Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite this positive growth trajectory, the industry encounters significant hurdles regarding safety regulations, as concerns over crashworthiness frequently restrict the street-legal status of LSVs on wider public road networks. To demonstrate the sector's scale in key regions, data from the Federation of Automobile Dealers Associations (FADA) indicates that retail sales of low-speed electric three-wheelers in India reached 481,599 units in 2024. These statistics highlight the considerable adoption of low-speed mobility options in emerging markets, even as manufacturers continue to navigate diverse and complex regulatory frameworks across the globe.

Market Drivers

The enforcement of strict environmental regulations and the growing preference for sustainable urban mobility are fundamentally transforming the Global Low Speed Vehicle Market. Governments globally are implementing rigorous emission standards to combat urban pollution, necessitating a transition from internal combustion engines to electric low-speed alternatives for facility and campus management. This shift is further accelerated by corporate sustainability goals, as businesses deploy low-speed electric vehicles (LSEVs) to lower their carbon footprints and adhere to green mandates. Illustrating this global trend toward electrification, the International Energy Agency's 'Global EV Outlook 2024' from April 2024 reported a robust 35% year-on-year increase in electric car sales in 2023, exceeding 14 million units, a trajectory that supports the infrastructure growth required for smaller electric mobility solutions.Additionally, the expansion of last-mile delivery and logistics networks acts as a critical driver, fueling the adoption of LSVs for efficient cargo transport. As e-commerce volumes rise, logistics providers are utilizing agile three- and four-wheeled LSVs to traverse congested city centers where larger trucks face restrictions, offering a cost-effective solution for high-frequency stops. Highlighting this operational shift, Flipkart announced in November 2024 the deployment of over 10,000 electric vehicles in its delivery fleet to enhance speed and reduce costs. Furthermore, demonstrating the financial magnitude of key players capitalizing on these needs, Textron Inc.'s '2023 Annual Report' from February 2024 revealed that its Industrial segment, including brands like E-Z-GO and Cushman, generated $3.8 billion in revenue.

Market Challenges

The primary obstacle restricting the expansion of the Global Low Speed Vehicle Market is the stringent regulatory environment regarding crashworthiness, which severely limits the operational scope of these vehicles. Unlike full-sized automobiles, low-speed vehicles (LSVs) often lack advanced safety features such as airbags, reinforced crumple zones, and electronic stability control, rendering them vulnerable in collisions with heavier traffic. Consequently, transport authorities globally enforce restrictive legislation that confines LSVs to roads with low speed limits, typically under 35 miles per hour, or designated closed campuses. This regulatory limitation drastically reduces the vehicle's utility for general consumers who require versatile transportation capable of navigating mixed-traffic public roadways to access essential services.This inability to seamlessly integrate into broader traffic networks has a quantifiable negative impact on market adoption rates, even in regions with strong environmental mandates. The difficulty in maintaining sales momentum against fuller-featured alternatives is evident in recent industry performance data. According to the European Association of Motorcycle Manufacturers (ACEM), registrations of mopeds and light vehicles in key European markets declined by 14.5% to 132,533 units during the first nine months of 2024. This contraction suggests that despite the push for electrification, the functional limitations imposed by safety-driven regulations are discouraging mass adoption, effectively capping the market's growth potential compared to less restricted vehicle categories.

Market Trends

The widespread adoption of Lithium-Ion Battery Technology is revolutionizing the Global Low Speed Vehicle Market by replacing traditional lead-acid systems with higher-efficiency, zero-maintenance power solutions. This technological evolution significantly improves vehicle range and reduces charging intervals, making electric LSVs more viable for extended commercial and fleet operations. Manufacturers are increasingly integrating advanced battery management systems (BMS) to optimize energy usage and extend the operational lifespan of their fleets. Demonstrating this industrial shift, Yamaha Motor Co., Ltd. announced in a March 2025 news release the launch of new five-seater electric golf cars equipped with in-house lithium-ion batteries that reduce power consumption by approximately 30% compared to previous generations.Simultaneously, the rise of Modular and Customizable Vehicle Platforms is reshaping the sector, allowing fleet operators to adapt a single chassis for diverse applications ranging from security patrols to facility maintenance. This trend addresses the growing need for versatile utility vehicles that can be rapidly reconfigured to meet specific operational demands without requiring investment in entirely new fleets. Companies are responding by launching multi-purpose lineups that seamlessly blend passenger transport with heavy-duty cargo capabilities. Highlighting this development, an Electrek article from July 2025 reported that Waev Inc. unveiled its new 'Fusion' line of commercial electric low-speed vehicles, featuring six distinct models designed to interchangeably serve both people-moving and utility functions for municipal and industrial fleets.

Key Players Profiled in the Low Speed Vehicle Market

- Textron, Inc.

- Polaris Inc.

- Club Car, LLC

- Yamaha Motor Corporation, U.S.A.

- Columbia Vehicle Group, Inc.

- Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd.

- ACG, Inc.

- STAR EV Corporation

- Alke s.r.l.

- GEM WAEV, LLC

Report Scope

In this report, the Global Low Speed Vehicle Market has been segmented into the following categories:Low Speed Vehicle Market, by Propulsion Type:

- Electric Vehicle

- ICE

Low Speed Vehicle Market, by Vehicle Type:

- Sports Field Utility Vehicle

- Commercial Utility vehicle

- Personal Carrier

Low Speed Vehicle Market, by Application:

- Sports Field

- Industrial Facilities

- Airports

- Hotels & Resort

Low Speed Vehicle Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Low Speed Vehicle Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Low Speed Vehicle market report include:- Textron, Inc

- Polaris Inc

- Club Car, LLC

- Yamaha Motor Corporation, U.S.A.

- Columbia Vehicle Group, Inc

- Suzhou Eagle Electric Vehicle Manufacturing Co., Ltd

- ACG, Inc.

- STAR EV Corporation

- Alke s.r.l.

- GEM WAEV, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

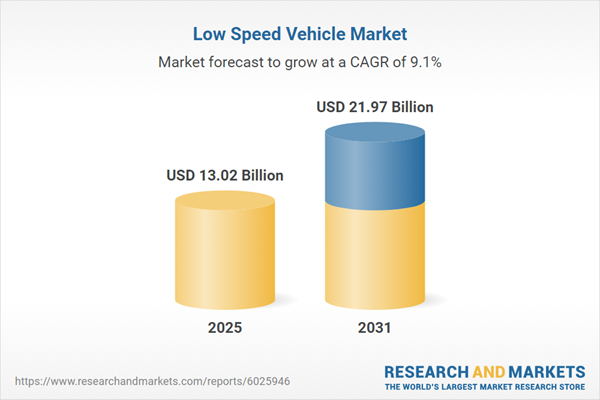

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 13.02 Billion |

| Forecasted Market Value ( USD | $ 21.97 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |