Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Enterprises are increasingly integrating these solutions to streamline operations and ensure strict adherence to security protocols. However, a significant obstacle impeding broader market expansion is the complexity involved in deployment and the substantial expertise required to customize and maintain automation playbooks. This implementation difficulty often leads to prolonged integration phases and can discourage organizations with limited technical maturity from fully adopting these comprehensive security management systems.

Market Drivers

The escalating frequency and sophistication of global cyber threats serve as a primary catalyst for the adoption of Security Orchestration, Automation, and Response platforms. As threat actors employ advanced tactics to breach defenses, organizations are compelled to deploy automated systems capable of detecting and neutralizing attacks at machine speed. This surge in hostile activity necessitates tools that can parse vast amounts of telemetry data to identify genuine indicators of compromise without human delay. According to Check Point Research’s 'Cyber Attack Trends: 2024 Mid-Year Report', global cyber attacks increased by 30% weekly in the second quarter of 2024 compared to the previous year, rapidly intensifying the dependency on centralized orchestration to maintain robust defensive postures against relentless external pressure.Concurrently, the imperative to reduce operational costs through automated security workflows is driving significant market investment. Enterprises are increasingly turning to orchestration layers to minimize the financial impact of breaches and optimize the efficiency of security operations centers. By integrating artificial intelligence, these platforms streamline incident response, thereby reducing the manual labor hours required for investigation and remediation. According to IBM’s 'Cost of a Data Breach Report 2024', organizations that utilized security AI and automation extensively saved an average of USD 2.22 million in breach costs compared to those that did not. Furthermore, SonicWall reported in 2024 that encrypted threats increased by 117% globally, further validating the need for automated solutions to handle complex attack vectors.

Market Challenges

The complexity associated with deployment and the substantial expertise required to customize and maintain automation playbooks act as significant restraints on the Global Security Orchestration Automation and Response Market. Although these platforms offer enhanced efficiency, integrating them into existing IT ecosystems is often intricate and resource-intensive. Organizations frequently discover that designing effective automation workflows requires deep technical knowledge that is not readily available within their current teams. This implementation hurdle leads to prolonged setup phases and can deter companies with lower technical maturity from committing to these solutions.The impact of this challenge is magnified by the scarcity of specialized talent capable of managing such advanced tools. Without skilled personnel to configure and update playbooks, the potential for automation remains untapped, causing organizations to pause or scale back their investment plans. According to ISACA, in 2024, 45% of cybersecurity professionals indicated that their staff lacks sufficient training and skills to manage evolving security demands. This proficiency gap directly hampers the market's growth, as businesses may prioritize simpler solutions over complex platforms that they cannot effectively maintain.

Market Trends

A dominant trend is the convergence of SOAR with SIEM and XDR platforms, driven by the operational inefficiency of managing disparate security tools. Organizations are increasingly abandoning standalone orchestration solutions in favor of unified architectures that consolidate threat detection and response capabilities into a single interface. This shift is accelerating as security teams struggle with the complexity of maintaining numerous isolated point products, which hampers visibility and delays incident resolution. According to Cisco’s '2024 Cybersecurity Readiness Index', 80% of organizations admitted that having multiple point solutions slowed down their team’s ability to detect, respond, and recover from incidents, prompting a consolidation that simplifies the technology stack and reduces the integration burden.Simultaneously, the integration of Generative AI for playbook development is revolutionizing how security teams create automation workflows. By leveraging large language models, platforms are enabling analysts to generate complex response playbooks using natural language commands, effectively lowering the technical barrier to entry. This capability addresses the critical shortage of coding expertise within security operations centers and empowers less experienced staff to contribute to engineering tasks previously reserved for senior developers. According to Splunk’s 'State of Security 2024' report, 90% of security executives believe entry-level talent can lean on generative AI to develop their skills in the SOC, democratizing automation to foster faster deployment of response protocols and enhance productivity.

Key Players Profiled in the Security Orchestration Automation and Response Market

- IBM Corporation

- Cisco Systems, Inc.

- Splunk LLC

- Palo Alto Networks, Inc.

- Sumo Logic, Inc.

- Rapid7, Inc.

- Swimlane Inc.

- Fortinet, Inc.

Report Scope

In this report, the Global Security Orchestration Automation and Response Market has been segmented into the following categories:Security Orchestration Automation and Response Market, by Application:

- Threat Intelligence

- Incident Response

- Compliance

Security Orchestration Automation and Response Market, by Industry Vertical:

- BFSI

- IT & Telecom

- Healthcare

- Manufacturing

- Education

Security Orchestration Automation and Response Market, by Deployment:

- Cloud

- On-Premises

Security Orchestration Automation and Response Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Security Orchestration Automation and Response Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Security Orchestration Automation and Response market report include:- IBM Corporation

- Cisco Systems, Inc.

- Splunk LLC

- Palo Alto Networks, Inc.

- Sumo Logic, Inc.

- Rapid7, Inc.

- Swimlane Inc.

- Fortinet, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

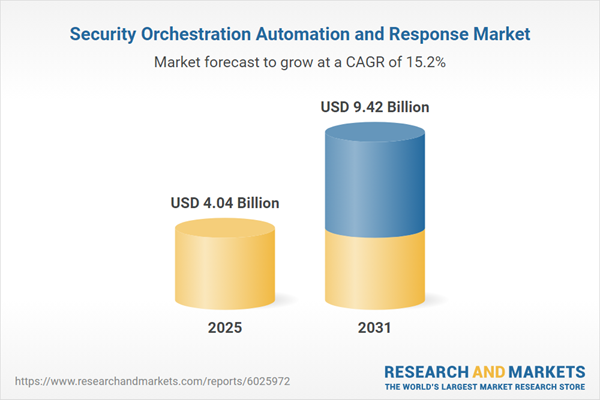

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 4.04 Billion |

| Forecasted Market Value ( USD | $ 9.42 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |