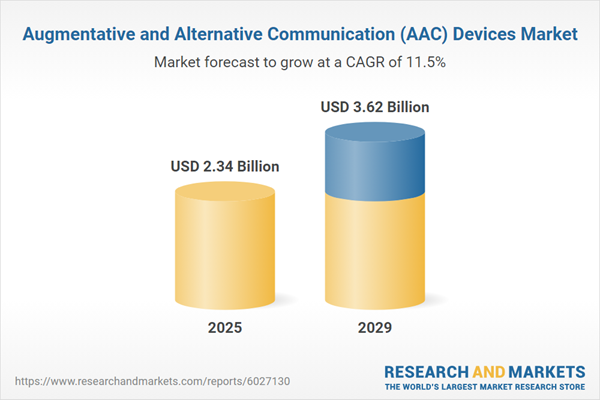

The augmentative and alternative communication (AAC) devices market size has grown rapidly in recent years. It will grow from $2.09 billion in 2024 to $2.34 billion in 2025 at a compound annual growth rate (CAGR) of 11.9%. The growth in the historic period can be attributed to increased smartphone and tablet adoption, government support and funding, an aging population, education and inclusion initiatives, and a rising incidence of disabilities.

The augmentative and alternative communication (AAC) devices market size is expected to see rapid growth in the next few years. It will grow to $3.62 billion in 2029 at a compound annual growth rate (CAGR) of 11.5%. The growth in the forecast period can be attributed to growing demand for personalized and user-friendly solutions, increasing prevalence of various speech disorders, growing customer awareness and demand, and rising need for effective communication solutions. Major trends in the forecast period include technological developments, integration of AI and machine learning, development of assistive technologies, personalized and customizable solutions, and integration into various social and educational contexts.

The rising prevalence of communication disabilities is expected to drive the growth of the augmentative and alternative communication (AAC) devices market in the future. Communication disabilities hinder an individual's ability to understand, detect, or use language and speech effectively, affecting their capacity to communicate. This increase in communication disabilities can be attributed to improved diagnostic capabilities and higher survival rates among at-risk individuals, leading to better identification and reporting of these conditions. AAC devices play a crucial role in enhancing communication by providing alternative means for expressing thoughts and needs, thereby promoting independence and communication effectiveness for individuals with these disabilities. For example, NHS Digital reported that the number of patients with open referrals for suspected autism in the UK rose from over 88,000 in 2021 to more than 122,000 in 2022. Additionally, the number of patients receiving a first appointment within 13 weeks increased from 6,500 in 2021 to over 9,000 in 2022. As a result, the growing prevalence of communication disabilities is fueling demand for AAC devices.

Key players in the AAC devices market are focusing on developing advanced technological solutions, such as touch-based speech-generating devices, to improve communication for individuals with speech impairments. These devices allow users to select symbols or text on a touchscreen, which are then converted into spoken words. In February 2022, Tobii Dynavox, a US-based manufacturer of speech-generating devices, launched the TD I-110, an innovative touch-based AAC device designed to support individuals with speech impairments, especially those with autism. This durable device features an integrated crash case, a Gorilla Glass touchscreen, and a water-resistant design, making it suitable for active users. With up to three times the processing speed, double the memory, and a battery life of up to 10 hours compared to its predecessor, the TD I-110 ensures efficient communication. It also comes pre-loaded with TD Snap software, which offers over 50,000 Picture Communication Symbols (PCS) for intuitive interaction.

In February 2023, Forbes AAC, a US-based provider of communication devices, acquired CoughDrop Inc. for an undisclosed sum. This acquisition aims to combine CoughDrop's communication technology with Forbes AAC’s hardware to create comprehensive AAC solutions, improve accessibility, and utilize Forbes AAC's expertise in insurance funding to expand purchasing options for schools and practitioners. CoughDrop Inc. is a US-based company that develops an AAC app designed to empower individuals with complex communication needs.

Major companies operating in the augmentative and alternative communication (AAC) devices market are Forbes AAC Inc., Tobii Dynavox AB, Prentke Romich Company, Spectronics Corporation, Lingraphica Inc., AbleNet Inc., Acapela Group SA, Goshen Medical Inc., EyeTech Digital Systems Inc., Adaptive Tech Solutions LLC, Smartbox Assistive Technology Limited, Talk To Me Technologies LLC, Attainment Company Inc., Jabbla BVBA, Saltillo Corporation, GEMINI Technologies Inc., Liberator Ltd, Enabling Devices Inc., Inclusive Technology Ltd, Voiceitt Inc., Cognixion Inc., Crick Software Ltd, Control Bionics Inc.

North America was the largest region in the augmentative and alternative communication (AAC) devices market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the augmentative and alternative communication (AAC) devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the augmentative and alternative communication (AAC) devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Augmentative and alternative communication (AAC) devices are tools or systems designed to assist individuals with speech or language impairments in communicating more effectively. These devices can either enhance existing speech or act as an alternative to verbal communication for those with limited or no speaking ability. AAC devices are crucial for individuals with conditions such as autism, cerebral palsy, stroke, or traumatic brain injury, enabling them to engage more fully in everyday activities and social interactions.

The primary types of AAC products include speech-generating devices, symbol communication boards, and others. Speech-generating devices (SGDs) are electronic tools that help individuals who struggle with speaking. These devices cover a variety of technologies, such as manual speech generation and picture exchange communication systems, and serve a wide range of applications for both children and adults. These products are used in various settings, including hospitals, rehabilitation centers, homecare environments, and others.

The augmentative and alternative communication (AAC) devices market research report is one of a series of new reports that provides augmentative and alternative communication (AAC) devices market statistics, including augmentative and alternative communication (AAC) devices industry global market size, regional shares, competitors with an augmentative and alternative communication (AAC) devices market share, detailed augmentative and alternative communication (AAC) devices market segments, market trends and opportunities, and any further data you may need to thrive in the augmentative and alternative communication (AAC) devices industry. This augmentative and alternative communication (AAC) devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The augmentative and alternative communication (AAC) devices market consists of sales of eye-tracking systems, voice amplifiers, switches and scanners, customizable communication devices, text-to-speech systems, mobile communication devices, and prosthetic communication devices. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Augmentative and Alternative Communication (AAC) Devices Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on augmentative and alternative communication (aac) devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for augmentative and alternative communication (aac) devices ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The augmentative and alternative communication (aac) devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Speech Generating Devices; Symbol Communication Boards; Other Products2) By Technology: Manual Speech Generating; Picture Exchange Communication Systems; Other Technologies

3) By Application: Children; Adults

4) By End-User: Hospitals; Rehabilitation Centers; Homecare Settings; Other End Users

Subsegments:

1) By Speech Generating Devices: Dedicated Speech Generating Devices; Mobile Communication Applications; Tablet-based Communication Devices2) By Symbol Communication Boards: Picture Exchange Communication Systems (PECS); Graphic Symbol Boards; Text-Based Communication Boards

3) By Other Products: Switches and Access Devices; Communication Software; AAC Accessories

Key Companies Mentioned: Forbes AAC Inc.; Tobii Dynavox AB; Prentke Romich Company; Spectronics Corporation; Lingraphica Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The major companies featured in this Augmentative and Alternative Communication (AAC) Devices market report include:- Forbes AAC Inc.

- Tobii Dynavox AB

- Prentke Romich Company

- Spectronics Corporation

- Lingraphica Inc.

- AbleNet Inc.

- Acapela Group SA

- Goshen Medical Inc.

- EyeTech Digital Systems Inc.

- Adaptive Tech Solutions LLC

- Smartbox Assistive Technology Limited

- Talk To Me Technologies LLC

- Attainment Company Inc.

- Jabbla BVBA

- Saltillo Corporation

- GEMINI Technologies Inc.

- Liberator Ltd

- Enabling Devices Inc.

- Inclusive Technology Ltd

- Voiceitt Inc.

- Cognixion Inc.

- Crick Software Ltd

- Control Bionics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | April 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.34 Billion |

| Forecasted Market Value ( USD | $ 3.62 Billion |

| Compound Annual Growth Rate | 11.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |