Fixed is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The Global Signals Intelligence Market is significantly influenced by two primary factors: heightened global security threats and the continuous advancements in signal intelligence technologies. Escalating geopolitical instability and the persistent threat of terrorism worldwide necessitate robust intelligence gathering capabilities, driving demand for advanced SIGINT systems. According to the Stockholm International Peace Research Institute (SIPRI) in its April 2025 "Trends in World Military Expenditure, 2024" report, global military expenditure soared to $2.718 trillion in 2024, marking a 9.4% real-terms increase from 2023.Key Market Challenges

A significant challenging factor impeding the expansion of the Global Signals Intelligence Market is the pervasive concern regarding regulatory complexities and data privacy. The increasing global emphasis on safeguarding individual privacy rights, coupled with the establishment of stringent legal frameworks for data collection and usage, creates substantial obstacles for the deployment and operation of advanced SIGINT technologies. This environment necessitates careful navigation of compliance requirements and ethical considerations, directly affecting market participation.Key Market Trends

Multi-intelligence fusion for comprehensive analysis is a pivotal trend, focusing on integrating data from various intelligence disciplines to construct a more complete and actionable operational picture. This approach provides a holistic understanding of complex threat environments, transcending single-source data limitations for enhanced decision-making. According to SatNews, BAE Systems received a $48 million contract from the Air Force Research Laboratory in August 2024 to advance its Insight system, emphasizing multiple intelligence signal processing and multi-level fusion to address critical gaps in military intelligence analysis.Key Market Players Profiled:

- Thales Group

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- RTX Corporation

- Rheinmetall AG

- Mercury Systems, Inc.

- BAE Systems plc

- Northrop Grumman Corporation

- General Dynamics Corporation

- Lockheed Martin Corporation

Report Scope:

In this report, the Global Signals Intelligence Market has been segmented into the following categories:By Type:

- Electronic Intelligence (ELINT)

- Communications Intelligence (COMINT)

By Application:

- Airborne

- Ground

- Naval

- Space

- Cyber

By Mobility:

- Fixed

- Man Portable

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Signals Intelligence Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Thales Group

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- RTX Corporation

- Rheinmetall AG

- Mercury Systems, Inc.

- BAE Systems plc

- Northrop Grumman Corporation

- General Dynamics Corporation

- Lockheed Martin Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | November 2025 |

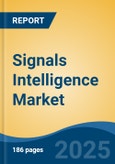

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.03 Billion |

| Forecasted Market Value ( USD | $ 25.46 Billion |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |