Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Unlike traditional ionization or photoelectric smoke detectors, laser smoke detectors offer superior sensitivity, enabling early detection of even the smallest particles generated by smoldering fires or other slow-burning sources. This makes them particularly effective in high-risk environments where early warning is crucial, such as data centers, laboratories, manufacturing facilities, healthcare settings, and other areas where the rapid identification of fire is critical to prevent damage and ensure safety.

Laser smoke detectors are also known for their ability to reduce false alarms, which are a common issue with conventional detectors, by using precise calibration to differentiate between actual smoke and other airborne particles like dust or steam. This reliability makes them ideal for industries with sensitive equipment or areas where continuous operation is essential. These detectors are often integrated into building management systems to enhance overall fire safety through real-time monitoring and remote diagnostics.

Key Market Drivers

Stringent Fire Safety Regulations and Building Codes

The implementation of stringent fire safety regulations and building codes across various regions is a key driver for the global laser smoke detector market. Governments and regulatory bodies worldwide are enforcing more rigorous standards to enhance fire safety in both commercial and residential buildings. For instance, regulatory frameworks like the National Fire Protection Association (NFPA) standards in the United States, the European EN standards, and other local fire safety codes emphasize the need for reliable smoke detection systems.Laser smoke detectors, known for their high precision in detecting early signs of fire, are becoming the preferred choice among builders and facility managers who must comply with these evolving regulations. Unlike conventional smoke detectors, laser-based systems are designed to detect smoke particles at a much earlier stage, reducing false alarms and providing quicker response times, which is crucial for large, complex buildings like hospitals, hotels, and high-rise apartments.

The growing concern for occupant safety in crowded public spaces like shopping malls, airports, and entertainment venues is prompting stakeholders to adopt more efficient fire detection solutions, thus driving the market for laser smoke detectors. Furthermore, with the increasing frequency of fire-related incidents, especially in densely populated urban areas, the demand for advanced smoke detection technologies that can offer real-time alerts and integration with emergency response systems is rising. The ability of laser smoke detectors to operate efficiently in environments with challenging air quality conditions, such as industrial plants and warehouses, also aligns with the stringent safety standards set by regulatory authorities, making them indispensable in critical infrastructure projects.

Advancements in Laser Detection Technology and Miniaturization

Advancements in laser detection technology, coupled with the trend towards miniaturization, are playing a crucial role in driving the growth of the global laser smoke detector market. The latest developments in laser optics, sensor technology, and data processing capabilities have significantly enhanced the performance and efficiency of smoke detectors. These technological innovations are enabling manufacturers to develop compact, highly sensitive, and energy-efficient smoke detection systems that can be seamlessly integrated into various applications, from small residential units to expansive commercial complexes.The miniaturization of components has allowed for the production of smaller yet more powerful laser smoke detectors that can fit into tight spaces, making them ideal for modern buildings with complex layouts. Additionally, the integration of AI and machine learning algorithms with laser detection systems is enabling these devices to differentiate between smoke from real fires and other airborne particles, thereby reducing the occurrence of false alarms. This advancement is particularly beneficial in settings like restaurants, kitchens, or industrial sites where traditional smoke detectors may trigger frequent, unnecessary alarms.

As the global construction industry increasingly prioritizes the integration of high-tech safety features in new projects, the demand for innovative smoke detection solutions is on the rise. Laser-based systems are also becoming more affordable due to economies of scale and technological breakthroughs, making them accessible to a broader range of users, including homeowners and small businesses. With the ongoing investment in research and development, the laser smoke detector market is poised to benefit from further technological advancements, including wireless communication, enhanced battery life, and robust data analytics capabilities, ensuring continued market expansion.

Key Market Challenges

High Initial Investment and Complex Installation Processes

The global laser smoke detector market faces a significant challenge due to the high initial investment and complex installation processes associated with this advanced technology. Unlike conventional smoke detectors, which are relatively inexpensive and simple to install, laser smoke detectors require sophisticated components and precise calibration. These detectors utilize highly sensitive laser-based technology to detect smoke particles, offering superior performance in terms of early fire detection and minimizing false alarms. However, this technological advancement comes at a cost.The intricate manufacturing processes needed to produce high-quality laser diodes, sensors, and electronic components contribute to increased production costs, which ultimately drive up the market price of these detectors. This price factor can deter budget-conscious consumers, especially in regions where cost-sensitive sectors like residential housing and small businesses may prioritize affordability over cutting-edge technology. Additionally, installing laser smoke detectors often requires specialized technicians with the technical expertise to ensure proper calibration and functionality, which further adds to the overall cost.

The need for skilled labor in the installation process can be a barrier in regions with limited technical resources, further restricting the adoption of this technology. For businesses and institutions, the costs are compounded by the need to integrate these detectors into existing fire safety systems, which may involve retrofitting buildings, updating electrical wiring, and implementing new software systems to manage the detectors. In industries such as commercial real estate and large-scale industrial facilities, the cost of upgrading existing infrastructure can be prohibitively high, slowing the rate of adoption. This challenge is further exacerbated in emerging markets, where the high price point may not align with the financial capabilities of many end-users, leading to a preference for more cost-effective, albeit less advanced, traditional smoke detection solutions.

Limited Awareness and Resistance to Technology Adoption

The global laser smoke detector market also grapples with limited awareness and resistance to the adoption of new technology, especially among end-users who are accustomed to traditional smoke detection systems. Despite the proven benefits of laser-based smoke detectors, such as faster response times and reduced false alarms, there remains a significant knowledge gap among potential buyers. Many facility managers, safety officers, and even homeowners are not fully aware of the advantages that laser technology offers over conventional optical or ionization smoke detectors. This lack of awareness can be attributed to insufficient marketing efforts and a general reluctance among manufacturers to invest in educational campaigns.Without a clear understanding of the benefits, end-users are more likely to stick with older, well-known technologies that have served them adequately in the past. Additionally, the perception that laser smoke detectors are overly complex or require extensive maintenance can discourage potential buyers, even in sectors where fire safety is a top priority, such as healthcare facilities and data centers. The reluctance to adopt new technology is also driven by concerns over compatibility with existing fire safety systems, where integrating a new type of detector might require significant upgrades or modifications.

Moreover, stringent regulatory standards and certification processes in the fire safety industry add another layer of complexity, as end-users may hesitate to switch to newer technologies that are perceived as untested or insufficiently proven in real-world scenarios. Resistance to change is particularly prevalent in industries with long-established safety protocols, such as manufacturing and transportation, where compliance with existing fire codes is paramount. Thus, even though laser smoke detectors offer superior performance, overcoming the inertia of traditional practices remains a significant hurdle for market penetration, limiting the widespread adoption of this technology.

Key Market Trends

Increasing Adoption of IoT and Smart Building Technologies Driving Laser Smoke Detector Integration

As the Internet of Things (IoT) and smart building technologies continue to expand, there has been a marked shift toward integrating advanced laser smoke detectors into modern infrastructure. The trend is driven by the growing demand for real-time monitoring, remote diagnostics, and automated safety systems that can proactively respond to potential hazards. Laser smoke detectors are preferred in smart buildings because of their high sensitivity and precision in detecting smoke particles at a much earlier stage than conventional optical or ionization detectors.These detectors utilize laser beams to identify even the smallest particles of combustion, ensuring quicker alerts and reducing the risk of false alarms, which are common with traditional systems. The integration of IoT capabilities enables laser smoke detectors to be interconnected with centralized building management systems (BMS), enhancing the overall safety and efficiency of buildings. Through IoT-enabled connectivity, these detectors can send real-time data to facility managers or emergency services, significantly reducing response times during fire incidents.

Additionally, this trend aligns with the broader move toward sustainability and energy efficiency, as laser smoke detectors can optimize their power usage when integrated into smart systems. The demand for these solutions is particularly strong in commercial buildings, data centers, healthcare facilities, and high-end residential complexes, where early fire detection is critical.

As regulatory standards and building codes evolve to mandate more stringent fire safety measures, particularly in high-risk areas, the adoption of IoT-integrated laser smoke detectors is expected to surge. This trend is further amplified by technological advancements in wireless communication and cloud computing, which facilitate seamless data transmission and analytics. Overall, the integration of laser smoke detectors with IoT and smart building systems is set to play a pivotal role in transforming fire safety strategies, providing robust, real-time insights, and enhancing the overall resilience of modern infrastructures.

Rising Emphasis on Safety in Public Spaces Fueling Demand for Laser Smoke Detectors

The emphasis on public safety has intensified in recent years, leading to an increased demand for high-performance fire detection systems, particularly in densely populated areas such as airports, shopping malls, hospitals, and educational institutions. As concerns over public safety grow, there has been a noticeable trend toward the deployment of laser smoke detectors, which are capable of detecting even the faintest traces of smoke, thereby ensuring a swift response to potential fire hazards. Traditional smoke detectors often struggle in large, open spaces due to factors such as high ceilings, fluctuating air currents, and the presence of dust or other airborne particles that can trigger false alarms.In contrast, laser smoke detectors excel in these challenging environments due to their precision and rapid response times. These detectors use laser-based scattering techniques to detect microscopic smoke particles, which significantly reduces the chances of false alarms and ensures reliable performance. The growing emphasis on safety in public spaces is further driven by stricter fire safety regulations and standards, particularly in regions like North America and Europe, where governments are implementing more rigorous compliance requirements. Additionally, there is increasing investment in infrastructure modernization, especially in emerging markets, where public safety is becoming a higher priority.

As public spaces are often the target of large-scale safety upgrades, including fire detection systems, the demand for advanced laser smoke detectors is expected to grow. The integration of laser detectors with smart building automation systems also plays a crucial role in improving response times and optimizing evacuation procedures during emergencies. As a result, the trend toward adopting laser smoke detectors in public spaces is poised to gain momentum, driven by advancements in detection technology, heightened safety awareness, and the need for compliance with evolving fire safety standards worldwide.

Segmental Insights

Service Insights

The Testing & Inspection Service segment held the largest Market share in 2023. The laser smoke detector market is witnessing significant growth within the Testing & Inspection Service segment, driven primarily by the increasing demand for advanced fire safety solutions across industries. As businesses and regulatory bodies emphasize the need for stringent safety protocols, the adoption of laser smoke detectors in testing and inspection services has surged. Laser-based technology offers enhanced accuracy, early detection capabilities, and a reduction in false alarms compared to traditional smoke detectors, making it a preferred choice for facilities with sensitive equipment or high-value assets.Industries such as manufacturing, data centers, healthcare, and energy facilities are increasingly leveraging these advanced smoke detectors as part of their comprehensive fire safety inspections to safeguard critical infrastructure. The growing regulatory focus on workplace safety, particularly in regions like North America and Europe, is fueling the integration of laser smoke detection systems in routine inspections to ensure compliance with safety standards. The use of these detectors in testing services is particularly beneficial in environments where early smoke detection is crucial, such as laboratories, pharmaceutical plants, and semiconductor facilities, where even minor disruptions due to fire can result in substantial financial losses and production downtime.

In addition, the proliferation of smart buildings and automation in infrastructure has propelled the demand for precise, real-time monitoring solutions, further boosting the adoption of laser smoke detectors in inspection services. These detectors' ability to detect minute particles of smoke, coupled with minimal maintenance requirements, is driving their deployment in critical areas that require continuous monitoring.

The trend towards predictive maintenance and asset protection is another contributing factor, as companies seek to identify potential fire hazards before they escalate into catastrophic events. As organizations prioritize business continuity and risk mitigation, the integration of laser smoke detectors within the testing and inspection framework is expected to expand, driven by advancements in sensor technology and the adoption of IoT-enabled fire safety systems. Additionally, the increasing focus on sustainability and green building certifications is encouraging companies to opt for eco-friendly, energy-efficient detection systems, further promoting the market for laser smoke detectors in the testing and inspection segment.

Regional Insights

North America region held the largest market share in 2023. The North America segment of the laser smoke detector market is witnessing robust growth, primarily driven by the region's increasing emphasis on fire safety regulations and standards. As governments and regulatory authorities, such as the National Fire Protection Association (NFPA) in the United States, continue to enforce stringent fire safety codes, there is a rising demand for advanced detection systems like laser smoke detectors, which offer heightened sensitivity and faster response times compared to traditional smoke detectors.This push for improved safety measures is particularly significant in high-risk environments such as hospitals, data centers, industrial facilities, and commercial buildings, where early detection of smoke is critical to prevent fire-related damages and loss. The growing adoption of smart building technologies is fueling demand for innovative fire detection systems. Laser smoke detectors, with their ability to integrate seamlessly with building management systems, align with the ongoing trend toward smart infrastructure, making them a preferred choice for both new constructions and retrofitting projects.

Moreover, the increasing frequency of wildfires, particularly in regions like California, has heightened awareness among both commercial and residential property owners about the importance of early fire detection, further boosting the adoption of laser smoke detectors. Another crucial factor driving the market is the growing focus on sustainability and energy efficiency. Unlike conventional ionization smoke detectors, laser-based systems are free of radioactive materials, making them an environmentally friendly option, which aligns with North America's shift towards sustainable building practices.

Advancements in laser technology have led to the development of more reliable and accurate detectors, capable of distinguishing between real fire events and nuisance alarms, thus reducing false alarms and improving operational efficiency. This technological edge is prompting widespread adoption across industries, including healthcare, manufacturing, and education, where minimizing disruptions is crucial. The expansion of the Internet of Things (IoT) ecosystem is also playing a pivotal role in the market's growth, enabling laser smoke detectors to provide real-time alerts and remote monitoring capabilities, which are particularly valuable in large-scale facilities and multi-site operations.

Furthermore, the presence of key market players and continuous investments in research and development are contributing to the competitive landscape, driving innovation and the introduction of cost-effective solutions. As the construction industry in North America continues to recover and expand, driven by rising investments in infrastructure projects and urbanization, the demand for sophisticated fire safety systems like laser smoke detectors is expected to grow. The increasing awareness among consumers and businesses about the potential losses due to fire incidents, both in terms of property and lives, is reinforcing the importance of adopting advanced fire detection technologies, solidifying the market's upward trajectory in the region.

Key Market Players

- Samsung Electronics Co., Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- AMP Smart Security

- Newell Brands Inc.,

- Siemens AG

- ABB Limited

- Hochiki Corporation

- Johnson Controls International plc

- Panasonic Holdings Corporation

Report Scope:

In this report, the Global Laser Smoke Detector Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Laser Smoke Detector Market, By Connectivity:

- Wi-Fi

- Bluetooth

- Zigbee

Laser Smoke Detector Market, By Service:

- Testing & Inspection Service

- Installation Service

- Maintenance & Replacement Service

Laser Smoke Detector Market, By Power Source:

- Hard-Wired

- Battery Powered

Laser Smoke Detector Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Laser Smoke Detector Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Samsung Electronics Co., Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- AMP Smart Security

- Newell Brands Inc.,

- Siemens AG

- ABB Limited

- Hochiki Corporation

- Johnson Controls International plc

- Panasonic Holdings Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2024 |

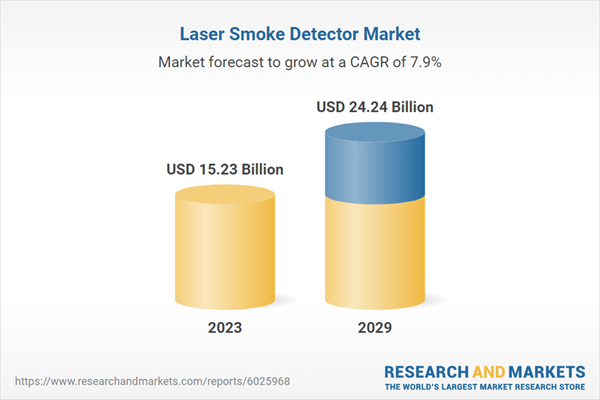

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 15.23 Billion |

| Forecasted Market Value ( USD | $ 24.24 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |