Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

This market serves a wide range of industries, including banking, financial services, insurance (BFSI), healthcare, retail, government, and IT, where maintaining regulatory compliance and managing risks are critical. The market is expected to rise due to increasing regulatory pressures across Europe, particularly with the tightening of financial regulations and corporate governance standards post-financial crisis. As businesses face stricter compliance requirements, they are turning to audit software to ensure they meet these obligations more efficiently.

Furthermore, the growing digital transformation across industries is driving the demand for cloud-based audit solutions, offering scalability, real-time access, and enhanced collaboration features, which are increasingly preferred over traditional on-premises systems. The rise of artificial intelligence and data analytics in audit software is also a significant factor, as these technologies help organizations detect anomalies, manage risks, and gain insights more effectively, boosting the market’s growth. Additionally, as companies prioritize cybersecurity, audit software is being increasingly used to monitor and ensure compliance with evolving data protection laws, such as the General Data Protection Regulation (GDPR) in the European Union. Overall, the combination of increasing regulatory complexity, digitalization, and advancements in technology is driving the growth of the Europe Audit Software Market, and this trend is expected to continue in the coming years.

Key Market Drivers

Increasing Regulatory Compliance Requirements Driving Adoption of Audit Software

One of the primary drivers behind the growth of the Europe Audit Software Market is the rising complexity of regulatory compliance requirements across various industries. Organizations are continuously facing stringent government regulations, industry standards, and international compliance frameworks that demand regular auditing and transparency. The regulatory environment in Europe, particularly within industries such as banking, healthcare, and manufacturing, has become increasingly challenging, with more comprehensive standards related to financial reporting, data protection, and environmental compliance.In the banking and financial sectors, for example, regulations such as Basel III, MiFID II, and the EU Anti-Money Laundering Directives have placed heightened scrutiny on financial transactions, risk management, and transparency. This has led organizations to seek robust audit software that can streamline compliance processes, reduce human error, and ensure that all operations are in accordance with the latest regulatory guidelines. The ability of audit software to automate key compliance functions, generate real-time audit reports, and integrate with other financial systems is crucial for businesses aiming to avoid penalties and mitigate risk.

Moreover, the implementation of the General Data Protection Regulation (GDPR) has driven companies across all sectors to adopt more sophisticated audit systems. GDPR imposes strict rules on how personal data is collected, stored, and used, and any breaches can result in heavy fines. Audit software equipped with data protection compliance features allows businesses to continuously monitor their data management processes, ensuring that they align with GDPR requirements. As regulatory frameworks continue to evolve, organizations are investing heavily in audit software that can adapt to new regulations, thereby fueling the growth of the Europe Audit Software Market.

Growing Demand for Automation in Auditing Processes

Another key driver for the Europe Audit Software Market is the increasing demand for automation in auditing processes. As businesses scale and their operations become more complex, manual auditing practices can no longer meet the demand for accuracy, speed, and efficiency. Traditional methods of auditing involve labor-intensive processes, which are prone to human error and often lead to delays in the completion of audits. Additionally, the sheer volume of data that modern organizations must audit has increased significantly, making manual auditing impractical for many large enterprises.Audit software addresses these challenges by automating key audit functions, such as data collection, risk assessment, compliance monitoring, and reporting. With automation, companies can streamline their auditing processes, reduce operational costs, and minimize the risk of non-compliance. The software allows auditors to focus on strategic decision-making rather than spending time on repetitive and time-consuming tasks, such as data entry and document review. For instance, audit software can automatically flag potential compliance issues or irregularities in financial records, enabling auditors to address these problems in a timely manner.

Furthermore, automation enhances the ability of organizations to conduct continuous auditing rather than relying on periodic audits, which can leave gaps in compliance. Continuous auditing ensures that potential issues are identified and resolved in real-time, thereby reducing the risk of financial misstatements or regulatory violations. This growing trend toward automation in auditing processes is particularly beneficial for industries with high regulatory burdens, such as financial services, healthcare, and government. As a result, the demand for audit software that supports automation is expected to drive the growth of the Europe Audit Software Market over the forecast period.

Increasing Adoption of Cloud-Based Audit Software Solutions

The Europe Audit Software Market is also being driven by the increasing adoption of cloud-based audit software solutions. Cloud computing has transformed the way businesses operate, offering greater flexibility, scalability, and cost-effectiveness compared to traditional on-premises software solutions. In the auditing domain, cloud-based audit software enables organizations to access their audit data from anywhere, at any time, facilitating real-time collaboration among auditors and stakeholders.Cloud-based audit software eliminates the need for expensive hardware and IT infrastructure, reducing the total cost of ownership for businesses. This is particularly advantageous for small and medium-sized enterprises that may lack the financial resources to invest in on-premises solutions. Moreover, cloud-based systems offer automatic updates, ensuring that organizations are always using the most up-to-date versions of the software without the need for manual intervention. This is especially important in industries where regulatory requirements change frequently, as cloud-based systems can quickly adapt to new compliance standards.

Another key advantage of cloud-based audit software is its ability to integrate with other cloud-based enterprise systems, such as enterprise resource planning (ERP) and customer relationship management (CRM) platforms. This integration allows for seamless data flow between different departments, enhancing the overall efficiency of the audit process. Furthermore, the use of advanced data encryption and security protocols in cloud-based systems ensures that sensitive audit data is protected from unauthorized access, which is a critical consideration in today’s cybersecurity landscape.

As organizations across Europe continue to embrace digital transformation, the demand for cloud-based audit software solutions is expected to increase. The flexibility, cost savings, and enhanced collaboration capabilities offered by cloud-based platforms are key factors driving this shift, contributing to the growth of the Europe Audit Software Market.

Key Market Challenges

High Implementation and Integration Costs

One of the significant challenges facing the Europe Audit Software Market is the high cost associated with the implementation and integration of audit software solutions. While audit software offers substantial benefits in terms of efficiency and accuracy, the initial investment required to implement these systems can be a considerable burden, especially for small and medium-sized enterprises. The cost of purchasing licenses, setting up the infrastructure, and training employees to effectively use the software often requires substantial financial resources. Additionally, ongoing maintenance costs, including software updates and support services, further increase the overall expenses for businesses.For large enterprises with complex auditing needs, integrating audit software with existing enterprise systems such as enterprise resource planning (ERP) or customer relationship management (CRM) platforms can be a daunting task. These systems must work seamlessly together to ensure data flow across various departments, but achieving such integration often involves customized solutions and the involvement of specialized IT consultants, which can significantly raise costs. Moreover, for organizations that operate in multiple locations across Europe, integrating audit systems across different branches or subsidiaries adds another layer of complexity and expense.

Many businesses also face the challenge of managing legacy systems that are incompatible with modern audit software solutions. Upgrading or replacing these legacy systems to accommodate new software can be time-consuming and costly, leading to disruptions in business operations. As a result, the high implementation and integration costs act as a deterrent for some businesses, particularly smaller firms, limiting the widespread adoption of audit software in the region. Despite the clear advantages of audit software, overcoming the financial barriers associated with its adoption remains a key challenge for the growth of the Europe Audit Software Market.

Data Security and Privacy Concerns

Data security and privacy concerns pose another significant challenge for the Europe Audit Software Market. The growing reliance on digital platforms and cloud-based solutions has raised concerns about the vulnerability of sensitive audit data to cyberattacks, data breaches, and unauthorized access. Organizations handling confidential financial information, personal client data, or proprietary business data must ensure that their audit software is equipped with robust security measures to protect against potential threats. Any breach in data security can result in significant financial losses, reputational damage, and legal liabilities, particularly in highly regulated industries such as banking, healthcare, and government.The General Data Protection Regulation (GDPR), which sets strict standards for data protection in Europe, has heightened the need for businesses to safeguard personal data. Audit software that fails to meet these stringent data privacy requirements can expose organizations to severe penalties. Businesses must ensure that their audit software complies with all relevant regulations, which can be challenging, especially when using cloud-based solutions where data is stored and processed off-premises. Cloud-based audit solutions, while offering many advantages in terms of flexibility and scalability, are particularly vulnerable to security risks if not properly managed.

Some organizations remain skeptical about moving their sensitive audit data to the cloud due to the perceived lack of control over data storage and access. The possibility of data being stored in servers located outside of the European Union, where different data protection laws may apply, also raises concerns. These apprehensions about data security and privacy are particularly pronounced in industries such as banking and healthcare, where compliance with regulatory standards is paramount. To mitigate these concerns, vendors of audit software must invest in advanced encryption technologies, multi-factor authentication, and continuous monitoring systems to assure clients that their data is secure. However, addressing data security and privacy concerns remains a significant challenge for the growth of the Europe Audit Software Market.

Key Market Trends

Growing Adoption of Artificial Intelligence and Machine Learning in Audit Software

One of the prominent trends in the Europe Audit Software Market is the increasing incorporation of artificial intelligence and machine learning technologies. These advanced technologies are transforming the auditing process by automating complex tasks, enhancing accuracy, and improving decision-making capabilities. Artificial intelligence and machine learning are enabling audit software to analyze large volumes of data, detect anomalies, and identify patterns that may signal potential risks or compliance issues.As organizations in Europe deal with increasingly complex regulatory environments, they are turning to artificial intelligence-powered audit software to streamline compliance and reduce the likelihood of human error. Artificial intelligence tools help auditors focus on high-risk areas by automating routine tasks such as data collection, classification, and analysis. Moreover, machine learning algorithms are improving over time as they learn from historical audit data, making the auditing process more predictive and efficient.

This trend is expected to continue as businesses recognize the value of artificial intelligence in reducing operational costs, improving accuracy, and enabling continuous monitoring. The demand for audit software with artificial intelligence and machine learning capabilities will likely increase, driving innovation in the Europe Audit Software Market.

Rising Popularity of Cloud-Based Audit Software Solutions

The Europe Audit Software Market is witnessing a strong shift toward cloud-based solutions, driven by the growing demand for flexible, scalable, and cost-effective software platforms. Cloud-based audit software enables organizations to access their audit data from any location, improving collaboration between auditors, management, and stakeholders. It also allows businesses to reduce upfront investments in hardware and infrastructure, making cloud-based solutions particularly appealing to small and medium-sized enterprises.Cloud-based audit software offers automatic updates, ensuring that businesses are always using the latest features and security enhancements. Additionally, the ability to integrate with other cloud-based enterprise systems, such as enterprise resource planning and customer relationship management platforms, enhances overall efficiency. Data security is another priority in cloud-based systems, and vendors are increasingly investing in advanced encryption technologies to protect sensitive information.

The scalability and flexibility offered by cloud-based solutions are key drivers of this trend, with organizations across Europe continuing to adopt cloud audit software as part of their digital transformation strategies.

Increased Focus on Data Analytics and Real-Time Reporting

Another emerging trend in the Europe Audit Software Market is the growing emphasis on data analytics and real-time reporting capabilities. Audit software with integrated data analytics tools allows organizations to gain deeper insights into their financial performance, compliance status, and operational efficiency. By leveraging advanced data analytics, businesses can identify trends, detect potential risks, and make informed decisions based on real-time information.Real-time reporting is becoming increasingly important in highly regulated industries such as banking, healthcare, and government, where timely access to accurate data is critical for maintaining compliance. With real-time reporting, audit software can continuously monitor key performance indicators, generate up-to-date reports, and provide alerts in the event of non-compliance or financial irregularities. This capability enhances an organization’s ability to respond quickly to emerging risks or regulatory changes.

As organizations seek to improve decision-making and risk management, the integration of data analytics and real-time reporting features in audit software is becoming a critical factor for businesses in Europe. This trend is expected to drive the demand for advanced audit software solutions across the region.

Segmental Insights

Component Insights

In 2023, the software segment dominated the Europe Audit Software Market and is expected to maintain its dominance throughout the forecast period. The significant growth of the software segment can be attributed to the increasing demand for automation and digital transformation across industries. Businesses are continuously seeking efficient solutions to streamline their audit processes, reduce human error, and enhance compliance management, which has led to the widespread adoption of advanced audit software. The software segment provides comprehensive features such as data analytics, real-time reporting, risk assessment, and audit trail management, all of which are critical for ensuring accuracy and efficiency in auditing operations.Moreover, the software segment has gained traction due to its ability to integrate seamlessly with other enterprise systems such as enterprise resource planning and customer relationship management platforms, which improves overall operational efficiency. As more organizations in Europe prioritize digitalization, the adoption of audit software is likely to increase, supported by advancements in artificial intelligence and machine learning, which are further enhancing the capabilities of audit software. Additionally, cloud-based audit software solutions, which offer flexibility, scalability, and cost-efficiency, have become a preferred choice for businesses of all sizes. This trend is particularly pronounced among small and medium-sized enterprises that are looking for cost-effective solutions to meet regulatory requirements. The software segment's continuous innovation and ability to address complex auditing needs will ensure its sustained dominance in the Europe Audit Software Market during the forecast period.

End-user Industry Insights

In 2023, the Banking, Financial Services, and Insurance (BFSI) sector dominated the Europe Audit Software Market and is expected to maintain its dominance throughout the forecast period. The BFSI sector's dominance is driven by the industry's highly regulated nature, where compliance with financial reporting standards, regulatory audits, and risk management practices are critical. Financial institutions, including banks, insurance companies, and investment firms, are subject to stringent regulatory requirements set by both national and international bodies. This creates a high demand for sophisticated audit software solutions that can streamline auditing processes, ensure regulatory compliance, and manage risks effectively.Audit software provides the BFSI industry with essential tools for automating complex financial audits, enhancing transparency, and improving accuracy in financial reporting. Additionally, the sector's reliance on large volumes of data, including sensitive customer information and financial transactions, makes audit software critical for monitoring and assessing risk factors in real-time. With increasing concerns over data breaches, fraud, and financial irregularities, financial institutions are increasingly adopting advanced audit software equipped with artificial intelligence, machine learning, and data analytics capabilities.

The continuous evolution of financial regulations in Europe, such as the Basel Accords and European Union directives, further drives the demand for audit software in the BFSI sector. These regulations require institutions to conduct regular audits to assess their financial stability, capital adequacy, and risk exposure. As the BFSI sector continues to expand its digital transformation initiatives and faces more complex regulatory challenges, the adoption of audit software is expected to grow, ensuring the sector maintains its leading position in the Europe Audit Software Market during the forecast period.

Country Insights

In 2023, Germany dominated the Europe Audit Software Market and is expected to maintain its dominance throughout the forecast period. Germany’s leadership in the market can be attributed to its advanced technological infrastructure, strong industrial base, and stringent regulatory environment. As one of Europe’s largest economies, Germany is home to a significant number of multinational corporations and medium-sized enterprises, all of which require sophisticated audit solutions to ensure compliance with both national and international regulations. The country’s regulatory framework, particularly in sectors such as manufacturing, finance, and healthcare, drives the demand for audit software that provides comprehensive data analysis, risk management, and real-time reporting functionalities.The increasing focus on digital transformation across industries in Germany has accelerated the adoption of audit software. Companies are investing in automation and artificial intelligence-powered audit tools to improve operational efficiency, reduce manual errors, and enhance their decision-making processes. The widespread adoption of cloud-based audit software in Germany is also contributing to the market’s growth, as businesses seek scalable and flexible solutions to meet their evolving auditing needs.

Germany’s robust economic environment and its proactive approach to technological innovation position the country as a leader in the Europe Audit Software Market. With continued investments in digital technologies, Germany is expected to maintain its dominance, driven by the growing demand for automated auditing solutions across various industries. This trend is further supported by government initiatives aimed at promoting digitalization and compliance in the corporate sector.

Key Market Players

- Wolters Kluwer N.V.

- SAP SE.

- AuditBoard Inc

- Caseware International Inc

- Thomson Reuters Corporation

- Workiva Inc.

- Diligent Corporation.

- Ideagen plc

- MetricStream, Inc

- TrueContext Corporation.

Report Scope:

In this report, the Europe Audit Software Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Europe Audit Software Market, By Component:

- Software

- Services

Europe Audit Software Market, By Deployment Type:

- Cloud-based

- On-premises

Europe Audit Software Market, By Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Europe Audit Software Market, By End-user Industry:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecom

- Healthcare

- Manufacturing

- Retail

- Government

- Others

Europe Audit Software Market, By Country:

- Germany

- Italy

- France

- Spain

- Netherlands

- Belgium

- United Kingdom

- Rest of Europe

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Europe Audit Software Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Wolters Kluwer N.V.

- SAP SE.

- AuditBoard Inc

- Caseware International Inc

- Thomson Reuters Corporation

- Workiva Inc.

- Diligent Corporation.

- Ideagen plc

- MetricStream, Inc

- TrueContext Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 134 |

| Published | November 2024 |

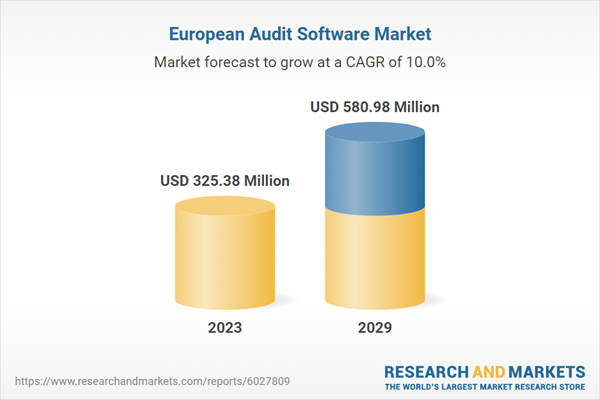

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 325.38 Million |

| Forecasted Market Value ( USD | $ 580.98 Million |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Europe |

| No. of Companies Mentioned | 10 |