Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market growth faces significant obstacles due to tightening browser security standards and stringent data privacy regulations. Evolving compliance mandates like GDPR require rigorous data anonymization and consent protocols, which can limit the depth of insights available to marketers and complicate tracking methodologies. Underscoring the severity of this issue, the Interactive Advertising Bureau reported in 2024 that 95% of data and advertising decision-makers anticipate continued privacy legislation and signal loss, presenting a substantial operational hurdle for analysis and data collection tools.

Market Drivers

The rapid growth of the global e-commerce sector serves as a primary catalyst for the adoption of heatmap software, as online retailers face increasing pressure to maximize returns on digital traffic. With digital storefronts becoming the main revenue generators for many enterprises, the ability to visualize user behavior through scroll tracking and click maps is essential for optimizing the path to purchase and reducing cart abandonment.The sheer volume of transactions necessitates these tools; the U.S. Census Bureau’s 'Quarterly Retail E-Commerce Sales' report from November 2024 estimates that U.S. retail e-commerce sales reached $288.8 billion in the third quarter alone. This commercial activity is supported by massive investments in traffic acquisition, creating a financial imperative to ensure landing pages perform efficiently. As noted in the Interactive Advertising Bureau’s April 2024 'Internet Advertising Revenue Report,' internet ad revenues surged to a record $225 billion in 2023, indicating that companies are prioritizing heatmap analytics to safeguard their advertising ROI by ensuring paid visitors convert successfully.

Concurrently, the growing focus on User Experience (UX) optimization compels organizations to integrate heatmap solutions to systematically detect and resolve interface friction. As digital products mature, the competitive differentiator often shifts from feature availability to seamless interaction, prompting product teams to rely on granular visual data to diagnose navigational hurdles.

Eliminating these design flaws is critical for retention, as unoptimized interfaces lead to immediate user churn. Highlighting the prevalence of these engagement barriers, the Contentsquare '2024 Digital Experience Benchmark Report' from February 2024 found that frustration signals like rage clicks and dead clicks impacted 39.6% of all global visitor sessions. Consequently, businesses are deploying heatmap software not merely for aesthetic refinement, but as a strategic necessity to identify operational bottlenecks and engineer more intuitive, customer-centric digital environments.

Market Challenges

Stringent data privacy regulations and tightening browser security standards act as significant restraints on the global heatmap software market. These compliance mandates fundamentally disrupt the core functionality of heatmap tools, which rely on capturing granular user interactions such as mouse movements, clicks, and scrolling behavior to generate visual analytics. When browsers block tracking scripts or users decline consent via mandated pop-ups, heatmap software suffers from substantial data gaps, rendering the resulting graphical representations less accurate and less representative of actual user behavior. As a result, organizations face difficulties in obtaining the complete datasets necessary for precise user experience optimization, effectively diminishing the perceived return on investment for these analytics platforms.This regulatory environment forces businesses to divert resources away from behavioral tracking tools toward compliance and first-party data strategies. The fear of legal repercussions and reputational damage has led many enterprises to limit the scope of their data collection, directly reducing the adoption of third-party tracking solutions. According to the Interactive Advertising Bureau, in 2024, nearly 90% of marketers reported shifting their personalization tactics, budget allocation, and data mix in anticipation of privacy changes. This broad strategic pivot hampers market growth as potential clients prioritize strict adherence to privacy standards over the deep tracking capabilities that heatmap software traditionally provides.

Market Trends

The integration of AI-driven predictive analytics is shifting the market from retrospective analysis to proactive behavioral forecasting. These advanced systems utilize machine learning to simulate eye-tracking and predict attention hotspots before live traffic reaches a page, enabling product teams to validate design hierarchies instantly without prolonged A/B testing. This capability transforms heatmaps from passive reporting tools into active predictive assets that can forecast engagement outcomes during the prototyping phase. The industry-wide momentum toward these intelligent tools is strong; according to the Salesforce 'State of Marketing' report from May 2024, 32% of marketing organizations have fully implemented AI into their workflows, with predictive applications for automated interactions cited as a primary use case, signaling high demand for automated insight generation.Simultaneously, there is a distinct adoption of mobile-first and in-app heatmap solutions, responding to the superior engagement rates found in native applications compared to mobile web interfaces. Vendors are upgrading their technical stacks with specialized Software Development Kits (SDKs) designed to capture touch-specific gestures like swipes and pinches, which browser-based trackers often miss. This technical pivot is driven by the imperative to optimize the most retentive digital channels; the Contentsquare '2024 Digital Experience Benchmark Report' from February 2024 reveals that mobile app users spend 64% more time in-app than visitors spend on mobile websites, compelling companies to deploy app-centric visualization tools to capitalize on this deeper engagement.

Key Players Profiled in the Heatmap Software Market

- Hotjar Ltd.

- Quantum Metric, Inc.

- Lucky Orange LLC

- Cisco Systems, Inc.

- MicroStrategy Incorporated

- Salesforce, Inc.

- Glassbox Ltd.

- Contentsquare SAS

Report Scope

In this report, the Global Heatmap Software Market has been segmented into the following categories:Heatmap Software Market, by Deployment Type:

- Cloud-Based

- On-Premises

Heatmap Software Market, by End-User Industry:

- E-commerce & Retail

- Healthcare

- BFSI

- IT & Telecommunications

- Media and Entertainment

- Education

- Others

Heatmap Software Market, by Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Heatmap Software Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Heatmap Software Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Heatmap Software market report include:- Hotjar Ltd.

- Quantum Metric, Inc.

- Lucky Orange LLC

- Cisco Systems, Inc.

- MicroStrategy Incorporated

- Salesforce, Inc.

- Glassbox Ltd.

- Contentsquare SAS

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

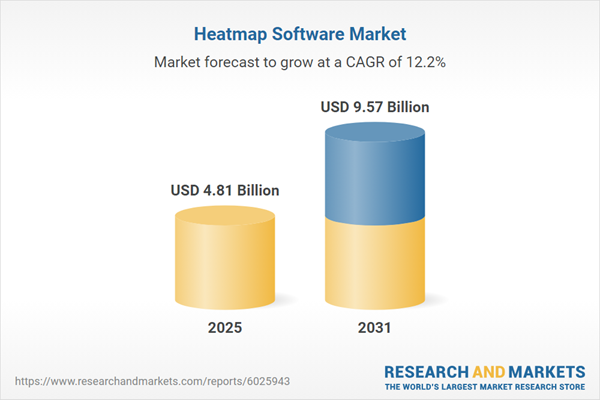

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 4.81 Billion |

| Forecasted Market Value ( USD | $ 9.57 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 9 |