Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, market innovation is significantly constrained by intense industry consolidation, which establishes high barriers for new entrants seeking to challenge legacy brands. Data from the Baby Safety Alliance indicates that in 2025, its members controlled 95 percent of the prenatal through preschool product sales throughout North America. This dominance by major entities restricts the ability of smaller, independent manufacturers to effectively enter the retail space, as they often lack the necessary capital to fund extensive safety verification and secure distribution channels.

Market Drivers

Technological advancements in electric and automated nail trimmers are transforming the sector by resolving the major parental concern of accidental injury during grooming. Modern devices now incorporate features such as ultra-quiet motors, LED lights for nighttime visibility, and oscillating file heads that halt immediately upon skin contact. These innovations have turned nail care from a stressful task into a safe, efficient process, prompting consumers to switch from manual clippers to sophisticated appliances. This trend is reflected in the financial results of key players; for instance, Pigeon Corporation reported a 10.3 percent year-on-year net sales increase in February 2025, a growth trajectory driven by their strategic focus on childcare appliances, including electric nail files.Concurrently, the market is bolstered by rising birth rates and a growing consumer base in emerging economies. As developing nations experience urbanization and demographic shifts, the increasing number of infants drives volume demand for both basic and premium grooming tools. This impact is particularly notable in Asian markets where policy changes are influencing population figures. The National Bureau of Statistics of China recorded 9.54 million newborns in 2024, an increase of 520,000 from the previous year. This demographic expansion supports broader industry growth, as evidenced by Goodbaby International Holdings Limited, which announced a 10.6 percent revenue increase in March 2025, highlighting robust global demand for parenting products.

Market Challenges

A significant hurdle for the Global Baby Nail Care Products Market is the high degree of industry consolidation, which impedes overall sector growth and innovation. Dominant legacy brands utilize their extensive market share to control essential retail distribution channels, effectively preventing independent manufacturers from securing shelf space or negotiating favorable supply chain terms. This monopolistic environment forces smaller entities to operate with extremely narrow margins, severely restricting their ability to invest in the research and development needed to introduce the superior ergonomic designs and advanced safety features that today's parents require.This exclusionary landscape is further aggravated by the prohibitive operational costs associated with regulatory compliance. In 2024, the Toy Association noted the complexity of the legislative environment, tracking over 1,000 bills across 50 states regarding chemical regulations and producer responsibility. For new entrants, the capital required to verify compliance against such a vast and shifting array of safety standards is often insurmountable. Consequently, the market stagnates as only well-capitalized incumbents can absorb these rising verification expenses, leaving consumers with fewer choices and limiting the adoption of potentially safer technologies.

Market Trends

The shift toward sustainable and biodegradable materials is fundamentally altering manufacturing standards as eco-conscious parents increasingly reject single-use plastics. Manufacturers are redesigning nail care tools using renewable resources like bamboo, corn starch bioplastics, and recycled metals to align with the values of consumers who prioritize circular economy principles. This strategic move toward eco-friendly products is yielding tangible financial benefits; in February 2025, The Honest Company reported a 10 percent increase in full-year revenue to 378 million dollars, a growth explicitly driven by robust consumer demand for its sustainably designed baby and personal care portfolio.Simultaneously, the expansion of Direct-to-Consumer (DTC) online retail channels is democratizing access to specialized grooming solutions, allowing brands to bypass the limitations of traditional brick-and-mortar stores. This digital shift enables manufacturers to deliver educational content, such as safety tutorials, and utilize subscription models for replacement parts directly to buyers. The dominance of digital marketplaces is underscored by recent spending data; SGB Online reported in December 2025 that U.S. consumers spent a record 11.8 billion dollars online during Black Friday, a 9.1 percent year-over-year increase fueled significantly by high engagement in the baby and toddler product categories.

Key Players Profiled in the Baby Nail Care Products Market

- Mayborn Group Limited

- Dorel UK Ltd.

- Fridababy, LLC

- Peek A Boo USA Inc.

- Artsana S.p.A.

- Preview Brands International Ltd.

- TOMY International, Inc.

- Little Martin's Drawer LLC

- Pigeon Corporation

- Koninklijke Philips N.V.

Report Scope

In this report, the Global Baby Nail Care Products Market has been segmented into the following categories:Baby Nail Care Products Market, by Product Type:

- Nail Clippers

- Nail Trimmers

- Nail Scissors

- Nail Files

- Others

Baby Nail Care Products Market, by Distribution Channel:

- Online

- Offline

Baby Nail Care Products Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Baby Nail Care Products Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Baby Nail Care Products market report include:- Mayborn Group Limited

- Dorel UK Ltd

- Fridababy, LLC

- Peek A Boo USA Inc.

- Artsana S.p.A.

- Preview Brands International Ltd.

- TOMY International, Inc.

- Little Martin's Drawer LLC

- Pigeon Corporation

- Koninklijke Philips N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

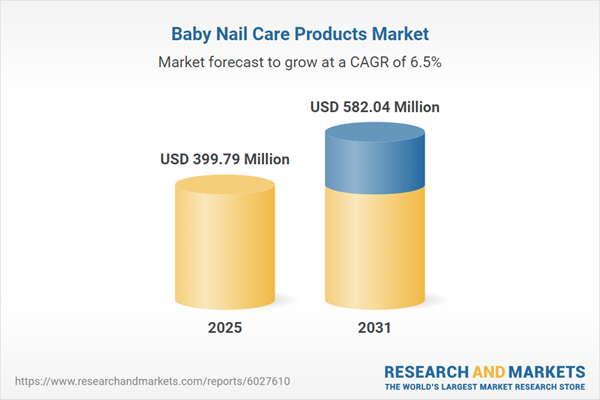

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 399.79 Million |

| Forecasted Market Value ( USD | $ 582.04 Million |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |