Market Introduction:

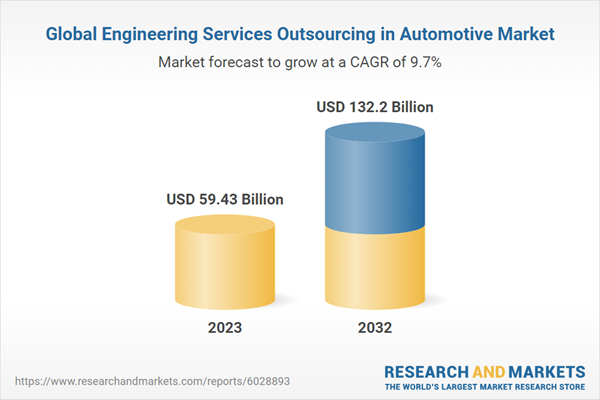

The Global Engineering Services Outsourcing in Automotive Market is experiencing robust expansion, valued at US$ 59.43 billion in 2023 and projected to grow at a CAGR of 9.72% from 2024 to 2032.The Global Engineering Services Outsourcing (ESO) market in the automotive industry is rapidly gaining momentum as manufacturers increasingly seek external expertise to meet the demands of evolving technologies and market pressures. Automotive ESO involves outsourcing critical engineering tasks, including product design, development, testing, and software integration, to third-party specialists. This shift is driven by the need for innovation in areas such as electric vehicles (EVs), autonomous driving, and connected car technologies, which require advanced engineering capabilities.

Cost efficiency, faster time-to-market, and access to a global talent pool are key benefits that make ESO an attractive solution for automakers. Additionally, regulatory pressures to meet safety and environmental standards further drive the need for specialized engineering services focused on vehicle safety, emissions reduction, and sustainability. Regions like Asia-Pacific, Europe, and North America are at the forefront of this outsourcing trend, with automotive companies looking to streamline operations and leverage cutting-edge expertise. As the industry transforms, ESO is poised to become an integral part of the automotive value chain.

Growth Influencers:

Industry 4.0, driven by technologies such as IoT, AI, big data analytics, cloud computing, and smart manufacturing, is significantly boosting the growth of the automotive Engineering Services Outsourcing (ESO) market. The adoption of these technologies demands advanced engineering solutions, increasingly outsourced to specialized firms. Industry 4.0 facilitates intelligent manufacturing, automation, and digitalization, expanding opportunities for Engineering Service Providers (ESPs) to offer innovative solutions, including AI, machine learning, and robotics. Key services like IoT platform integration and the use of CAD, CAE, CAM, and EDA software are transforming basic engineering services into comprehensive, tech-enabled solutions.The rise in labor costs and skills shortages is another major driver, with 36% of industry experts highlighting these issues as primary concerns. The recent labor disruptions, such as the United Auto Workers (UAW) strikes in North America, have further exacerbated these challenges, costing major automakers like GM $1.1 billion. Additionally, rising material and energy costs compound financial pressures for automotive manufacturers, with 26% and 17% of industry respondents citing these issues. Outsourcing engineering services is becoming a strategic approach to mitigate these challenges, allowing manufacturers to enhance operational efficiency and remain competitive amidst increasing economic pressures.

Segment Overview:

The Global Engineering Services Outsourcing in Automotive market is categorized based on Service Type, Location, Pricing Model, Application, Vehicle Type, Propulsion Type and End User.By Service Type

- Design and Engineering

- Concept and detailed design

- CAD modeling and drafting

- Design optimization

- Ergonomics and aesthetics

- Prototyping

- Rapid prototyping

- 3D printing

- Virtual prototyping

- Functional and aesthetic prototypes

- Manufacturing Engineering

- Process planning and optimization

- Tooling and fixture design

- Assembly line design

- Quality control and assurance

- Software Development

- Embedded software development

- Automotive application development

- ADAS (Advanced Driver Assistance Systems) software

- Infotainment system software

- Testing and Validation

- Component and system testing

- Durability and reliability testing

- NVH (Noise, Vibration, and Harshness) testing

- Crash and safety testing

- System Integration

- Integration of mechanical, electrical, and software systems

- Vehicle system architecture design

- Integration of new technologies (e.g., electric and autonomous vehicles)

- Consulting Services

- Market analysis and strategy consulting

- Regulatory compliance consulting

- Sustainability and environmental impact consulting

By Location

- On-Site

- Onshore

- Offshore

By Pricing Model

- Staff Augmentation (FTE based)

- Time and Materia

- Fixed Price Projects

- Services

- Risk/Rewards

By Application

- Powertrain Components

- Engines

- Transmission

- Exhaust Systems

- Others

- Chassis and Suspension Systems

- Suspension Components

- Steering Systems

- Brakes

- Others

- Body and Exterior Components

- Body Panels

- Lights

- Aerodynamics

- Others

- Electronics and Connectivity

- Infotainment Systems

- ADAS Systems

- Vehicle Connectivity

- Others

- Other Application

By Vehicle Type

- Commercial Vehicle

- Off-Highway Vehicle

- Passenger Vehicle

By Propulsion Type

- Internal Combustion Engine

- Electric Engine

By End User

- Original Equipment Manufacturers (OEMs)

- Tier 1 Suppliers

- Aftermarket Service Providers

The rise of electric vehicles (EVs) and autonomous driving technologies further amplifies the demand for advanced engineering solutions. Conversely, the Software Development segment is experiencing the highest CAGR due to the increasing reliance on software in areas such as infotainment, safety, and autonomous driving. As cars become more connected, automotive companies are outsourcing more software development to keep pace with rapid technological advancements.

The Offshore segment captured 55% of the ESO market in the automotive sector in 2023. Offshore outsourcing is preferred for its cost-saving benefits, access to a skilled talent pool, and increased productivity due to differing time zones. India and China have emerged as leading hubs for outsourcing, offering competitive labor costs and expertise in design, engineering, and software development. However, the On-Site segment is projected to grow at the highest CAGR, driven by the need for direct collaboration between service providers and manufacturers. Real-time feedback, system integration, and rigorous testing are essential for more complex projects, making on-site services critical for efficient delivery and quality control.

In 2023, the Staff Augmentation (FTE-based) segment accounted for the largest share of the automotive ESO market at 38%. This model is preferred for its flexibility, allowing companies to scale their workforce based on project needs without long-term commitments. It provides access to specialized expertise, ensuring operational efficiency and cost control, particularly in complex projects.

Meanwhile, the Fixed Price Projects segment is expected to achieve the highest CAGR. The demand for predictable cost structures, particularly in software development and engineering services with defined scopes, is driving the popularity of fixed-price contracts. This model helps mitigate budget overruns and ensures financial certainty for automotive companies.

In 2023, the Powertrain Components segment held the largest share in the automotive ESO market, at 34%. This is driven by the increasing complexity of powertrain systems, particularly with the shift toward electric vehicles (EVs) and hybrids. Automakers are outsourcing the design and development of powertrain components to reduce costs and meet stricter emission standards.

The demand for fuel-efficient and environmentally friendly technologies also supports this segment’s growth. In contrast, the Electronics and Connectivity segment is expected to witness the highest CAGR, driven by the integration of advanced electronics and connectivity features like autonomous driving technologies and vehicle-to-everything (V2X) communication.

In 2023, the Passenger Vehicle segment held the largest share in the automotive ESO market, at 50%. The increasing demand for engineering services related to vehicle design, powertrain development, and safety features has driven this segment’s dominance. The shift toward electric and autonomous vehicles, along with evolving consumer preferences and regulatory requirements, also fuels its growth. The Passenger Vehicle segment is projected to register the highest CAGR due to advancements in autonomous driving, connected car technologies, and electric vehicle development. Automotive companies are outsourcing these services to accelerate product development, reduce costs, and stay competitive in a rapidly evolving industry.

The Electric Engine segment held the largest market share at 46% in 2023 in the automotive ESO market. This dominance is fueled by the growing adoption of electric vehicles (EVs) as automakers focus on electrification to meet environmental regulations and consumer demand for sustainable solutions. Outsourcing engineering services for electric engine development helps automakers innovate, cut costs, and access expertise in battery technologies, electric drivetrains, and power management systems. The Electric Engine segment is also projected to have the highest CAGR, driven by advancements in EV technology and the rising demand for eco-friendly mobility solutions.

In 2023, the Original Equipment Manufacturers (OEMs) segment accounted for the largest share in the automotive ESO market, at 63%. OEMs dominate the market due to their central role in designing, developing, and manufacturing vehicles. They increasingly outsource engineering services to reduce costs and focus on core activities like vehicle innovation, performance, and safety. The rise of electric and autonomous vehicles has further increased OEMs' reliance on ESO services. Conversely, the Tier 1 Suppliers segment is expected to grow at the highest CAGR, driven by their crucial role in providing advanced components like powertrains and safety systems, and their increasing collaboration with OEMs on complex projects.

Regional Overview:

Based on Region, the market is divided into North America, Europe, Asia Pacific, Middle East & Africa and South America.- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

Meanwhile, the Asia-Pacific (APAC) region is expected to have the highest CAGR during the forecast period, with rapidly expanding automotive markets in China, India, and South Korea. Growing demand for electric and autonomous vehicles, coupled with a cost-effective and skilled engineering workforce, makes APAC a key hub for ESO. Increasing investments in automotive R&D further boost the region’s appeal, attracting global automakers and suppliers seeking to leverage its growth potential.

Competitive Landscape:

The Global Engineering Services Outsourcing in Automotive market is characterized by a vigorous competitive landscape, with prominent entities like players Tata Consultancy Services (TCS), HCL Technologies, Capgemini Engineering, Accenture, L&T Technology Services (LTTS), ALTEN, Bertrandt among others at the forefront, collectively accounting for more than 50% of the overall market share. This competitive milieu is fueled by their intensive efforts in research and development as well as strategic partnerships and collaborations, underscoring their commitment to solidifying market presence and diversifying their offerings. The primary competitive factors include pricing, product caliber, and technological innovation.As the Global Engineering Services Outsourcing in Automotive industry continues to expand, the competitive fervor among these key players is anticipated to intensify. The impetus for ongoing innovation and alignment with evolving customer preferences and stringent regulations is high. The industry's fluidity anticipates an uptick in novel innovations and strategic growth tactics from these leading corporations, which in turn propels the sector's comprehensive growth and transformation.

Report Insights:

- The global Engineering Services Outsourcing in Automotive market is projected to grow from US$ 59.43 billion in 2023 to US$ 132.20 billion by 2032, at a CAGR of 9.72%.

- Adoption of IoT, AI, and smart manufacturing boosts demand for outsourced engineering services.

- Growing use of AI, big data, and robotics drives ESO market growth.

- Rising labor costs and skills shortages are increasing reliance on outsourcing.

- Offshore segment holds 55.90% share due to cost savings and skilled workforce in regions like India and China.

Questions to be Answered:

- What is the estimated growth rate of the Global Engineering Services Outsourcing in Automotive market?

- What are the key drivers and potential restraints?

- Which market segments are expected to witness significant growth?

- Who are the leading players in the market?

Executive Summary:

The The Global Engineering Services Outsourcing (ESO) market in the automotive sector is poised for significant growth, expanding from an estimated US$ 59.43 billion in 2023 to US$ 132.20 billion by 2032, at a robust CAGR of 9.72%. This surge is driven by increasing demands for innovative technologies such as electric vehicles (EVs) and autonomous driving systems, alongside pressures to meet stringent regulatory standards on safety and emissions. Key service areas include design and engineering, software development, and prototyping, with the Design and Engineering segment currently holding the largest market share.Offshore outsourcing is particularly favored for its cost efficiencies and access to skilled talent, with regions like India and China emerging as significant hubs. As labor costs rise and skills shortages become prevalent, automotive manufacturers are increasingly relying on ESO to streamline operations and enhance competitive advantage. Leading players in the market include Tata Consultancy Services, HCL Technologies, and Accenture, who are focusing on strategic partnerships and technological innovations to maintain their market positions. The Asia-Pacific region is expected to see the highest growth rate, driven by expanding automotive markets and increasing R&D investments.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Accenture

- Altair Engineering Inc.

- Cognizant Technology Solutions Corporation

- Frost & Sullivan

- Genpact

- International Business Machines Corporation (IBM)

- TekRevol

- Adecco Group AG (Akkodis)

- ALTEN

- Applus+ IDIADA

- ARRK Product Development Group Ltd

- Arobs

- ASAP Holding GmbH

- AVL List GmbH (AVL)

- Bertrandt AG

- Capgemini Engineering

- Concise Software

- EDAG Group

- ESI Group

- Ester Digital

- HQSoftware

- IAV GmbH

- Intersog

- Kistler Group

- Lemberg Solutions

- Magna Steyr GmbH & Co KG

- Promwad

- SEGULA Technologies Group

- TietoEVRY

- TÜV SÜD

- Cyient

- HCL Technologies

- Infosys Limited

- KPIT Technologies

- L&T Technology Services (LTTS)

- Sasken Technologies Limited

- Tata Technologies Limited

- Tech Mahindra

- Wipro Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 618 |

| Published | October 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 59.43 Billion |

| Forecasted Market Value ( USD | $ 132.2 Billion |

| Compound Annual Growth Rate | 9.7% |

| Regions Covered | Global |