Waterborne resins are used for multiple purposes. For example, epoxy resins can be used as coatings, floor primers, top coats, self-leveling coatings, grouts and sealants, adhesives, composites, etc. The driving factor of the waterborne resins is the increased volume in the construction and automotive markets.

Further, the growing awareness of a sustainable environment and increasing focus on pollution-free manufacturing practices drive this market’s growth during the forecast period. Waterborne resins use water as a solvent to disperse a resin, thus making these resins environment-friendly and low in toxicity and flammability. It significantly contributes to the reduction of volatile organic compound (VOC) emissions.

In 2023, according to the China Construction Co., Ltd, China Construction's signed contracts amounted to 4.32 trillion yuan, a year-on-year increase of 10.8%. They reached an operating income of 2.27 trillion yuan, a year-on-year increase of 10.2%. China Construction's business performance is spread across more than 100 countries, and its business layout covers investment and development in real estate development, construction financing, holding, and operation, and new businesses like green construction, energy conservation, environmental protection, e-commerce, etc.

India's leather products exports were continuously increasing from US$3.68 billion in 2020-21, US$4.87 billion in 2021-22, and US$5.38 billion in 2022-23. Footwear, including leather footwear, footwear components, and non-leather footwear, holds a major share of 42.6% of the total exports of leather and leather products.

Waterborne resins market drivers

Rapid urbanization leading to growth in the paints & coatings industry

The construction and building industry worldwide is showing significant growth. One of the major reasons for this industry's expansion is the growing global urbanization. Urbanization causes the rapid industrialization of the country and region. The global urban population has increased from 56% in 2021 to 57% in 2022, according to the World Bank. The rate of urbanization in the developing part of the world, mainly APAC, Middle East, and African regions, is rising significantly.The innovative development in the construction industry, such as adhesives and sealants, is a major factor in the waterborne resins market growth. Clear concrete sealers were based on solvent-based resin technologies earlier, but recently, water-based technologies have been gaining attention as an alternative to regulatory restrictions on VOCs and emissions. Water-based coatings are likely to be safer alternatives to handle and use compared to solvent-based technologies.

Lubrizol developed water-based resin technology and is continuously evolving and improving this technology. In July 2022, a new water-based resin for concrete sealers was launched. This resin further enabled floor coatings with lower VOC formulating capabilities, free of hazard-regulated substances.

Waterborne resins market geographical outlooks

The waterborne resins market is segmented into five regions worldwide

By geography, the waterborne resins market is segmented into North America, South America, Europe, the Middle East and Africa, and Asia Pacific. The major economies like China, Japan, India, and South Korea dominate the Asia-Pacific region. Some of the fastest-growing emerging economies are from this region, such as ASEAN countries.The Asia Pacific region is expected to see the fastest growth in the waterborne resin market due to its increasing applications in paints, coatings, leather, and sealants.

According to IBEF (India Brand Equity Foundation), India is the second-largest exporter of leather garments and the fourth-largest exporter of leather goods in the world. North America is expected to have a significant waterborne resin market share due to the major utilization of waterborne resins for architectural coatings, industrial coatings, and textiles.

Reasons for buying this report::

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub- segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2029

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The waterborne resins market is analyzed into the following segments:

By Type

- Acrylic Resin

- Epoxy Ester Resin

- Saturated Polyester Resin

- Epoxy Resin

- Polyurethane Resin

- Alkyd Resin

- Others

By Application

- Paints & Coatings

- Adhesives & Sealants

- Inks

- Leather

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Middle East and Africa

- Saudi Arabia

- UAE

- Rest of the Middle East and Africa

- Asia Pacific

- China

- India

- Japan

- South Korea

- Taiwan

- Thailand

- Indonesia

- Rest of Asia-Pacific

Table of Contents

Companies Mentioned

- BASF SE

- Lawter Inc.

- Allnex Group

- The Lubrizol Corporation

- Hexion

- Westlake Epoxy

- DIC Corporation

- Arkema

- BELIKE Chemical

- Vil Resins

- Arakawa Chemical Industries Ltd

- KITO Chemical Co. Ltd

- DOW

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 143 |

| Published | November 2024 |

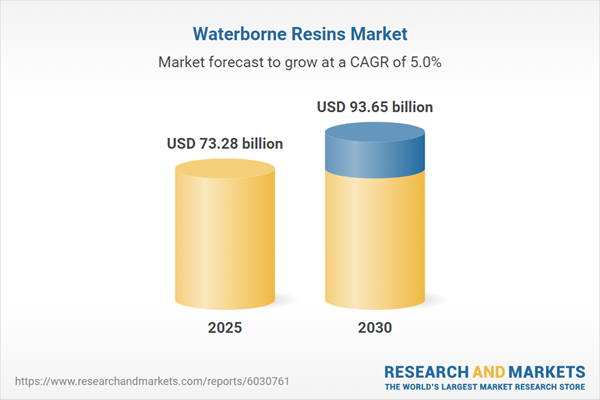

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 73.28 billion |

| Forecasted Market Value ( USD | $ 93.65 billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |