Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A primary role of passenger car thermal systems is engine cooling. This is achieved through components like radiators, cooling fans, and coolant pumps, which ensure the engine operates within its optimal temperature range. Proper engine cooling promotes efficient combustion, reduces emissions, and extends engine life. With increasing emissions regulations, effective thermal management is essential for automakers to meet environmental standards while maintaining performance.

Cabin comfort is another critical function of these systems. Heating, ventilation, and air conditioning (HVAC) systems are essential for creating a pleasant cabin environment. They provide heating in cold weather and cooling in hot conditions, enhancing passenger comfort. Advances in HVAC technology, such as eco-friendly refrigerants and energy-efficient compressors, help lower the environmental impact of vehicle operation.

In electric and hybrid vehicles (EVs and HEVs), thermal systems have gained greater significance. Battery thermal management systems are vital for regulating the temperature of lithium-ion batteries, which are central to these vehicles. Effective management of battery temperature ensures safety, extends battery life, and optimizes driving range. Techniques like liquid cooling, phase-change materials, and advanced insulation address the unique thermal challenges of electric drivetrains.

Thermal systems also play a key role in maintaining the functionality of various components, including transmissions, powertrains, and exhaust systems, by preventing overheating and ensuring reliable vehicle performance.

The future of passenger car thermal systems is increasingly shaped by sustainability and environmental concerns. Manufacturers are focusing on eco-friendly solutions, such as lightweight materials to reduce energy consumption, renewable energy integration, and systems designed to minimize carbon footprints.

Global Passenger Car Thermal System Market is vital for enhancing engine performance, passenger comfort, and environmental sustainability. As the automotive industry evolves, these systems will continue to address challenges related to electric mobility, emissions regulations, and the demand for improved comfort and environmental responsibility.

Key Market Drivers

Rising Demand for Electric Vehicles (EVs)

The increasing popularity of EVs is a major driver for the thermal system market. Battery thermal management systems are crucial for regulating lithium-ion battery temperatures, ensuring safety, and maximizing performance. As governments worldwide promote electric mobility, the demand for advanced thermal solutions in EVs continues to surge. The International Energy Agency (IEA) reported that the global electric car fleet experienced robust growth, with sales expected to hit 17 million in 2024. Although some markets faced short-term challenges, current policies suggested that nearly one-third of vehicles on the roads in China would be electric by 2030, while nearly one-fifth of vehicles in the United States and the European Union would also be electric.Stringent Emissions Regulations

Stringent emissions standards are compelling automakers to invest in innovative exhaust gas management solutions. Thermal systems play a pivotal role in reducing harmful emissions, improving engine efficiency, and ensuring compliance with emissions regulations globally. For instance, In May 2024, it was reported that electric vehicle manufacturers were expected to shift towards natural refrigerants for air conditioning. Over the next five years, OEMs were likely to choose CO2 (R744) or propane (R290) over the commonly used HFO 1234yf in mobile air-conditioning systems for plug-in hybrid electric vehicles (PHEVs) and electric vehicles (EVs).Consumer Focus on Cabin Comfort

Passenger comfort remains a top priority for consumers. As a result, HVAC systems within thermal systems are continuously evolving to provide efficient heating, ventilation, and air conditioning. Multi-zone climate control, eco-friendly refrigerants, and energy-efficient HVAC solutions cater to consumer demands for enhanced cabin comfort.Advancements in Battery Technology

Ongoing advancements in battery technology have increased the range and performance of electric vehicles. This necessitates advanced battery thermal management systems to regulate temperatures effectively, extend battery life, and enhance overall EV performance.Growing Urbanization

The trend of urbanization, with more people residing in cities, has led to increased demand for compact and efficient passenger vehicles. Thermal systems in these vehicles are designed to optimize space and performance, ensuring efficient cooling and heating solutions in compact packages.Technological Innovation

Continuous technological innovation is driving the development of more efficient thermal management solutions. Liquid cooling systems, phase-change materials, and advanced insulation materials are being integrated into thermal systems to meet evolving performance and sustainability requirements.Government Support for Sustainable Transportation

Governments worldwide are actively promoting sustainable transportation solutions, including electric and hybrid vehicles. Subsidies, tax incentives, and stringent emissions targets encourage automakers to invest in cutting-edge thermal technologies for environmentally friendly vehicles.Environmental Sustainability

Sustainability concerns are pushing the industry to develop eco-friendly thermal solutions. Lightweight materials, renewable energy sources, and energy-efficient technologies are being adopted to minimize the environmental impact of thermal systems, aligning with global sustainability goals.Global Passenger Car Thermal System Market is shaped by a complex interplay of factors, ranging from the rapid adoption of EVs and emissions regulations to consumer comfort expectations and ongoing technological advancements. As the automotive industry continues to evolve, thermal systems will play a pivotal role in meeting the demands of electric mobility, emissions reduction, and passenger comfort.

Key Market Challenges

Emission Reduction Targets

The automotive industry is under constant pressure to reduce emissions to comply with stringent regulations aimed at curbing air pollution and mitigating climate change. Achieving these targets requires innovative exhaust gas management solutions within thermal systems, which can be technologically complex and expensive to develop and implement.Electrification Transition

While the electrification of vehicles is a positive step toward reducing greenhouse gas emissions, it poses challenges for thermal systems. Developing efficient battery thermal management systems capable of maintaining optimal temperatures for lithium-ion batteries is critical. This transition also necessitates a shift in engineering expertise and supply chain management.Battery Range and Charging Infrastructure

The limited driving range of some EVs remains a concern for consumers. Thermal systems play a key role in managing battery temperatures to extend range, but this requires sophisticated thermal solutions. Availability and accessibility of charging infrastructure must improve to alleviate range anxiety and promote EV adoption.Cost Constraints

The automotive industry must balance the need for efficient thermal systems with cost considerations. High-performance thermal management solutions, particularly for batteries, can increase the overall cost of the vehicle. Finding cost-effective materials and manufacturing processes while maintaining performance is a constant challenge.Consumer Expectations

Consumers expect a comfortable cabin environment with efficient heating and cooling. Meeting these expectations while ensuring energy efficiency and reducing environmental impact is a balancing act. Developing HVAC systems that are both efficient and capable of providing rapid cabin temperature adjustments presents an ongoing challenge.Extreme Weather Conditions

Vehicles operate in diverse climates, from sweltering summers to frigid winters. Thermal systems must perform reliably under extreme conditions, which can strain components like radiators, compressors, and coolant systems. Designing thermal systems that function optimally across a wide range of temperatures is a complex engineering challenge.Global Supply Chain Disruptions

Recent disruptions in the global supply chain have exposed vulnerabilities in sourcing critical components for thermal systems. Ensuring a stable supply chain, particularly for specialized components like refrigerants and advanced materials, is vital to maintaining production and meeting market demands.Integration with Autonomous Driving

The advent of autonomous driving introduces additional challenges for thermal management. Autonomous vehicles may require sophisticated thermal solutions to ensure the reliable operation of sensors, computers, and advanced driver assistance systems (ADAS). Maintaining thermal comfort for passengers while integrating complex autonomous systems is a multifaceted challenge.The Global Passenger Car Thermal System Market confronts a multitude of challenges, from regulatory pressures to technological complexities and consumer demands. Overcoming these challenges requires continuous innovation, collaboration among industry stakeholders, and a commitment to environmentally responsible solutions.

Key Market Trends

Electrification Emphasis

The shift toward electric vehicles (EVs) is a prominent trend. Thermal systems are adapting to efficiently manage battery temperatures in EVs, optimizing performance, safety, and longevity. Liquid cooling, phase-change materials, and advanced insulation are being employed for effective battery thermal management.Sustainable Solutions

Sustainability is a pervasive trend, with automakers focusing on eco-friendly thermal technologies. Lightweight materials, renewable energy sources for heating and cooling, and the adoption of eco-friendly refrigerants are reducing the environmental footprint of thermal systems.Advanced HVAC

Heating, ventilation, and air conditioning (HVAC) systems are evolving to provide more efficient cabin climate control. Multi-zone climate control, air purification, and energy-efficient compressors cater to consumer demands for enhanced passenger comfort while minimizing energy consumption.Smart Thermal Systems

Integration of smart sensors and artificial intelligence (AI) in thermal systems is a growing trend. These systems can adapt to real-time conditions, optimizing heating and cooling to enhance efficiency and passenger comfort. Predictive maintenance based on sensor data is also becoming more prevalent.Efficient Exhaust Gas Management

As emissions regulations become more stringent, thermal systems play a crucial role in managing exhaust gases. Innovations in exhaust gas recirculation (EGR) systems, selective catalytic reduction (SCR) technologies, and improved turbocharging are aiding in emissions reduction.Thermal Comfort for Autonomous Vehicles

With the rise of autonomous driving, ensuring passenger thermal comfort is essential. Advanced thermal systems are being developed to provide optimal cabin conditions for passengers while also ensuring the reliable operation of sensors and ADAS components.Modular Thermal Systems

Modular thermal systems are gaining popularity. These systems allow for greater flexibility in vehicle design and manufacturing, making it easier to integrate thermal components into various vehicle models.Integration of Renewable Energy

Automakers are exploring the integration of renewable energy sources, such as solar panels, into thermal systems. Solar-powered ventilation and cooling systems are being incorporated to reduce the load on traditional HVAC systems, especially in hybrid and electric vehicles.Global Passenger Car Thermal System Market is characterized by a transition toward electrification, sustainability initiatives, enhanced passenger comfort, and the integration of smart technologies. These trends are driving the development of more efficient, eco-friendly, and adaptive thermal systems to meet the evolving needs of the automotive industry and its consumers.

Segmental Insights

Vehicle Type Insight

The SUV segment has rapidly become the fastest-growing area in the Passenger Car Thermal System Market due to several pivotal factors. The increasing popularity of SUVs among consumers is a primary driver. These vehicles are favored for their versatility, higher driving position, and spacious interiors, which has led to heightened demand for advanced thermal management systems. Unlike traditional passenger cars, SUVs often feature larger engines and more complex systems that require robust thermal solutions to ensure optimal performance, engine efficiency, and passenger comfort.Modern SUVs come equipped with a plethora of advanced features, including heated and cooled seats, panoramic sunroofs, and extensive infotainment systems. These features increase the complexity of thermal management requirements, driving demand for sophisticated systems that can effectively handle varying thermal loads. As SUVs incorporate more high-tech amenities, the need for enhanced thermal solutions becomes more critical.

In addition to consumer preferences and advanced features, stringent emissions regulations and efficiency standards play a significant role in driving growth in this segment. Automakers must adopt innovative thermal management technologies to meet regulatory requirements while maintaining fuel efficiency and reducing emissions. This regulatory pressure pushes manufacturers to develop and integrate advanced thermal systems into their SUVs.

The trend toward electrification is also influencing the SUV market. As electric and hybrid SUVs become more prevalent, the demand for effective battery thermal management systems increases. These systems are essential for maintaining battery performance and longevity, further propelling growth in the thermal management sector.

The combination of growing consumer demand for SUVs, the need for advanced thermal management to support high-tech features, regulatory pressures, and the rise of electrification trends has positioned SUVs as the fastest-growing segment in the Passenger Car Thermal System Market.

Regional Insights

The Asia-Pacific region dominates the Passenger Car Thermal System Market due to several key factors that drive its leading position. The region is home to some of the world's largest automotive manufacturing hubs, including countries like China, Japan, and South Korea. These countries have a robust automotive industry that drives substantial demand for advanced thermal management systems in passenger vehicles. The high volume of vehicle production and sales in this region significantly contributes to its dominance in the market.Rapid economic growth and urbanization in Asia-Pacific have led to increased vehicle ownership and rising standards of living. As more consumers in the region purchase passenger cars, there is a heightened need for efficient thermal management systems to ensure vehicle performance and comfort. The growing middle class, particularly in emerging markets like India and Southeast Asia, is further fueling demand for advanced thermal solutions.

Stringent environmental regulations and emission standards in countries like China have necessitated the adoption of advanced thermal management technologies. Automakers in the region are required to implement innovative systems to meet regulatory requirements, which drives the demand for sophisticated thermal solutions. This regulatory pressure compels manufacturers to invest in and adopt the latest technologies in thermal management.

Asia-Pacific region is experiencing a significant shift towards electric and hybrid vehicles, which require specialized thermal management systems for battery cooling and overall vehicle efficiency. The increasing adoption of electric vehicles (EVs) and hybrid vehicles in the region has accelerated the demand for advanced thermal solutions tailored to these new technologies.

The combination of large-scale automotive production, rising vehicle ownership, stringent environmental regulations, and the growth of electric and hybrid vehicles makes Asia-Pacific the dominant market in the Passenger Car Thermal System sector.

Key Market Players

- Robert Bosch GmbH

- Dana Incorporated

- MAHLE GmbH

- Gentherm Inc

- Hanon Systems

- DENSO Corporation

- BorgWarner Inc

- Continental AG

- Modine Manufacturing Company

- Schaeffler AG.

Report Scope:

In this report, the Global Passenger Car Thermal System Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Passenger Car Thermal System Market, By Vehicle Type:

- SUV

- MUV

- Sedan

- Hatchback

Passenger Car Thermal System Market, By Application:

- HVAC

- Powertrain Cooling

- Fluid Transport

- Others

Passenger Car Thermal System Market, By Propulsion:

- ICE Vehicles

- Electric Vehicles and Hybrid Vehicles

Passenger Car Thermal System Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Turkey

- Iran

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Passenger Car Thermal System Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- Dana Incorporated

- MAHLE GmbH

- Gentherm Inc

- Hanon Systems

- DENSO Corporation

- BorgWarner Inc

- Continental AG

- Modine Manufacturing Company

- Schaeffler AG.

Table Information

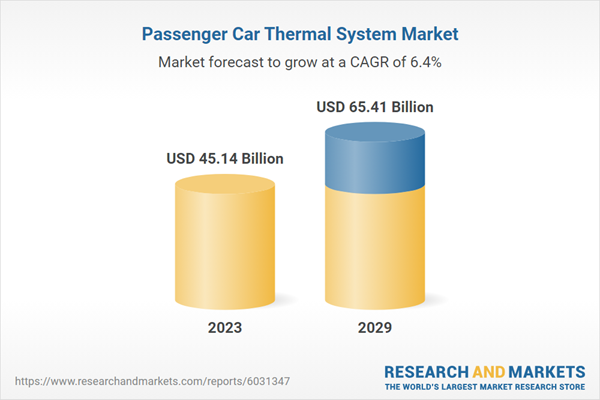

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 45.14 Billion |

| Forecasted Market Value ( USD | $ 65.41 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |