Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Technological Advancements in Manufacturing

One of the primary drivers of the industrial design market in Saudi Arabia is the continuous technological advancement in manufacturing. Over the past few years, Saudi Arabia has witnessed significant investments in modern manufacturing technologies, such as 3D printing, automation, robotics, and artificial intelligence. These technologies have transformed the industrial design landscape by enabling designers to prototype, test, and refine their ideas with greater efficiency, precision, and speed.3D printing, for example, has drastically reduced the cost and time associated with creating prototypes. This allows industrial designers to iterate and optimize designs quickly, improving product functionality and reducing errors before the manufacturing process begins. The ability to produce complex, customized designs at scale has also opened up new opportunities for creating innovative products that cater to specific consumer needs. As Saudi Arabia's manufacturing industry adopts these advanced technologies, the demand for skilled industrial designers has grown. These designers are needed to harness the full potential of new tools and technologies, which further drives market growth.

Automation and robotics have also played a pivotal role in revolutionizing Saudi Arabia's manufacturing capabilities. With automated production lines, the country has been able to scale its manufacturing processes more efficiently and with higher precision. This has resulted in better-quality products, fewer defects, and reduced production costs. Industrial designers are now tasked with ensuring that the products they create are optimized for these advanced manufacturing methods, resulting in designs that are not only functional and aesthetically pleasing but also easily manufacturable at scale.

Artificial intelligence is another area of technological innovation impacting industrial design. AI-driven design software can analyze vast amounts of data and predict trends, helping designers to make more informed decisions about product features, materials, and aesthetics. This has opened the door to smarter and more user-centric products, which resonate with the growing demand for personalized and innovative solutions in Saudi Arabia.

As Saudi Arabia continues to develop its manufacturing infrastructure in line with its Vision 2030 objectives, the industrial design market will expand in response to the adoption of these cutting-edge technologies. The combination of increased automation, AI integration, and 3D printing presents a powerful catalyst for the market, driving the demand for more innovative and efficient industrial design solutions.

Government Initiatives and Vision 2030

Saudi Arabia's Vision 2030 plays a crucial role in shaping the industrial design market by driving economic diversification, technological innovation, and sustainability. As part of Vision 2030, the Saudi government has emphasized the importance of developing local industries, fostering innovation, and investing in non-oil sectors to reduce the country's dependency on petroleum revenues. This transformation has created an environment conducive to the growth of industries such as industrial design, which is seen as a key component in enhancing the competitiveness of Saudi products in both local and global markets.

A critical aspect of Vision 2030 is the push for the development of advanced manufacturing sectors, including the automotive, aerospace, and consumer electronics industries. These sectors require a high level of industrial design expertise to create competitive, high-quality products. The government has actively supported the growth of these sectors by investing in research and development, establishing industrial zones, and offering financial incentives to businesses. This has led to a surge in demand for industrial designers who can contribute to the development of products that meet international standards and consumer expectations. Additionally, Vision 2030 has highlighted the importance of sustainability and eco-friendly initiatives.

The Saudi government is committed to reducing its environmental impact by encouraging the adoption of green technologies and sustainable production practices. In this context, industrial designers in Saudi Arabia are increasingly tasked with creating products that are not only aesthetically appealing but also environmentally sustainable. From using recycled materials to designing energy-efficient products, industrial design is playing a key role in achieving the nation’s sustainability goals. These design innovations are also helping Saudi Arabia improve its global competitiveness by meeting the growing demand for sustainable products from international markets.

The Saudi government's support for education and training in industrial design further strengthens the market's potential. By investing in programs that equip the next generation of designers with the skills necessary to thrive in a rapidly evolving technological landscape, the government ensures that Saudi Arabia will continue to be a hub for innovation and creativity in the industrial design sector.

As Saudi Arabia continues to implement its Vision 2030 goals, the industrial design market is expected to experience robust growth, driven by government-backed initiatives that foster innovation, technological adoption, and sustainability.

Growing Consumer Demand for Innovative and High-Quality Products

Consumer demand for innovative, high-quality products is another significant driver of the industrial design market in Saudi Arabia. As the country’s economy continues to diversify and its middle class grows, there is an increasing demand for products that reflect modern design aesthetics, functionality, and quality. Consumers are becoming more discerning, seeking products that are not only practical but also visually appealing, technologically advanced, and durable.This growing demand for high-quality and innovative products is particularly evident in the consumer electronics, automotive, and furniture sectors. The rise of a young, tech-savvy population in Saudi Arabia is fueling interest in smart devices, wearable technology, and home automation systems. These products require cutting-edge industrial design to integrate the latest technology seamlessly with user-friendly interfaces and visually attractive forms. As consumer expectations evolve, businesses are increasingly looking to industrial designers to create products that stand out in an increasingly competitive marketplace.

The automotive industry is another key sector where innovation and design are essential. Saudi Arabia is one of the largest markets for automobiles in the Middle East, and consumers are increasingly seeking vehicles that offer both high performance and advanced features. The demand for electric vehicles (EVs) and environmentally friendly transportation solutions has further pushed the need for innovative industrial design to ensure that these new products meet consumer expectations while adhering to sustainability goals. This shift in consumer preferences is prompting automakers to invest in design teams that specialize in creating both visually striking and highly functional vehicles.

Moreover, the construction and furniture sectors are experiencing a transformation driven by changing consumer lifestyles and preferences. With increasing demand for stylish, ergonomic, and sustainable home furnishings, industrial designers are being called upon to create furniture that aligns with modern tastes while maximizing functionality and comfort. The growing trend toward urbanization in Saudi Arabia also calls for innovative design solutions for residential and commercial spaces, driving further demand for skilled industrial designers.

As the Saudi consumer market continues to evolve, the demand for products that are aesthetically pleasing, functional, and high-quality is likely to remain a key driver for the industrial design sector. This trend will inspire designers to push the boundaries of creativity and technology, ensuring that the market remains dynamic and responsive to shifting consumer needs.

Key Market Challenges

Lack of Skilled Workforce and Design Education

One of the major challenges facing the industrial design market in Saudi Arabia is the shortage of skilled professionals and the limited scope of design education. While the country is investing heavily in modernizing its industries and diversifying its economy, the demand for highly trained industrial designers often outpaces the supply of qualified talent. This skills gap limits the market's ability to fully realize its potential, as businesses struggle to find professionals who can develop innovative and effective designs for products in various sectors, including automotive, consumer goods, and electronics.The industrial design profession requires a diverse set of skills, including creativity, technical knowledge, and an understanding of manufacturing processes, materials, and user experience. As design technologies evolve, so too must the knowledge and abilities of industrial designers. However, Saudi Arabia’s design education system has struggled to keep pace with these developments. While some universities and institutions offer design-related programs, the curriculum and training do not always align with the rapidly changing needs of the industry.

Many educational programs still focus heavily on traditional design principles, with less emphasis on cutting-edge technologies such as 3D printing, automation, and AI-driven design tools, which are becoming essential in the modern industrial design landscape. Moreover, the relatively young industrial design community in Saudi Arabia has limited experience in handling large-scale projects. Many of the country’s top designers are relatively new to the field or have studied abroad and may not be fully aware of the local market's unique needs and challenges. This results in a mismatch between the skills offered by the workforce and the specific demands of the Saudi market, which is increasingly focused on innovation, sustainability, and high-quality production.

To bridge this skills gap, Saudi Arabia needs to invest more in industrial design education and training programs that incorporate the latest tools and technologies. Collaborations between universities and industry stakeholders can help ensure that the curriculum aligns with market demands. Additionally, efforts to attract global design talent and offer incentives for professionals to work in the Kingdom can help raise the overall standard of industrial design in the country. Until this gap is addressed, Saudi Arabia's industrial design market will continue to face challenges in meeting the growing demand for innovative, high-quality products.

Challenges in Sustainability and Material Innovation

Another significant challenge facing the Saudi Arabian industrial design market is the difficulty in sourcing sustainable materials and integrating eco-friendly design practices into product development. Saudi Arabia, like many other nations, is under increasing pressure to reduce its environmental impact and transition toward more sustainable manufacturing processes. However, the availability and cost of sustainable materials are often limited, and businesses are frequently faced with the challenge of balancing environmental goals with economic viability.Sustainability is a key driver of innovation in industrial design globally, but in Saudi Arabia, the challenge is particularly pronounced due to the country’s dependence on the petrochemical industry, which supplies many of the raw materials used in manufacturing. The majority of materials traditionally used in product design, such as plastics and synthetic fibers, are derived from petroleum, which contributes to environmental degradation. While there has been a growing push to find alternative materials, such as biodegradable plastics, recycled materials, and plant-based options, these alternatives are often less readily available or more expensive than conventional materials.

As a result, many designers and manufacturers struggle to balance the economic constraints of production with the environmental goals of sustainability. Furthermore, the local supply chain for sustainable materials is still in its infancy. Although the Saudi government has made strides to promote sustainability through initiatives like Vision 2030, there is still a lack of infrastructure to support widespread use of green materials in industrial design. Many materials that are considered environmentally friendly, such as recycled metals or sustainable wood, are either not produced domestically or are difficult to source in sufficient quantities. This results in reliance on international suppliers, which can increase costs and complicate logistics for local businesses. Additionally, the lack of standardized certifications for sustainable materials further complicates the design process, as designers must navigate varying regulations and quality standards.

While there is growing interest in environmentally responsible design, the transition to sustainability is slow. Industrial designers in Saudi Arabia are often forced to make trade-offs between using sustainable materials and keeping production costs competitive. The lack of available sustainable options, coupled with the need for more robust supply chains, means that many products are still being designed and produced using traditional, less eco-friendly materials.

To overcome this challenge, Saudi Arabia must focus on developing local sources of sustainable materials, expanding recycling programs, and incentivizing manufacturers to invest in eco-friendly technologies. As the global demand for sustainable products increases, addressing these material shortages will be crucial for the growth and competitiveness of the industrial design market in Saudi Arabia. Until these obstacles are addressed, the sector will continue to face difficulties in fully embracing sustainability in design.

Key Market Trends

Increased Focus on Sustainability and Green Design

Sustainability has become one of the most significant trends shaping the Saudi Arabian industrial design market. As the country works to diversify its economy and reduce its dependency on oil, there is a growing emphasis on sustainable practices across all industries, including industrial design. The Saudi government’s Vision 2030 highlights the importance of sustainability in its national development plans, and this has trickled down to the industrial design sector, where there is a rising demand for eco-friendly products and solutions.In recent years, industrial designers in Saudi Arabia have been increasingly tasked with creating products that reduce environmental impact. This includes designing products using renewable or recyclable materials, optimizing energy consumption, and ensuring that products can be easily disassembled for recycling at the end of their life cycle. Designers are also innovating to reduce waste during production processes by adopting lean manufacturing principles and using 3D printing technology to minimize material use.

The automotive industry in Saudi Arabia, for example, is experiencing a shift toward electric vehicles (EVs) and hybrid cars, which require new design approaches focused on energy efficiency and sustainable materials. Designers are exploring the use of alternative materials such as biodegradable plastics, recycled metals, and sustainable wood to reduce the carbon footprint of these vehicles. Similarly, the rise of eco-friendly consumer products, including electronics and packaging, reflects this broader trend toward environmental responsibility in design.

Furthermore, the demand for green building materials is on the rise in Saudi Arabia, particularly as the country invests in new infrastructure projects and urban developments. Sustainable designs for residential, commercial, and industrial buildings that optimize energy use and incorporate renewable energy solutions like solar power are becoming more common. Industrial designers are integrating sustainable materials into their designs while collaborating with architects and engineers to ensure that the entire building lifecycle is as environmentally friendly as possible.

With global and domestic consumers becoming more environmentally conscious, Saudi Arabia’s industrial design market is expected to continue leaning heavily into sustainability. The trend toward green design is anticipated to gain further momentum as the country strengthens its commitment to reducing carbon emissions and advancing green technology under Vision 2030.

Integration of Smart Technologies and the Internet of Things (IoT)

The increasing integration of smart technologies and the Internet of Things (IoT) is another key trend driving the industrial design market in Saudi Arabia. As the country moves toward a more technologically advanced and digitally connected future, industrial designers are increasingly incorporating IoT solutions into consumer and industrial products. This shift is driven by consumer demand for more intuitive, connected products, as well as Saudi Arabia’s push toward digital transformation under its Vision 2030 initiative.Smart devices and IoT-enabled products have gained significant popularity in Saudi Arabia, particularly in the consumer electronics and home automation markets. Industrial designers are tasked with creating sleek, functional designs that seamlessly integrate advanced technologies such as sensors, connectivity, and artificial intelligence (AI) while ensuring ease of use and aesthetic appeal. Examples include smart home products like connected thermostats, security systems, and lighting solutions, as well as wearable technology like smartwatches and fitness trackers. These products not only require innovation in terms of functionality but also need designs that fit within the modern consumer’s lifestyle.

In the automotive sector, the demand for connected and autonomous vehicles is growing. Industrial designers are now working closely with engineers to design vehicles that incorporate smart technologies such as advanced driver-assistance systems (ADAS), infotainment systems, and connectivity features. These technologies enhance the driving experience by providing real-time information, improving safety, and increasing convenience. Designers must balance the technological complexity with a user-friendly interface and an attractive exterior to ensure that these vehicles appeal to consumers.

Another area where IoT integration is becoming more prominent is in the industrial sector. Saudi Arabia’s manufacturing and oil industries are adopting IoT technologies for predictive maintenance, supply chain optimization, and enhanced operational efficiency. Industrial designers are playing a critical role in designing the interfaces, controls, and displays of these smart products, ensuring that they are functional, reliable, and easy to use in complex industrial environments.

As IoT technologies become more ingrained in everyday life and business operations, the demand for industrial designers who can create smart, connected products is expected to grow. This trend represents a significant opportunity for the Saudi industrial design market to align with global technological advancements, making products more innovative and competitive in both local and international markets.

Customization and Personalization in Product Design

The trend toward customization and personalization in product design is gaining significant traction in Saudi Arabia, mirroring global consumer desires for more tailored, unique products. As consumers in Saudi Arabia become more discerning and value individualism, the demand for products that reflect personal preferences is on the rise. This trend is particularly evident in sectors like consumer electronics, automotive, fashion, and furniture, where customization options are increasingly offered to cater to diverse tastes and needs.In the automotive industry, for example, Saudi consumers are seeking vehicles that allow for personalization in terms of features, finishes, and even design elements. Car manufacturers are responding by offering customized interiors, exterior colors, and technology options that allow consumers to build a car that fits their exact specifications. Industrial designers play a key role in ensuring that these customization options are seamlessly integrated into the design process while maintaining the brand’s identity and ensuring product functionality.

Similarly, the rise of e-commerce and online platforms in Saudi Arabia has led to an increase in demand for personalized consumer products. Consumers now have access to a wide range of customized products, from clothing and accessories to home decor and electronics. Designers are leveraging technologies like 3D printing and digital fabrication to produce products that can be easily modified to suit individual preferences. In the furniture sector, for example, consumers can now select everything from materials to dimensions to create furniture pieces that perfectly match their tastes and living spaces.

In the realm of fashion, customization is becoming a major trend, with consumers increasingly seeking clothing and accessories that reflect their personal styles. Industrial designers are responding by exploring new ways to create adaptable and customizable fashion items, incorporating modular components or offering design choices that allow for more flexible and personalized products.

As demand for personalized products continues to grow, the industrial design market in Saudi Arabia is expected to see an increasing focus on creating flexible, customizable designs that can cater to individual consumer preferences. This trend not only boosts consumer satisfaction but also presents opportunities for designers to innovate and explore new ways of combining aesthetics, functionality, and personalization in product design.

Segmental Insights

Component Insights

The Services held the largest market share in 2023. Services dominate the Saudi Arabia industrial design market due to the highly customized and complex nature of design projects across various sectors, such as automotive, construction, consumer electronics, and healthcare. In these industries, companies require specialized expertise to create innovative, functional, and market-competitive products. Industrial design services include consulting, product development, prototyping, user experience design, and engineering solutions that address unique customer needs, local market demands, and regulatory requirements.Saudi Arabian industries often need tailored design solutions that align with global trends and the country's Vision 2030 goals of diversification and innovation. Designers work closely with manufacturers to ensure that products are not only aesthetically appealing but also manufacturable, cost-effective, and sustainable. This highly collaborative approach necessitates services that provide hands-on support throughout the entire design process, from initial concept to final product realization.

The growing demand for sustainability and smart technologies further fuels the need for design services, as companies seek expertise in integrating eco-friendly materials, smart features, and advanced manufacturing processes like 3D printing and automation.

While software tools like CAD are integral to the design process, they primarily support the creative and technical work of designers. As such, the service-oriented nature of industrial design, requiring specialized knowledge and ongoing collaboration, remains the dominant component of the Saudi Arabian market.

Regional Insights

Riyadh held the largest market share in 2023. Riyadh, the capital city of Saudi Arabia, dominated the country's industrial design market due to its central role in the nation's economic, political, and industrial landscape. As the hub of government activities and the center of Vision 2030 initiatives, Riyadh attracts significant investment in infrastructure, manufacturing, and technology sectors, creating a high demand for industrial design services. The city’s emphasis on modernization and innovation fosters a thriving ecosystem for industrial design professionals, with major sectors like automotive, construction, healthcare, and consumer electronics investing heavily in product development and design solutions.Riyadh is also home to many global companies and multinational corporations that establish their regional headquarters there, driving demand for cutting-edge industrial design. These organizations require advanced design capabilities for both local production and export markets. Furthermore, Riyadh’s growing focus on technological advancements, including smart city projects and sustainability, creates an environment ripe for industrial design innovation, particularly in areas such as smart products, green building materials, and connected devices. Additionally, the availability of world-class educational institutions and design agencies in Riyadh nurtures a skilled workforce, providing a solid foundation for the region’s dominance. The concentration of infrastructure development projects and a strong business environment make Riyadh the natural leader in Saudi Arabia's industrial design market.

Key Market Players

- IDEO

- Pentagram Design, Inc

- Gaiadigital Design Private Limited

- Ziba Design Inc.

- Teague

- RKS Design Inc.

- Steelcase Inc.

- Smart Design LLC

Report Scope:

In this report, the Saudi Arabia Industrial Design Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Industrial Design Market, By Component:

- Software

- Services

Saudi Arabia Industrial Design Market, By Deployment:

- Cloud

- On-Premises

Saudi Arabia Industrial Design Market, By Application:

- Automotive

- Machinery & Equipment

- Consumer Goods

- Healthcare

- Others

Saudi Arabia Industrial Design Market, By Region:

- Riyadh

- Makkah

- Madinah

- Eastern Province

- Dammam

- Rest of Saudi Arabia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Industrial Design Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- IDEO

- Pentagram Design, Inc

- Gaiadigital Design Private Limited

- Ziba Design Inc.

- Teague

- RKS Design Inc.

- Steelcase Inc.

- Smart Design LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 86 |

| Published | November 2024 |

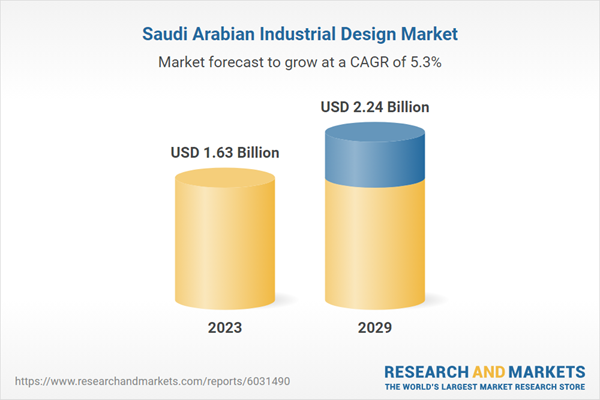

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 1.63 Billion |

| Forecasted Market Value ( USD | $ 2.24 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 8 |