Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these positive growth factors, the market faces significant hurdles related to data privacy concerns and the technical difficulties of integrating these solutions with legacy systems. Organizations are often reluctant to fully embrace third-party management tools due to security risks involving sensitive communication records and the potential disruption to established workflows. Furthermore, navigating the complicated landscape of global compliance regulations presents a formidable challenge, which could potentially hinder the widespread adoption and expansion of telecom expense management strategies.

Market Drivers

The widespread adoption of mobile devices and the shift toward remote workforce models have fundamentally transformed the enterprise telecommunications landscape, creating a need for robust expense management strategies. As organizations disperse their teams globally, the volume of data consumed by mobile assets has surged, resulting in intricate billing environments that are difficult to track manually. This explosion in connectivity is quantifiable; according to the 'Ericsson Mobility Report' from June 2025, mobile network data traffic increased by 19 percent between the first quarter of 2024 and the first quarter of 2025. Such rapid growth in data usage exposes enterprises to significant billing variances and operational risks, thereby driving the adoption of automated solutions capable of monitoring real-time usage across dispersed teams.Simultaneously, the increasing demand for operational cost optimization and audit accuracy acts as a critical catalyst for market expansion. Companies are increasingly turning to specialized providers to detect billing errors, remove unused services, and validate invoices against contracted rates. The financial impact of these audits is substantial; Tangoe’s 'IT Expense Management 2024 Year in Review', published in December 2024, noted that the company helped its clients save over USD 245 million on mobile and telecom expenses. These savings underscore the essential role expense management plays in maintaining fiscal health within the digital economy, a sector where, according to the GSMA in 2025, mobile technologies generated approximately 5.8 percent of global GDP, amounting to USD 6.5 trillion in economic value added.

Market Challenges

The primary impediment to the growth of the Global Telecom Expense Management Market involves significant obstacles related to data privacy concerns and the technical complexity of integrating solutions with legacy systems. Enterprises frequently hesitate to adopt third-party management tools because granting external access to sensitive communication records exposes them to potential security breaches and compliance liabilities. This reluctance is further entrenched by the operational risks associated with merging modern software into established, often outdated, internal workflows, which can disrupt business continuity and deter organizations from upgrading their expense management strategies.The severity of these security apprehensions is justified by the immense financial risks associated with telecommunications vulnerabilities. When organizations weigh the efficiency gains of expense management against the potential for data misuse, the high cost of failure often leads to stalled adoption rates. According to the Communications Fraud Control Association, in 2025, global fraud losses in the telecommunications industry amounted to $39.89 billion. This magnitude of financial exposure underscores why enterprises remain cautious, directly slowing the ubiquitous expansion of telecom expense management solutions in the global market.

Market Trends

The convergence of Telecom Expense Management with Cloud FinOps frameworks is fundamentally reshaping the market as enterprises transition from siloed billing audits toward a unified Technology Expense Management (TEM) strategy. This shift is driven by the increasing overlap between traditional telecommunications and cloud-based services, compelling organizations to adopt holistic governance models that manage variable spend across mobile, fixed-line, and SaaS categories simultaneously. As finance and IT teams integrate these disciplines, they are expanding their scope to include emerging cost centers such as artificial intelligence workloads, which require the rigorous tracking methodologies inherent in mature expense management systems. According to the FinOps Foundation’s '2025 State of FinOps' report from November 2025, 63 percent of companies are actively managing AI spending, an increase of 31 percent from 2024, illustrating how expense management frameworks are rapidly evolving to encompass broader digital assets.Concurrently, the integration of Artificial Intelligence and Machine Learning for predictive analytics is transforming expense management from a reactive administrative task into a proactive strategic function. Advanced algorithms are now capable of forecasting usage spikes, identifying anomalous spending patterns in real-time, and automating complex invoice validation processes that were previously prone to human error. This technological advancement allows businesses to not only detect billing discrepancies but also to model future consumption scenarios for optimized budgeting, ensuring that procurement decisions align with actual operational needs. The financial impact of utilizing these intelligent tools is significant; according to the Tangoe 'Tangoe One Cloud Achieves FinOps Certified Platform Status' report in July 2025, organizations utilizing AI-powered software within their financial operations are 53 percent more likely to save over 20 percent on cloud costs compared to those relying on manual methods.

Key Players Profiled in the Telecom Expense Management Market

- Calero Software LLC

- Tangoe, Inc.

- Sakon Inc.

- MDSL Limited

- Asentinel LLC

- Cass Information Systems, Inc.

- Cimpl Inc.

- Valicom Corporation

- WidePoint Corporation

- Tellennium, Inc.

Report Scope

In this report, the Global Telecom Expense Management Market has been segmented into the following categories:Telecom Expense Management Market, by Solution:

- Dispute Management

- Invoice Management

- Ordering & Provisioning Management

- Sourcing Management

- Usage Management

- Others

Telecom Expense Management Market, by Service:

- Hosted Services

- Managed Services

Telecom Expense Management Market, by Deployment:

- On-Cloud

- On-premises

Telecom Expense Management Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Telecom Expense Management Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Telecom Expense Management market report include:- Calero Software LLC

- Tangoe, Inc.

- Sakon Inc.

- MDSL Limited

- Asentinel LLC

- Cass Information Systems, Inc.

- Cimpl Inc.

- Valicom Corporation

- WidePoint Corporation

- Tellennium, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

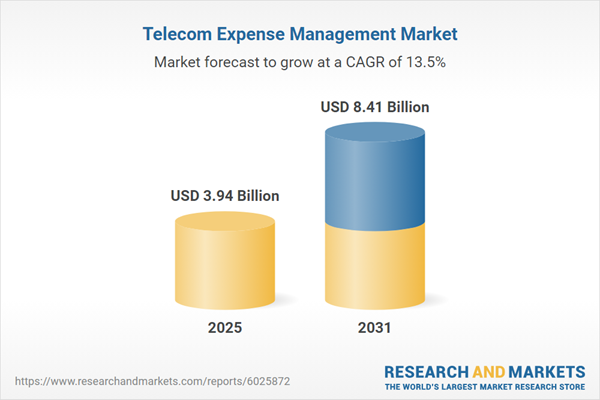

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 3.94 Billion |

| Forecasted Market Value ( USD | $ 8.41 Billion |

| Compound Annual Growth Rate | 13.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |