Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the average intake currently stands at approximately 0.6 grams per kilogram of body weight. A 2017 survey revealed that 73% of Indians suffer from protein deficiency, while over 90% are unaware of their daily protein requirements. Furthermore, a recent survey conducted across 16 cities in India regarding perceptions, knowledge, and consumption of protein highlighted a knowledge gap regarding the importance of quality protein in daily diets. So the market is expected to maintain strong momentum, as fitness awareness extends beyond metro areas, there is a growing opportunity to serve middle-income groups in smaller cities, unlocking new consumer segments.

Domestic players are likely to form partnerships with international brands for manufacturing, distribution, and technology transfer, leveraging global expertise to enhance their competitive positioning. With growing environmental awareness, whey protein brands that adopt sustainable packaging and sourcing practices will gain favor with eco-conscious consumers, creating long-term brand loyalty. The India whey protein market is on a strong growth trajectory, driven by increasing consumer awareness, an expanding fitness culture, and ongoing product innovation. Brands that prioritize quality, adopt effective pricing strategies, and build consumer trust will be well-positioned for success in this rapidly evolving market.

Key Market Drivers

Rising Health and Fitness Awareness and Growing Disposable Income and Urbanization

Rising health and fitness awareness is a critical driver of the India whey protein market, fueling its rapid expansion. As a growing number of Indians become conscious of their health and physical well-being, whey protein has emerged as a favored supplement, particularly among fitness enthusiasts, athletes, and individuals focused on maintaining a balanced diet. India is witnessing a significant lifestyle shift, particularly in urban areas, where fitness is becoming an integral part of daily routines. The growing prevalence of gyms, fitness centers, and health clubs, along with the increasing popularity of activities like yoga, CrossFit, and strength training, has created a strong demand for nutritional support products.Whey protein, being an excellent source of high-quality protein that aids in muscle recovery, muscle mass building, and fat loss, is naturally aligned with these fitness goals. Gyms and fitness centers have become a social hub for health-conscious individuals, with members actively seeking ways to enhance their fitness results. Whey protein supplements are often recommended by personal trainers and fitness experts, creating a direct link between rising fitness participation and the consumption of whey protein.

This awareness is not limited to elite athletes; it extends to a broader consumer base, including working professionals, homemakers, and older adults, all of whom are increasingly adopting fitness regimens to maintain long-term health and vitality. In the digital age, social media has become a powerful tool for promoting health and fitness. Fitness influencers, celebrities, and trainers use platforms like Instagram, YouTube, and Facebook to share workout routines, diet plans, and supplement advice, including whey protein.

These influencers often endorse whey protein brands, showcasing the benefits of regular protein intake for performance enhancement, body toning, and weight management. Social proof plays a critical role in consumer behavior, and endorsements from trusted fitness figures boost consumer confidence in whey protein as an essential part of a healthy lifestyle. The rise of fitness challenges, online workout programs, and home fitness during the pandemic further amplified the demand for protein supplements as consumers sought ways to maintain their health while staying at home.

The growing awareness of preventive healthcare is also driving demand for dietary supplements like whey protein. Consumers today are more informed about the benefits of nutrition and exercise in preventing chronic diseases such as obesity, diabetes, and cardiovascular issues. Whey protein is seen not only as a muscle-building supplement but as a functional food that supports overall health by providing essential amino acids, boosting metabolism, and helping in weight management. As more Indians realize the importance of managing their health proactively, the adoption of whey protein as part of a balanced, nutrient-dense diet has increased.

For example, many urban professionals include whey protein in their morning smoothies or post-workout shakes to meet daily protein requirements, contributing to the sustained growth of this market. India faces a significant issue of protein deficiency, with a large portion of the population not meeting the recommended daily intake of protein. This problem is particularly acute among vegetarians, who form a significant part of India’s demographic, as they often struggle to get enough protein from plant-based sources.

As awareness of protein deficiency and its health risks spreads, consumers are increasingly turning to whey protein as an efficient, bioavailable source of high-quality protein. Whey protein’s superior digestibility and rapid absorption make it a preferred choice for individuals aiming to address protein gaps in their diet, especially when coupled with fitness goals. The dual benefit of promoting physical performance and meeting nutritional needs has accelerated its adoption across various consumer segments.

The rise in corporate wellness programs is another factor boosting health awareness and, by extension, demand for whey protein products. Many companies now offer their employees gym memberships, fitness challenges, and dietary guidance as part of their wellness initiatives. These programs often highlight the importance of nutritional supplements like whey protein to support overall well-being, energy levels, and productivity. Government health campaigns and public initiatives aimed at tackling obesity, malnutrition, and lifestyle diseases also emphasize the role of protein in maintaining health, further enhancing awareness and adoption of whey protein supplements.

The health and fitness trend in India is no longer confined to the younger demographic. Middle-aged and senior citizens are also becoming more proactive about their health, realizing the importance of maintaining muscle mass, strength, and mobility as they age. Whey protein, with its easy digestibility and broad applicability, is increasingly being marketed to these groups, highlighting its benefits in aging health management and sarcopenia prevention (age-related muscle loss). Women, particularly those focused on weight management, toning, and overall fitness, represent another important consumer segment. Brands are now creating tailored marketing campaigns and product formulations that appeal to this expanding market segment.

Growing Disposable Income and Urbanization

Growing disposable income and urbanization are pivotal forces driving the expansion of the India whey protein market. As India's economy grows and more of its population migrates to urban centers, consumer behaviors, spending patterns, and dietary habits are evolving in ways that significantly benefit the whey protein industry. India’s rising disposable income, particularly within the expanding middle class, is directly boosting the demand for health and wellness products, including whey protein. Over the last decade, income levels have grown considerably across urban and semi-urban regions, allowing more consumers to allocate funds towards non-essential, health-oriented products.As more people experience a rise in disposable income, they are able to afford premium, high-quality nutritional supplements, which were previously considered a luxury. This shift is especially notable in metro cities like Mumbai, Delhi, and Bengaluru, where disposable incomes are higher and the propensity to spend on health-related products is growing. Higher income levels often lead to lifestyle changes where consumers prioritize quality over quantity. This is seen in the increased adoption of protein supplements like whey, as health-conscious consumers are more willing to invest in products that enhance their physical well-being, support fitness goals, and improve overall health.

Urbanization is another significant driver of growth for the whey protein market. As India's population migrates from rural to urban areas, cities are experiencing an unprecedented transformation in lifestyle, work culture, and dietary preferences, all of which favor increased consumption of whey protein. Sedentary Lifestyles and the Need for Health Supplements: Urban environments often lead to more sedentary lifestyles due to office-based jobs and busy schedules. To counterbalance this, many urban residents are seeking ways to maintain their health through diet and exercise.

Whey protein, known for its convenience and effectiveness, is increasingly being incorporated into daily diets to supplement protein intake, enhance energy levels, and support physical activity. Urbanization has also brought with it an explosion of gyms, fitness centers, and boutique wellness studios in cities. As fitness becomes a critical part of urban life, particularly among younger professionals, the demand for protein supplements like whey protein rises in tandem. This urban fitness boom is further amplified by social media and fitness influencers promoting whey protein as part of an optimal post-workout routine.

Urban consumers in India are increasingly shifting towards protein-enriched diets due to a growing understanding of the importance of balanced nutrition, particularly for those engaged in fitness or trying to maintain a healthy lifestyle. With urbanization comes access to a broader range of nutritional products and greater exposure to Western dietary habits, which include protein supplementation as a standard health practice. Urban lifestyles are often fast paced, leaving little time for meal preparation or sourcing protein from traditional foods. Whey protein offers a convenient and fast way to meet daily protein requirements, especially for working professionals and students.

The growing number of people relying on quick, on-the-go nutrition solutions like protein shakes or protein bars, particularly in metro cities, is driving the demand for whey protein products. Urbanization is closely tied to the rise of health-conscious eating patterns, with more consumers adopting clean, functional, and nutritionally balanced foods. Whey protein fits into this paradigm, as it offers a clean source of high-quality protein that is low in fat, carbs, and sugars, making it ideal for individuals pursuing weight management, lean muscle building, or general health improvement.

Urbanization has been accompanied by the rapid expansion of organized retail and e-commerce, which has made whey protein products more accessible to consumers. The rise of supermarkets, hypermarkets, and health stores in urban centers ensures that consumers have greater access to a wide variety of whey protein brands and formats (e.g., powder, RTD, bars). Moreover, the growth of online platforms, particularly in cities, provides consumers with the ability to browse, compare, and purchase whey protein products with ease. Urbanization goes hand in hand with digitalization, and cities are hubs for online shopping.

The widespread use of e-commerce platforms like Amazon, Flipkart, and specialized health and fitness portals such as HealthKart have contributed significantly to the whey protein market's growth. These platforms provide extensive product choices, consumer reviews, and price comparisons, driving increased consumption in urban areas, where convenience is highly valued. As consumers' purchasing power grows, brands can introduce tiered product offerings, ranging from affordable basic whey concentrates to premium isolates and hydrolysates. This segmentation allows brands to target various income brackets within urban areas, catering to both first-time buyers and seasoned fitness enthusiasts looking for advanced supplements.

Urbanization exposes Indian consumers to global trends, including the increasing focus on fitness, wellness, and healthy eating prevalent in developed markets like the U.S. and Europe. This exposure, combined with rising disposable incomes, has driven greater acceptance of dietary supplements, including whey protein, as essential components of a modern, health-conscious lifestyle. International brands like Optimum Nutrition, MuscleTech, and MyProtein have made strong inroads into the Indian market, particularly in urban centers. These brands are often perceived as premium, and urban consumers, with higher disposable incomes, are more likely to spend on these global offerings, seeking the quality and reputation associated with foreign products.

Shift Toward Protein-Enriched Diets

The shift toward protein-enriched diets is one of the most influential trends driving the growth of the India whey protein market. This shift reflects a broader transformation in consumer behavior, where nutritional awareness and fitness objectives have made protein a central element of daily diets. The growing demand for high-quality protein sources, particularly whey protein, is propelled by a variety of factors that address both health and lifestyle needs. The increasing focus on health and fitness among Indian consumers is a key catalyst for the shift toward protein-enriched diets.As more people engage in fitness activities, such as strength training, weightlifting, and high-intensity workouts, they recognize the critical role of protein in muscle repair, recovery, and growth. Whey protein, known for its superior amino acid profile and rapid absorption, has become the preferred choice for those seeking to enhance their fitness performance and meet daily protein requirements. For fitness enthusiasts and athletes, protein intake is vital for muscle recovery after intense workouts.

Whey protein, with its high bioavailability, helps to speed up muscle repair and prevent muscle loss, making it an essential part of post-exercise nutrition. This has led to a significant increase in the consumption of whey protein among gym-goers, bodybuilders, and sports professionals. The proliferation of gyms, fitness centers, and boutique fitness studios in urban areas has amplified the demand for protein supplements. Trainers and nutritionists frequently recommend whey protein as a foundational supplement, encouraging its adoption among a broader audience looking to build lean muscle or manage their weight effectively.

India has long struggled with protein deficiency, particularly among vegetarians and those living in rural or semi-urban areas. According to studies, a significant portion of the population falls short of the recommended daily intake of protein. This deficiency has become a major health concern, leading to increased public awareness and efforts to address the issue through dietary improvements. Government health campaigns and initiatives led by nutritionists, dietitians, and media outlets are raising awareness about the importance of protein in a balanced diet.

As consumers become more educated about the risks associated with inadequate protein intake - such as fatigue, muscle loss, and weakened immunity - the demand for protein-enriched foods and supplements has surged. Whey protein is viewed as a high-quality, complete protein source that offers all the essential amino acids the body needs. It is especially attractive to vegetarians, who often struggle to meet protein needs through plant-based sources alone. Whey protein’s versatility, ease of consumption, and wide availability make it a go-to supplement for those seeking to fill protein gaps in their diet. An increasing number of consumers in India are adopting protein-enriched diets to support weight management and overall health.

Protein plays a crucial role in satiety, metabolism, and fat loss, making it a key component for individuals aiming to maintain or lose weight. This shift is particularly relevant in urban areas, where sedentary lifestyles, work-related stress, and the availability of processed foods have led to an uptick in obesity and lifestyle-related diseases. High-protein diets are known to enhance feelings of fullness, reduce cravings, and promote fat loss, making them popular among those looking to manage their weight. Whey protein, with its low fat and carbohydrate content, is considered an ideal supplement for dieters who want to control calorie intake while ensuring adequate nutrition. The growing demand for functional foods has led to the development of protein-enriched snacks, bars, and meal replacements, many of which are formulated with whey protein. These products cater to busy urban consumers looking for convenient, healthy options that support their weight management goals without compromising on nutrition.

Key Market Challenges

High Cost of Whey Protein

The most significant challenges in the Indian whey protein market is the high cost associated with whey protein products, which makes them less accessible to a large portion of the population. While demand for whey protein has increased, pricing remains a critical barrier, particularly for middle- and lower-income consumers. A substantial portion of the whey protein consumed in India is imported, primarily from countries such as the U.S., Europe, and New Zealand. This reliance on imports makes pricing highly susceptible to currency fluctuations, which can drive up costs for both manufacturers and consumers. The weakening of the Indian rupee against the U.S. dollar or Euro directly translates to higher prices for imported raw materials and finished products, affecting affordability.Whey protein, particularly premium isolates and hydrolysates is perceived as a high-cost, premium product. Brands that prioritize high-quality ingredients and advanced processing methods often must pass these costs onto the consumer, making it difficult for lower-income groups to justify the expense. This creates a significant gap between the aspirational demand for whey protein and the actual purchasing power of a vast majority of the population. In metro cities, the higher disposable income of consumers mitigates the issue of cost to some extent, but in Tier 2 and Tier 3 cities, where incomes are lower, the price sensitivity is much higher. This restricts market penetration in these emerging regions, where affordability plays a more critical role in consumer decision-making.

Lack of Consumer Awareness and Education

Major challenge restraining the growth of the India whey protein market is the lack of consumer awareness and education about whey protein and its benefits. Although awareness has grown in recent years, there is still widespread misinformation, particularly among non-fitness enthusiasts, which can hinder market expansion. A large segment of Indian consumers, especially in non-urban areas, still associates whey protein primarily with bodybuilding and fitness, viewing it as a product meant only for athletes or gym-goers. This niche perception limits the potential consumer base, as many individuals who could benefit from whey protein for general health, weight management, or post-illness recovery may not consider it relevant to their needs.There are prevalent misconceptions regarding the safety of whey protein, with some consumers believing that long-term use can cause adverse effects, such as kidney damage or liver problems. These myths, often fueled by anecdotal evidence or misinformation, deter potential buyers from incorporating whey protein into their diets, particularly among older adults or those with pre-existing health concerns. While protein deficiency is a well-documented issue in India, many consumers are still unaware of the importance of adequate protein intake in their daily diets. The concept of protein supplementation to address dietary gaps is not widely understood, especially outside major urban centers. This lack of knowledge creates a significant barrier to demand, as many consumers may not recognize the need for whey protein supplementation in their daily lives.

In semi-urban and rural areas, where awareness of modern nutritional practices is still developing, the understanding of whey protein’s health benefits remains limited. Brands face the challenge of not only introducing whey protein to these markets but also educating consumers on its value, usage, and safety.

Key Market Trends

Increasing Popularity of Personalized Nutrition

As Indian consumers become more health-conscious and focused on achieving specific fitness goals, the demand for personalized nutrition is gaining momentum. This trend involves creating customized dietary solutions tailored to individual health needs, fitness levels, and lifestyle preferences. The growing emphasis on personalized health and wellness is reshaping the way consumers view whey protein, positioning it as a flexible and adaptable nutritional product.In the future, consumers are expected to seek personalized whey protein formulations that cater to their unique health objectives, such as muscle gain, weight loss, or recovery from specific conditions like diabetes or post-surgery rehabilitation. Brands that offer specialized products with tailored protein blends, vitamins, and minerals will have a competitive edge. For example, whey protein isolates with added ingredients like BCAAs (branched-chain amino acids) for muscle recovery or digestive enzymes for improved gut health are gaining popularity.

The integration of wearable fitness devices and mobile health apps is expected to accelerate the adoption of personalized nutrition. These technologies can track an individual’s daily activity levels, caloric expenditure, and macronutrient requirements, offering data-driven insights that can guide personalized protein supplementation. Brands that leverage these insights to offer tailored whey protein solutions, such as subscription-based services or customized protein blends, will align with the growing preference for data-backed health decisions. Personalized nutrition is also expanding beyond fitness enthusiasts to cater to a broader audience, including older adults seeking to prevent muscle loss (sarcopenia), women focusing on hormonal balance or pregnancy nutrition, and individuals with dietary restrictions like lactose intolerance. This trend toward targeted whey protein offerings will drive innovation in product development and marketing strategies, helping brands attract diverse customer segments.

Growth of Plant-Whey Protein Blends and Hybrid Proteins

The rising interest in plant-based nutrition is influencing the whey protein market in India, with the development of hybrid protein products that combine both whey and plant-based proteins. As consumers look for more balanced and sustainable dietary options, plant-whey blends are becoming an attractive choice for those who want the superior protein quality of whey but also value plant-based alternatives for environmental or dietary reasons. With the growing number of flexitarians individuals who primarily eat plant-based diets but still consume animal products occasionally the demand for hybrid protein products is on the rise.These consumers seek the nutritional benefits of whey protein, such as its high bioavailability and complete amino acid profile, but also want to incorporate more plant-based proteins into their diets. Hybrid protein powders, which combine whey with plant-based options like pea, soy, or brown rice protein, offer a solution that meets these preferences.For instance, In June 2024, Steadfast Nutrition, a prominent leader in performance and wellness nutrition, expanded its product portfolio with the introduction of three innovative supplements. The company unveiled two fast-absorbing protein supplements - Whey Protein and LIV Raw - as well as a vegetarian Multivitamin Mega Pack containing an impressive 180 tablets. These new offerings aim to address the growing protein and nutrient needs of health-conscious individuals and serious athletes in India. The supplements were officially launched at a prestigious ceremony during Asia’s largest health and fitness event, the International Health Sports and Fitness Festival (IHFF).

Concerns about the environmental impact of traditional dairy production are driving interest in sustainable protein options. Plant-whey blends appeal to eco-conscious consumers who want to reduce their carbon footprint without compromising on protein quality. Brands that market hybrid protein products as both nutritionally superior and environmentally friendly are likely to attract a new segment of consumers who are committed to sustainability. In the past, plant-based proteins were often criticized for their taste and texture, which deterred consumers from trying them.

However, recent innovations in food technology have significantly improved the taste, solubility, and overall mouthfeel of plant-based proteins. This has opened the door for successful blending with whey protein, resulting in products that not only meet the taste preferences of consumers but also offer the combined benefits of plant and animal proteins. The ongoing improvement in product formulations will further propel the growth of plant-whey hybrid proteins in India.

Segmental Insights

Type Insights

Based on the category of Type, the Whey Protein Concentrate (WPC) segment emerged as the dominant in the market for India Whey Protein in 2024. Whey Protein Concentrate (WPC) stands as the most widely consumed form of whey protein in India due to its affordability, versatility, and suitability for a broad consumer base. The dominant position of WPC in the market can be attributed to several key factors:WPC is the most economical option among the three types of whey protein, making it the preferred choice for most Indian consumers, particularly those in price-sensitive markets like Tier 2 and Tier 3 cities. As fitness awareness grows among middle-income groups in these regions, affordability becomes a crucial factor in product selection. WPC, with a relatively lower price point, offers a cost-effective solution for consumers seeking a high-quality protein supplement without straining their budget. WPC typically contains between 70-80% protein content, which makes it a balanced option for individuals looking to improve overall nutrition, gain muscle mass, or enhance fitness performance. This level of protein is suitable for both fitness beginners and moderate gym-goers, driving its popularity across various demographic segments. WPC’s blend of protein and other nutrients, like fats and carbohydrates, appeals to consumers who seek a more comprehensive nutritional profile, as opposed to purer forms of protein.

Due to its moderate protein content, WPC is widely used not only by fitness enthusiasts but also by individuals seeking general health improvement or meal supplementation. It is incorporated into smoothies, shakes, and even certain food products, broadening its market scope beyond just bodybuilding and athletic performance. The versatile nature of WPC, combined with its relatively pleasant taste, positions it as a favored choice among diverse consumer groups.

WPC is readily available across a variety of distribution channels, including gyms, health food stores, and online platforms, which boosts its market reach. The dominance of WPC is further enhanced by strong brand presence and marketing efforts by both domestic and international players, ensuring that WPC remains the go-to option for consumers new to the whey protein segment. These factors are expected to drive the growth of this segment.

Regional Insights

North India emerged as the dominant in the India Whey Protein market in 2024, holding the largest market share in terms of value. In North India, especially in key metropolitan areas like Delhi-NCR, Chandigarh, Ludhiana, and Jaipur, the growth of fitness centers, gyms, and health clubs has fueled the rising demand for whey protein supplements. This fitness-conscious population, largely driven by the youth and urban professionals, is adopting whey protein as part of their daily fitness regimens to enhance muscle growth, recovery, and overall health.Delhi-NCR is particularly important in this growth, as it is not only a hub for fitness centers but also home to a large population of health-conscious individuals with high purchasing power. This region has witnessed a rapid expansion in the number of gyms, yoga centers, and sports clubs, encouraging an increase in demand for whey protein. Additionally, the corporate sector in Delhi-NCR, where professionals often seek quick, protein-enriched dietary supplements to maintain fitness amidst hectic lifestyles, further boosts the region’s consumption. North India has seen a surge in fitness trends, largely influenced by social media fitness influencers, bodybuilders, and celebrities who promote the use of whey protein as an essential part of fitness nutrition. This has helped popularize protein supplements among a younger demographic, leading to an increasing trend toward adopting whey protein, particularly in the upper-middle-class and urban populations.

Key Market Players

- Glanbia plc

- Parag Milk Foods

- Fonterra Co-operative Group Limited

- Arla Foods Ingredients Group P/S

- Davisco Foods International, Inc,

- Gujarat Cooperative Milk Marketing Federation

- Saputo Inc.

- Hilmar Cheese Company, Inc

- Meiji Holdings Co., Ltd

Report Scope:

In this report, the India Whey Protein Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Whey Protein Market, By Type:

- Whey Protein Concentrate

- Whey Protein Isolate

- Whey Protein Hydrolysate

India Whey Protein Market, By Application:

- Food & Beverages

- Dietary Nutrition

- Pharmaceutical

- Others

India Whey Protein Market, By Region:

- North India

- South India

- East India

- West India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Whey Protein Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Glanbia plc

- Parag Milk Foods

- Fonterra Co-operative Group Limited

- Arla Foods Ingredients Group P/S

- Davisco Foods International, Inc,

- Gujarat Cooperative Milk Marketing Federation

- Saputo Inc.

- Hilmar Cheese Company, Inc

- Meiji Holdings Co., Ltd

Table Information

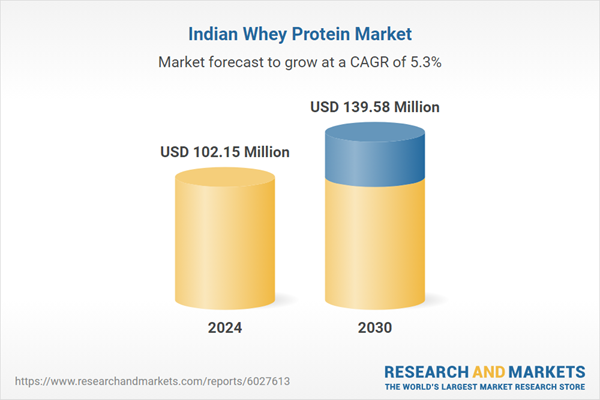

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | November 2024 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 102.15 Million |

| Forecasted Market Value ( USD | $ 139.58 Million |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | India |

| No. of Companies Mentioned | 9 |