Global Crab Market - Key Trends & Drivers Summarized

What Are Crabs and Why Are They Essential in the Seafood Industry?

Crabs are marine crustaceans highly valued for their delicate, flavorful meat and are an essential commodity within the global seafood industry. They are harvested and farmed across various regions, including the North American coasts, Southeast Asia, and Northern Europe. Crabs come in multiple species, such as blue crabs, snow crabs, Dungeness crabs, and king crabs, each prized for its distinct texture, flavor, and culinary applications. The versatility of crab meat has made it a staple in various cuisines worldwide, from fine dining establishments to street food markets. Crabs are enjoyed in diverse preparations, including steamed, grilled, sautéed, or incorporated into dishes like crab cakes, sushi, and bisques.The importance of crabs extends beyond their culinary appeal; they are an economically significant species for fishing communities globally. Crab harvesting and aquaculture provide income for coastal communities, supporting local economies and creating jobs in both primary production and related sectors, such as processing, packaging, and transportation. In addition, crabs play a vital role in the ecosystem as both predator and prey, contributing to the health and biodiversity of marine environments. This ecological role underscores the importance of sustainable crab fishing practices, which protect crab populations and ensure long-term availability of this valuable seafood source.

The demand for crab has grown consistently due to the popularity of seafood as a healthy protein source rich in omega-3 fatty acids, vitamins, and minerals. Health-conscious consumers increasingly choose crab meat as a nutrient-rich alternative to red meat. Furthermore, the globalization of cuisines has introduced crab dishes to new markets, expanding consumer interest and demand. The consistent demand from both traditional seafood-consuming regions and emerging markets highlights crabs' essential status in the seafood industry and ensures their continued economic and cultural importance worldwide.

How Are Sustainability Concerns and Market Trends Shaping the Crab Industry?

Sustainability concerns are significantly influencing the crab industry as consumers and regulatory bodies push for responsible fishing and aquaculture practices to protect crab populations and marine biodiversity. Overfishing and environmental degradation have threatened some crab species, prompting countries to enforce stricter regulations on crab harvesting, such as setting catch limits, establishing protected areas, and implementing closed seasons during breeding cycles. Organizations like the Marine Stewardship Council (MSC) and local governing bodies work with fisheries to promote sustainable practices, including selective harvesting techniques that protect juvenile crabs and non-target species. Sustainable practices in crab fishing are becoming more essential as consumers show increased preference for seafood that is responsibly sourced and certified by reputable standards.Aquaculture, or crab farming, is gaining traction as an alternative to wild-caught crabs, providing a stable supply while reducing pressure on natural populations. Advances in aquaculture have enabled the controlled breeding and rearing of crab species, such as mud crabs and blue crabs, in environmentally responsible ways. This approach not only ensures a consistent supply for the market but also supports the recovery of wild crab populations by reducing dependence on wild-caught supplies. Sustainable aquaculture practices, such as habitat restoration and pollution reduction, align with global environmental goals and appeal to eco-conscious consumers who prioritize sustainable seafood choices. Crab farming also offers economic benefits to communities, creating new jobs in regions with favorable aquaculture conditions, such as Southeast Asia.

Market trends in convenience and premiumization are also shaping the crab industry. With rising demand for ready-to-eat and pre-cooked seafood, crab meat is increasingly available in various forms, such as frozen, canned, and processed products, catering to busy consumers who seek convenience. This shift supports the growth of value-added crab products, such as crab cakes, crab sticks, and crab meat salads, which are widely available in retail stores and supermarkets. Additionally, premiumization trends, particularly in North America, Europe, and East Asia, have driven demand for high-end crab varieties, such as king crab and snow crab, which are often marketed as luxury seafood. These trends are expanding the reach of the crab industry to new consumer segments, including those willing to pay a premium for high-quality or sustainably sourced crab products.

Where Are Crabs Making the Greatest Impact Across Industry Segments?

Crabs have a significant impact across various industry segments, including fine dining, retail, aquaculture, and export markets. In the fine dining and hospitality sector, crabs are a popular choice for premium seafood dishes, often featured as a highlight on restaurant menus. High-value species, such as king crabs and snow crabs, are especially popular in high-end restaurants and seafood-focused eateries, where they are prepared and served in visually striking presentations. The demand for fresh, high-quality crabs in fine dining has led to the development of specialized suppliers and distributors who provide restaurants with consistent, premium-grade crab products. This segment benefits from the willingness of consumers to pay for luxury seafood experiences, particularly in regions like North America, Europe, and East Asia, where crabs are often seen as a gourmet delicacy.In the retail sector, crabs are available in fresh, frozen, and processed forms, making them accessible to a wide range of consumers. Retail demand has grown significantly as supermarkets and grocery stores expand their seafood sections to include a variety of crab products, from whole crabs to pre-packaged crab meat. Frozen and canned crab products, such as crab cakes and crab sticks, appeal to consumers seeking convenience without compromising on flavor or nutrition. This segment is particularly strong in urban markets, where consumers look for easy-to-prepare meals. The retail market has responded by offering value-added crab products that cater to health-conscious and convenience-driven shoppers, making crab a popular choice in both high-end grocery chains and budget-friendly supermarkets.

In aquaculture, crabs play a growing role as sustainable farming techniques enable the controlled production of specific crab species, meeting rising demand without exhausting natural populations. Crab aquaculture is particularly impactful in Southeast Asia, where farming practices have been optimized to cultivate species like mud crabs, which are popular in both local and international markets. Aquaculture supports year-round crab supply and is a growing industry segment that benefits both local economies and global seafood markets. As aquaculture technology improves, farm-raised crabs are becoming a reliable alternative to wild-caught crabs, expanding the availability of this seafood staple in the global market while contributing to sustainability initiatives.

The export market is another significant area where crabs have a substantial impact. Major crab-exporting countries, such as the United States, Canada, Russia, and China, supply global markets with high-demand crab species. Exported crabs are a significant source of revenue for these countries, contributing to trade balances and supporting local fisheries. Export markets, particularly in Asia, have shown strong demand for imported crab species, with consumers willing to pay a premium for varieties that are not locally available, such as Alaskan king crab and Dungeness crab. The impact of crabs in export markets underscores the species' importance in international trade, where they serve as both a cultural delicacy and a high-value seafood commodity.

What Are the Key Drivers Fueling Growth in the Crab Market?

The growth in the crab market is driven by several key factors, including the rising demand for seafood as a healthy protein source, the increasing popularity of luxury and exotic seafood, and expanding aquaculture practices. The global shift toward healthier diets has led to greater consumption of seafood, including crab, which is rich in protein, omega-3 fatty acids, vitamins, and minerals. Health-conscious consumers favor crab meat as a lean alternative to red meat, contributing to its popularity as a nutritious, low-fat protein source. This health trend is particularly strong in North America and Europe, where consumers are seeking seafood options that support a balanced diet. Additionally, as more people adopt flexitarian or pescatarian diets, crab consumption is expected to increase, driving demand for both fresh and processed crab products.The growing popularity of luxury and exotic seafood is another significant driver, with crabs, particularly premium varieties like king crab and snow crab, being highly sought after in fine dining and specialty markets. As disposable income rises in emerging economies, consumers are more willing to spend on high-end food experiences, including premium seafood. This trend is especially prevalent in East Asia, where crabs are considered a delicacy and are often featured in festive meals and celebrations. The premiumization trend extends to Western markets as well, where consumers value sustainably sourced, gourmet seafood products. The demand for premium crab varieties is driving growth in the crab market, particularly as consumers seek out unique, high-quality seafood experiences.

Expanding aquaculture practices are also a major growth driver, supporting a stable and sustainable supply of crabs to meet global demand. With advancements in crab farming techniques, particularly in Southeast Asia, aquaculture is becoming an increasingly important method for producing crabs at scale. Aquaculture allows for the controlled breeding, rearing, and harvesting of crabs, which helps stabilize supply and reduce the pressure on wild populations. This approach aligns with the industry's commitment to sustainable seafood, appealing to environmentally conscious consumers and enabling a reliable supply chain for distributors and retailers. As more investment is directed toward improving crab aquaculture, the availability of farmed crabs is expected to rise, supporting market growth and meeting consumer demand for both affordable and premium crab products.

Together, these drivers - growing health consciousness, demand for premium seafood, and sustainable aquaculture practices - are fueling the growth of the crab market, establishing crabs as an essential and increasingly popular component of global seafood consumption. As the industry continues to innovate and adapt to consumer preferences, crabs are expected to remain a vital part of the seafood market, supporting culinary traditions, economic growth, and sustainable fishing practices.

Report Scope

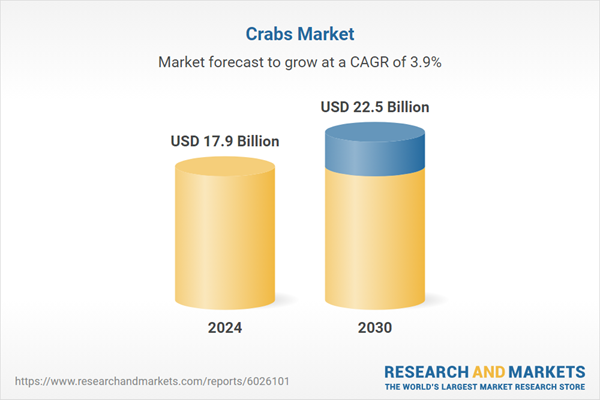

The report analyzes the Crabs market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Frozen Crabs, Fresh Crabs, Canned Crabs); End-Use (Foodservice End-Use, Retail End-Use).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Frozen Crabs segment, which is expected to reach US$11.3 Billion by 2030 with a CAGR of a 4.4%. The Fresh Crabs segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.8 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $4.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Crabs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Crabs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Crabs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Alaskan King Crab Co., Graham & Rollins, Inc., Handy Seafood (Handy International), J.M. Clayton Seafood Company, Keyport LLC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 51 companies featured in this Crabs market report include:

- Alaskan King Crab Co.

- Graham & Rollins, Inc.

- Handy Seafood (Handy International)

- J.M. Clayton Seafood Company

- Keyport LLC

- Maine Lobster Now

- Mazetta Company, LLC

- Pacific Seafood

- Phil Union Frozen Foods Inc.

- Phillips Foods, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Alaskan King Crab Co.

- Graham & Rollins, Inc.

- Handy Seafood (Handy International)

- J.M. Clayton Seafood Company

- Keyport LLC

- Maine Lobster Now

- Mazetta Company, LLC

- Pacific Seafood

- Phil Union Frozen Foods Inc.

- Phillips Foods, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 285 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 17.9 Billion |

| Forecasted Market Value ( USD | $ 22.5 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |