Market Introduction:

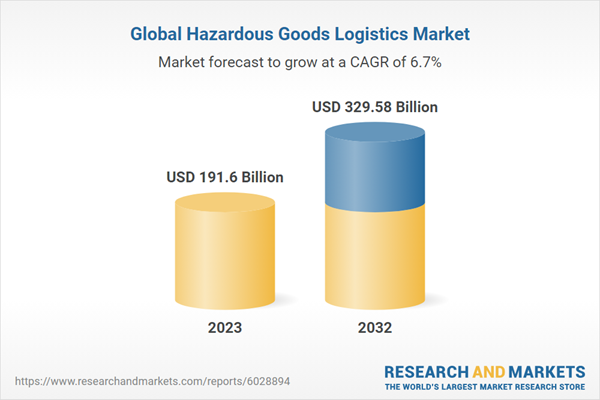

The Global Hazardous Goods Logistics Market is experiencing robust expansion, valued at US$ 191.60 billion in 2023 and projected to grow at a CAGR of 6.68% from 2024 to 2032.The Global Hazardous Goods Logistics Market has emerged as a critical sector within the broader logistics industry, addressing the complex and stringent requirements associated with the transportation and handling of hazardous materials. As global trade expands, the demand for specialized logistics services to manage dangerous goods - ranging from chemicals and pharmaceuticals to radioactive materials - has intensified. This market is characterized by its unique challenges, including regulatory compliance, safety protocols, and environmental considerations.

Advancements in technology and an increasing emphasis on sustainability are reshaping how hazardous materials are handled, with innovations in tracking, packaging, and transportation methods enhancing safety and efficiency. Additionally, the growing awareness of environmental impacts and regulatory pressures are prompting companies to adopt more responsible logistics practices.

Key players in this market are focusing on developing tailored solutions that not only meet legal standards but also ensure the safety of personnel and the environment. As industries worldwide continue to evolve, the Global Hazardous Goods Logistics Market is poised for significant growth, driven by rising demand for efficient and secure logistics solutions that address the complexities of transporting hazardous materials.

Growth Influencers:

The rapid expansion of hazardous waste management is a key driver for the hazardous goods logistics market, as both industries and governments emphasize safe disposal, treatment, and recycling of hazardous materials. Increasing environmental regulations and sustainability initiatives have created a pressing need for specialized transportation solutions. Regulatory bodies, such as the European Union and the U.S. Environmental Protection Agency (EPA), enforce stringent protocols for the movement and treatment of hazardous waste, particularly for flammable, toxic, and radioactive substances.For instance, the European Union's Waste Framework Directive imposes strict guidelines that enhance demand for logistics providers capable of safely transporting these materials. This regulatory environment compels logistics companies to invest in advanced vehicles, secure packaging, and comprehensive personnel training to meet safety standards. Industrial growth in sectors like chemicals and healthcare is contributing to escalating volumes of hazardous waste; China alone is projected to generate over 80 million tons annually by 2025. Moreover, advancements in waste treatment technologies, such as waste-to-energy and recycling processes, further boost demand for secure logistics solutions. As regulatory pressures intensify, the hazardous goods logistics market is expected to grow steadily, driven by a global shift toward sustainability and environmental responsibility.

Segment Overview:

The Global Hazardous Goods Logistics market is categorized based on Service Type, Goods Type, Location and Industry.By Service Type

- Transportation

- Seaways

- Roadways

- Railways

- Airways

- Warehousing

- Value Added Services

- Others

By Goods Type

- Flammable Goods

- Gases

- Chemicals

- Fuels

- Others

- Corrosive Goods

- Acids

- Alkalis

- Others

- Explosives

- Fireworks

- Dynamites

- Others

- Toxic Goods

- Pesticides

- Industrial Chemicals

- Others

- Radioactive Materials

- Medical Isotopes

- Uranium

- Others

By Location

- Domestic

- International

By Industry

- Oil & Gas

- Chemical

- Pharmaceutical and Healthcare

- Agriculture

- Manufacturing

- Mining

- Construction and Building Materials

- Waste Management

- Food Processing

- Others

Additionally, the value-added services segment is expanding rapidly, with the highest Compound Annual Growth Rate (CAGR) due to rising demand for consulting, packaging, and risk management. Businesses increasingly seek third-party logistics providers for integrated solutions that enhance efficiency while complying with international hazardous material regulations.

The flammable goods segment is a key driver in the hazardous goods logistics market, holding a 38.05% share in 2023. This growth results from heightened demand for hazardous materials in industries like chemicals, pharmaceuticals, and manufacturing. With strict safety regulations, logistics providers are investing in specialized solutions for transporting flammable materials to ensure compliance and mitigate risks.

The segment is projected to experience a robust CAGR, particularly as developing economies increase their production and consumption of flammable substances. The rise of e-commerce has also intensified the demand for efficient logistics, prompting providers to implement dedicated transportation routes and enhanced packaging to comply with international standards like the Globally Harmonized System (GHS) and the International Maritime Dangerous Goods (IMDG) Code.

In 2023, the domestic segment of the hazardous goods logistics market leads with a 64.18% share, driven by strict regulations governing hazardous material transportation within countries. In the U.S. and Europe, compliance with regulations such as the Hazardous Materials Transportation Act and the ADR Agreement necessitates specialized logistics services, encouraging businesses to partner with compliant logistics providers.

Conversely, the international segment exhibits the highest CAGR, fueled by global trade dynamics and increasing demand for hazardous materials across sectors like chemicals and pharmaceuticals. As the global chemical industry expands, the volume of hazardous goods transported internationally rises. International regulations, including those from the International Maritime Organization (IMO), further emphasize safe logistics solutions, propelling growth in this segment.

The Oil & Gas sector dominates the hazardous goods logistics market, holding a 25.53% share in 2023. This is largely due to the complex supply chain needs associated with transporting hazardous materials such as crude oil and natural gas. Stringent regulatory frameworks and safety protocols necessitate specialized logistics services to ensure compliance and minimize environmental risks.

Companies like DHL Supply Chain and Kuehne + Nagel have developed tailored logistics solutions, including advanced tracking systems and safety training programs, to enhance operational efficiency and safety within this sector. Meanwhile, the Pharmaceutical and Healthcare segment is witnessing the highest CAGR, driven by the growing demand for temperature-sensitive and hazardous pharmaceutical products, highlighting the need for specialized logistics to meet evolving healthcare requirements.

Regional Overview:

Based on Region, the market is divided into North America, Europe, Asia Pacific, Middle East & Africa and South America.- North America

- The U.S.

- Canada

- Mexico

- Europe

- Western Europe

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Western Europe

- Eastern Europe

- Poland

- Russia

- Rest of Eastern Europe

- Asia Pacific

- China

- India

- Japan

- Australia & New Zealand

- South Korea

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

- South America

- Argentina

- Brazil

- Rest of South America

The European Union’s commitment to safety and environmental standards has further driven the demand for specialized logistics services, requiring companies to adopt robust compliance measures. For example, Germany's rigorous enforcement of the ADR (European Agreement concerning the International Carriage of Dangerous Goods by Road) has prompted logistics firms to invest in advanced training and technology for safe handling and transportation.

Conversely, the Asia Pacific region is projected to achieve the highest Compound Annual Growth Rate (CAGR). Rapid industrialization in countries like China and India has significantly heightened the demand for hazardous goods logistics, particularly in sectors such as chemicals, pharmaceuticals, and construction. China's expanding chemical manufacturing industry, for instance, requires efficient logistics solutions to manage hazardous materials, driving investments in specialized transportation and warehousing. The logistics strategies in these regions reflect their unique dynamics; Europe emphasizes compliance and technology for real-time tracking, while Asia Pacific increasingly adopts innovative solutions like automated warehousing and IoT-enabled monitoring systems to enhance safety and efficiency.

Competitive Landscape:

The Global Hazardous Goods Logistics market is characterized by a vigorous competitive landscape, with prominent entities like players DHL Group, Kuehne+Nagel, FedEx Corporation, Deutsche Bahn SCHENKER, United Parcel Service Inc. among others at the forefront, collectively accounting for more than 35% of the overall market share. This competitive milieu is fueled by their intensive efforts in research and development as well as strategic partnerships and collaborations, underscoring their commitment to solidifying market presence and diversifying their offerings. The primary competitive factors include pricing, product caliber, and technological innovation.As the Global Hazardous Goods Logistics industry continues to expand, the competitive fervor among these key players is anticipated to intensify. The impetus for ongoing innovation and alignment with evolving customer preferences and stringent regulations is high. The industry's fluidity anticipates an uptick in novel innovations and strategic growth tactics from these leading corporations, which in turn propels the sector's comprehensive growth and transformation.

Report Insights:

- The global Hazardous Goods Logistics market is projected to grow from US$ 191.60 billion in 2023 to US$ 329.58 billion by 2032, at a CAGR of 6.68%.

- The global hazardous goods logistics market is expanding rapidly, driven by the need for safe disposal and transportation of hazardous materials.

- Stringent regulations, especially from the EU and EPA, necessitate specialized logistics solutions for hazardous waste management.

- The transportation segment holds 38.75% of the market share, highlighting demand for compliant logistics services.

- This segment leads with a 38.05% share, spurred by rising industrial demand and e-commerce in chemicals and pharmaceuticals.

Questions to be Answered:

- What is the estimated growth rate of the Global Hazardous Goods Logistics market?

- What are the key drivers and potential restraints?

- Which market segments are expected to witness significant growth?

- Who are the leading players in the market?

Executive Summary:

The global hazardous goods logistics market is experiencing significant growth driven by increased investments in healthcare infrastructure and the rising volumes of hazardous waste generated by industries like chemicals and healthcare. Heightened regulatory pressures, including the EU's Waste Framework Directive and U.S. Hazardous Materials Regulations, are compelling logistics providers to improve safety protocols, invest in specialized vehicles, and implement rigorous training programs. Additionally, advancements in waste treatment technologies and a focus on corporate responsibility are creating a demand for efficient, secure logistics services.The market is divided into domestic and international logistics, with domestic logistics leading in volume while international logistics holds the highest growth potential. As companies recognize the importance of compliant and environmentally responsible logistics, the market is set for steady growth, particularly for providers that adapt to evolving regulations and embrace innovative solutions.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Public Listed Player

- Agility

- Ceva Logistics

- DHL Supply Chain

- DB Schenker

- DSV

- FedEx Corporation

- GEODIS

- Kuehne + Nagel

- United Parcel Service of America, Inc.

- XPO Logistics, Inc.

- Private Listed Players

- Bollore Logistics

- DGD Transports

- Dangerous Goods International

- Rhenus Logistics

- Toll Holdings Ltd.

- Yusen Logistics Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 251 |

| Published | October 2024 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 191.6 Billion |

| Forecasted Market Value ( USD | $ 329.58 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |