Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Nevertheless, a major hurdle restricting market growth is the shortage of qualified professionals equipped to manage these sophisticated IT landscapes. Companies frequently face difficulties in hiring talent skilled in handling complex monitoring architectures, which hinders the successful deployment and use of these systems. This workforce limitation is supported by recent data; according to ISACA in 2024, 53% of digital trust experts pinpointed insufficient staff skills and training as the main barrier to attaining digital trust and sustaining resilient infrastructure.

Market Drivers

The widespread implementation of hybrid and multi-cloud architectures is fundamentally transforming the Global System Monitoring Market by demanding enhanced visibility across scattered environments. As businesses move essential workloads from on-site centers to various public cloud services, conventional perimeter-focused monitoring becomes ineffective. Enterprises now demand unified systems that can gather and analyze telemetry data from multiple sources to uphold security and performance standards. This shift is highlighted by Flexera's '2024 State of the Cloud Report' from March 2024, which notes that 89% of organizations have adopted multi-cloud strategies, prompting vendors to create platform-agnostic tools that offer comprehensive views of these distributed ecosystems to prevent operational blind spots.Simultaneously, the incorporation of AI and machine learning into predictive analytics is changing how IT teams handle the massive increase in operational data. Traditional monitoring solutions frequently produce an overwhelming number of alerts, causing fatigue and delayed responses. By utilizing AIOps, platforms can automate root cause identification and forecast anomalies before users are affected. This technological shift is pervasive; Splunk's 'State of Observability 2024' report from October 2024 indicates that 97% of respondents utilize AI or ML-powered systems. Furthermore, New Relic reported in 2024 that full-stack observability leads to 79% less annual downtime, underscoring the link between intelligent monitoring and operational resilience.

Market Challenges

The shortage of qualified personnel presents a significant obstacle to the growth of the Global System Monitoring Market. As IT environments become more complex through the use of microservices and hybrid cloud architectures, the technical expertise needed to implement and oversee system monitoring tools has increased considerably. Companies need professionals capable of not only installing these systems but also analyzing massive volumes of telemetry data to separate false alerts from genuine performance threats. When organizations lack the human resources to manage these sophisticated systems, they frequently suspend or abandon intended investments in new infrastructure, meaning market revenue is limited not by technology, but by the client's capacity to effectively employ the software.This disparity between workforce readiness and technological advancement compels many businesses to depend on rudimentary or legacy tools instead of comprehensive monitoring solutions. The reluctance to invest in advanced licenses arises from the understanding that without skilled oversight, these tools will fail to provide a return on investment. The severity of this staffing crisis is highlighted by ISC2's 2024 data, which reveals that 67% of industry professionals report significant staffing shortages within their organizations. This statistic demonstrates that a large portion of prospective buyers are constrained by resources, resulting in stalled implementation initiatives as companies prioritize filling positions over expanding their technological capabilities.

Market Trends

The fusion of performance and security monitoring is redefining market demands by removing the barriers between ITOps and SecOps. Contemporary observability platforms are increasingly incorporating vulnerability management into their monitoring processes, enabling teams to link performance irregularities with security breaches. This integration allows IT personnel to identify threats concurrently with latency issues, simplifying incident management and reducing the need for disparate tools. This movement towards consolidation is accelerating; according to Dynatrace's 'State of Observability 2024' report from March 2024, 79% of organizations currently utilize or intend to adopt a unified platform for security and observability data within the coming year.The emergence of cloud-native monitoring is propelled by the transient nature of microservices, which makes conventional polling-based tools obsolete. Unlike static servers, containerized setups depend on short-lived instances that automatically activate and deactivate, necessitating high-speed metric collection to ensure visibility. Technologies such as extended Berkeley Packet Filter (eBPF) are becoming crucial for tracking these temporary workloads without introducing latency or losing vital data. The requirement for specialized real-time monitoring is emphasized by the volatility of these environments; Sysdig’s '2024 Cloud-Native Security and Usage Report' from January 2024 notes that 70% of containers exist for five minutes or less, presenting a major blind spot for legacy systems.

Key Players Profiled in the System Monitoring Market

- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Nokia Corporation

- Juniper Networks, Inc.

- Qualcomm Technologies, Inc.

- Ribbon Communications Inc.

- Mavenir Systems, Inc.

- Oracle Corporation

Report Scope

In this report, the Global System Monitoring Market has been segmented into the following categories:System Monitoring Market, by Component:

- Solution Application Monitoring

- Sever Monitoring

- Network Monitoring

- Cloud Monitoring

- Service Professional

- Managed Service

System Monitoring Market, by Deployment Type:

- On-Premises

- Cloud

System Monitoring Market, by Organization Type:

- Large

- Small & Medium Sized Enterprise

System Monitoring Market, by Vertical:

- BFSI

- IT & Telecom

- Government

- Energy & Utilities

- Healthcare

- Manufacturing

System Monitoring Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global System Monitoring Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this System Monitoring market report include:- Huawei Technologies Co., Ltd.

- Cisco Systems, Inc.

- Nokia Corporation

- Juniper Networks, Inc.

- Qualcomm Technologies, Inc.

- Ribbon Communications Inc.

- Mavenir Systems, Inc.

- Oracle Corporation

Table Information

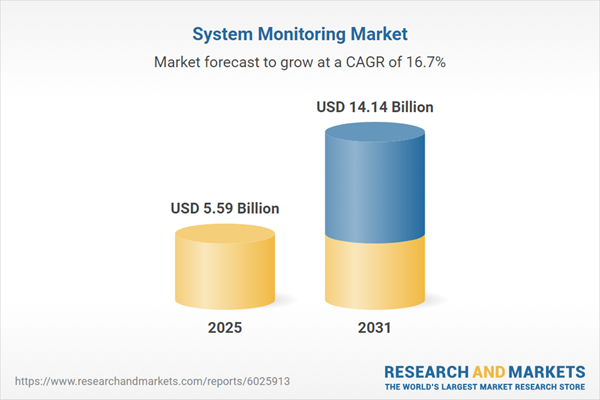

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 5.59 Billion |

| Forecasted Market Value ( USD | $ 14.14 Billion |

| Compound Annual Growth Rate | 16.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |