Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

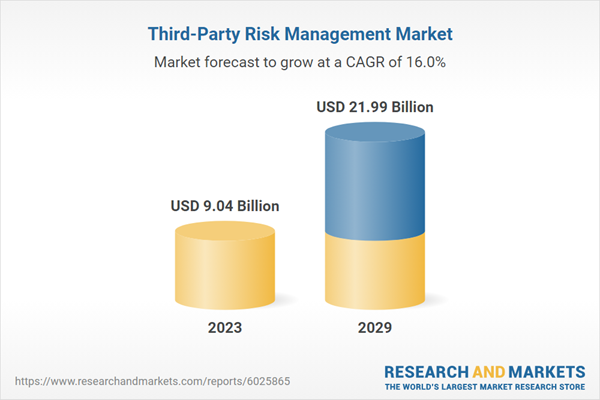

Third-Party Risk Management refers to the processes and practices organizations employ to identify, assess, and mitigate risks associated with their relationships with external vendors, suppliers, and partners. As businesses increasingly rely on third parties for various functions, such as IT services, supply chain logistics, and even customer service, the potential vulnerabilities these partnerships introduce have become a critical concern. This growing interconnectedness heightens the risk of data breaches, operational failures, and regulatory non-compliance, prompting organizations to adopt robust third-party risk management strategies. The market for these services is projected to rise significantly, driven by several key factors.

Escalating regulatory requirements across industries are compelling organizations to implement comprehensive risk management frameworks to avoid penalties and maintain compliance. Regulatory bodies are becoming more stringent, demanding transparency and accountability in how organizations manage their vendor relationships. The increasing prevalence of cyber threats and data breaches has heightened awareness of the need for security measures that extend beyond internal operations. Organizations recognize that vulnerabilities in third-party systems can lead to substantial financial losses, reputational damage, and legal liabilities.

As a result, there is a growing emphasis on conducting thorough due diligence before engaging with third parties, which involves assessing their security protocols, financial stability, and compliance with relevant regulations. The rise of digital transformation initiatives has accelerated the adoption of cloud services and technology solutions, increasing reliance on third-party vendors. This shift necessitates a more structured approach to risk management, as organizations must ensure that these external partners adhere to the same security standards they maintain internally.

The COVID-19 pandemic has also underscored the importance of third-party risk management, as organizations faced disruptions and challenges in their supply chains, revealing the vulnerabilities that can arise from over-dependence on external partners. Consequently, companies are increasingly investing in specialized technologies and platforms designed to streamline third-party risk assessments, automate monitoring processes, and facilitate ongoing risk management. As organizations continue to navigate a complex landscape of vendor relationships and compliance requirements, the demand for third-party risk management solutions is expected to grow. Overall, the convergence of regulatory pressures, increasing cyber threats, the shift toward digital services, and the lessons learned from recent global events collectively position the Third-Party Risk Management Market for significant expansion in the coming years, making it a critical area of focus for organizations aiming to safeguard their operations and reputations.

Key Market Drivers

Increasing Regulatory Compliance Requirements

As organizations operate in an increasingly regulated environment, the demand for robust Third-Party Risk Management frameworks has surged. Regulatory bodies across various sectors, including finance, healthcare, and information technology, have introduced stringent requirements to ensure that companies adequately manage the risks associated with their external relationships. For instance, regulations such as the General Data Protection Regulation in Europe and the Health Insurance Portability and Accountability Act in the United States mandate organizations to assess and monitor their third-party vendors for compliance with data protection standards.Failure to comply with these regulations can result in substantial financial penalties, reputational damage, and even legal action. As a result, organizations are compelled to invest in Third-Party Risk Management solutions that enable them to conduct thorough due diligence, maintain continuous oversight, and ensure that their vendors adhere to the required standards. The growing complexity of the regulatory landscape is thus a significant driver for the expansion of the Third-Party Risk Management Market, as organizations seek to mitigate risks and protect their interests in an evolving legal framework.

Escalating Cybersecurity Threats

The increasing frequency and sophistication of cyber threats have made Third-Party Risk Management an essential component of organizational security strategies. With many organizations relying heavily on external vendors for critical services and functions, the potential entry points for cyber attacks have multiplied. Recent high-profile data breaches linked to third-party vendors have highlighted the vulnerabilities inherent in these relationships, prompting organizations to reassess their risk management practices. Cybercriminals often target less secure third-party partners as a means to infiltrate larger organizations, making it imperative for companies to conduct thorough assessments of their vendors' cybersecurity protocols.As the landscape of cyber threats continues to evolve, organizations are recognizing the need for proactive measures to safeguard sensitive data and maintain operational integrity. Consequently, the demand for Third-Party Risk Management solutions that provide comprehensive cybersecurity assessments, ongoing monitoring, and incident response capabilities is on the rise. This escalating threat landscape serves as a critical driver for the growth of the Third-Party Risk Management Market, as organizations strive to fortify their defenses against potential breaches stemming from external partnerships.

Growing Importance of Supply Chain Resilience

The COVID-19 pandemic has underscored the vital importance of supply chain resilience, highlighting the risks associated with over-reliance on single sources or geographic regions for essential goods and services. As organizations faced unprecedented disruptions in their supply chains, the need for effective Third-Party Risk Management practices became more pronounced. Businesses are now prioritizing diversification and risk assessment of their supply chain partners to mitigate vulnerabilities. This shift has prompted organizations to evaluate not only the financial stability of their vendors but also their operational capabilities, geographic risks, and contingency plans.The emphasis on building resilient supply chains has led to increased investments in Third-Party Risk Management solutions that facilitate comprehensive assessments and continuous monitoring of vendor performance. By enhancing their ability to identify potential disruptions and implement corrective measures, organizations can better navigate the complexities of their supply chains. As companies prioritize resilience in the face of ongoing uncertainties, the demand for Third-Party Risk Management solutions will continue to grow, positioning this market for significant expansion.

Technological Advancements in Risk Management Solutions

Technological innovations are transforming the Third-Party Risk Management landscape, making it easier for organizations to assess and manage risks associated with their external partners. The emergence of advanced technologies, such as artificial intelligence, machine learning, and big data analytics, is enabling organizations to conduct more comprehensive and efficient risk assessments. These technologies can automate data collection and analysis, providing organizations with real-time insights into their vendors' performance and risk profiles. Cloud-based solutions offer scalability and accessibility, allowing organizations to implement Third-Party Risk Management practices without significant infrastructure investments.As organizations increasingly leverage technology to enhance their risk management capabilities, the demand for innovative solutions in the Third-Party Risk Management Market is expected to rise. The ability to harness technology for continuous monitoring, predictive analytics, and streamlined reporting will empower organizations to proactively manage risks and respond to emerging threats effectively. As the technological landscape evolves, organizations that adopt advanced Third-Party Risk Management solutions will be better positioned to navigate the complexities of their external relationships and safeguard their operational integrity.

Key Market Challenges

Complexity of Vendor Ecosystems

One of the foremost challenges in Third-Party Risk Management is the complexity of vendor ecosystems. Organizations often engage with a myriad of external partners, ranging from suppliers and subcontractors to service providers and technology vendors. Each of these relationships can introduce unique risks, making comprehensive risk assessment a daunting task. The diverse nature of third-party vendors means that their operational practices, compliance requirements, and risk profiles can vary significantly. This diversity complicates the standardization of risk management frameworks, as organizations must tailor their assessments to account for the specific characteristics of each vendor.The interdependencies within these ecosystems can lead to cascading risks; for instance, the failure of a single vendor may have far-reaching implications for other partners and the organization itself. As a result, organizations must invest substantial resources in data collection, risk analysis, and monitoring processes to maintain an accurate understanding of their vendor landscape. The challenge is further compounded by the lack of centralized data management systems that can provide a holistic view of all vendor relationships. Without such systems, organizations may struggle to identify potential risks and ensure that all vendors are being adequately monitored.

This complexity necessitates a robust strategy that incorporates advanced technologies, such as artificial intelligence and machine learning, to streamline data collection and analysis. However, the initial investment in these technologies, along with the ongoing need for skilled personnel to interpret the data, poses additional challenges for organizations. Thus, the intricate web of vendor relationships represents a significant hurdle for effective Third-Party Risk Management.

Insufficient Awareness and Training

Another critical challenge facing the Third-Party Risk Management Market is the insufficient awareness and training regarding risk management practices among organizational staff. Many employees, especially those not directly involved in compliance or risk management functions, may lack a comprehensive understanding of the risks associated with third-party relationships. This knowledge gap can lead to inadequate risk assessments and a failure to implement necessary safeguards. For instance, employees in procurement or IT may prioritize cost and efficiency over risk considerations when selecting vendors, inadvertently exposing the organization to vulnerabilities.The rapidly evolving regulatory landscape and increasing complexity of cybersecurity threats necessitate continuous education and training for staff members. Organizations often struggle to establish effective training programs that not only convey the importance of Third-Party Risk Management but also provide practical guidance on identifying and mitigating risks. The lack of a cohesive culture around risk awareness can result in inconsistent practices across departments, making it challenging to maintain a unified approach to Third-Party Risk Management.

To overcome this challenge, organizations must prioritize the development of comprehensive training initiatives that are tailored to various roles within the organization. These initiatives should emphasize the significance of Third-Party Risk Management, outline specific responsibilities, and provide employees with the tools they need to recognize and address potential risks. Fostering a culture of risk awareness will be instrumental in enhancing the effectiveness of Third-Party Risk Management practices and ensuring that all employees are equipped to contribute to the organization’s risk mitigation efforts.

Evolving Threat Landscape

The constantly evolving threat landscape presents a significant challenge for the Third-Party Risk Management Market. Organizations must navigate an array of potential risks, including cybersecurity threats, regulatory changes, and geopolitical risks, all of which can affect their third-party relationships. Cybersecurity threats, in particular, have become increasingly sophisticated, with attackers leveraging advanced techniques to exploit vulnerabilities in both organizational and vendor systems. For example, supply chain attacks, where hackers infiltrate an organization through a compromised third-party vendor, have become more prevalent, underscoring the need for robust risk management practices.The dynamic nature of these threats necessitates that organizations continuously monitor and assess their third-party vendors, but this is often easier said than done. Many organizations lack the resources or expertise to maintain real-time monitoring systems, leaving them vulnerable to sudden changes in risk profiles. The regulatory environment is continually changing, with new laws and guidelines emerging to address risks associated with third-party relationships. Organizations must stay abreast of these changes to ensure compliance, which can be particularly challenging in industries with rapidly evolving regulations.

Geopolitical risks, such as trade disputes and political instability, can affect the reliability and performance of third-party vendors, necessitating ongoing assessments of vendors operating in different regions. To effectively manage these evolving threats, organizations must adopt a proactive approach to Third-Party Risk Management. This includes investing in advanced risk assessment tools, establishing clear communication channels with vendors, and fostering a culture of continuous improvement in risk management practices. However, the ongoing need for adaptation and responsiveness to new threats poses a substantial challenge for organizations seeking to protect themselves and their stakeholders.

Key Market Trends

Adoption of Advanced Technologies

The adoption of advanced technologies is a significant trend in the Third-Party Risk Management Market. Organizations are increasingly leveraging artificial intelligence, machine learning, and data analytics to enhance their risk assessment and management capabilities. These technologies facilitate the automation of data collection and analysis processes, allowing companies to quickly assess the risk profiles of their third-party vendors. By using predictive analytics, organizations can identify potential risks before they materialize, enabling proactive measures to mitigate threats.Natural language processing tools are being utilized to analyze large volumes of unstructured data, such as vendor communications and contractual agreements, to uncover potential compliance issues or red flags. As organizations continue to embrace digital transformation, the integration of these advanced technologies into Third-Party Risk Management practices will become a standard, helping businesses streamline their processes and improve their risk posture. This trend not only enhances efficiency but also provides a competitive advantage by allowing organizations to respond more effectively to emerging risks in their vendor ecosystems.

Emphasis on Supply Chain Resilience

The emphasis on supply chain resilience is reshaping the Third-Party Risk Management Market. The disruptions caused by global events, such as the COVID-19 pandemic, have highlighted the vulnerabilities inherent in traditional supply chain models, prompting organizations to reevaluate their risk management strategies. Companies are now prioritizing the assessment of their supply chain partners to ensure they can withstand unforeseen disruptions and continue operations without significant impact. This has led to an increased focus on diversifying suppliers, evaluating geographic risks, and implementing contingency plans.Organizations are adopting comprehensive risk assessments that encompass not just financial stability but also operational capabilities, technological infrastructure, and crisis management strategies of their vendors. By enhancing supply chain resilience through robust Third-Party Risk Management practices, businesses aim to mitigate risks and maintain continuity in their operations. This trend is expected to drive growth in the Third-Party Risk Management Market as organizations seek innovative solutions that enable them to build resilient and adaptable supply chains.

Growing Importance of Cybersecurity

The growing importance of cybersecurity in Third-Party Risk Management is an undeniable trend that is reshaping the market landscape. As organizations increasingly rely on third-party vendors for critical services and data management, the risks associated with cybersecurity breaches have become more pronounced. High-profile incidents involving third-party vendors have raised awareness of the need for stringent security measures, prompting organizations to conduct thorough cybersecurity assessments of their partners. This trend has led to an increased demand for specialized Third-Party Risk Management solutions that focus on evaluating the cybersecurity posture of vendors.Companies are now prioritizing the implementation of security frameworks, conducting regular penetration testing, and requiring vendors to adhere to industry-standard security protocols. The emphasis on cybersecurity extends beyond initial assessments, necessitating continuous monitoring and reporting to detect and address potential vulnerabilities in real time. As the threat landscape evolves, organizations recognize that a proactive approach to managing third-party cybersecurity risks is crucial for safeguarding their data and reputation. This trend is expected to significantly drive the growth of the Third-Party Risk Management Market as organizations seek to enhance their cybersecurity measures and protect themselves from the increasingly sophisticated threats posed by third-party relationships.

Segmental Insights

Component Insights

Solutions segment dominated the Third-Party Risk Management Market in 2023 and is expected to maintain its leadership throughout the forecast period. This dominance can be attributed to the increasing adoption of advanced technologies, such as artificial intelligence and data analytics, which are integral to effective risk management processes. Organizations are recognizing the value of comprehensive software solutions that enable them to automate risk assessments, enhance vendor monitoring, and ensure compliance with regulatory requirements. These solutions facilitate real-time data analysis, allowing companies to identify and mitigate risks associated with their third-party relationships more efficiently.As businesses face growing regulatory scrutiny and the evolving threat landscape, the demand for integrated risk management platforms that offer features such as continuous monitoring, risk scoring, and incident management has surged. The solutions segment provides organizations with the tools necessary to streamline their processes, improve decision-making, and ultimately protect their reputation and assets. While the services segment, which includes consulting, implementation, and support services, remains important, the scalability and efficiency of software solutions are increasingly appealing to organizations aiming for a proactive approach to risk management. Consequently, the solutions segment is anticipated to continue driving growth in the Third-Party Risk Management Market, as more companies seek to leverage technology to enhance their risk management capabilities and safeguard their operations in an increasingly complex and interconnected business environment.

Regional Insights

North America dominated the Third-Party Risk Management Market in 2023 and is projected to maintain its dominance throughout the forecast period. This leadership can be attributed to several key factors, including the presence of a robust regulatory framework and a high concentration of technology-driven enterprises that prioritize risk management practices. North American organizations are increasingly facing stringent regulations regarding data privacy, cybersecurity, and corporate governance, compelling them to invest in comprehensive Third-Party Risk Management solutions.The region's advanced technological infrastructure facilitates the rapid adoption of innovative risk management tools, such as artificial intelligence and machine learning, enhancing the ability to assess and mitigate risks associated with third-party vendors effectively. As cyber threats continue to evolve, companies in North America are more acutely aware of the vulnerabilities posed by third-party relationships, driving demand for effective risk management strategies.

The concentration of key market players and service providers in North America also contributes to the region's competitive landscape, fostering innovation and the development of tailored solutions that meet the specific needs of various industries. As organizations increasingly recognize the critical importance of Third-Party Risk Management in safeguarding their operations and reputation, North America is expected to continue leading the market, with a strong focus on technological advancement and regulatory compliance shaping its future growth trajectory. This trend positions the region as a pivotal player in the ongoing evolution of risk management practices, ensuring that it remains at the forefront of the Third-Party Risk Management Market.

Key Market Players

- SAP SE

- Oracle Corporation

- IBM Corporation

- Resolver Inc.

- RSA Security LLC

- LogicGate, Inc.

- ProcessUnity, Inc.

- BitSight Technologies, Inc.

- Prevalent Inc.

- OneTrust LLC

Report Scope:

In this report, the Global Third-Party Risk Management Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Third-Party Risk Management Market, By Component:

- Solutions

- Services

Third-Party Risk Management Market, By Deployment Mode:

- On-premises

- On-cloud

Third-Party Risk Management Market, By Organization Size:

- Small & Medium Enterprises

- Large Enterprises

Third-Party Risk Management Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Indonesia

- Vietnam

- South America

- Brazil

- Colombia

- Argentina

- Chile

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Third-Party Risk Management Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- SAP SE

- Oracle Corporation

- IBM Corporation

- Resolver Inc.

- RSA Security LLC

- LogicGate, Inc.

- ProcessUnity, Inc.

- BitSight Technologies, Inc.

- Prevalent Inc.

- OneTrust LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 9.04 Billion |

| Forecasted Market Value ( USD | $ 21.99 Billion |

| Compound Annual Growth Rate | 15.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |