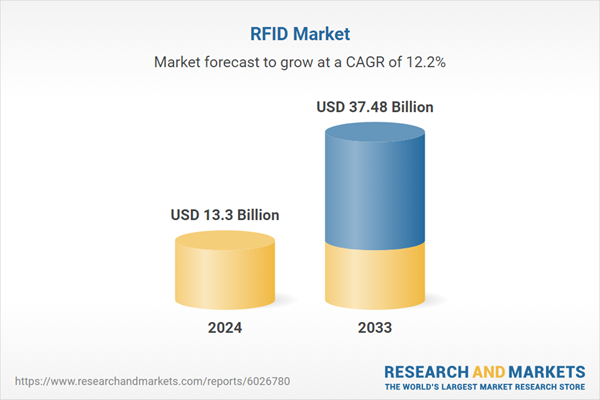

RFID Global Market Report by System (Active RFID System, Passive RFID System), Product Type (Tags, Readers, Software & Services), End Use (Retail, Financial Services, Healthcare, Industrial, Transportation & Logistics, Government, Others), Countries and Company Analysis, 2025-2033.

Global RFID Industry Overview

Technological developments and growing usage in sectors including manufacturing, logistics, retail, and healthcare are propelling the RFID market's rapid expansion. Through wireless data transfer between tags and readers, RFID technology makes it possible to track and manage staff, inventories, and assets in real time. RFID and IoT integration improve automation, increasing operational efficiency and supply chain visibility. The market is expanding at an even faster rate due to the rising demand for contactless solutions. The Asia-Pacific region is anticipated to develop at the fastest rate due to rising industrialization and government measures supporting digital transformation, while North America leads the market because of early adoption. The RFID industry has a bright future because to ongoing technical advancements that are fueling its growth.According to the ASHP Foundation's 2022 study, RFID technology has become widely used in the healthcare industry, with about 40% of healthcare companies having used it. These systems have shown impressive gains, such as a 72% decrease in expired drugs and an 82% boost in inventory tracking capabilities. Avery Dennison's September 2023 debut of the AD Pure series, a line of RFID inlays and tags made completely of PET plastic, is an example of recent advancements in the area that incorporate sustainable alternatives. This innovation maintains high performance requirements for applications in the apparel, retail, industrial, and supply chain industries while addressing rising environmental concerns.

The RFID industry has a lot of room to develop because of the government's increasing support for digital technologies like Big Data and the Internet of Things (IoT). One example of how government policies are supporting the development of digital infrastructure is the Delhi Municipal Council's decision in February 2023 to link its RFID toll collecting system with the National FASTag system. The use of RFID technology by Indian Railways in July 2023 to automatically scan freight yard wagon numbers via the Freight Operations Management System is another example of how government incentives are propelling the usage of RFID in public infrastructure. These regulations not only improve operational effectiveness but also provide the groundwork for future economic expansion and technical development.

Key Factors Driving the RFID Market Growth

Increased Adoption of IoT

One of the main reasons for the RFID market's explosive growth is the integration of RFID technology with the Internet of Things (IoT). Businesses may increase operational efficiency and automate procedures by allowing RFID tags and IoT-enabled devices to communicate and gather data in real-time. Businesses can now track workers, inventory, and assets more quickly and accurately thanks to this connectivity. IoT-powered RFID solutions improve decision-making, lower manual error rates, and facilitate predictive maintenance in sectors including manufacturing, shipping, and healthcare. Additionally, it facilitates improved data exchange across partners and departments, which results in more efficient operations. The need for RFID solutions keeps growing as more businesses adopt IoT, spurring advancements and expanding the use of these technologies throughout the world.Demand for Contactless Solutions

The increasing need for contactless solutions in a variety of industries is a major factor propelling RFID technology growth. RFID is being used more and more in sectors including retail, healthcare, and transportation to improve consumer experiences, increase safety, and expedite processes. For example, RFID enables contactless checkout and payment systems in retail, which shorten lines and enhance the shopping experience. RFID tags are used in healthcare to identify patients and ensure that medical data and equipment are tracked safely and effectively. The necessity of reducing physical contact was underscored by the COVID-19 epidemic, which further increased demand for touch-free devices. RFID's capacity to provide quick, safe, and touchless interactions makes it an essential technology in a variety of applications, since both consumers and organizations place a high value on speed and safety.Supply Chain and Inventory Management

Because RFID technology offers real-time visibility and improves the effectiveness of monitoring products, it is revolutionizing supply chain and inventory management. Businesses may track the whereabouts and condition of goods as they go through the supply chain by attaching RFID tags to them, which lowers the possibility of lost, stolen, or misplaced inventory. Businesses may increase order accuracy, expedite stock replenishment, and optimize warehouse management with this visibility. RFID technologies provide faster and more precise stock audits by automating inventory checks and minimizing human error. As a result, operational efficiency is increased, downtime is decreased, and stock discrepancy costs are decreased. RFID is being used by sectors including manufacturing, logistics, and retail to guarantee a more streamlined, transparent supply chain and more dependable inventory control, which is causing a notable increase in corporate growth.Challenges in the RFID Market

Limited Read Range and Interference

The short read range of RFID technology, especially for passive RFID tags, is one of its drawbacks. The range of these tags can be limited, usually to a few meters, because they depend on energy that is transmitted by the reader. Large-scale activities or settings where objects must be tracked over great distances may find this to be a constraint. Furthermore, ambient elements like liquids or metal surfaces might interfere with signals, reducing the precision of data transfer. It might be challenging to get reliable readings since metals, in particular, can reflect or block RFID signals. The overall dependability of the RFID system may be impacted by these physical barriers, which may result in missed scans, data loss, or mistakes in inventory management.Tagging Costs and Standardization

RFID adoption may be severely hampered by tagging prices, particularly in sectors with substantial inventories or goods of diverse sizes and forms. Even while the price of individual RFID tags has been declining over time, it can still mount up rapidly when used on every item in a manufacturing facility, retail establishment, or warehouse. Businesses also need to account for the added expenses of software, readers, and installation. Furthermore, incompatibilities may arise from a lack of standardization in RFID tags and readers. Businesses wishing to deploy RFID systems across several suppliers or geographical areas may encounter difficulties due to the possibility of non-interoperable tags or readers produced by different manufacturers. RFID technology adoption across a range of businesses is slowed down by the absence of common standards, which also makes scaling difficult.RFID Market Overview by Regions

North America leads the RFID industry thanks to early sector adoption and technology developments. Europe continues to have consistent demand, particularly in the areas of logistics and healthcare, while the Asia-Pacific region is expanding quickly as a result of government efforts and industrialization. The following provides a market overview by region:United States RFID Market

The extensive use of cutting-edge technology in a variety of industries, including manufacturing, logistics, retail, and healthcare, has made the US RFID market a significant player in the worldwide RFID market. RFID systems have grown in popularity due to the growing need for improved consumer experiences, supply chain optimization, and real-time inventory management. Furthermore, RFID's connection with the Internet of Things (IoT) improves data management and operational efficiency. A robust technical environment, substantial investments in R&D, and an established infrastructure all help the U.S. market. The US continues to be at the forefront of RFID technology research and usage, with an increasing focus on automation, security, and contactless solutions.Germany RFID Market

The RFID market in Germany is a crucial part of Europe's technology landscape because of its widespread use in industries including manufacturing, logistics, healthcare, and retail. Because of the country's dedication to Industry 4.0, RFID technology has been incorporated into manufacturing processes more quickly, increasing automation and operational efficiency. RFID guarantees precise patient identification and asset management in the healthcare industry, while it enables real-time inventory tracking and enhanced consumer experiences in the retail sector. RFID facilitates smooth tracking and traceability of commodities, which is advantageous for supply chain and logistics operations. Furthermore, the significance of safe RFID solutions is highlighted by Germany's emphasis on data security and adherence to laws like the General Data Protection Regulation (GDPR). Germany is positioned as a leader in RFID technology adoption and innovation in Europe because to its robust industrial base and continuous research and development programs.China RFID Market

The dynamic and quickly growing RFID market in China is fueled by the nation's important contribution to global industry and technological advancement. RFID technology adoption has been aided by the government's active support through regulations and programs in a number of areas, including manufacturing, logistics, healthcare, and retail. The extensive use of RFID for real-time tracking and administration of commodities, which improves supply chain efficiency and product authenticity, is a result of China's status as a key manufacturing hub. RFID solutions are in high demand for asset monitoring, transportation, and urban planning because of the country's focus on smart city development and Internet of Things (IoT) integration. China is a major player in the global RFID market thanks to its strong local manufacturing base and expanding network of more than 150 RFID firms.United Arab Emirates RFID Market

Due to the UAE's dedication to technological innovation and smart city projects, the RFID industry is expanding significantly. Leading cities like Dubai and Abu Dhabi are using RFID technology into a range of industries, such as government services, retail, healthcare, and logistics. The use of RFID technology to improve operational efficiency, security, and customer experiences has been made easier by the government's backing of automation and digital transformation. RFID helps with inventory control and loss prevention in retail, and it is used for asset monitoring and patient management in the healthcare industry. RFID also improves service delivery and passenger satisfaction in tourism and hospitality, as well as in transportation systems like the Salik toll system. The UAE is well-positioned to maintain its position as the Middle East's leader in RFID adoption thanks to sustained investments and a supportive legislative framework.Recent Developments in RFID Industry

- Zebra Technologies Corp. introduced the Zebra FXR90, a new line of UHF RFID fixed readers, in June 2024. The ultra-rugged design and dual IP 65/67 sealing of this new range of fixed RFID readers make it stand out under extreme weather conditions. The FXR90 is certified as IP 67 for brief submersion and IP 65 for dust and moisture protection due to its dual sealing IP certification. Furthermore, these readers are 20 °C cooler than the standard RFID fixed readers on the market today, operating in a larger temperature range of -40 °C to +65 °C. With a maximum receive sensitivity of -92 dBm and a peak transmit power of 33 dBm, the Zebra FXR90 RAIN RFID Readers have a reading speed of up to 1,300 RFID tags per second. The integrated antenna of the Zebra FXR90 RAIN Readers allows for a maximum read distance of 100 feet (30.5 meters) when the RFID tag and equipment are configured optimally.

Market Segmentations

System

- Active RFID System

- Passive RFID System

Product Type

- Tags

- Readers

- Software & Services

End Use

- Retail

- Financial Services

- Healthcare

- Industrial

- Transportation & Logistics

- Government

- Others

Regional Outlook

North America

- United States

- Canada

Europe

- France

- Germany

- Italy

- Spain

- United Kingdom

- Belgium

- Netherlands

- Turkey

Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Thailand

- Malaysia

- Indonesia

- New Zealand

Latin America

- Brazil

- Mexico

- Argentina

Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

All the Key players have been covered

- Overview

- Key Persons

- Recent Development & Strategies

- Revenue Analysis

Company Analysis:

- Alien Technology Corporation

- William Frick & Company

- Invengo Technology Pte Ltd.

- Impinj Inc.

- CCL Industries Inc.

- Nedap NV

- Trace-Tech ID Solutions SL

Table of Contents

Companies Mentioned

- Alien Technology Corporation

- William Frick & Company

- Invengo Technology Pte Ltd.

- Impinj Inc.

- CCL Industries Inc.

- Nedap NV

- Trace-Tech ID Solutions SL

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 13.3 Billion |

| Forecasted Market Value ( USD | $ 37.48 Billion |

| Compound Annual Growth Rate | 12.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 7 |