Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Data from the European Dairy Association indicates that consumption of fermented dairy products in Europe reached 7.75 million tonnes in 2024. Despite strong performance in mature markets, global growth faces substantial hurdles related to distribution and logistics. The necessity for a continuous, temperature-controlled cold chain to preserve live culture viability and guarantee safety results in elevated operational costs and restricts market reach in areas lacking robust infrastructure.

Market Drivers

Increasing consumer awareness regarding probiotics and gut health serves as a primary catalyst for the global sour milk drinks market. Contemporary consumers connect fermented beverages with benefits like immune support, digestive wellness, and microbiome balance, transforming these items from niche health products into everyday staples. This movement is highlighted by the rising popularity of drinkable yogurts and kefir, where buying choices are strongly swayed by clean labels and live culture content. For instance, Lifeway Foods, Inc. reported in their 'First Quarter 2024 Results' from May 2024 that net sales reached $44.6 million, a 17.8% year-over-year rise driven principally by volume growth in their kefir line, confirming the shift toward accessible, health-promoting drinkable probiotics.The market value is further boosted by the growing demand for fortified and functional beverages, as producers introduce innovations offering benefits like sleep support and stress relief. Moving beyond standard digestion-focused claims, companies are creating high-potency formulations that address specific physiological requirements, allowing them to charge premium prices and build brand loyalty. In May 2024, Yakult Honsha Co., Ltd. reported in its 'Consolidated Financial Results for the Year Ended March 31, 2024' that net sales climbed to 503.0 billion yen, supported by strong sales of high-value functional items. Similarly, Danone’s Essential Dairy and Plant-Based segment recorded €3.47 billion in sales during the first quarter of 2024, demonstrating the vast commercial scale of functional fermented products.

Market Challenges

A major obstacle to the growth of the sour milk drinks market is the dependence on a seamless cold chain infrastructure. Because these beverages contain active live cultures, they demand rigorous temperature control from the manufacturing stage through to the point of sale to ensure probiotic effectiveness and prevent spoilage. Constructing and upholding these specialized distribution networks requires substantial capital investment, adding to manufacturers' operational burdens and limiting product availability in markets sensitive to price.This logistical reliance restricts market entry in areas with fragmented transportation networks or inconsistent energy supplies. The inability to ensure product stability results in significant waste and financial losses for distributors, effectively alienating large potential consumer bases in developing nations. According to the Food and Agriculture Organization, approximately 20 percent of dairy products in developing economies were lost during post-harvest handling and storage in 2024 due to insufficient cooling infrastructure. As a result, manufacturers frequently face difficulties expanding into these regions, constraining the market's growth largely to areas with established logistics capabilities.

Market Trends

The sector is being reshaped by the global proliferation of traditional regional ferments, as consumers look for authentic, nutrient-rich alternatives to standard sweetened dairy drinks. Shoppers are expanding their horizons beyond typical drinkable yogurts to embrace cultural staples such as Turkish Ayran and Icelandic Skyr, which are prized for their distinctive tartness and naturally high protein levels. This trend signals a preference for minimally processed foods that provide satiety without artificial additives. As noted in Arla Foods' 'Annual Report 2024' from February 2025, revenue for the Arla Skyr brand rose by 21.5%, highlighting the increasing commercial success of these heritage-based, specialized fermented products in the global marketplace.Concurrently, the push toward organic formulations and clean labels is transforming product development, fueled by increased demand for ingredient transparency. Modern consumers are turning away from synthetic sweeteners and artificial preservatives, viewing shorter ingredient lists as a marker of higher quality. This desire for purity goes beyond basic nutritional needs, with shoppers willing to pay more for certified organic products that ensure the absence of synthetic pesticides. According to the Organic Trade Association's '2025 Organic Market Report' released in April 2025, organic yogurt sales in the United States increased by 10.5%, emphasizing the strong economic drive behind transparently sourced fermented dairy goods.

Key Players Profiled in the Sour Milk Drinks Market

- Nestle S.A.

- Danone S.A.

- Lifeway Foods, Inc.

- PepsiCo, Inc.

- Yakult Honsha Co., Ltd.

- General Mills, Inc.

- Fonterra Co-operative Group Limited

- Emmi AG

- Meiji Holdings Co., Ltd.

- Arla Foods amba

Report Scope

In this report, the Global Sour Milk Drinks Market has been segmented into the following categories:Sour Milk Drinks Market, by Product Type:

- Buttermilk

- Kefir

- Drinking Yogurt

- Others

Sour Milk Drinks Market, by Category:

- Flavored

- Unflavored

Sour Milk Drinks Market, by Distribution Channel:

- Hypermarkets & Supermarkets

- Convenience Stores

- Online

- Others

Sour Milk Drinks Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Sour Milk Drinks Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Sour Milk Drinks market report include:- Nestle S.A.

- Danone S.A.

- Lifeway Foods, Inc.

- PepsiCo, Inc.

- Yakult Honsha Co., Ltd.

- General Mills, Inc.

- Fonterra Co-operative Group Limited

- Emmi AG

- Meiji Holdings Co., Ltd

- Arla Foods amba

Table Information

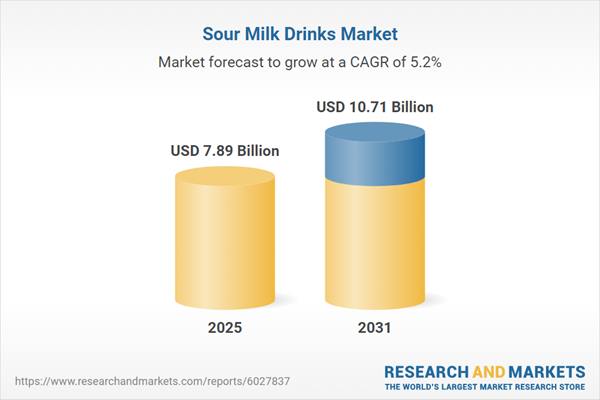

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 7.89 Billion |

| Forecasted Market Value ( USD | $ 10.71 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |