Global Amylase Market - Key Trends & Drivers Summarized

What Is Amylase and Why Has It Become Essential in Various Industrial Processes?

Amylase is an enzyme that catalyzes the breakdown of starch into sugars, making it a valuable tool across multiple industries, from food and beverages to pharmaceuticals and biofuel production. This enzyme is naturally found in humans and other organisms and is widely used in industrial applications to accelerate and enhance the processing of starchy materials. Amylase has become particularly vital in the food industry, where it plays a key role in baking, brewing, and dairy processing by improving product texture, taste, and shelf life. For example, in bread-making, amylase helps break down starches into sugars, which yeast can ferment to produce the carbon dioxide that causes the dough to rise. Its ability to efficiently break down complex carbohydrates into simpler sugars also supports the production of sweeteners, such as high-fructose corn syrup, making it indispensable in food processing.Beyond food, amylase is widely used in the textile, paper, and pulp industries for desizing fabrics and processing raw materials. In textiles, amylase helps remove starch-based sizing agents from fabrics, preparing them for dyeing and finishing. In the paper industry, it assists in breaking down starch coatings, facilitating smoother paper production processes. Additionally, amylase is gaining popularity in the pharmaceutical industry, where it aids in drug formulation, particularly in digestibility and bioavailability enhancement. The enzyme's versatility and efficiency make it an essential component across diverse industrial applications, offering cost-effective and eco-friendly solutions that align with industry demands for both performance and sustainability.

The biofuel industry has also adopted amylase, particularly in the production of ethanol from starchy biomass, such as corn and wheat. Amylase accelerates the conversion of starches into fermentable sugars, which are then processed to produce bioethanol, a renewable alternative to fossil fuels. As global interest in renewable energy sources grows, amylase's role in biofuel production is becoming more significant, supporting the industry's shift toward sustainable energy solutions. This broad applicability across sectors highlights the growing importance of amylase as industries seek more efficient, sustainable methods to meet production goals and respond to environmental concerns.

How Are Technological and Scientific Advancements Enhancing Amylase Production and Applications?

Technological and scientific advancements have revolutionized amylase production and expanded its potential applications, making the enzyme more efficient, adaptable, and widely available. One of the most significant breakthroughs is the development of genetically modified microorganisms, such as bacteria and fungi, which can produce large quantities of amylase with enhanced properties. These engineered strains of microorganisms allow for the production of amylase that can function under a broader range of temperatures and pH levels, increasing its effectiveness across various industrial processes. For instance, thermostable amylases, which can withstand high temperatures, are particularly valuable in food processing and biofuel production, where heat stability is essential. These bioengineered enzymes have opened up new possibilities for using amylase in industries with stringent process conditions.The rise of immobilized enzyme technology has also transformed amylase applications, improving its efficiency and reusability. Immobilized amylase, in which the enzyme is attached to a solid support, enables continuous processing and easier recovery in industrial settings. This method reduces enzyme wastage, enhances process control, and lowers production costs, making amylase applications more economically viable for large-scale operations. In industries such as food and biofuel production, where high volumes of enzyme use are required, immobilized amylase offers substantial cost savings while maintaining high productivity. This technological advancement supports the growing demand for sustainable production methods, as immobilized enzymes are more resource-efficient and environmentally friendly than traditional enzyme applications.

In addition, advancements in amylase formulation and delivery have expanded its utility in pharmaceutical and nutraceutical applications. Novel delivery systems, such as encapsulation, ensure that amylase remains stable and active until it reaches the target site in the human body, improving the effectiveness of enzyme-based supplements and therapeutic products. This has significant implications in digestive health, where amylase is used to aid individuals with digestive enzyme deficiencies. Scientific research is also exploring the potential for customized amylase formulations tailored to specific dietary and health needs, making amylase a promising component in personalized nutrition and medicine. Together, these technological and scientific advancements are enhancing amylase's functionality and versatility, enabling its use in a growing array of applications and reinforcing its value across diverse industries.

Where Is Amylase Making the Greatest Impact Across Industries?

Amylase has become a critical enzyme in various industries, each utilizing its unique starch-degrading capabilities to enhance efficiency, product quality, and sustainability. In the food and beverage industry, amylase is widely used in baking, brewing, and the production of syrups and sweeteners. In baking, amylase improves dough handling and fermentation, resulting in better texture, volume, and shelf life in bread products. Similarly, in brewing, amylase breaks down the starch in malted grains, converting it into fermentable sugars that yeast can process into alcohol. Amylase's role in producing high-fructose corn syrup and other sweeteners is also significant, as it enables the conversion of starch into glucose and other simple sugars, which are widely used as sweetening agents in food products. These applications demonstrate amylase's value in enhancing food quality, consistency, and processing efficiency.In the textile industry, amylase is essential for fabric preparation, particularly in the desizing process, where it removes starch-based sizing agents from fabric fibers. This step is crucial for ensuring that fabrics are smooth and absorb dyes evenly, resulting in higher-quality finished products. The use of amylase in textile processing is eco-friendly, as it reduces the need for harsh chemicals that would otherwise be used to remove starches. This aligns with the industry's growing commitment to sustainable manufacturing practices, making amylase a favored solution in textile processing. Likewise, in the paper and pulp industry, amylase facilitates the breakdown of starch coatings, improving the efficiency of paper production and reducing the environmental impact of traditional starch-removal methods.

The biofuel industry has also embraced amylase, particularly in the production of bioethanol. In bioethanol production, amylase breaks down starchy materials, such as corn or wheat, into fermentable sugars that can be converted into alcohol. As demand for renewable energy grows, biofuel producers are increasingly turning to enzymes like amylase to enhance production efficiency, lower costs, and reduce the carbon footprint of biofuel production. Amylase's role in biofuel production is particularly impactful as it supports the global shift towards sustainable energy sources, making it a crucial component of the biofuel supply chain. These diverse applications illustrate amylase's significant impact across industries, showcasing its versatility and reinforcing its importance in advancing both product quality and sustainability.

What Are the Key Drivers Fueling Growth in the Amylase Market?

The growth in the amylase market is driven by several factors, including the increasing demand for processed foods, the expansion of the biofuel industry, and the rise in sustainable and eco-friendly industrial processes. The processed food sector is a major driver, as amylase is essential in creating consistent, high-quality products in baking, brewing, and sweetener production. As consumers continue to seek convenience foods with long shelf lives and appealing textures, manufacturers rely on amylase to meet these demands efficiently. Furthermore, health-conscious consumers are driving the demand for enzyme-based food processing as a natural alternative to chemical additives. Amylase enables the production of clean-label products, which are free from artificial ingredients and align with consumer preferences for natural, minimally processed foods. This demand for quality and health-conscious products is propelling the adoption of amylase in food processing globally.The biofuel industry is another significant driver for the amylase market, as the world increasingly shifts toward renewable energy sources. Bioethanol production, which relies on the efficient breakdown of starchy materials, is expected to grow as countries set ambitious targets to reduce greenhouse gas emissions. Amylase plays a critical role in converting starch to fermentable sugars, supporting the production of bioethanol as a sustainable alternative to fossil fuels. Government policies promoting biofuels and incentives for green energy solutions are further boosting the demand for amylase in biofuel production. As the biofuel industry expands, so too does the demand for enzymes like amylase that enhance production efficiency, reduce costs, and support environmentally responsible energy generation.

The trend towards sustainability in industrial processes is also fueling growth in the amylase market, as industries like textiles, paper, and detergents look for eco-friendly solutions. Amylase's ability to replace harsh chemicals in desizing and starch removal processes aligns with the push for greener manufacturing practices, reducing water and energy usage as well as chemical waste. Additionally, amylase's biodegradable nature supports cleaner, more sustainable production methods, meeting regulatory requirements and public demand for environmentally friendly products. This shift towards sustainability, combined with advancements in enzyme technology that enhance amylase's stability and effectiveness, is driving the enzyme's adoption across industrial sectors. Together, these trends in food processing, renewable energy, and sustainable manufacturing are fueling the growth of the amylase market, positioning it as a valuable enzyme in the pursuit of efficiency, quality, and environmental responsibility across industries.

Report Scope

The report analyzes the Amylase market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Form (Powder Form, Granules Form, Liquid Form); Grade (Food Grade, Pharmaceutical Grade, Technical Grade); Application (Food & Beverages Application, Paper & Pulp Application, Textiles Application, Detergents Application, Pharmaceuticals Application, Other Applications).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Powder Form segment, which is expected to reach US$1.5 Billion by 2030 with a CAGR of a 3.2%. The Granules Form segment is also set to grow at 2.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $734.1 Million in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $681.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Amylase Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Amylase Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Amylase Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AB Enzymes GmbH, Antozyme Biotech Pvt. Ltd., BASF SE, Biocatalysts Ltd., Biolaxi Corp. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Amylase market report include:

- AB Enzymes GmbH

- Antozyme Biotech Pvt. Ltd.

- BASF SE

- Biocatalysts Ltd.

- Biolaxi Corp.

- Brenntag Schweizerhall AG

- Cargill, Inc.

- Chemzyme Biotechnology Co. Ltd.

- dsm-firmenich Animal Nutrition & Health

- Infinita Biotech Private Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AB Enzymes GmbH

- Antozyme Biotech Pvt. Ltd.

- BASF SE

- Biocatalysts Ltd.

- Biolaxi Corp.

- Brenntag Schweizerhall AG

- Cargill, Inc.

- Chemzyme Biotechnology Co. Ltd.

- dsm-firmenich Animal Nutrition & Health

- Infinita Biotech Private Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

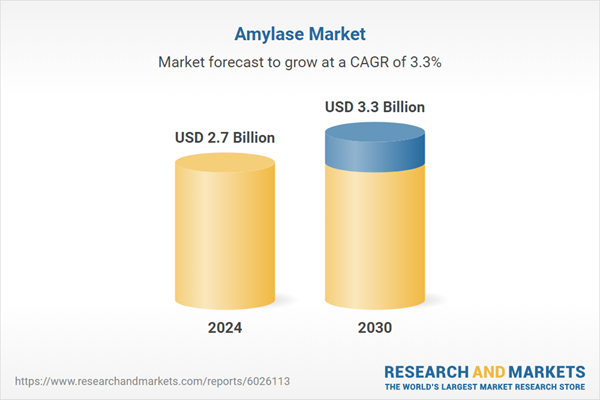

| Estimated Market Value ( USD | $ 2.7 Billion |

| Forecasted Market Value ( USD | $ 3.3 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Global |