Cricket continues to be a well-followed sport in the UK, and with increasing efforts to expand its presence in other European countries, demand for cricket equipment has grown steadily. In the United Kingdom, where cricket has deep-rooted cultural significance, the demand for cricket equipment remains strong, supported by substantial government funding and initiatives led by the England and Wales Cricket Board (ECB).

Programs such as All Stars Cricket and Dynamos Cricket aim to introduce children aged 5-11 to the sport, providing affordable access to cricket equipment and training. Therefore, the Europe segment acquired 1/4th revenue share in the market in 2023. The success of leagues such as The Hundred and international European tournaments attract new players and fans, creating a healthy demand for cricket equipment.

Cricket bears significant cultural and historical significance in countries such as India, Australia, England, and South Africa, where it is immensely popular. In these regions, cricket is not just a sport, but a deeply ingrained part of society celebrated and followed passionately by millions. The high visibility of national and international tournaments, combined with a genuine fan base, creates a thriving market for cricket equipment. This exposure has drawn attention from local audiences and expats, contributing to the sport’s popularity. Hence, such popularity is driving the demand for cricket equipment.

Additionally, T20 leagues, such as the Indian Premier League (IPL), Big Bash League (BBL) in Australia, and Pakistan Super League (PSL), have introduced a new, fast-paced format of cricket that appeals to a broad audience, including younger fans who may not have been drawn to the longer traditional formats. The shorter, action-packed matches keep viewers engaged and provide a thrilling experience that has expanded cricket’s appeal beyond traditional fans. This leads to increased cricket equipment sales, as fans invest in gear to play the sport themselves, inspired by the performances of international cricket icons. Thus, these tournaments have transformed the cricket equipment market, making it more robust and profitable globally.

However, the impact of high costs on equipment accessibility also extends to teams and schools, particularly in developing regions where government or institutional funding for sports may be limited. Schools and local teams often cannot adequately equip players without affordable options, limiting practice opportunities and game readiness. Hence, in the long run, this creates a disparity in skill levels and a less competitive environment, which can hinder the development of cricket as a sport on a larger scale.

Driving and Restraining Factors

Drivers

- Increasing Popularity of Cricket

- Rise of T20 Leagues and Global Tournaments

- Increased Accessibility Through E-commerce

Restraints

- High Cost of Quality Equipment

- Seasonal Nature of Cricket

Opportunities

- Rising Sports Culture and Fitness Trends

- Growing Participation at the Grassroots Level

Challenges

- Availability of Counterfeit and Low-quality Products

- Increasing Popularity of Alternative Sports

End User Outlook

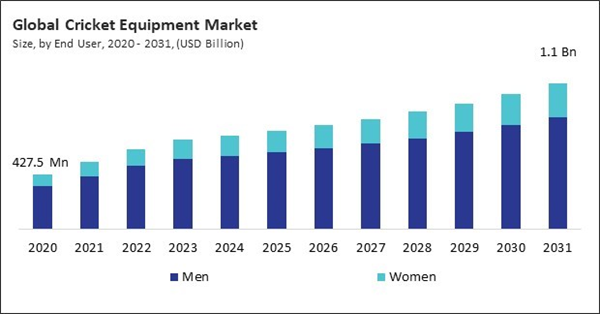

Based on end user, the market is bifurcated into men and women. The men segment garnered 79% revenue share in the market in 2023. With a higher participation rate in professional and recreational sports, the segment represents a significant demand for cricket equipment, including bats, protective gear, and accessories. This demand is fueled further by major tournaments like the ICC Men’s Cricket World Cup and various national leagues, increasing equipment sales and overall interest in the sport. As a result, brands continue to innovate and produce a diverse range of equipment suited to different playing levels, catering to the segment’s broad and steady consumer base.Distribution Channel Outlook

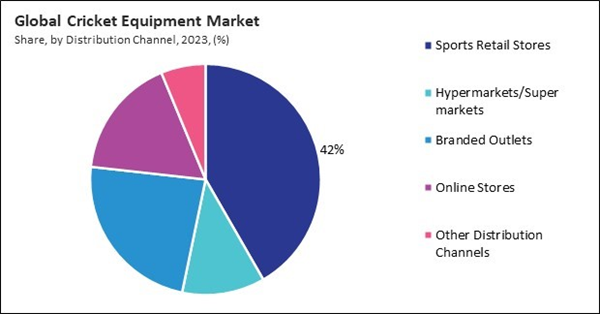

On the basis of distribution channel, the market is classified into sport retail stores, hypermarkets/supermarkets, branded outlets, online stores, and others. The branded outlets segment recorded 23% revenue share in the market in 2023. Many players prefer branded stores for reliability and specialized gear tailored to meet professional standards, as these outlets showcase exclusive products with the latest designs and technology. The association with well-established brands adds to their appeal, as consumers often perceive branded equipment as superior in performance and durability.Type Outlook

By type, the market is divided into bats, balls, protective gear, and others. The bats segment witnessed 39% revenue share in the market in 2023. The bats segment leads the cricket equipment market due to its indispensable role in the sport, as every player requires a bat, whether for casual play or professional matches. The high demand for quality bats across all playing levels drives this segment, with players looking for performance-enhancing features like optimal weight, balance, and grip. Manufacturers continuously innovate to provide bats crafted from premium wood, such as English willow and integrate new designs to cater to varied playing styles.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured 53% revenue share in the cricket equipment market in 2023. The Asia Pacific segment leads the market due to the sport’s immense popularity and cultural significance, especially in countries like India, Pakistan, Australia, and Sri Lanka.In these nations, cricket is a favored pastime and a major professional sport, with high-profile leagues and tournaments that drive continuous demand for equipment across all levels. The rise of popular leagues such as the Indian Premier League (IPL) and Big Bash League in Australia has further fueled demand for high-quality cricket gear among both amateur and professional players.

List of Key Companies Profiled

- PUMA SE (Groupe Artémis S.A.)

- Adidas AG

- Reebok International Ltd. (Authentic Brands Group LLC)

- Sareen Sports Industries

- Gray-Nicolls

- Sanspareils Greenlands Pvt. Ltd.

- Kookaburra Sport Pty Ltd

- Beat All Sports

- Gunn & Moore (GM)

- British Cricket Balls Ltd

Market Report Segmentation

By End User

- Men

- Women

By Distribution Channel

- Sports Retail Stores

- Hypermarkets/Supermarkets

- Branded Outlets

- Online Stores

- Other Distribution Channels

By Type

- Bats

- Balls

- Protective Gears

- Other Types

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Netherlands

- Ireland

- Italy

- Rest of Europe

- Asia Pacific

- Australia

- New Zealand

- India

- Sri Lanka

- Indonesia

- Thailand

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Zimbabwe

- Rest of LAMEA

Table of Contents

Companies Mentioned

- PUMA SE (Groupe Artémis S.A.)

- Adidas AG

- Reebok International Ltd. (Authentic Brands Group LLC)

- Sareen Sports Industries

- Gray-Nicolls

- Sanspareils Greenlands Pvt. Ltd.

- Kookaburra Sport Pty Ltd

- Beat All Sports

- Gunn & Moore (GM)

- British Cricket Balls Ltd