Global Turning Tools Market - Key Trends & Drivers Summarized

What Are Turning Tools and Why Are They Essential in Modern Manufacturing?

Turning tools are cutting tools used in lathes and CNC machines for shaping, cutting, and finishing metal, wood, and other materials by removing excess material to create specific shapes and surface finishes. These tools are essential for the precision manufacturing of components used in various industries, including automotive, aerospace, defense, and industrial machinery. Turning tools consist of different tool types, such as inserts, boring bars, and grooving tools, each designed for specific cutting operations that enable manufacturers to achieve precise dimensions and smooth finishes. They play a critical role in producing complex parts, from engine components and gear shafts to medical devices and aerospace parts, making them indispensable in industries that demand high accuracy and quality.The importance of turning tools in modern manufacturing lies in their ability to deliver the precision and consistency needed for mass production and intricate component design. As industries advance and products become more complex, turning tools support the high standards of today's manufacturing requirements. For instance, automotive and aerospace sectors require parts with tight tolerances and high durability, which turning tools can achieve through controlled and repeatable machining processes. Turning tools are used not only to shape raw materials but also to refine existing parts, ensuring that each component meets exact specifications, whether in high-speed, high-volume production or low-volume, high-precision applications. Their versatility across metals, alloys, and specialized materials makes them essential tools in meeting the diverse demands of modern manufacturing.

Additionally, turning tools contribute to manufacturing efficiency by reducing downtime and enhancing productivity. Modern turning tools, such as coated carbide and ceramic inserts, are designed to withstand high temperatures and cutting speeds, allowing for faster machining cycles and longer tool life. This durability and resilience enable manufacturers to reduce tool changeovers and maintenance, ultimately enhancing workflow efficiency and reducing production costs. By supporting optimized machining processes, turning tools help manufacturers improve throughput, reduce waste, and maintain a competitive edge, making them vital assets in manufacturing environments focused on cost-effectiveness and high output.

How Are Technological Advancements and Industry Demands Shaping the Turning Tools Market?

Technological advancements in materials, coatings, and tool designs are transforming the turning tools market, making tools more durable, efficient, and specialized for various applications. New materials, such as carbide, ceramic, and cubic boron nitride (CBN), are increasingly used for turning tool inserts due to their ability to maintain hardness and withstand high temperatures during cutting. Carbide inserts, often coated with materials like titanium nitride or aluminum oxide, are favored for their resistance to wear and heat, enabling them to cut through tough metals without losing sharpness. These advancements allow turning tools to perform well under extreme conditions, such as high-speed machining, making them suitable for industries where rapid production is necessary. Additionally, the development of indexable inserts that can be rotated to present a fresh cutting edge without tool change has enhanced efficiency, supporting continuous production and reducing downtime.Industry demands for precision and complex part geometries are driving innovation in turning tool design. CNC (computer numerical control) machines, widely used in modern manufacturing, require turning tools that can execute intricate cuts with high accuracy and repeatability. Multi-functional turning tools, which combine operations like turning, drilling, and grooving, are gaining popularity as they allow manufacturers to complete multiple processes in a single setup, reducing cycle time and enhancing productivity. Similarly, turning tools with specialized geometries, such as micro and mini turning tools, are designed to produce small, precise components required in sectors like electronics, medical devices, and aerospace. These tools enable manufacturers to create complex, high-tolerance parts in compact forms, catering to industries where miniaturization and precision are paramount.

The shift toward Industry 4.0 and smart manufacturing is also shaping the turning tools market. Manufacturers are increasingly adopting data-driven and automated solutions to optimize machining processes and minimize downtime. Smart tooling, which integrates sensors and data analytics into turning tools, allows real-time monitoring of parameters such as tool wear, cutting temperature, and vibrations. This data-driven approach supports predictive maintenance, ensuring that tools are replaced or serviced before they fail, reducing the risk of unplanned downtime. Digital innovations like tool management software are also emerging, enabling manufacturers to track tool inventory, usage, and performance, which supports efficient planning and cost control. Together, these technological advancements and industry demands are driving the evolution of turning tools, making them more adaptable, durable, and aligned with the needs of modern manufacturing environments.

Where Are Turning Tools Making the Greatest Impact Across Industry Segments?

Turning tools have a substantial impact across various industry segments, including automotive, aerospace, medical, and energy, where precision machining and high-quality finishes are essential. In the automotive industry, turning tools are widely used to produce engine components, transmission parts, and structural elements, all of which require precise dimensions and surface finishes. Automotive manufacturers benefit from turning tools that enable high-speed machining and long-lasting tool life, as these features support the industry's need for high-volume production while maintaining quality standards. Carbide inserts and ceramic-based turning tools are commonly used for machining tough alloys, allowing automotive companies to meet stringent performance and safety requirements. As electric vehicles (EVs) become more popular, the demand for specialized turning tools that can handle materials used in EV components, such as lightweight alloys and high-strength steels, is increasing.In the aerospace sector, turning tools are essential for producing complex, high-tolerance components, such as turbine blades, engine casings, and landing gear parts. Aerospace parts often involve machining hard-to-cut materials, including titanium and Inconel, which require turning tools that can maintain cutting performance at high temperatures and pressures. Advanced turning tools, such as CBN inserts and coated carbides, are frequently used to achieve the high surface quality and dimensional accuracy required in aerospace components. Given the industry's focus on safety and durability, turning tools that offer precise, reliable cutting are indispensable. The demand for specialized tools in aerospace is expected to grow as manufacturers innovate with lighter, stronger materials to improve aircraft fuel efficiency and performance.

In the medical industry, turning tools are used to create precision components for devices such as surgical instruments, implants, and diagnostic equipment. Medical devices require strict adherence to design specifications and smooth, biocompatible finishes, especially for parts that come into contact with human tissue. Micro turning tools and carbide inserts are frequently used in this sector to machine small, intricate parts with high precision. Titanium and stainless steel, common materials in medical manufacturing, require turning tools that can handle tough metals while maintaining sharpness and precision. The medical industry's growth and focus on miniaturized, high-precision components make turning tools vital for producing reliable, high-quality parts that meet stringent regulatory standards.

In the energy sector, particularly in oil and gas, turning tools play a key role in manufacturing heavy-duty components like drill bits, pipelines, and valves that withstand extreme conditions. These components require robust turning tools that can handle heavy cuts and provide durability in harsh environments. Turning tools with wear-resistant coatings and high hardness levels are essential for machining tough metals used in energy applications, ensuring long tool life and reduced maintenance needs. The renewable energy segment, such as wind and solar, also utilizes turning tools to produce large, precision parts for turbines and generators. As the energy industry grows and diversifies, demand for reliable turning tools in both traditional and renewable energy applications is expected to increase, highlighting their critical role across this diverse industry segment.

What Are the Key Drivers Fueling Growth in the Turning Tools Market?

The growth in the turning tools market is driven by several key factors, including the expansion of high-precision manufacturing, increasing adoption of CNC machines, and the demand for specialized tools across industries. The rise of high-precision manufacturing, particularly in automotive, aerospace, and medical sectors, has led to greater demand for turning tools that can achieve tight tolerances, complex geometries, and smooth surface finishes. As products become more intricate and performance-driven, turning tools that support high-precision machining are essential. This trend is particularly strong in industries like aerospace and medical devices, where the safety and functionality of components depend on precise, consistent production. As companies strive to meet these high standards, the need for advanced turning tools continues to drive market growth.The increasing adoption of CNC machines in manufacturing is another significant growth driver for the turning tools market. CNC machines require specialized turning tools that can handle automated, high-speed operations with minimal supervision. CNC machining allows manufacturers to achieve greater efficiency, accuracy, and repeatability, making it a preferred technology for producing high-quality components. Turning tools designed for CNC applications, such as indexable inserts and multi-functional tools, enable fast tool changes, reduce setup times, and support continuous production. The widespread integration of CNC technology across industries is driving demand for compatible, high-performance turning tools that enhance productivity and reduce operational costs.

The demand for specialized turning tools across sectors like energy, automotive, and defense is further fueling market growth. Industries that work with hard-to-machine materials, such as titanium, Inconel, and carbon composites, require durable, high-performance turning tools capable of maintaining cutting performance under extreme conditions. The growing use of these materials in sectors like aerospace, defense, and energy due to their strength and lightweight properties has increased demand for turning tools that can effectively machine them. Additionally, as industries shift toward lighter, stronger materials to improve efficiency and reduce environmental impact, manufacturers require turning tools that are both versatile and durable. This trend is expected to continue, particularly as manufacturers in automotive and aerospace increasingly seek advanced turning tools that can handle emerging material requirements.

Together, these drivers - demand for high-precision manufacturing, CNC adoption, and specialized tooling - are propelling growth in the turning tools market, establishing these tools as indispensable assets for achieving quality, efficiency, and innovation in modern manufacturing. As industries evolve and machining requirements become more complex, turning tools will continue to play a central role in supporting the productivity and competitiveness of global manufacturing.

Report Scope

The report analyzes the Turning Tools market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Type (Rough Turning Tools, Finish Turning Tools); End-Use (Automotive End-Use, Electronics & Electrical End-Use, Construction & Mining End-Use, Aerospace End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rough Turning Tools segment, which is expected to reach US$7.3 Billion by 2030 with a CAGR of a 6.7%. The Finish Turning Tools segment is also set to grow at 4.1% CAGR over the analysis period.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Turning Tools Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Turning Tools Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Turning Tools Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amrat Tools Corporation, Applitec Moutier SA, BIG KAISER Precision Tooling Inc., CERATIZIT S.A., Ingersoll Cutting Tools and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 25 companies featured in this Turning Tools market report include:

- Amrat Tools Corporation

- Applitec Moutier SA

- BIG KAISER Precision Tooling Inc.

- CERATIZIT S.A.

- Ingersoll Cutting Tools

- ISCAR Ltd.

- JS Tools Lathe Machine Cutting Tools Manufacturers in Ahmedabad, Gujarat, India.

- Kennametal, Inc.

- Kreative Tooling Systems

- Mikron Tool SA

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amrat Tools Corporation

- Applitec Moutier SA

- BIG KAISER Precision Tooling Inc.

- CERATIZIT S.A.

- Ingersoll Cutting Tools

- ISCAR Ltd.

- JS Tools Lathe Machine Cutting Tools Manufacturers in Ahmedabad, Gujarat, India.

- Kennametal, Inc.

- Kreative Tooling Systems

- Mikron Tool SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 265 |

| Published | February 2026 |

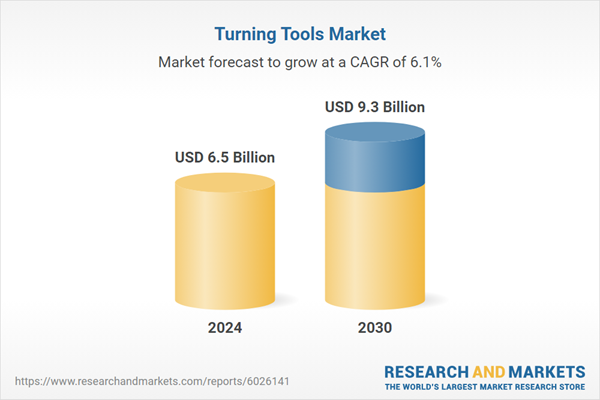

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.5 Billion |

| Forecasted Market Value ( USD | $ 9.3 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |