Global Fluorosilicic Acid Market - Key Trends & Drivers Summarized

What Is Fluorosilicic Acid and Why Is It Essential Across Industries?

Fluorosilicic acid (H2SiF6) is a chemical compound commonly used in water fluoridation, industrial processing, and the production of various chemical compounds. Known for its effectiveness as a fluoridating agent, fluorosilicic acid is widely added to public drinking water supplies to promote dental health by preventing tooth decay. This application is considered an essential public health measure, supported by health authorities worldwide for its role in reducing dental cavities and improving oral hygiene at a population level. Fluorosilicic acid is also a key component in manufacturing applications such as glass etching, surface treatments, and ceramic production, where it acts as a cleaning and preparation agent, allowing for precision processing and high-quality finishes.Beyond water treatment and industrial processing, fluorosilicic acid is utilized in the production of aluminum fluoride and other fluorine-based chemicals. These compounds are essential in industries ranging from aluminum manufacturing to pharmaceuticals, where they serve as catalysts and intermediates in chemical reactions. In the aluminum industry, for example, aluminum fluoride produced from fluorosilicic acid is used to lower the melting point of aluminum during electrolysis, making production more energy-efficient. This widespread utility highlights fluorosilicic acid's role as a versatile chemical that supports both consumer health initiatives and a range of industrial applications. Its ability to act as a fluoridation agent, industrial cleaner, and chemical precursor makes it valuable across diverse markets, from municipal water systems to heavy manufacturing.

The stability and effectiveness of fluorosilicic acid under various environmental and industrial conditions make it particularly suitable for long-term applications. Its usage in large-scale industrial processing and water fluoridation programs highlights the demand for reliable and effective chemical solutions that can support high-volume needs. As industries and municipalities worldwide seek cost-effective and sustainable solutions to meet their operational and health goals, fluorosilicic acid stands out as a critical component in achieving these objectives, particularly in applications that require consistent and controlled chemical action.

How Are Technological Innovations and Environmental Regulations Shaping the Fluorosilicic Acid Market?

Technological advancements in chemical manufacturing and handling are enhancing the safety, quality, and efficiency of fluorosilicic acid production and application, particularly in industries that require high purity and precision. Modern production methods, including advancements in distillation and purification processes, allow for the manufacture of high-purity fluorosilicic acid, reducing the presence of contaminants and improving overall efficacy. These innovations are especially important in applications like water fluoridation, where the purity of fluorosilicic acid impacts the safety and effectiveness of drinking water treatment. With high-precision chemical manufacturing, companies can meet stricter quality standards, ensuring that fluorosilicic acid used in public health and industrial applications is both safe and effective.In water treatment, improvements in storage, handling, and dosing technologies have facilitated more controlled and accurate application of fluorosilicic acid, addressing concerns over dosage consistency and safety. Automated dosing systems enable precise control of fluorosilicic acid levels in water treatment plants, ensuring that optimal fluoride levels are maintained without manual intervention. These systems also enhance safety by reducing the risk of human exposure to the chemical, a factor that is particularly significant in large-scale water treatment facilities. This level of precision and control not only improves water quality but also supports compliance with public health standards, allowing municipalities to meet regulatory requirements with greater accuracy.

Environmental regulations are influencing the fluorosilicic acid market, particularly as regulatory bodies impose stricter guidelines for chemical handling, emissions, and wastewater disposal. While fluorosilicic acid is widely used in water fluoridation programs, its industrial applications, particularly in aluminum manufacturing and glass processing, are subject to environmental scrutiny due to potential environmental and health impacts. Regulations often require manufacturers to implement measures to prevent fluorosilicic acid from entering natural water sources and to control emissions during production. In response, companies are investing in eco-friendly processes and waste management practices, such as closed-loop systems that minimize environmental impact by recycling fluorosilicic acid waste. This regulatory focus encourages the industry to adopt sustainable practices that reduce chemical runoff and emissions, promoting a responsible approach to fluorosilicic acid use across applications.

Where Is Fluorosilicic Acid Making the Greatest Impact Across Industries?

Fluorosilicic acid has a substantial impact in the field of water fluoridation, where it is used to promote dental health by adding controlled levels of fluoride to public drinking water. Municipal water treatment facilities worldwide utilize fluorosilicic acid in water fluoridation programs to reduce the prevalence of dental caries, benefiting millions of people by strengthening teeth and preventing decay. This application is endorsed by health organizations such as the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC), which recognize water fluoridation as an effective, community-wide measure for improving oral health. In regions where dental care access is limited, water fluoridation provides an affordable, accessible solution to reduce dental health disparities, underscoring fluorosilicic acid's critical role in public health.In the aluminum industry, fluorosilicic acid is essential for producing aluminum fluoride, a compound used to reduce energy consumption in aluminum smelting. Aluminum fluoride acts as a flux, lowering the melting point of aluminum oxide during the electrolysis process, which improves energy efficiency and reduces production costs. As global aluminum demand grows - driven by industries like automotive, construction, and packaging - fluorosilicic acid's role in supporting efficient aluminum production has become increasingly significant. The aluminum industry's emphasis on reducing energy consumption and optimizing production aligns with fluorosilicic acid's function as a cost-effective chemical that supports high-volume manufacturing, making it a vital component in the aluminum production supply chain.

In the glass and ceramics industries, fluorosilicic acid is widely used for etching and surface treatment, allowing for precision finishes and high-quality product output. The compound's ability to modify surfaces makes it ideal for creating textured, matte, or frosted glass, which is popular in both consumer products and architectural applications. In ceramics, fluorosilicic acid is used to enhance the surface properties of tiles and other products, contributing to aesthetic quality and durability. These surface treatment applications leverage fluorosilicic acid's chemical properties to produce customized finishes that add value to glass and ceramic products. The demand for high-quality finishes in architectural, automotive, and decorative glass, along with premium ceramic products, highlights fluorosilicic acid's versatility and its impact on industries focused on product aesthetics and durability.

What Are the Key Drivers Fueling Growth in the Fluorosilicic Acid Market?

The growth in the fluorosilicic acid market is driven by several factors, including expanding public water fluoridation programs, rising aluminum production, and increasing demand for high-quality glass and ceramic products. The importance of public health initiatives focused on dental care is a major driver, as countries worldwide implement or expand water fluoridation programs to improve oral health outcomes. Water fluoridation is a cost-effective measure that benefits entire communities, making fluorosilicic acid a preferred solution for municipalities aiming to reduce dental decay rates. This trend is especially relevant in regions with limited access to dental care services, where water fluoridation serves as a preventive healthcare measure. The focus on public health, supported by recommendations from global health organizations, continues to drive demand for fluorosilicic acid in water treatment applications.Rising aluminum demand, particularly in sectors like automotive, aerospace, and construction, is another key driver for the fluorosilicic acid market. As aluminum is increasingly used for its lightweight, durable, and recyclable properties, efficient production processes are critical for meeting industry demand. Fluorosilicic acid, which is used to produce aluminum fluoride, supports energy-efficient aluminum smelting, making it essential for the production of aluminum in large volumes. With aluminum manufacturers focused on reducing energy costs and minimizing their environmental impact, the role of fluorosilicic acid in enabling efficient production is expected to grow. This alignment with industry goals for energy savings and sustainability further bolsters the market for fluorosilicic acid in the aluminum sector.

The demand for high-quality glass and ceramics, driven by consumer and architectural trends, is also fueling growth in the fluorosilicic acid market. As manufacturers seek ways to achieve unique finishes and textures, fluorosilicic acid's role in surface treatment has become more prominent. High-end glass products, including frosted glass and decorative glass used in interiors and facades, require precision etching, which fluorosilicic acid facilitates. The ceramics industry, too, benefits from the compound's ability to enhance surface aesthetics and durability, making it valuable for premium tiles, tableware, and decorative items. The trend toward customization in consumer products and architectural design is increasing demand for fluorosilicic acid in these applications, supporting its growth in the market. Together, these drivers - public health initiatives, aluminum production, and demand for high-quality surface finishes - are propelling the fluorosilicic acid market, establishing its role as an essential chemical in various industries.

Report Scope

The report analyzes the Fluorosilicic Acid market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Grade (40% Grade, 35% Grade, 25% Grade); Application (Water Fluoridation Application, Chemical Manufacturing Application, Metal Surface Treatment & Electroplating Application, Hide Processing Application, Other Applications).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 40% Grade Fluorosilicic Acid segment, which is expected to reach US$362.7 Million by 2030 with a CAGR of a 5.6%. The 35% Grade Fluorosilicic Acid segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $118.3 Million in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $122.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fluorosilicic Acid Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fluorosilicic Acid Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fluorosilicic Acid Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

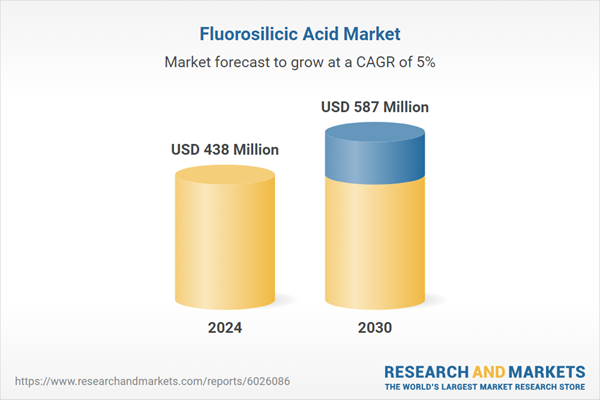

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Elements, Anhui Sinograce Chemical Co., Ltd., Ataman Kimya A.S., Buss ChemTech AG, Derivados del Fluor SAU (DDF) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Fluorosilicic Acid market report include:

- American Elements

- Anhui Sinograce Chemical Co., Ltd.

- Ataman Kimya A.S.

- Buss ChemTech AG

- Derivados del Fluor SAU (DDF)

- Foshan Nanhai Shuangfu Chemical Co. Ltd.

- Gelest, Inc.

- Hawkins, Inc.

- Henan Yellow River New Material Technology Co. Ltd.

- Honeywell International, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Elements

- Anhui Sinograce Chemical Co., Ltd.

- Ataman Kimya A.S.

- Buss ChemTech AG

- Derivados del Fluor SAU (DDF)

- Foshan Nanhai Shuangfu Chemical Co. Ltd.

- Gelest, Inc.

- Hawkins, Inc.

- Henan Yellow River New Material Technology Co. Ltd.

- Honeywell International, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 438 Million |

| Forecasted Market Value ( USD | $ 587 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |