The North America region witnessed 36% revenue share in this market in 2023. This region's dominance can be attributed to several factors, including a robust technological infrastructure, high adoption rates of advanced technologies, and significant investments in research and development. North America has many leading embedded computing manufacturers and technology companies that drive innovation and market growth.

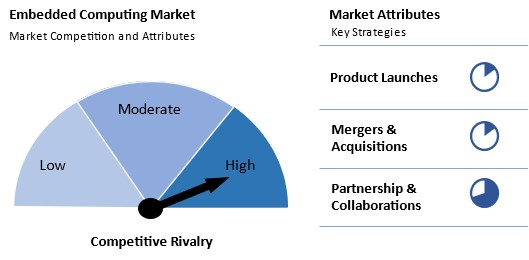

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In May, 2023, IBM Corporation and SAP announced the integration of IBM Watson AI into SAP solutions, enhancing user productivity and decision-making through AI-driven insights and automation. This collaboration aims to transform business processes across industries using AI, machine learning, and large language models.

Moreover, In November, 2024, Fujitsu Limited and AMD have partnered to create sustainable AI and high-performance computing platforms. This collaboration combines Fujitsu’s FUJITSU-MONAKA processor with AMD’s Instinct™ accelerators, aiming to advance open-source AI and HPC initiatives with a focus on energy efficiency and ecosystem expansion.

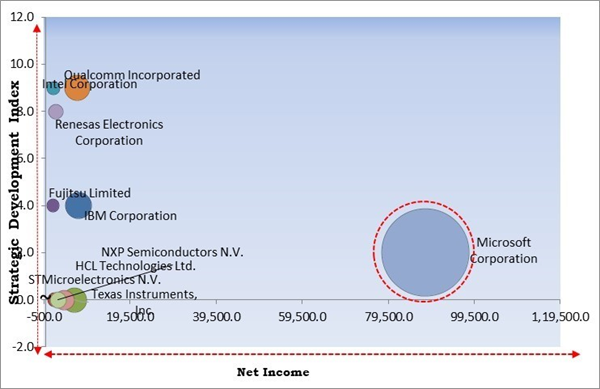

KBV Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the KBV Cardinal matrix; Microsoft Corporation is the forerunners in the Embedded Computing Market. In May, 2020, Microsoft Corporation partnered with Sony Semiconductor Solutions to integrate Azure AI into Sony’s smart cameras. This collaboration enhances video analytics for embedded systems, optimizing resource allocation and improving business outcomes across various industries, particularly for enterprise customers relying on AI-driven IoT solutions and smart camera technologies. Companies such as IBM Corporation is the key innovator in Embedded Computing Market.Market Growth Factors

The growing need for automation and control systems in manufacturing, automotive, healthcare, and energy drives the embedded computing market. As industries strive for efficiency, productivity, and safety, embedded systems are increasingly integrated into control systems to manage operations in real-time. These systems ensure seamless automation of production lines, process monitoring, and even predictive maintenance. For instance, in manufacturing, they allows for machine control, data acquisition, and remote monitoring, leading to reduced operational downtime and higher output efficiency. Hence, increasing demand for automation and control systems across various industries is propelling the growth of the market.Additionally, Energy efficiency and system compactness have become significant drivers for this technology. In today’s market, energy consumption has become a focal point across sectors as companies and governments seek to reduce their carbon footprints and energy costs. Embedded systems, by nature, are designed to offer high performance with lower power consumption, which makes them an attractive option for applications that require continuous operation without excessive energy use. Therefore, rising demand for energy-efficient and compact systems is propelling the growth of the market.

Market Restraining Factors

One of the primary restraints for the embedded computing market is the high initial development and manufacturing costs. Developing embedded systems often requires specialized hardware, custom software, and a skilled workforce capable of handling system architecture, design, and integration. As a result, these solutions, especially for complex applications, can be expensive to develop.Furthermore, integrating new technologies such as AI, machine learning, or 5G into embedded systems can further raise development costs, as these technologies require more advanced hardware and software platforms. The complexity involved in designing systems that support these cutting-edge technologies can also lead to higher R&D costs, limiting market accessibility.

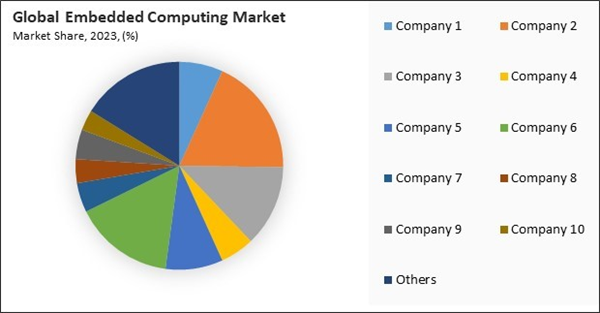

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships & Collaborations.

Driving and Restraining Factors

Drivers

- Increasing Demand For Automation And Control Systems Across Various Industries

- Rising Demand For Energy-Efficient And Compact Systems

- Growth Of Industrial Automation And Smart Manufacturing Worldwide

Restraints

- High Initial Development And Manufacturing Costs

- Complexity In System Integration And Customization

Opportunities

- Increasing Government Investments In Smart City Infrastructure

- Expansion Of Edge Computing And Real-Time Data Processing Needs

Challenges

- Challenges In Power Efficiency And Thermal Management

- Limited Availability Of Skilled Workforce For Embedded Systems Development

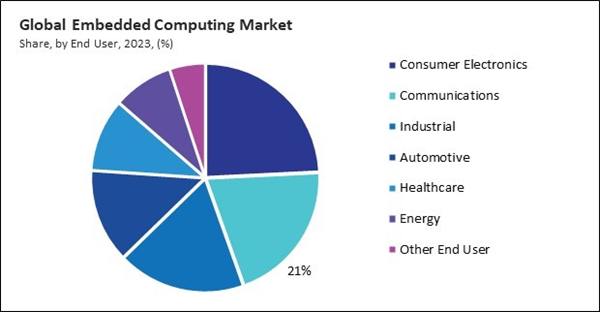

End User Outlook

On the basis of end user, the embedded computing market is segmented into consumer electronics, communications, industrial, automotive, healthcare, energy, and other. In 2023, the communications segment attained 20% revenue share in this market. This is critical in communication devices and infrastructure, including routers, modems, and network equipment. These embedded systems are essential for maintaining robust and efficient communication networks and are vital in increasing data consumption and connectivity demands.Component Outlook

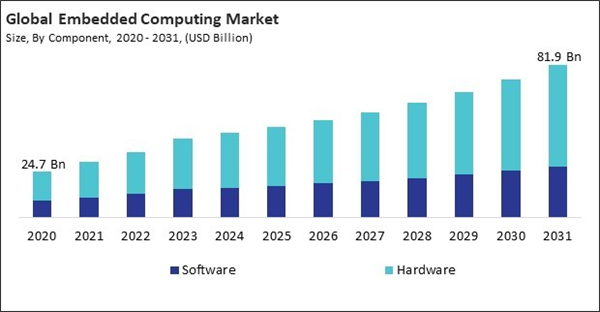

Based on component, the embedded computing market is divided into software and hardware. The software segment held 36% revenue share in this market in 2023. This segment encompasses various software solutions, including operating systems, middleware, and application software, enabling the hardware to execute specific tasks and processes efficiently. The software is crucial for customizing and optimizing embedded systems, allowing for tailored solutions across various industries.Regional Outlook

Region-wise, the embedded computing market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2023, the Europe region generated 31% revenue share in this market. Europe is known for its strong emphasis on industrial automation, automotive advancements, and sustainable energy solutions, which rely heavily on these systems. The region's commitment to innovation and supportive government policies and initiatives to promote digital transformation and smart manufacturing contributes to the significant market share.Market Competition and Attributes

Competition in the embedded computing market becomes more fragmented, with numerous small to mid-sized companies striving for market share. These companies focus on niche applications, custom solutions, and technological innovation to gain an edge. The competition emphasizes adaptability, cost efficiency, and specific industry expertise, enabling smaller players to meet unique customer needs and foster diverse advancements in embedded systems.

Recent Strategies Deployed in the Market

- Oct-2024: Renesas Electronics Corporation partners with EdgeCortix to accelerate AI/ML development for edge applications. The collaboration integrates Renesas’ embedded processors with EdgeCortix’s AI solutions, enhancing energy efficiency and enabling seamless compilation for heterogeneous architectures in industrial, smart home, and automotive applications.

- Oct-2024: Fujitsu Limited and Supermicro are collaborating to develop high-performance, energy-efficient computing systems, including the FUJITSU-MONAKA processor and liquid-cooled solutions for AI and HPC workloads, aiming to drive green IT innovation and support sustainable, efficient data center infrastructures.

- Oct-2024: Qualcomm Incorporated is collaborating with Kontron AG to advance edge computing and AI. This partnership leverages Qualcomm’s 5G, AI, and edge computing technologies to enhance Kontron's embedded solutions for industries like automotive, industrial automation, and smart cities.

- Aug-2024: Qualcomm Incorporated acquires Sequans' 4G IoT technologies, enhancing its Industrial IoT portfolio with low-power, optimized cellular connectivity solutions. Sequans retains rights to its 4G technology and continues to focus on expanding its 5G capabilities, supporting IoT applications and digital transformation.

- Aug-2024: Renesas completes the acquisition of Altium, a leader in PCB design software, to create an integrated electronics system design and lifecycle management platform. This collaboration aims to accelerate innovation, enhance productivity, and make electronics design more accessible globally.

List of Key Companies Profiled

- Fujitsu Limited

- Intel Corporation

- IBM Corporation

- HCL Technologies Ltd.

- Microsoft Corporation

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments, Inc.

- NXP Semiconductors N.V.

Market Report Segmentation

By Component

- Software

- Hardware

- Microcontroller (MCU)

- Microprocessor (MPU)

- Digital Signal Processor (DSP)

- Other Hardware Type

By End User

- Consumer Electronics

- Communications

- Industrial

- Automotive

- Healthcare

- Energy

- Other End User

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Fujitsu Limited

- Intel Corporation

- IBM Corporation

- HCL Technologies Ltd.

- Microsoft Corporation

- Qualcomm Incorporated (Qualcomm Technologies, Inc.)

- Renesas Electronics Corporation

- STMicroelectronics N.V.

- Texas Instruments, Inc.

- NXP Semiconductors N.V.