Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

By leveraging cellular technologies such as 5G and diverse low-power wide-area networks, these services ensure seamless data transmission between centralized platforms and distributed devices. Key growth drivers include the rising need for operational efficiency via industrial automation and the continued rollout of high-speed networks capable of supporting critical low-latency applications. GSMA Intelligence projected in 2024 that global IoT connections would reach 38.7 billion by 2030, with the enterprise sector driving the majority of this growth.

Despite this positive outlook, the market encounters substantial obstacles related to data privacy and cybersecurity within vast device ecosystems. As the number of connected endpoints grows rapidly, the attack surface for potential cyber threats widens, creating complex vulnerabilities that telecom providers are required to manage to preserve network integrity. A major difficulty lies in implementing standardized security protocols across a mix of legacy infrastructure and heterogeneous devices, which poses a barrier to broader adoption in sensitive industries like healthcare and critical utilities.

Market Drivers

The extensive rollout of 5G infrastructure acts as a primary catalyst for the Global IoT Telecom Services Market, delivering the essential reliability, low latency, and bandwidth needed for next-generation applications. As operators shift toward standalone architectures, they gain access to network slicing capabilities that enable precise management of various IoT ecosystems, ranging from critical control systems to massive sensor grids. This infrastructure expansion is both aggressive and global; the Global mobile Suppliers Association reported in their November 2024 '5G Market Snapshot' that 151 operators across 63 countries were investing in 5G standalone access networks. Such technical progression allows providers to advance their value proposition from basic data transport to specialized, high-performance managed connectivity tiers.Concurrently, the rapid uptake of Industrial IoT (IIoT) solutions is generating significant revenue for telecom service providers as enterprises pursue digital transformation. Sectors such as utilities and manufacturing are increasingly dependent on cellular connectivity to support autonomous robotics, real-time asset tracking, and predictive maintenance within smart factories, leading to higher demand for edge solutions and private networks. According to Rockwell Automation’s '9th Annual State of Smart Manufacturing Report' from April 2024, 95% of manufacturers are currently utilizing or evaluating smart manufacturing technologies, a notable increase from the prior year. This momentum aligns with broader service adoption trends; Viasat reported in 2024 that 68% of businesses increased their IoT progress over the previous year, indicating a growing reliance on telecom services for operational improvements.

Market Challenges

The central obstacle hindering the Global IoT Telecom Services Market is the rising threat to data privacy and cybersecurity within expansive device ecosystems. As telecommunication operators extend connectivity to encompass billions of endpoints, the potential attack surface for malicious actors increases exponentially. This vulnerability is worsened by the diverse nature of the IoT landscape, where low-power devices and legacy infrastructure frequently lack the processing power needed for robust, standardized encryption protocols. As a result, enterprises in strictly regulated industries, such as critical utilities and healthcare, remain reluctant to fully integrate these services, fearing that a single compromised node could trigger severe data breaches or systemic operational failures.Recent trends in cyber hostility validate these concerns regarding network integrity. Data from the Wireless Communications Alliance (WCA) in 2024 indicates that the frequency of security attacks targeting IoT devices rose by 107% in the first five months of the year compared to the same timeframe in 2023. This sharp rise in hostile activity compels telecom providers to reallocate substantial technical resources and capital toward defensive measures rather than focusing on service innovation. Ultimately, this security gap undermines the trust essential for large-scale deployment, directly slowing the adoption rates required to achieve the market's aggressive growth targets.

Market Trends

The convergence of terrestrial and satellite IoT connectivity is creating hybrid networks that ensure comprehensive coverage, overcoming the limitations of traditional cellular infrastructure. This integration fills critical connectivity voids in maritime operations and remote logistics where ground-based towers are not economically feasible. By leveraging standardized non-terrestrial networks, telecom providers facilitate seamless roaming between cellular and satellite bands, guaranteeing uninterrupted data transmission for assets moving through dead zones. Major operators are rapidly expanding into space-based services to generate revenue from previously inaccessible regions; GSMA Intelligence noted in its 'Satellite and NTN tracker, Q4 2024' that nearly 100 operators were investing in the satellite sector, following the entry of eight new players in the final quarter.At the same time, the widespread uptake of iSIM and eSIM technologies is transforming device management by eliminating the logistical burdens associated with physical SIM cards. This innovation enables enterprises to provision network profiles remotely over the air, removing the necessity for manual hardware swaps when changing carriers. Such flexibility is essential for global fleets, allowing devices to instantly switch to local profiles to avoid permanent roaming restrictions and reduce costs. This shift toward embedded solutions is generating substantial momentum in hardware deployment; the Trusted Connectivity Alliance reported in its March 2025 'Members Report' that eSIM shipment volumes hit 503 million units in 2024, marking a 35% increase over the previous year.

Key Players Profiled in the IoT Telecom Services Market

- Qualcomm Incorporated

- Aeris Communications, Inc.

- Reliance Jio Infocomm Ltd.

- Bharti Airtel Limited

- MediaTek

- Huawei Technologies Co., Ltd.

- AT&T Inc.

- Deutsche Telekom AG

- Vodafone Group PLC

Report Scope

In this report, the Global IoT Telecom Services Market has been segmented into the following categories:IoT Telecom Services Market, by Component:

- Connectivity Technology

- Network Management Solution

IoT Telecom Services Market, by Service Type:

- Device & Application Management

- Business Consulting Services

- Installation & Integration Services

- M2M Billing Services

IoT Telecom Services Market, by Application:

- Smart Buildings

- Automation

- Capillary Network Management

- Smart Healthcare

- Others

IoT Telecom Services Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global IoT Telecom Services Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this IoT Telecom Services market report include:- Qualcomm Incorporated

- Aeris Communications, Inc.

- Reliance Jio Infocomm Ltd.

- Bharti Airtel Limited

- MediaTek

- Huawei Technologies Co., Ltd.

- AT&T Inc.

- Deutsche Telekom AG

- Vodafone Group PLC

Table Information

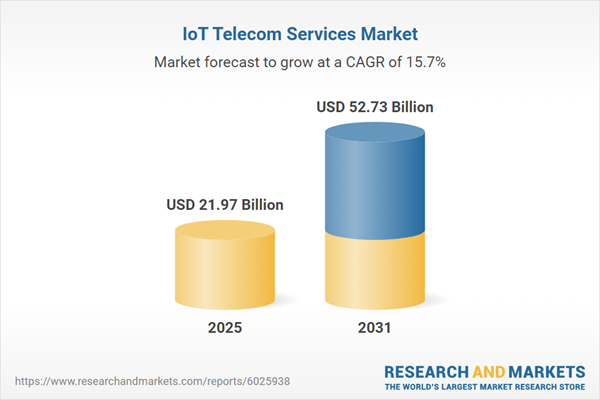

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 21.97 Billion |

| Forecasted Market Value ( USD | $ 52.73 Billion |

| Compound Annual Growth Rate | 15.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |