Global Telecom Towers Market - Key Trends & Drivers Summarized

What Are Telecom Towers and Why Are They Essential in Modern Communication Networks?

Telecom towers, also known as cell towers, are critical infrastructure in mobile and wireless communication networks, supporting the transmission of voice, data, and video signals over vast distances. Equipped with antennas, transmitters, and receivers, these towers enable seamless connectivity by facilitating communication between user devices and network base stations. Telecom towers are the backbone of wireless networks, playing an indispensable role in ensuring reliable service for billions of mobile users worldwide. They are especially important as data demand surges due to the widespread adoption of smartphones, 4G LTE, and the rollout of 5G networks, which require robust infrastructure to handle increased data loads and faster speeds. With each generation of mobile technology, the capacity, speed, and reach of telecom networks grow, making towers foundational to modern communication.In addition to mobile connectivity, telecom towers support various communication services, including IoT (Internet of Things) networks, emergency services, and broadcasting. As IoT applications expand across industries like agriculture, transportation, and healthcare, telecom towers provide the necessary infrastructure to connect sensors and devices, enabling real-time data collection and analysis. This expansion of IoT networks enhances operational efficiency and supports smart city initiatives by facilitating connected services. Telecom towers also play a vital role in public safety, providing reliable communication for first responders and emergency management systems. This multifaceted functionality highlights the critical role of telecom towers in supporting a connected world, making them essential for both commercial and public sector communications.

The global shift toward remote work, e-learning, and digital services, especially in the wake of the COVID-19 pandemic, has further underscored the importance of telecom towers in maintaining connectivity. As demand for high-speed data grows, especially in rural and underserved areas, telecom operators are investing in expanding tower networks to improve coverage and reduce digital divides. This focus on enhancing connectivity aligns with governmental and industry initiatives to provide universal access to high-quality digital infrastructure. With more users relying on mobile networks for work, education, and daily communication, telecom towers remain fundamental to modern society, supporting reliable connectivity and the ongoing digital transformation.

How Are Technological and Regulatory Trends Shaping the Telecom Tower Market?

Technological advancements and regulatory policies are driving significant changes in the telecom tower market, impacting everything from tower design and functionality to compliance requirements and environmental considerations. The rollout of 5G networks is a major technological shift, necessitating increased tower density to provide the ultra-fast speeds and low latency that 5G promises. Unlike previous generations, 5G networks require smaller, more numerous cell sites known as “small cells” to ensure continuous, high-speed connectivity, particularly in dense urban areas. This shift has led to a rise in demand for both traditional macro towers and small cell towers, with telecom operators investing in multi-tiered infrastructure to meet 5G performance standards. As a result, tower companies are diversifying their portfolios, deploying a mix of macro towers, small cells, and rooftop installations to achieve optimal coverage and capacity.The adoption of renewable energy solutions in telecom towers is another important trend, driven by both regulatory requirements and sustainability commitments from telecom operators. Traditionally, telecom towers in remote locations rely on diesel generators, which contribute to carbon emissions and are costly to maintain. However, with growing pressure to reduce environmental impact, many telecom companies are now incorporating solar panels, wind turbines, and energy storage systems into tower sites to power their operations more sustainably. Hybrid energy solutions, which combine renewable sources with traditional backup generators, are becoming increasingly common, especially in regions with unreliable grid electricity. This shift not only reduces operational costs but also aligns with global goals to lower emissions and promote clean energy. Regulatory incentives and green certifications further encourage telecom operators to invest in sustainable tower solutions, transforming the industry's approach to energy use.

Regulatory policies promoting infrastructure sharing are also reshaping the telecom tower market, as governments encourage operators to share tower sites to minimize environmental impact and reduce redundancy. Infrastructure sharing allows multiple telecom operators to use the same tower, reducing the need for additional structures and lowering costs for both operators and consumers. This trend is particularly relevant in urban areas where space constraints limit new tower construction and in rural regions where infrastructure costs are high. Tower companies known as towercos, which specialize in building and managing shared infrastructure, have gained prominence as telecom operators increasingly outsource tower operations to reduce expenses and focus on core network functions. These regulatory and technological shifts are fostering a more collaborative and sustainable telecom tower landscape, promoting efficient resource use and greater connectivity.

Where Are Telecom Towers Making the Greatest Impact Across Global Markets?

Telecom towers are making a significant impact across various markets, from urban centers to remote rural areas, each with distinct infrastructure needs. In densely populated urban areas, where data demand is highest, telecom towers provide essential connectivity for mobile users, businesses, and public services. With the rise of 5G, urban areas are witnessing the deployment of both traditional macro towers and small cell sites to achieve the necessary network density for high-speed service. These small cells are often mounted on streetlights, buildings, and other urban structures, supplementing larger towers and providing continuous coverage in high-traffic areas. The growing need for data in cities, driven by streaming, gaming, and IoT applications, underscores the critical role of telecom towers in supporting urban digital infrastructure.In rural and remote regions, telecom towers play a vital role in bridging the digital divide by expanding access to mobile networks in underserved areas. Telecom operators are investing in rural tower infrastructure to provide coverage where terrestrial infrastructure is lacking or impractical. This expansion is crucial for connecting rural populations, allowing residents to access essential services, educational resources, and economic opportunities online. Governments and regulatory bodies are increasingly supporting rural connectivity initiatives, providing subsidies and incentives to promote tower construction in hard-to-reach areas. In these regions, telecom towers are often powered by renewable energy sources due to limited access to electricity, enhancing both connectivity and sustainability. The expansion of tower networks in rural areas aligns with global efforts to achieve universal internet access, helping close the connectivity gap between urban and rural communities.

The role of telecom towers is also expanding in emerging markets, where growing mobile penetration and demand for digital services are driving tower deployment. In countries across Africa, Southeast Asia, and Latin America, telecom towers are essential to building modern communication networks that support economic growth and social development. As mobile phone usage rises, particularly in areas with limited fixed-line infrastructure, telecom towers enable access to banking, healthcare, and e-commerce services that are transforming local economies. Tower-sharing models are particularly effective in these regions, where cost constraints and regulatory support make infrastructure sharing an attractive solution for expanding connectivity. By supporting the rapid growth of mobile networks in these emerging markets, telecom towers play a key role in accelerating digital inclusion and facilitating access to essential services.

What Are the Key Drivers Fueling Growth in the Telecom Tower Market?

The growth in the telecom tower market is driven by several factors, including the global adoption of 5G technology, rising data consumption, and government initiatives aimed at expanding digital connectivity. The ongoing rollout of 5G networks is a major catalyst, as telecom operators worldwide race to deploy the infrastructure needed to support next-generation mobile networks. The higher data speeds and low latency promised by 5G require denser tower networks, with a mix of macro towers, small cells, and distributed antenna systems (DAS) to achieve seamless connectivity. This demand for expanded infrastructure is spurring investment in telecom towers, as operators build out their networks to deliver 5G capabilities. In regions where 5G deployment is already underway, telecom companies are focusing on filling coverage gaps, boosting demand for tower installations in both urban and suburban areas.The surge in mobile data consumption, driven by smartphones, streaming services, and IoT applications, is another significant growth driver. As consumers and businesses increasingly rely on mobile data for communication, entertainment, and remote work, the need for robust, reliable networks has intensified. Telecom towers provide the backbone for these networks, ensuring that carriers can handle high data traffic while maintaining quality of service. Additionally, the proliferation of IoT devices across sectors like transportation, agriculture, and smart cities has added new layers of demand, as these devices require reliable connectivity to operate effectively. This trend is expected to continue as new digital services emerge, driving further investment in telecom tower infrastructure to support ever-growing data requirements.

Government initiatives aimed at expanding digital access and improving connectivity in rural and underserved areas are also fueling growth in the telecom tower market. Many governments have launched programs to enhance rural connectivity, providing subsidies, incentives, and partnerships to encourage tower deployment in remote regions. These initiatives are aligned with goals to reduce the digital divide and promote digital inclusion, ensuring that rural communities have access to the same digital resources as urban areas. In addition, infrastructure-sharing policies supported by regulatory bodies are encouraging telecom operators to share tower sites, reducing costs and accelerating deployment in challenging environments. This collaborative approach benefits telecom operators by lowering capital expenditures and enables faster network expansion, especially in emerging markets. Together, these trends - 5G rollout, rising data consumption, and governmental support for connectivity - are driving growth in the telecom tower market, making it an essential pillar of modern communication infrastructure globally.

Report Scope

The report analyzes the Telecom Towers market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Tower Type (Lattice Towers, Guyed Towers, Monopole Towers, Stealth Towers, Other Tower Types); Installation Type (Ground-based Installation, Roof-Top Installation); Deployment (Shared Infrastructure Deployment, Owned Deployment).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Lattice Towers segment, which is expected to reach US$24.9 Billion by 2030 with a CAGR of a 6.7%. The Guyed Towers segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $10.6 Billion in 2024, and China, forecasted to grow at an impressive 8.5% CAGR to reach $11.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Telecom Towers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Telecom Towers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Telecom Towers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Tower Corporation, China Tower Corporation, GTL Infrastructure, Hebei Changtong Steel Structure Co., Ltd., Helios Towers plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 49 companies featured in this Telecom Towers market report include:

- American Tower Corporation

- China Tower Corporation

- GTL Infrastructure

- Hebei Changtong Steel Structure Co., Ltd.

- Helios Towers plc

- IHS Holding Limited (IHS Towers)

- Indus Towers

- MV Infra Services Pvt. Ltd.

- PT Telkom Indonesia (Persero) TBK

- Qingdao Megatro Mechanical and Electrical Equipment Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- American Tower Corporation

- China Tower Corporation

- GTL Infrastructure

- Hebei Changtong Steel Structure Co., Ltd.

- Helios Towers plc

- IHS Holding Limited (IHS Towers)

- Indus Towers

- MV Infra Services Pvt. Ltd.

- PT Telkom Indonesia (Persero) TBK

- Qingdao Megatro Mechanical and Electrical Equipment Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 382 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

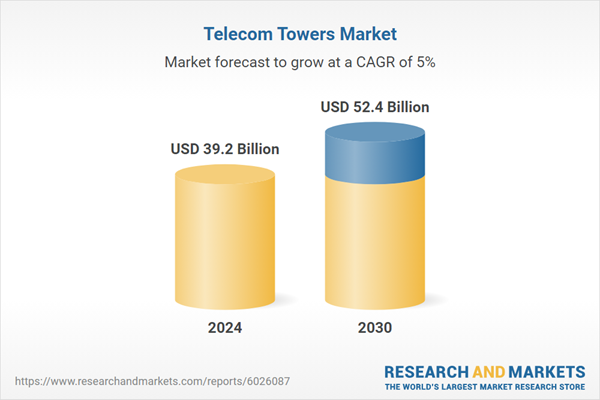

| Estimated Market Value ( USD | $ 39.2 Billion |

| Forecasted Market Value ( USD | $ 52.4 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |