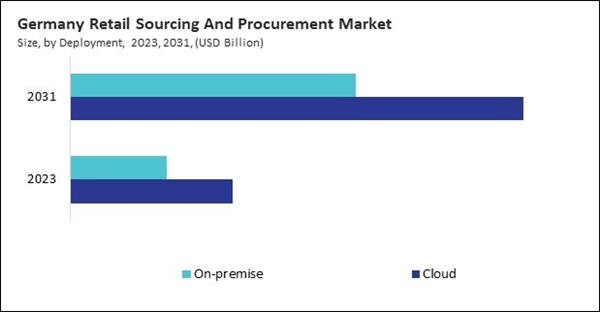

The Germany market dominated the Europe Retail Sourcing and Procurement Market by country in 2023, and is expected to continue to be a dominant market till 2031; thereby, achieving a market value of $1.03 billion by 2031. The UK market is exhibiting a CAGR of 14.7% during 2024-2031. Additionally, the France market would experience a CAGR of 16.5% during 2024-2031.

In addition, the transition to procurement has allowed retailers to access a vast network of suppliers, providing them with substantial benefits such as cost savings and access to specialized products. For instance, a U.S.-based fashion retailer might source fabrics from India and leather from Italy to create high-quality, cost-effective items. At the same time, a luxury brand could seek unique materials, such as Mongolian cashmere or Japanese denim, to differentiate its products.

Retailers are increasingly adopting advanced sourcing and procurement tools to manage these complexities. These digital solutions provide real-time visibility into supplier operations, predictive analytics, and automated compliance checks, all of which help retailers coordinate complex supply chains and mitigate risks. For example, a retailer using a centralized digital platform can simultaneously track shipments from factories in China and warehouses in Europe, enabling better coordination and quicker responses to potential issues.

Italy is witnessing a growing demand for retail sourcing and procurement technologies as retailers seek to modernize their supply chains and improve operational efficiency. The Italian government’s “Piano Nazionale di Ripresa e Resilienza” (PNRR) provides substantial funding to support digital transformation, specifically targeting SMEs and initiatives that promote sustainable practices. This funding has incentivized Italian retailers to adopt digital procurement platforms and cloud solutions, improving sourcing accuracy and transparency. Moreover, government grants focused on green technology have encouraged retailers to integrate sustainable practices within their procurement strategies, aligning with broader European Union environmental goals. Thus, all these developments will drive the expansion of the market.

List of Key Companies Profiled

- Cegid Group

- Epicor Software Corporation

- GEP Software

- Infor, Inc. (Koch Industries)

- IBM Corporation

- Ivalua Inc.

- Blue Yonder Group, Inc. (Panasonic Holdings Corporation)

- Oracle Corporation

- SAP SE

- Coupa Software, Inc.

Market Report Segmentation

By Deployment

- Cloud

- On-premise

By Component

- Solution

- Strategic Sourcing

- Supplier Management

- Contract Management

- Procure-to-Pay (P2P)

- Other Solution Type

- Service

- Implementation

- Consulting

- Other Service Type

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Country

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

Table of Contents

Companies Mentioned

Some of the leading companies profiled in this Europe Retail Sourcing and Procurement Market report include:- Cegid Group

- Epicor Software Corporation

- GEP Software

- Infor, Inc. (Koch Industries)

- IBM Corporation

- Ivalua Inc.

- Blue Yonder Group, Inc. (Panasonic Holdings Corporation)

- Oracle Corporation

- SAP SE

- Coupa Software, Inc.