Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Despite these growth factors, the market encounters significant obstacles due to the fragmentation of regional standards, which creates costly compliance hurdles for companies seeking simultaneous entry into multiple foreign markets. This regulatory complexity forces TIC providers to maintain broad accreditation scopes, thereby increasing operational overhead. The magnitude of the reliance on standardized testing is highlighted by data from the IECEE, which reported in 2024 that 120,009 international CB Test Certificates were issued globally during the previous year. This statistic emphasizes the substantial volume of conformity assessment activities necessary to successfully navigate the requirements of international trade.

Market Drivers

The surging growth of the Electric Vehicle and Automotive Electronics Market significantly dictates the need for specialized conformity assessment services. As the automotive industry shifts toward electrification, there is a heightened necessity to validate high-voltage safety systems, battery performance, and sophisticated electronic control units against strict international standards. This transition generates a major revenue source for testing laboratories, which are tasked with certifying compliance with safety and interoperability mandates prior to market entry. The rapid expansion of this sector is illustrated by the International Energy Agency (IEA), which noted in its 'Global EV Outlook 2024' that global electric car sales rose by roughly 25% in the first quarter of 2024 compared to the same period the prior year.Additionally, the rapid proliferation of the Internet of Things and connected devices is fueling the demand for extensive radio frequency and electromagnetic compatibility testing. Integrating wireless connectivity into industrial and consumer products requires rigorous adherence to interoperability protocols and spectrum regulations to avoid signal interference. The scale of devices needing certification underscores this trend; the 'Ericsson Mobility Report' from June 2024 forecasts that cellular IoT connections will hit 4.5 billion by late 2025. This increase in volume and complexity directly boosts market performance, as evidenced by Bureau Veritas' 'H1 2024 Results' from July 2024, where their Consumer Products Services division reported 7.3% organic revenue growth, indicating a strong recovery in demand for electronics testing.

Market Challenges

The fragmentation of regional standards presents a formidable barrier to the Global Electrical & Electronics Testing, Inspection & Certification (TIC) Market by creating prohibitive compliance costs that suppress international trade volumes. Manufacturers aiming to export goods frequently face the burden of redundant testing procedures to meet technical requirements that differ slightly across various jurisdictions. This duplication of effort serves as a financial deterrent, especially for small and medium-sized enterprises, effectively blocking their entry into new regions and consequently dampening the potential demand for conformity assessment services that a unified global market would otherwise generate.Moreover, this lack of harmonization complicates operations for TIC providers, compelling them to invest heavily in maintaining a wide range of accreditations to address every distinct local standard. The extensive scope of regulatory complexity limits the pace at which products can be certified and launched, causing significant supply chain bottlenecks. To highlight the depth of this technical environment, the International Electrotechnical Commission reported in 2024 that it maintained a total of 12,046 publications in its catalogue. This massive collection of unique technical specifications emphasizes the logistical friction that impedes the streamlined growth of the certification and testing sector.

Market Trends

The expansion of cybersecurity testing for connected devices has developed into a vital market trajectory, distinguishing itself from conventional electromagnetic compatibility assessments. With regulatory frameworks such as the UK PSTI Act and the EU Cyber Resilience Act imposing mandatory security baselines, testing providers are swiftly enhancing their capabilities to validate vulnerability management systems, encryption protocols, and data privacy safeguards for Internet of Things (IoT) products. This regulatory momentum is transforming cybersecurity from an optional feature into a fundamental prerequisite for market access. The magnitude of this commercial opportunity is highlighted by SGS in their February 2025 '2024 Integrated Report', which explicitly targets CHF 200 million in incremental revenue by 2027 from their digital trust and cybersecurity portfolio, reflecting the aggressive investments testing firms are undertaking to dominate this segment.Concurrently, the rise of sustainability and eco-design verification services is transforming the sector as manufacturers encounter growing pressure to prove environmental claims and comply with circular economy mandates. This trend broadens the scope beyond safety compliance to include carbon footprint verification, life cycle assessments, and recyclability auditing, driven by legislation like the EU Ecodesign for Sustainable Products Regulation. Testing entities are capitalizing on this shift by providing specialized assurance for supply chain ethical compliance and green bonds. The financial impact is evident in Bureau Veritas' '2024 Full Year Results' from February 2025, where the Certification business posted 15.0% organic growth for the fiscal year, a performance largely credited to the successful rollout and high demand for its new corporate social responsibility and sustainability solutions.

Key Players Profiled in the Electrical & Electronics Testing, Inspection & Certification Market

- Bureau Veritas

- SGS Group

- TUV Rheinland

- Intertek Group PLC

- ALS Limited

- ASTM International

- SAI Global Pty Limited

- Applus+ Servicios Tecnologicos, S.L

Report Scope

In this report, the Global Electrical & Electronics Testing, Inspection & Certification Market has been segmented into the following categories:Electrical & Electronics Testing, Inspection & Certification Market, by Service Type:

- Testing

- Inspection

- Certification service

Electrical & Electronics Testing, Inspection & Certification Market, by Product:

- Smart Lighting System

- Smart Wiring System

- HVAC System

- Electrical Component

- E-Toys

- Household Appliances

- Security & Access Control

Electrical & Electronics Testing, Inspection & Certification Market, by Offerings:

- Electromagnetic compatibility

- Electrical safety

- Connectivity

- Digital services

- Energy efficiency testing

- Cybersecurity services

Electrical & Electronics Testing, Inspection & Certification Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Electrical & Electronics Testing, Inspection & Certification Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Electrical & Electronics Testing, Inspection & Certification market report include:- Bureau Veritas

- SGS Group

- TUV Rheinland

- Intertek Group PLC

- ALS Limited

- ASTM International

- SAI Global Pty Limited

- Applus+ Servicios Tecnologicos, S.L

Table Information

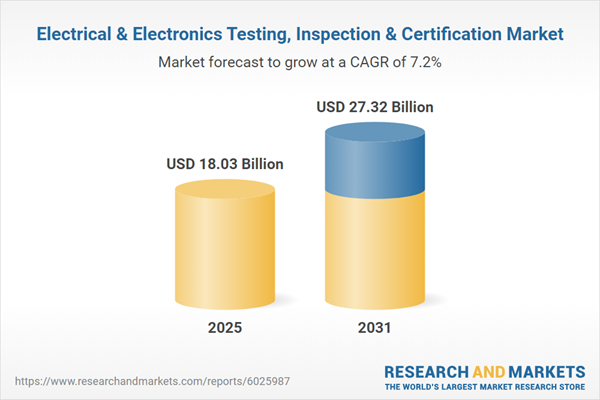

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 18.03 Billion |

| Forecasted Market Value ( USD | $ 27.32 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |