Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, despite this strong growth trajectory, the market encounters a formidable obstacle in the complexity associated with migrating from legacy relational systems to non-relational environments. This transition frequently demands specialized technical proficiency in non-relational data modeling and query optimization, skills that remain scarce within many enterprise IT teams. Consequently, this lack of expertise creates a significant operational barrier, potentially hindering the widespread adoption and expansion of NoSQL technologies across broader commercial sectors.

Market Drivers

The integration of vector search capabilities to support generative AI workloads has emerged as a primary driver for the Global NoSQL Market, significantly altering how databases handle unstructured data. As organizations rapidly deploy large language models, the need for non-relational systems that can efficiently store and query high-dimensional vector embeddings has revealed infrastructure gaps; a May 2024 Couchbase survey notes that 59% of IT decision-makers fear their current data management cannot support generative AI without major investment. To address this, providers are embedding vector search features, a move validating market growth as seen in Aerospike's September 2024 report of a 51% year-over-year increase in recurring revenue driven by AI demand.Concurrently, the shift toward cloud computing and Database-as-a-Service (DBaaS) models is revolutionizing deployment strategies by alleviating the operational complexities of managing distributed systems. Enterprises are increasingly moving from on-premises legacy infrastructure to managed cloud environments that provide elastic scalability and automated administration. This preference for cloud-native architectures is evidenced by MongoDB's March 2024 financial results, which reported a 34% year-over-year revenue increase for its fully managed Atlas database, demonstrating how businesses are prioritizing agility and operational efficiency in their data strategies.

Market Challenges

The Global NoSQL Market contends with a substantial operational barrier stemming from the intricate process of migrating from legacy relational systems to non-relational environments, a task that requires specialized technical expertise often missing in standard enterprise IT teams. This scarcity of professionals skilled in non-relational data modeling, query optimization, and distributed architecture management acts as a bottleneck, preventing organizations from fully embracing agile NoSQL solutions. As a result, many enterprises opt to retain outdated legacy infrastructure rather than risk a failed migration, effectively stalling the market's expansion into wider commercial areas.The acuteness of this skills deficit is corroborated by recent industry statistics. Data from the Linux Foundation in 2024 reveals that 55% of organizations cite cloud computing - the essential environment for distributed NoSQL deployments - as their most critical technical staffing need, underscoring a pervasive shortage of the specialized talent required to manage modern data systems. This widespread lack of expertise compels companies to postpone modernization efforts, thereby suppressing the adoption rates of NoSQL technologies despite the evident need for scalable, real-time data management.

Market Trends

The adoption of graph models for complex relationship analysis is accelerating as enterprises strive to derive deeper insights from interconnected datasets. Unlike traditional key-value or document stores that isolate data points, graph databases excel at mapping intricate dependencies, rendering them essential for applications such as fraud detection, supply chain visibility, and knowledge graphs that enhance AI accuracy. This architectural pivot toward relationship-centric data management is driving significant commercial success, as evidenced by Neo4j's November 2024 announcement that it surpassed $200 million in annual recurring revenue, a figure that has doubled over the last three years.In parallel, the emergence of Hybrid Transactional and Analytical Processing (HTAP) is fundamentally transforming database architectures by merging operational and analytical workloads into a unified platform. This convergence removes the latency and complexity involved in transferring data via ETL pipelines, allowing businesses to execute real-time analytics directly on live transactional data. The growing demand for these unified systems is validated by SingleStore's January 2024 report, which announced the company had exceeded $100 million in annual recurring revenue, confirming a strong market shift toward platforms capable of supporting both high-throughput transactions and low-latency analytics.

Key Players Profiled in the NoSQL Market

- MongoDB, Inc.

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- Couchbase, Inc.

- Redis Labs Ltd.

- Datastax, Inc.

- MarkLogic Corporation

- SAP SE

Report Scope

In this report, the Global NoSQL Market has been segmented into the following categories:NoSQL Market, by Type:

- Key-Value Store

- Document Database

- Column Store

- Graph Database

NoSQL Market, by Application:

- Data Storage

- Mobile Apps

- Data Analytics

- Web Apps

- Others

NoSQL Market, by Industry Vertical:

- Retail

- Gaming

- IT

- Others

NoSQL Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global NoSQL Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this NoSQL market report include:- MongoDB, Inc.

- Amazon Web Services, Inc.

- Microsoft Corporation

- Google LLC

- Oracle Corporation

- Couchbase, Inc.

- Redis Labs Ltd.

- Datastax, Inc.

- MarkLogic Corporation

- SAP SE

Table Information

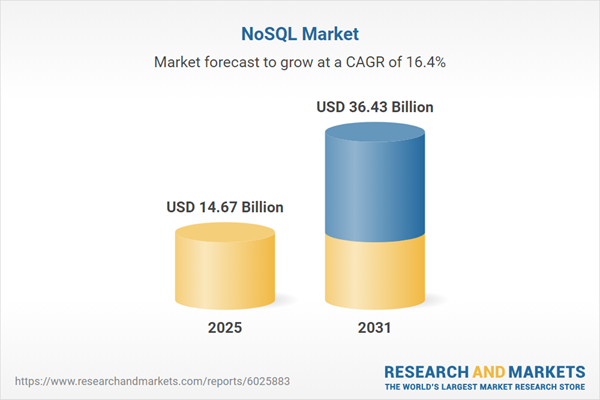

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 14.67 Billion |

| Forecasted Market Value ( USD | $ 36.43 Billion |

| Compound Annual Growth Rate | 16.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |