The Banking as a Service (BaaS) market is experiencing a period of dynamic growth, fueled by the convergence of technology, financial innovation, and the changing needs of businesses and consumers. This report provides a comprehensive analysis of this rapidly evolving market, exploring the latest trends, drivers, and challenges influencing its trajectory. It examines the diverse range of BaaS offerings, including payment processing, lending, deposit accounts, and other financial services, highlighting their value for businesses looking to embed financial capabilities within their applications and customer experiences.

- Market Introduction:

- Market Overview:

The Global Banking As A Service Market Analysis Report will provide a comprehensive assessment of business dynamics, offering detailed insights into how companies can navigate the evolving landscape to maximize their market potential through 2034. This analysis will be crucial for stakeholders aiming to align with the latest industry trends and capitalize on emerging market opportunities.

Banking As A Service Market Strategy, Price Trends, Drivers, Challenges and Opportunities to 2034:

In terms of market strategy, price trends, drivers, challenges, and opportunities from 2025 to 2034, Banking As A Service market players are directing investments toward acquiring new technologies, securing raw materials through efficient procurement and inventory management, enhancing product portfolios, and leveraging capabilities to sustain growth amidst challenging conditions. Regional-specific strategies are being emphasized due to highly varying economic and social challenges across countries.Factors such as global economic slowdown, the impact of geopolitical tensions, delayed growth in specific regions, and the risks of stagflation necessitate a vigilant and forward-looking approach among Banking As A Service industry players. Adaptations in supply chain dynamics and the growing emphasis on cleaner and sustainable practices further drive strategic shifts within companies.

The market study delivers a comprehensive overview of current trends and developments in the Banking As A Service industry, complemented by detailed descriptive and prescriptive analyses for insights into the market landscape until 2034.

North America Banking As A Service Market Outlook

The North American Banking As A Service market experienced significant advancements in 2024, driven by heightened consumer focus on sustainability, technological integration, and personalized offerings across various segments. Growth was propelled by the rise in demand for innovative packaging solutions, eco-friendly products, and digital transformation in retail and service sectors. Companies leveraged advanced technologies such as AI, IoT, and data analytics to enhance customer engagement, optimize supply chains, and develop targeted marketing strategies. From 2025, the market is anticipated to witness robust expansion, underpinned by increasing adoption of subscription-based services, heightened awareness of eco-conscious consumption, and innovations in packaging and delivery methods. A competitive landscape characterized by continuous product differentiation, strategic mergers and acquisitions, and the influx of startups is reshaping market dynamics, with key players investing in digitalization and sustainability to secure market share.Europe Banking As A Service Market Analysis

The European Banking As A Service market in 2024 demonstrated strong momentum, underpinned by regulatory emphasis on sustainable practices and consumer preferences for high-quality, eco-friendly, and customizable products. Rising interest in cultural and experiential offerings, coupled with advancements in e-commerce and digital solutions, bolstered market growth. The region's focus on circular economy principles encouraged investments in recyclable and biodegradable packaging solutions. Moving into 2025, growth is expected to be driven by the increasing prevalence of innovative retail models, AI-driven personalization, and a surge in demand for wellness-related consumer products. The competitive landscape is marked by robust participation from regional leaders and multinational firms, adopting strategies such as partnerships and green initiatives to meet regulatory and consumer demands, positioning Europe as a hub of innovation and sustainable growth.Asia-Pacific Banking As A Service Market Forecast

The Asia-Pacific Banking As A Service market witnessed dynamic growth in 2024, fueled by rapid urbanization, digital adoption, and evolving consumer preferences for convenience and premium products. Emerging markets played a pivotal role, with increasing disposable income and a young, tech-savvy population driving demand for connected home devices, innovative retail solutions, and functional packaging. Anticipated growth from 2025 stems from an expanding middle class, escalating e-commerce penetration, and strong demand for personalized and health-focused products. Companies are capitalizing on regional trends by localizing offerings and investing in digital infrastructure. The competitive landscape is intensifying, with global players entering the market and local firms leveraging cultural insights and price advantages to capture market share, ensuring a vibrant, fast-paced ecosystem.Middle East, Africa, Latin America Banking As A Service Market Analysis

The Rest of the World (RoW) Banking As A Service market showcased steady development in 2024, supported by advancements in retail automation, growing awareness of sustainable practices, and increasing preference for convenience-driven solutions. Markets in the Middle East, Africa, and South America demonstrated rising adoption of digital payment solutions, recyclable packaging, and smart home innovations, catering to evolving consumer demands. From 2025, the market is poised for substantial growth, fueled by infrastructure development, the rise of digital platforms, and increasing focus on affordable, quality products. The competitive landscape is characterized by regional players innovating in product design and packaging, while international companies expand through localized strategies and strategic partnerships, ensuring that the RoW remains a critical contributor to global market dynamics.Banking As A Service Market Dynamics and Future Analytics

The research analyses the Banking As A Service parent market, derived market, intermediaries’ market, raw material market, and substitute market are all evaluated to better prospect the Banking As A Service market outlook. Geopolitical analysis, demographic analysis, and Porter’s five forces analysis are prudently assessed to estimate the best Banking As A Service market projections.Recent deals and developments are considered for their potential impact on Banking As A Service's future business. Other metrics analyzed include the Threat of New Entrants, Threat of New Substitutes, Product Differentiation, Degree of Competition, Number of Suppliers, Distribution Channel, Capital Needed, Entry Barriers, Govt. Regulations, Beneficial Alternative, and Cost of Substitute in Banking As A Service market.

Banking As A Service trade and price analysis helps comprehend Banking As A Service's international market scenario with top exporters/suppliers and top importers/customer information. The data and analysis assist Clients in planning procurement, identifying potential vendors/clients to associate with, understanding Banking As A Service price trends and patterns, and exploring new Banking As A Service sales channels. The research will be updated to the latest month to include the impact of the latest developments such as the Russia-Ukraine war on the Banking As A Service market.

Banking As A Service Market Structure, Competitive Intelligence and Key Winning Strategies

The report presents detailed profiles of top companies operating in the Banking As A Service market and players serving the Banking As A Service value chain along with their strategies for the near, medium, and long term period.The analyst's proprietary company revenue and product analysis model unveils the Banking As A Service market structure and competitive landscape. Company profiles of key players with a business description, product portfolio, SWOT analysis, Financial Analysis, and key strategies are covered in the report. It identifies top-performing Banking As A Service products in global and regional markets. New Product Launches, Investment & Funding updates, Mergers & Acquisitions, Collaboration & Partnership, Awards and Agreements, Expansion, and other developments give Clients the Banking As A Service market update to stay ahead of the competition.

Company offerings in different segments across Asia-Pacific, Europe, the Middle East, Africa, and South and Central America are presented to better understand the company strategy for the Banking As A Service market. The competition analysis enables users to assess competitor strategies and helps align their capabilities and resources for future growth prospects to improve their market share.

Banking As A Service Market Research Scope

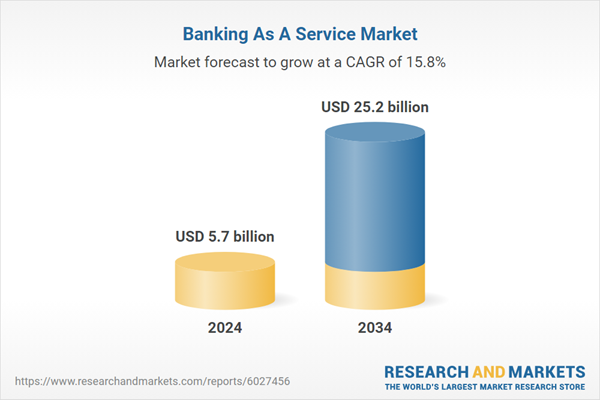

- Global Banking As A Service market size and growth projections (CAGR), 2024- 2034

- Policies of USA New President Trump, Russia-Ukraine War, Israel-Palestine, Middle East Tensions Impact on the Banking As A Service Trade and Supply-chain

- Banking As A Service market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Banking As A Service market size, CAGR, and Market Share of key products, applications, and end-user verticals, 2023-2034

- Short and long-term Banking As A Service market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, Technological developments in the Banking As A Service market, Banking As A Service supply chain analysis

- Banking As A Service trade analysis, Banking As A Service market price analysis, Banking As A Service supply/demand

- Profiles of 5 leading companies in the industry- overview, key strategies, financials, and products

- Latest Banking As A Service market news and developments

Countries Covered

North America Banking As A Service market data and outlook to 2034:

- United States

- Canada

- Mexico

Europe Banking As A Service market data and outlook to 2034:

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

Asia-Pacific Banking As A Service market data and outlook to 2034:

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

Middle East and Africa Banking As A Service market data and outlook to 2034:

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

South and Central America Banking As A Service market data and outlook to 2034:

- Brazil

- Argentina

- Chile

- Peru

Who can benefit from this research

The research would help top management/strategy formulators/business/product development/sales managers and investors in this market in the following ways

1. The report provides 2024 Banking As A Service market sales data at the global, regional, and key country levels with a detailed outlook to 2034 allowing companies to calculate their market share and analyze prospects, uncover new markets, and plan market entry strategy.2. The research includes the Banking As A Service market split into different types and applications. This segmentation helps managers plan their products and budgets based on the future growth rates of each segment

3. The Banking As A Service market study helps stakeholders understand the breadth and stance of the market giving them information on key drivers, restraints, challenges, and growth opportunities of the market and mitigating risks

4. This report would help top management understand competition better with a detailed SWOT analysis and key strategies of their competitors, and plan their position in the business

5. The study assists investors in analyzing Banking As A Service business prospects by region, key countries, and top companies' information to channel their investments.

Available Customizations

The standard syndicate report is designed to serve the common interests of Banking As A Service Market players across the value chain and include selective data and analysis from entire research findings as per the scope and price of the publication. However, to precisely match the specific research requirements of individual clients, we offer several customization options to include the data and analysis of interest in the final deliverable.Some of the customization requests are as mentioned below:

- Segmentation of choice - Clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

- Banking As A Service Pricing and Margins Across the Supply Chain, Banking As A Service Price Analysis / International Trade Data / Import-Export Analysis, Supply Chain Analysis, Supply-Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Banking As A Service market analytics

- Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations

- Clients can seek customization to break down geographies as per requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

- Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

This product will be delivered within 1-3 business days.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | December 2024 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 5.7 billion |

| Forecasted Market Value ( USD | $ 25.2 Billion |

| Compound Annual Growth Rate | 15.8% |

| Regions Covered | Global |