Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market faces a substantial obstacle in the form of rising operational expenditures linked to increasing energy consumption and volatile fuel prices for remote installations. Operators are under immense pressure to reconcile network reliability with sustainable energy practices while managing these escalating costs. According to 2024 data from the GSMA, the telecommunications industry was responsible for approximately 1% of global energy consumption, a statistic that underscores the significant energy burden limiting capital allocation for further infrastructure development. This financial constraint challenges the industry's ability to balance immediate operational needs with long-term expansion goals.

Market Drivers

The rapid acceleration of global 5G network deployment acts as the primary catalyst reshaping the market, as the intense power density requirements of active antenna units and massive MIMO technologies demand significant upgrades to existing power infrastructure. Operators are swiftly densifying networks to meet latency and bandwidth targets, necessitating a transition from traditional backup systems to robust, high-capacity power configurations capable of handling heavier loads. As highlighted in the Ericsson Mobility Report from June 2025, global 5G subscriptions reached 2.3 billion by the end of 2024, creating a critical need for reliable power to maintain network availability for this expanding user base, thereby driving investment in high-efficiency rectifiers and intelligent control units.A secondary but equally vital driver is the increasing adoption of renewable and hybrid energy solutions, motivated by the dual need to reduce carbon footprints and mitigate the high operational costs of diesel dependency in off-grid locations. Telecom tower companies are aggressively integrating solar photovoltaics and advanced battery storage to ensure energy resilience while adhering to sustainability objectives. For instance, the American Tower Corporation’s '2024 Sustainability Executive Report' from July 2025 noted an expansion of energy storage capacity to one gigawatt-hour across 24,500 sites. Furthermore, China Tower Corporation managed over 2.09 million sites as of late 2024, demonstrating the massive scale of infrastructure requiring such green power modernization globally.

Market Challenges

High operational expenditure, driven by escalating energy consumption and unstable fuel prices, presents a significant barrier to the growth of the telecom tower power system market. Network operators and tower companies face distinct financial pressures as the recurring costs of powering remote sites deplete budgets that would otherwise be allocated for capital investments in new infrastructure. When financial resources are heavily diverted to cover daily energy bills, organizations are often compelled to delay or reduce the procurement of updated power units, which in turn slows the overall momentum of the market.This financial strain is particularly acute in regions that rely heavily on diesel generators, where price volatility severely impacts long-term planning. According to the GSMA, energy costs accounted for between 20% and 40% of network operational expenditure for mobile operators in emerging markets during 2024. Such a substantial portion of the budget limits the financial flexibility required to upgrade existing systems or expand into new territories. Consequently, the high cost of maintaining current energy supplies directly restricts the purchasing power necessary to drive growth and modernization within the global power system sector.

Market Trends

The integration of AI-enabled smart energy management platforms is rapidly becoming a pivotal trend as operators seek to decouple network expansion from rising energy costs. Unlike traditional power configurations, these software-defined systems utilize machine learning algorithms to analyze traffic patterns in real-time, autonomously adjusting power delivery to active antenna units and cooling infrastructure. This intelligent orchestration allows for granular control, such as activating deep sleep modes during low-traffic periods without compromising service quality, thereby significantly reducing waste. For example, Telefónica reported in February 2025 that the deployment of AI-driven traffic prediction and autonomous power management modes enabled energy savings of up to 30% across its optimized sites, highlighting a shift toward data-driven operational efficiency.Simultaneously, the emergence of hydrogen fuel cells as green backup alternatives is gaining traction as a reliable, low-carbon substitute for diesel generators in off-grid and unreliable grid locations. While solar-hybrid systems address general load requirements, hydrogen fuel cells offer a distinct advantage for long-duration backup during extended outages, eliminating the noise, pollution, and maintenance intensity associated with combustion engines. This technology is increasingly favored for critical infrastructure where battery autonomy is insufficient and diesel logistics are cost-prohibitive. According to Plug Power in December 2024, the US-based carrier Southern Linc successfully deployed approximately 500 hydrogen fuel cell systems to ensure resilient backup for its LTE network, underscoring the industry's broadening focus on diverse, sustainable energy carriers.

Key Players Profiled in the Telecom Tower Power System Market

- Delta Electronics, Inc.

- ABB Ltd.

- Eaton Corporation PLC

- Vertiv Holdings Co.

- Crown Castle Inc.

- American Tower Corporation

- General Electric Company

- Huawei Technologies Co. Ltd.

- Schneider Electric SE

- ZTE Corporation

Report Scope

In this report, the Global Telecom Tower Power System Market has been segmented into the following categories:Telecom Tower Power System Market, by Power Source:

- Diesel-Battery Power Source

- Diesel-Solar Power Source

- Diesel-Wind Power Source

- Multiple Power Sources

Telecom Tower Power System Market, by Grid:

- On-grid

- Off-grid

Telecom Tower Power System Market, by Component:

- Rectifiers

- Inverters

- Convertors

- Controllers

- Heat Management Systems

- Generators

- Others

Telecom Tower Power System Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Telecom Tower Power System Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Telecom Tower Power System market report include:- Delta Electronics, Inc.

- ABB Ltd.

- Eaton Corporation PLC

- Vertiv Holdings Co.

- Crown Castle Inc.

- American Tower Corporation

- General Electric Company

- Huawei Technologies Co. Ltd.

- Schneider Electric SE

- ZTE Corporation

Table Information

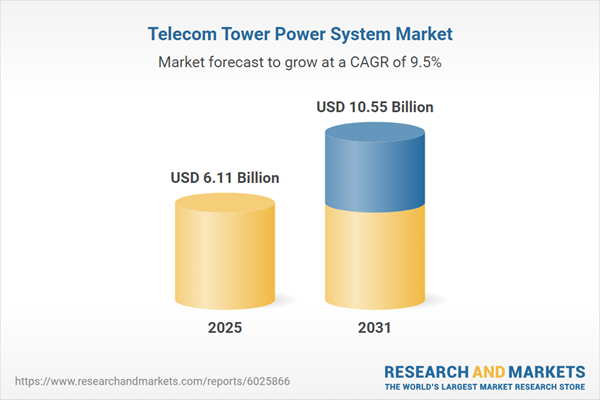

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 6.11 Billion |

| Forecasted Market Value ( USD | $ 10.55 Billion |

| Compound Annual Growth Rate | 9.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |