the basis of technology, the market is segmented into structured light, time of flight, stereoscopic vision, ultrasound, and others. The structured light segment recorded 30% revenue share in the market in 2023. This technology utilizes projected light patterns to capture the three-dimensional shape of objects, making it highly effective for applications requiring precise depth measurements and detailed surface information. Structured light sensors are widely used in automotive, robotics, and consumer electronics for quality inspection, object recognition, and gesture control tasks.Connectivity Outlook

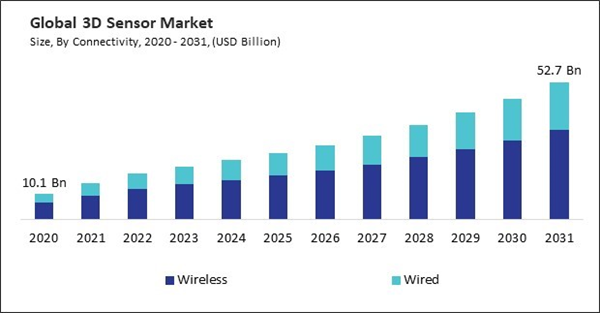

By connectivity, the market is divided into wireless and wired. The wired segment procured 33% revenue share in the market in 2023. Wired 3D sensors are known for their reliability, low latency, and stable performance, making them suitable for critical applications that require consistent data transmission and accuracy. Industries such as manufacturing, automotive, and healthcare often favour wired connections due to their robustness in environments where interference can be a concern.End Use Outlook

Based on end use, the market is divided into aerospace & defense, automotive, healthcare, consumer electronics, and others. The consumer electronics segment attained 30% revenue share in the 3D sensor market in 2023. This can be attributed to the widespread integration of 3D sensing technologies in smartphones, tablets, gaming consoles, and smart home devices. The increasing consumer demand for enhanced user experiences through features like facial recognition, augmented reality (AR), and gesture control has driven significant investments in 3D sensors within this sector.Market Competition and Attributes

The Market is highly competitive, spurred by growing demand across sectors like consumer electronics, automotive, healthcare, and industrial automation. Providers are vying to offer sensors with enhanced accuracy, speed, and versatility to support applications like facial recognition, gesture control, and depth sensing. As industries increasingly adopt 3D sensing technology for advanced user experiences and precision measurement, competition centers on delivering sensors that are compact, energy-efficient, and capable of high-resolution data capture. Innovation in sensing technology and integration capabilities is crucial for maintaining a competitive edge.

By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 36% revenue share in the market in 2023. This can be attributed to major technology companies, extensive research and development activities, and a robust consumer electronics industry. The region’s focus on innovation and early adoption of advanced technologies has propelled the demand for 3D sensors across various sectors, including automotive, healthcare, and aerospace.Recent Strategies Deployed in the Market

- Oct-2024: NXP Semiconductors N.V. teamed up with FRAMOS to enhance embedded vision development. Their collaboration introduces the FSM optical sensor modules, utilizing SONY Stavis 2 technology and compatible with NXP's i.MX 8M Plus processors. This simplifies integration for various applications, including drones, conference cameras, and industrial automation, expanding developers' possibilities.

- Jul-2024: OmniVision Technologies, Inc. unveiled the OG0TC BSI global shutter image sensor for eye and face tracking in AR/VR/MR headsets, featuring patented DCG HDR technology. At just 1.64 mm x 1.64 mm, this ultra-small, low-power sensor is ideal for inward-facing cameras, ensuring compatibility with previous-generation models for easy upgrades.

- Mar-2024: OmniVision Technologies, Inc. unveiled the OV50K40, the first smartphone image sensor with TheiaCel technology, achieving human eye-level HDR in a single exposure. This 50MP sensor, featuring 1.2µm pixels, excels in low light and enhances photo quality, particularly in challenging lighting conditions, revolutionizing mobile photography.

- Feb-2024: STMicroelectronics N.V. unveiled a direct Time-of-Flight (dToF) 3D LiDAR module featuring a market-leading 2.3k resolution, along with an early design win for the smallest 500k-pixel indirect ToF sensor. These sensors enhance smart devices, home appliances, and industrial automation, with the VL53L9 offering advanced ranging capabilities from 5cm to 10 meters.

- Jan-2024: Sony Corporation unveiled a new immersive spatial content creation system featuring a 4K OLED Microdisplay XR head-mounted display and precision controllers. It will support 3D designers by partnering with Siemens, enhancing collaborative product engineering via the NX Immersive Designer on the Siemens Xcelerator platform.

List of Key Companies Profiled

- Sony Corporation

- Infineon Technologies AG

- Intel Corporation

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- IFM Electronics GmbH

- Apple Inc.

- OmniVision Technologies, Inc.

- Texas Instruments, Inc.

- Samsung Electronics Co., Ltd. (Samsung Group)

Market Report Segmentation

By Connectivity

- Wireless

- Wired

By End use

- Consumer Electronics

- Aerospace & Defense

- Automotive

- Healthcare

- Other End use

By Type

- Image Sensor

- Position Sensor

- Accelerometer Sensor

- Other Type

By Technology

- Structured Light

- Stereoscopic Vision

- Time of Flight

- Ultrasound

- Other Technology

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Sony Corporation

- Infineon Technologies AG

- Intel Corporation

- STMicroelectronics N.V.

- NXP Semiconductors N.V.

- IFM Electronics GmbH

- Apple Inc.

- OmniVision Technologies, Inc.

- Texas Instruments, Inc.

- Samsung Electronics Co., Ltd. (Samsung Group)