Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this robust demand, the market faces a significant obstacle due to the current energy density limitations of battery technology. This technical constraint creates severe weight penalties that restrict the range and payload capabilities of electric aircraft, currently confining the broad application of high-power electric motors to short-haul routes and light aircraft segments. Consequently, the deployment of these technologies in larger commercial airframes is being delayed, as the industry waits for advancements that can overcome the performance limitations inherent in existing energy storage solutions.

Market Drivers

The implementation of rigorous environmental regulations and government-backed research incentives serves as a primary catalyst for market growth. Governments worldwide are directing substantial capital into the aerospace sector to facilitate the transition away from fossil fuels, effectively mandating the integration of electric drivetrains in next-generation airframes. This financial backing significantly lowers the barrier to entry for developing flight-certified high-voltage motors. For instance, according to the UK Department for Business and Trade in November 2024, the government allocated £975 million over five years in the 'Autumn Budget 2024' to support aerospace manufacturing and green technology development, enabling original equipment manufacturers to prioritize the testing and certification of electric propulsion systems for regional flight operations.Furthermore, the rapid advancement of Urban Air Mobility and eVTOL platforms is driving a distinct volume-based demand for specialized electric motors. Unlike traditional aviation, which relies on centralized turbines, these modern aircraft employ distributed electric propulsion requiring multiple high-power-density motors per unit to ensure safety and vertical lift. Commercial interest in this sector is substantial; Archer Aviation reported in its August 2024 'Q2 2024 Shareholder Letter' an indicative order book valued at nearly $6 billion. To meet these delivery commitments, supply chains are expanding rapidly, as evidenced by BETA Technologies securing $318 million in Series C equity capital in 2024 to scale the production of its electric aircraft and proprietary propulsion systems.

Market Challenges

The major impediment constraining the Global Aircraft Electric Motor Market is the severe energy density limitation inherent in current battery technologies. This technical bottleneck necessitates a disadvantageous trade-off between aircraft weight and operational range, as the massive battery weight required to match the energy output of conventional fuel creates prohibitive penalties. As a result, electric motors are currently rendered unsuitable for medium-to-long-haul commercial flights, which generate the majority of aviation revenue, thereby restricting the technology to niche segments such as pilot training and short-distance urban mobility.This gap in energy storage capability directly hinders market adoption by limiting the commercial viability of electric aircraft for standard passenger and cargo operations. According to the International Air Transport Association in 2024, conventional jet fuel offered an energy density of approximately 43.3 megajoules per kilogram, whereas available battery technologies provided only a minute fraction of this capacity. This immense performance disparity forces airframe manufacturers to delay the integration of high-power electric motors into larger regional and commercial fleets, significantly slowing the overall developmental trajectory of the sector.

Market Trends

The evolution of megawatt-class electric propulsion systems represents a critical shift, advancing the market from low-power motors suitable only for light urban aircraft toward solutions capable of powering regional and single-aisle commercial airliners. Manufacturers are aggressively increasing power density to replace or augment conventional turboprops, utilizing high-voltage architectures that can manage the significant thermal and electrical loads required for larger airframes. Demonstrating this progress, GE Aerospace announced in a November 2024 press release titled 'GE Aerospace demonstrates hybrid electric propulsion system for U.S. Army' that it successfully tested a hybrid electric propulsion system rated at one megawatt, maturing technologies applicable to future single-aisle aircraft propulsion.Simultaneously, the integration of High-Temperature Superconducting (HTS) technology with cryogenic liquid hydrogen cooling is emerging as a transformative trend to address thermal management and weight challenges in high-power motors. By using liquid hydrogen to cool motor windings, engineers can eliminate electrical resistance, drastically increasing efficiency and power-to-weight ratios compared to conventional copper-wound systems. This technological convergence is essential for making multi-megawatt electric powertrains operationally viable, a potential highlighted by Aviation International News in October 2024, which reported that Airbus UpNext and Toshiba Energy Systems & Solutions pledged to co-develop a 2-megawatt superconducting electric motor designed to support the decarbonization needs of future hydrogen-powered aircraft.

Key Players Profiled in the Aircraft Electric Motor Market

- Allied Motion Technologies, Inc.

- Meggitt PLC

- Altra Industrial Motion Corp.

- Woodward, Inc.

- Rolls-Royce PLC

- Ametek, Inc.

- MGM COMPRO International s. r. o.

- Emrax d.o.o

- ThinGap, Inc.

- Safran S.A.

Report Scope

In this report, the Global Aircraft Electric Motor Market has been segmented into the following categories:Aircraft Electric Motor Market, by Type:

- AC Motor

- DC Motor

Aircraft Electric Motor Market, by Applications:

- Propulsion System

- Flight Control System

- Environmental Control System

- Engine Control System

- Avionics System

- Door Actuation System

- Landing and Braking System

- Cabin Interior System

- Others

Aircraft Electric Motor Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Aircraft Electric Motor Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Aircraft Electric Motor market report include:- Allied Motion Technologies, Inc.

- Meggitt PLC

- Altra Industrial Motion Corp.

- Woodward, Inc.

- Rolls-Royce PLC

- Ametek, Inc.

- MGM COMPRO International s. r. o.

- Emrax d.o.o

- ThinGap, Inc.

- Safran S.A.

Table Information

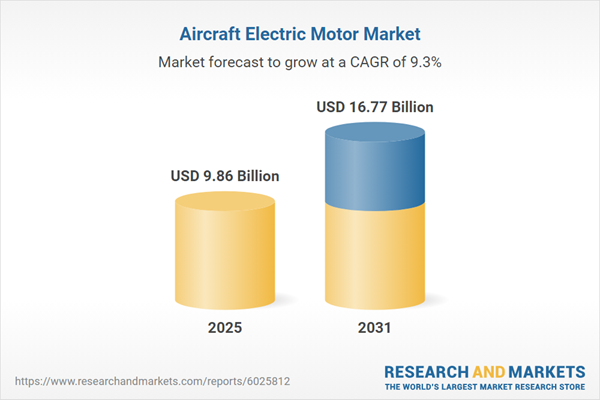

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 9.86 Billion |

| Forecasted Market Value ( USD | $ 16.77 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |