Global Hyperscale Computing Market - Key Trends & Drivers Summarized

What Is Hyperscale Computing and Why Is It Essential for Data-Driven Businesses?

Hyperscale computing refers to a computing environment that can scale seamlessly to accommodate increased workloads and data demands by adding more computing power, storage, and networking capacity. Unlike traditional data centers, hyperscale infrastructures are built for scalability, flexibility, and efficiency, enabling companies to support massive amounts of data, complex applications, and high-traffic workloads. Primarily used by tech giants like Amazon, Google, and Microsoft, hyperscale computing is essential for large-scale digital services, including cloud computing, big data analytics, artificial intelligence (AI), and content delivery networks (CDNs). This approach ensures that as demand grows, the infrastructure can scale without disruption, maintaining the speed and performance needed to deliver services to millions of users globally.Hyperscale computing has become indispensable for data-driven businesses seeking to provide uninterrupted, high-speed digital services to customers. With the explosion of data from IoT devices, streaming services, and online transactions, companies need robust infrastructures that can handle growing amounts of data while optimizing resource allocation. Hyperscale computing enables such scalability by using highly modular architectures, which allow companies to expand data center capacity by adding standardized servers and storage units as demand grows. This structure allows businesses to maintain operational efficiency and agility, supporting services and applications that require rapid response times and high availability.

In addition to scalability, hyperscale computing enhances cost-efficiency by allowing companies to utilize resources more effectively. Hyperscale environments often leverage automation, energy-efficient hardware, and virtualization to reduce costs associated with power, cooling, and management. The ability to efficiently manage massive workloads without significant increases in operational costs makes hyperscale computing ideal for organizations that depend on continuous processing of large data sets, such as e-commerce, social media, and enterprise cloud providers. By providing the backbone for data-driven innovation, hyperscale computing supports the high-performance needs of modern businesses and enables them to adapt swiftly to new technological challenges.

How Are Technological Advancements and Demand for Cloud Services Shaping the Hyperscale Computing Market?

Technological advancements in artificial intelligence (AI), machine learning (ML), and data storage are significantly enhancing hyperscale computing, making it more powerful, efficient, and adaptable. AI and ML technologies enable predictive analytics, resource optimization, and automated management in hyperscale environments, allowing data centers to adjust power, cooling, and processing resources in real-time based on demand. These technologies help data centers operate more efficiently by reducing energy consumption and minimizing downtime. Hyperscale environments increasingly use AI-driven monitoring tools to detect and address potential issues before they impact performance, enabling seamless scalability. By incorporating AI and ML into hyperscale computing, data centers can process massive workloads more effectively, improve fault tolerance, and optimize resource allocation, supporting the high-demand workloads typical in cloud computing and big data processing.The growth of cloud services is a major driver of hyperscale computing, as businesses shift their operations to the cloud to gain flexibility, reduce IT overhead, and support remote work. Hyperscale data centers, with their high density and modular architectures, are fundamental to the cloud computing infrastructure that powers software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS) solutions. Companies such as Amazon Web Services, Microsoft Azure, and Google Cloud rely on hyperscale infrastructure to offer customers scalable, on-demand services. As more businesses migrate to cloud platforms to support business continuity, digital transformation, and data storage, the demand for hyperscale computing has skyrocketed, establishing it as the foundational architecture for cloud-based services.

Storage advancements, including solid-state drives (SSDs) and non-volatile memory express (NVMe), are transforming hyperscale data centers by providing faster, more reliable storage solutions that meet the needs of high-performance applications. NVMe technology, for example, enables ultra-fast data transfer rates that are essential for workloads like real-time analytics, machine learning, and AI training. By incorporating SSDs and NVMe, hyperscale environments can handle the vast data demands of these applications while minimizing latency. Furthermore, innovations in storage enable hyperscale data centers to efficiently store and access enormous volumes of data generated by IoT, edge computing, and AI, enhancing the performance of hyperscale computing in data-intensive industries.

Where Is Hyperscale Computing Making the Greatest Impact Across Industry Segments?

Hyperscale computing is making a substantial impact across industry segments such as e-commerce, financial services, telecommunications, and healthcare, where data processing and storage requirements are high. In the e-commerce industry, hyperscale computing provides the computing power needed to handle massive amounts of transaction data, customer analytics, and inventory management. For global e-commerce platforms like Amazon and Alibaba, hyperscale computing supports real-time analytics, personalized recommendations, and high-speed transaction processing, which are essential for enhancing user experience and maintaining competitive advantage. The scalability of hyperscale computing allows e-commerce companies to accommodate traffic surges, especially during peak shopping seasons, ensuring seamless performance for customers and maximizing revenue.In financial services, hyperscale computing enables institutions to handle high-frequency trading, fraud detection, and complex risk assessments in real-time. Financial transactions require fast processing and stringent security measures, which hyperscale environments support with advanced data encryption and scalable storage solutions. Hyperscale computing also enables financial firms to leverage AI and ML for fraud detection, market analysis, and automated trading, processing large volumes of data with minimal latency. Banks, investment firms, and insurance companies benefit from hyperscale infrastructure that provides both the performance and security necessary to meet regulatory requirements and customer expectations. The ability to rapidly scale resources during market fluctuations also allows financial services to maintain stability and resilience under varying conditions.

In healthcare, hyperscale computing supports applications such as electronic health records (EHR), telemedicine, and genomic research, which require vast storage and real-time data processing capabilities. Hyperscale data centers provide healthcare institutions with the capacity to store and analyze large volumes of patient data, supporting medical research and personalized treatments. In genomic research, for instance, hyperscale computing enables the processing of extensive datasets used in genetic sequencing, accelerating discoveries in precision medicine. Additionally, telemedicine services rely on hyperscale environments to provide secure, high-speed access to patient records and communication tools, enhancing healthcare delivery. By supporting large-scale data storage and rapid processing, hyperscale computing helps healthcare providers improve patient care and advance research.

What Are the Key Drivers Fueling Growth in the Hyperscale Computing Market?

The growth in the hyperscale computing market is driven by several key factors, including the rapid expansion of data generation, the need for real-time processing, and the shift toward digital transformation across industries. The exponential growth of data, generated by IoT devices, online transactions, social media, and multimedia content, is a primary driver of hyperscale computing. As businesses and consumers create more data than ever before, organizations require scalable infrastructures that can store, manage, and analyze this information efficiently. Hyperscale computing provides the architecture needed to handle high volumes of data continuously, allowing companies to leverage data for analytics, insights, and decision-making. In industries where data insights drive competitive advantage, such as retail, healthcare, and finance, hyperscale computing has become essential for managing large data sets and supporting real-time applications.The increasing demand for real-time processing and low-latency applications is also fueling the hyperscale computing market, as more industries rely on real-time data for enhanced decision-making and customer experience. Applications such as AI, machine learning, video streaming, and autonomous vehicles require immediate data processing capabilities, which hyperscale environments provide. Hyperscale computing supports low-latency communication and high-speed data transfer, ensuring that critical applications operate smoothly. This capability is particularly valuable in industries where milliseconds matter, such as financial trading, healthcare diagnostics, and logistics. As companies develop new real-time applications, hyperscale computing enables them to scale processing power dynamically, meeting performance requirements without interruptions.

The push toward digital transformation and cloud adoption across industries is another significant growth driver, as organizations migrate to cloud platforms to enhance scalability, reduce infrastructure costs, and improve operational flexibility. Hyperscale data centers are the foundation for cloud services, providing the scalability needed to support businesses transitioning from on-premises to cloud-based operations. Cloud computing adoption has surged in recent years as businesses of all sizes seek to streamline operations, facilitate remote work, and improve disaster recovery capabilities. Hyperscale computing supports this transition by providing a reliable and adaptable infrastructure, allowing companies to expand and innovate without the constraints of physical servers. Together, these drivers - data growth, real-time processing needs, and digital transformation - are propelling the hyperscale computing market forward, establishing it as a cornerstone of the digital economy and modern data infrastructure.

Report Scope

The report analyzes the Hyperscale Computing market, presented in terms of market value (US$ Thousand). The analysis covers the key segments and geographic regions outlined below.- Segments: Component (Solutions, Services); Organization Size (Large Enterprises, Small & Medium Enterprises); Application (Cloud Computing Application, Big Data Application, Internet of Things (IoT) Application, Other Applications); End-Use (IT & Telecom End-Use, Media & Entertainment End-Use, BFSI End-Use, Retail & eCommerce End-Use, Healthcare End-Use, Other End-Uses).

- Geographic Regions/Countries:World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Regional Analysis

Gain insights into the U.S. market, valued at $14.4 Billion in 2024, and China, forecasted to grow at an impressive 18.8% CAGR to reach $24.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hyperscale Computing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hyperscale Computing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hyperscale Computing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AFL Hyperscale, Alibaba Cloud, Amazon Web Services, Inc., Broadcom, Inc., Dell, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Hyperscale Computing market report include:

- AFL Hyperscale

- Alibaba Cloud

- Amazon Web Services, Inc.

- Broadcom, Inc.

- Dell, Inc.

- Digital Realty

- Fujitsu Ltd.

- Google Cloud

- Hewlett Packard Enterprise Development LP (HPE)

- Huawei Cloud

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AFL Hyperscale

- Alibaba Cloud

- Amazon Web Services, Inc.

- Broadcom, Inc.

- Dell, Inc.

- Digital Realty

- Fujitsu Ltd.

- Google Cloud

- Hewlett Packard Enterprise Development LP (HPE)

- Huawei Cloud

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 273 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

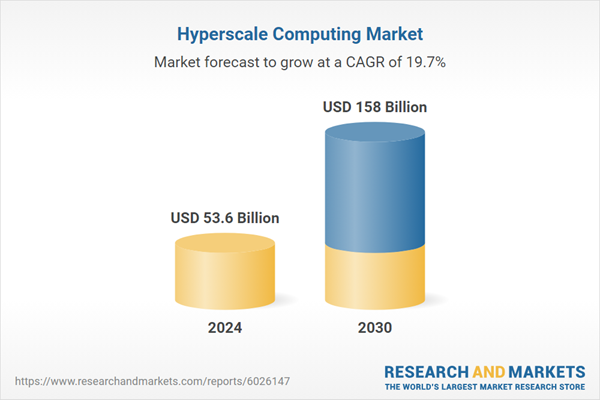

| Estimated Market Value ( USD | $ 53.6 Billion |

| Forecasted Market Value ( USD | $ 158 Billion |

| Compound Annual Growth Rate | 19.7% |

| Regions Covered | Global |