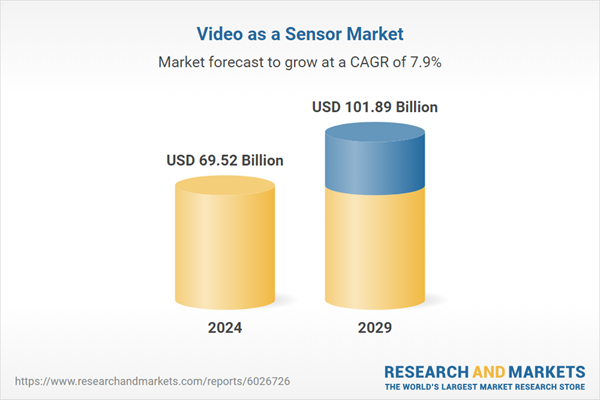

Rapid technological advancements to drive the video as a sensor market.

Launch of sophisticated solutions through aggressive developments in high-resolution cameras, Al, ML, cloud computing, and edge computing are creating growth and adoption in the video as a sensor market. High-resolution cameras improve images, allowing enhanced object identification, better facial recognition, and readable license plates. Al-enabled cameras are revolutionizing video surveillance by introducing real-time detection of threats and automatic anomaly recognition, which increases security efficiency. Some of the companies offering Al-enabled cameras for video as a sensor market include VCA Technology Ltd. (UK), Spot Al, Inc. (US), and Honeywell International Inc. (US).Services segment is expected to grow at a significant CAGR for offering segment during the forecast period.

The video as a sensor services segment is crucial in enhancing the functionality and accessibility of video surveillance technologies. The services segment is categorized into two primary categories: Video Surveillance as a Service (VSaaS) and Installation and Maintenance Services. VSaaS offers cloud-based surveillance solutions which help users to monitor their premises remotely. Installation and maintenance services ensure these systems are set up correctly and remain operational, maximizing their effectiveness in various applications such as security, traffic management, and retail analytics. Companies such as Bosch Security Systems GmbH (Germany), and Honeywell International Inc. (US) offer VSaaS in the video as a sensor market.Machine vision and monitoring segment to witness significant CAGR for product type segment during the forecast period.

The machine vision and monitoring segment is a key segment of the video as a sensor market, and it leverages advanced imaging technologies to enhance quality control and operational efficiency across various industries such as manufacturing. Some of the important components of machine vision and monitoring are hardware, software, and services. Hardware products comprise lenses, cameras- area scan cameras or others, light sources, and processors used to capture and process images. Software includes special software specially designed for image processing, analysis, and integration of other data management systems. The services include installation, maintenance, and support services to ensure that the machine vision system is working at its best. Omron Corporation (Japan) offers machine vision sensors/cameras that consist of the FHV7 smart camera that is primarily used for inspection of automobile parts, food & beverage products inspection, pharmaceutical products, and packaging, as well as general manufacturing.Healthcare application segment set to hold a significant market share by 2029.

By utilizing video surveillance and analytics, healthcare organizations monitor environments, support clinical workflows, and improve safety for patients and staff. Video as sensor systems monitor patients in real-time in critical care units, enabling healthcare providers to respond quickly to changes by minimizing response times in emergencies. Video as sensor systems improve security by ensuring that only authorized personnel can enter sensitive areas. Companies such as Honeywell International Inc. and Johnson Controls Inc. offer video as sensor solutions used in healthcare applications.Residential end-user segment set to hold a significant market share by 2029.

The residential segment is increasingly significant due to the growing demand for home security and automation. This segment encompasses various applications, including home surveillance, smart home systems, and safety monitoring. As more homeowners seek to enhance their security measures, integrating video as sensor systems into residential settings has become a priority.Home surveillance systems are one of the primary applications within this segment. These systems typically include video cameras that can be monitored remotely via smartphones or computers. For instance, IntelliVision (US), a company operating in AI and deep learning-based video analytics and cloud software, provides the Smart Home/IoT Solution for object tracking, home security, and baby/pet monitoring. Johnson Controls Inc. (Ireland) and IntelliVision (US) provide video as sensor products for residential monitoring, security, and surveillance.

North America is likely to hold prominent market share in 2024.

The growth of the video as a sensor market in North America is basically due to increased interest in real-time analytics and security measures across healthcare, retail, and government. Integration of advanced technologies such as Al, ML, and loT is expected to support sophisticated video analytics solutions and enhance these solutions for efficiency and better decision-making. Further, the booming smart city projects and urban development are increasing the demand for smart surveillance systems that deal with public safety issues and manage traffic. Also, the presence of the video as sensor systems developers and providers like Cisco Systems, Inc. (US), IBM Corporation (US), and AT&T (US) in the region has made the region an attractive hub for other systems providers the region.Breakdown of primaries

A variety of executives from key organizations operating in the video as a sensor market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.- By Company Type: Tier 1 = 45%, Tier 2 = 35%, and Tier 3 = 25%

- By Designation: C-level Executives = 35%, Directors = 40%, and Others (sales, marketing, and product managers, as well as members of various organizations) = 25%

- By Region: North America =35%, Europe = 25%, Asia Pacific =32%, and RoW = 8%

Key players profiled in this report

Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd (China), Honeywell International Inc. (US), Bosch Security Systems GmbH (Germany), Cisco Systems, Inc. (US), IBM Corporation (US), AT&T (US), Axis Communications AB (Sweden), Sony Group Corporation (Japan), Teledyne Technologies Incorporated (US), Hexagon AB (Sweden), and Johnson Controls Inc. (US) are the some of the key players in the video as a sensor market. These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets. The study provides a detailed competitive analysis of these key players in the video as a sensor market, presenting their company profiles, most recent developments, and key market strategies.Research Coverage

This report offers detailed insights into the video as a sensor market based on Product Type (Video Surveillance, Thermal Imaging, Hyperspectral Imaging, and Machine Vision and Monitoring), Offering (Hardware, Software, and Services), End User (Government, Commercial, Industrial, and Residential), Application (Security & Surveillance, Traffic Management, Retail Analytics, Healthcare, Manufacturing, and Mapping) and region (North America, Europe, Asia Pacific, and the Rest of the World (including the Middle East, South America, and Africa.)The report also comprehensively reviews the video as a sensor market drivers, restraints, opportunities, and challenges. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Reasons to buy the report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the video as a sensor market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.The report provides insights on the following pointers:

- Analysis of key drivers (rapid technological advancements, Favorable government initiatives and funding, and increasing demand for surveillance and security), restraints (privacy and security concerns, and complexities in integrating video as sensor solutions) opportunities (rapid advancement in AI, and proliferation of Smart City initiatives) and challenges (challenges in data management & storage, and vendor lock-in and interoperability issues).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the video as a sensor market

- Market Development: Comprehensive information about lucrative markets - the report analyses the video as a sensor market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the video as a sensor market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Hangzhou Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd (China), Honeywell International Inc. (US), Bosch Security Systems GmbH (Germany), Cisco Systems, Inc. (US), IBM Corporation (US), AT&T (US), Axis Communications AB (Sweden), Sony Group Corporation (Japan), Teledyne Technologies Incorporated (US), Hexagon AB (Sweden), and Johnson Controls Inc. (US) among others.

Table of Contents

Companies Mentioned

- Bosch Security Systems GmbH

- Motorola Solutions, Inc.

- Hangzhou Hikvision Digital Technology Co. Ltd.

- Zhejiang Dahua Technology Co. Ltd.

- Honeywell International Inc.

- AT&T

- IBM Corporation

- Cisco Systems, Inc.

- Axis Communications Ab

- Johnson Controls Inc.

- Sony Group Corporation

- Sharp Corporation

- Teledyne Technologies Incorporated

- Corning Incorporated

- Pixart Imaging Inc.

- Exosens

- Senstar Corporation

- Irisity

- Hexagon Ab

- Allgovision Technologies Pvt. Ltd.

- Intellivision

- Puretech Systems Inc.

- Vca Technology Ltd.

- Iomniscient Pty Ltd.

- Fluke Corporation

- Briefcam

- Omnivision

- Hinalea Imaging Corp.

- Photon Etc.

- Wyze Labs, Inc.

- Spot AI, Inc.

- Rhombus Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 354 |

| Published | March 2025 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value ( USD | $ 69.52 Billion |

| Forecasted Market Value ( USD | $ 101.89 Billion |

| Compound Annual Growth Rate | 7.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |