The onshore drilling fluids market is significantly driven by the increasing number of onshore drilling operations across various sectors, particularly in oil and gas. Additionally, the market for onshore drilling fluids is expanding due to urbanization, industrialization, a spike in government investments, and rising consumer expenditure.

With the growing demand for energy worldwide, the need for oil exploration has also expanded. In fiscal year 2022, the United States onshore oil and gas program accounted for nearly 14 percent of total U.S. onshore oil production. Despite growing demand, onshore drilling operations may face challenges related to environmental disturbances and impacts on local communities.

According to the U.S. Energy Information Administration, crude oil and natural gas drilling activity onshore had 464 in 2021, 708 in 2022, and 669 in 2023 in the country.

Baker Hughes International's active Rig Count has expanded in the last few years, averaging 1361 in 2021, 1747 in 2022, and 1814 in 2023.

Onshore drilling fluids market

Increasing global consumption of oil

The onshore drilling fluids market is expected to expand as the demand surges for oil and petroleum in many developing countries worldwide. These demands would increase in the market of Asia Pacific and Africa. Rapid industrialization and demand for large shipments and logistics have created the need for crude oil. The global crude oil production has risen which was 37.30 (mb/d) in 2020, moved to 38.02 (mb/d) in 2021, and reached 39.69 (mb/d) in 2022, according to Organization of the Petroleum Exporting Countries data. Due to these developments, the demand for onshore drilling fluids would rise.Onshore drilling fluids market geographical outlooks

The Onshore drilling fluids market is segmented into five regions worldwide

By geography, the market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.The Asia Pacific region is expected to see the fastest growth in the onshore drilling fluids market due to increasing investment in the oil exploration industry. North America is expected to have a significant market share in the onshore drilling fluids market. As the new-well oil production per rig has expanded in the United States from around 500 barrels/day to 670 barrels/day from 2023 to 2024, the number of rig counts has expanded from around 100 to 150 from 2023 to 2024.

Reasons for buying this report::

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub- segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2029

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The onshore drilling fluids market is segmented and analyzed as follows:

By Product Type

- Oil-based

- Synthetic-based

- Water-based

- Others

By Well Type

- HPHT

- Conventional

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

Table of Contents

Companies Mentioned

- Baker Hughes

- Castle Harlan Inc.

- AMC Drilling Fluids & Products (Imdex Ltd.)

- Secure Energy Services

- Global Drilling and Chemicals

- Sagemines

- Halliburton Company

- Schlumberger

- National Oilwell Varco

- Total Energies

- Petra Industries Global L.L.C

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 142 |

| Published | November 2024 |

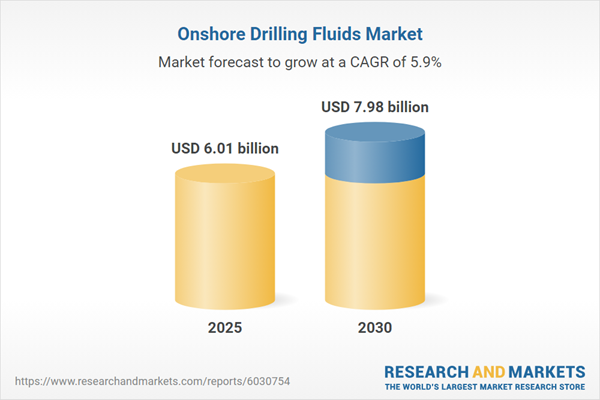

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 6.01 billion |

| Forecasted Market Value ( USD | $ 7.98 billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |