The rising integration of AEB systems in vehicles is driven by stringent safety regulations and consumer demand for enhanced safety features. Governments and regulatory bodies worldwide are mandating the inclusion of AEB systems in new vehicles to reduce the number and severity of road accidents. This regulatory push, combined with the growing awareness of AEB’s life-saving potential, propels these systems' adoption. Consequently, the autonomous emergency braking (AEB) segment held 11% revenue share in the market in 2023. Sensor and braking technologies have improved the accuracy and responsiveness of AEB systems, making them more effective in various driving conditions. As a result, AEB systems are becoming a standard feature in many new vehicle models, further driving their market growth.

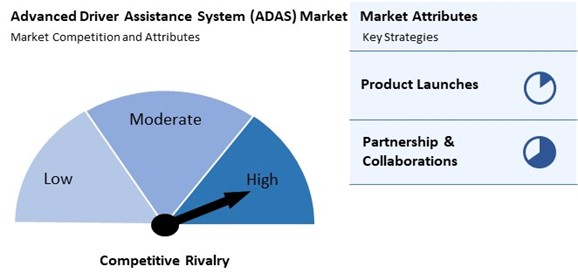

The major strategies followed by the market participants are Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January, 2024, Valeo and Teledyne FLIR have partnered to enhance automotive safety by integrating thermal imaging technology into advanced driver-assistance systems (ADAS). Their collaboration aims to improve night vision capabilities, particularly for automatic emergency braking, addressing the increasing need for safer road user protection. Additionally, in June, 2024, Autoliv, Inc. and the UN Road Safety Fund have renewed their partnership to enhance motorcycle safety worldwide. This collaboration supports the UN's goal of reducing road traffic fatalities and focuses on addressing the rising motorcycle-related deaths through shared expertise and innovative safety solutions.

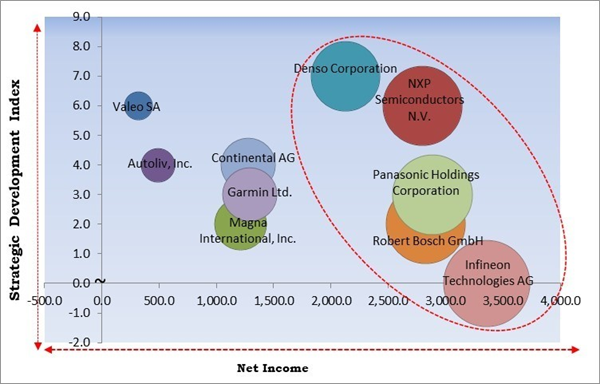

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Infineon Technologies AG, Robert Bosch GmbH, Panasonic Holdings Corporation, NXP Semiconductors N.V. and Denso Corporation are the forerunners in the Market. In September, 2024, DENSO and ROHM plan to form a strategic semiconductor partnership to meet the rising demand for electric vehicle components and enhance vehicle intelligence for autonomous driving. The collaboration aims to ensure a stable supply and develop high-quality, efficient semiconductors. Companies such as Valeo SA, Continental AG and Autoliv, Inc. are some of the key innovators in Advanced Driver Assistance System (ADAS) Market.Market Growth Factors

Consumer expectations have evolved as they become accustomed to the convenience and safety provided by modern technology in their daily lives. Features such as automatic emergency braking, lane-keeping assist, and adaptive cruise control are not seen as luxury add-ons but as essential components of a safe driving experience. This shift in consumer expectations drives automakers to integrate ADAS into their vehicles to meet the rising demand for enhanced safety features. Therefore, rising consumer awareness and demand for enhanced vehicle safety technologies drive the market's growth.The rise in urban traffic congestion has also raised concerns about environmental sustainability. Increased vehicle emissions and fuel consumption associated with traffic jams contribute to air pollution and climate change. ADAS technologies can help optimize driving patterns, reduce unnecessary stops, and improve fuel efficiency, thus supporting environmental objectives. As consumers and governments prioritize sustainability, the demand for ADAS technologies that promote greener driving practices will likely increase. In conclusion, increasing traffic congestion and urbanization drive the market's growth.

Market Restraining Factors

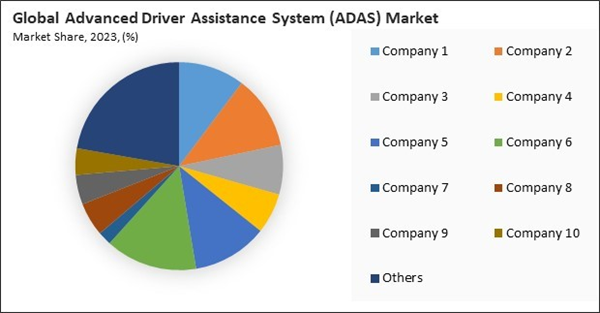

The successful deployment of ADAS technologies requires advanced vehicle systems, trained personnel, and supporting infrastructure. Manufacturers must invest in training programs for engineers and technicians to ensure they possess the necessary skills to design, install, and maintain ADAS features. Additionally, implementing supportive infrastructure, such as smart traffic signals and connected roadways, adds another layer of costs that manufacturers must consider. The cumulative expenses associated with training and infrastructure can act as a deterrent to broader adoption. In conclusion, high development and implementation costs hamper the market's growth.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

Driving and Restraining Factors

Drivers

- Rising Consumer Awareness and Demand for Enhanced Vehicle Safety Technologies

- Increasing Road Traffic Congestion and Urbanization

- Growth Of Electric and Autonomous Vehicles Worldwide

Restraints

- High Development and Implementation Costs

- Data Privacy and Security Concerns Related to Connected Technologies

Opportunities

- Rising Insurance Premiums and Economic Incentives for Safer Vehicles

- Increasing Vehicle Safety Regulations and Standards

Challenges

- Competition from Alternative Safety Technologies

- Potential Overreliance on Driver Assistance Systems

Solution Type Outlook

Based on solution, the market is divided into adaptive cruise control (ACC), blind spot detection system (BSD), park assistance, lane departure warning (LDWS) system, tire pressure monitoring system (TPMS), autonomous emergency braking (AEB), adaptive front lights (AFL), and others. The blind spot detection system (BSD) segment procured 14% revenue share in the market in 2023. BSD systems prevent accidents by alerting drivers to vehicles in their blind spots, enhancing situational awareness and safety. The increasing adoption of BSD systems is driven by the rising awareness of their benefits in reducing side-impact collisions and improving overall driving safety.Component Outlook

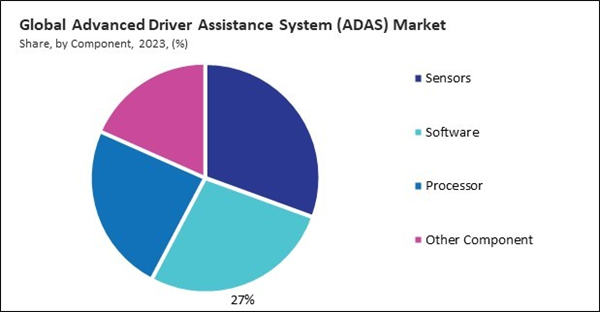

On the basis of component, the market is segmented into processor, sensors, software, and others. In 2023, the processor segment attained a noteworthy revenue share in the market. Processors serve as the brains of ADAS technologies, executing complex algorithms and processing vast amounts of data collected from various sensors, including cameras, radar, and LiDAR. This capability enables real-time decision-making, allowing vehicles to respond promptly to dynamic driving conditions and enhance overall safety. The increasing complexity of ADAS features, such as autonomous driving functions and integrated safety systems, has driven demand for more powerful and efficient processors.Sensor Outlook

The sensors segment is further subdivided into radar, LiDAR, ultrasonic, and others. In 2023, the radar segment procured a 31% revenue share in the market. Radar technology utilizes electromagnetic waves to detect and track the speed and position of surrounding objects, enabling vehicles to respond promptly to potential hazards. This functionality is crucial for enhancing the safety and reliability of driver assistance systems.Vehicle Type Outlook

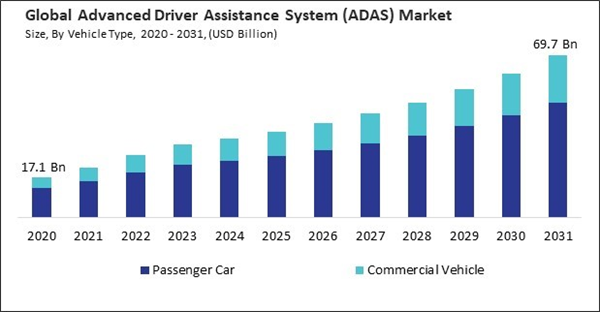

Based on vehicle type, the market is bifurcated into passenger car and commercial vehicle. In 2023, the passenger car segment registered 73% revenue share in the market. This substantial share can be attributed to increasing consumer demand for safety features, enhanced driving experiences, and the growing preference for advanced technologies in personal vehicles. As consumers become more aware of the benefits of ADAS, manufacturers are responding with a wider array of features aimed at improving safety and convenience.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The North America region witnessed 35% revenue share in the market in 2023. This dominance can be attributed to the robust presence of key automotive manufacturers and technology providers in the region and strong consumer demand for enhanced safety features in vehicles. Additionally, stringent regulatory standards and increased investment in research and development have accelerated the adoption of ADAS technologies in North America.Market Competition and Attributes

The Advanced Driver Assistance System (ADAS) Market is highly competitive, fueled by rising demand for vehicle safety and automation features. Providers are focused on developing ADAS technologies, such as adaptive cruise control, lane-keeping assistance, and automatic emergency braking, to enhance driver safety and convenience. As automotive manufacturers increasingly integrate ADAS into vehicles, competition intensifies around offering systems that are accurate, reliable, and adaptable to various vehicle types. Continuous innovation in sensor technology, AI, and machine learning is essential for companies to maintain a competitive edge in this fast-evolving market.

Recent Strategies Deployed in the Market

- Jan-2024: Garmin announced significant enhancements to its Unified Cabin automotive solutions, featuring customizable HMI theming, Dolby Atmos audio, and improved driver distraction mitigation. These updates aim to elevate user experience and connectivity while further integrating advanced driver-assistance systems (ADAS) functionalities.

- Jan-2024: NXP Semiconductors expanded its automotive radar one-chip family with the SAF86xx, enabling advanced, software-defined vehicle architectures. This SoC enhances ADAS capabilities, supporting NCAP safety functions and advanced features while facilitating seamless transitions with Over-the-Air updates for OEMs.

- Jan-2024: Robert Bosch GmbH and Qualcomm unveiled the first central vehicle computer at CES 2024, integrating infotainment and ADAS functions on a single Snapdragon Ride Flex SoC. This scalable platform enhances vehicle architecture, offering advanced features for both entry-level and premium automotive segments.

- Dec-2023: Panasonic launched a 6-in-1 inertial sensor compliant with ASIL-D standards, enhancing vehicle safety by measuring acceleration and angular rates. It supports various applications, including ADAS, V2X communication, and features for two-wheelers, ensuring robust performance in modern automotive systems.

- Sep-2023: Autoliv, Inc. and Great Wall Motor are collaborating to advance automotive safety technologies, including overhead airbags and zero-gravity seats for autonomous vehicles. Their focus is on innovation, sustainability, and enhancing the driving experience with bio-materials and integrated safety solutions.

List of Key Companies Profiled

- Autoliv, Inc.

- Denso Corporation

- Valeo SA

- NXP Semiconductors N.V.

- Continental AG

- Robert Bosch GmbH

- Garmin Ltd.

- Infineon Technologies AG

- Magna International, Inc.

- Panasonic Holdings Corporation

Market Report Segmentation

By Vehicle Type- Passenger Car

- Commercial Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

- Sensors

- Radar

- LiDAR

- Ultrasonic

- Other Sensors Type

- Software

- Processor

- Other Component

- Adaptive Cruise Control (ACC)

- Blind Spot Detection System (BSD)

- Park Assistance

- Autonomous Emergency Braking (AEB)

- Lane Departure Warning (LDWS) System

- Tire Pressure Monitoring System (TPMS)

- Adaptive Front Lights (AFL)

- Other Solution Type

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

Some of the leading companies profiled in this Advanced Driver Assistance System (ADAS) Market report include:- Autoliv, Inc.

- Denso Corporation

- Valeo SA

- NXP Semiconductors N.V.

- Continental AG

- Robert Bosch GmbH

- Garmin Ltd.

- Infineon Technologies AG

- Magna International, Inc.

- Panasonic Holdings Corporation