Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Consumer Demand

As consumer preferences evolve towards healthier and more specialized dairy products, there is a heightened demand for enzymes that can enhance product quality, nutritional content, and overall consumer satisfaction. The expanding consumer base, driven by population growth and rising disposable incomes, creates a larger market for dairy products. Enzymes play a pivotal role in meeting this demand by enabling manufacturers to produce diverse dairy offerings efficiently and economically. Consumer demand encourages dairy processors to innovate and differentiate their products.Enzymes facilitate the development of unique textures, flavors, and nutritional profiles in dairy products, catering to varied consumer preferences and enhancing market competitiveness. Increasing awareness of health benefits associated with dairy consumption prompts consumers to seek products with reduced fat, lactose, or enhanced nutritional value. Enzymes enable manufacturers to address these trends by modifying dairy compositions while maintaining product integrity.

Enzymes contribute to consistent product quality and safety standards, crucial for gaining consumer trust in dairy products. This reliability in product performance reinforces consumer loyalty and drives repeat purchases, further stimulating market growth. Enzyme technologies improve processing efficiency, reduce production costs, and minimize waste in dairy manufacturing processes.

This efficiency enhancement supports scalability in production to meet growing consumer demand effectively. Increasing consumer demand acts as a catalyst for innovation and market expansion within the Indian dairy enzymes sector. It drives manufacturers to adopt advanced enzyme technologies that not only meet current consumer preferences but also anticipate future market trends and regulatory requirements. This proactive approach positions the industry for sustained growth and competitiveness in the evolving dairy market landscape.

Technological Advancements

Technological innovations enable the development of enzymes with enhanced specificity and efficiency in dairy processing. These enzymes can catalyze biochemical reactions more effectively, reducing processing time and improving overall production efficiency. Cutting-edge technologies facilitate better process control and automation in dairy production facilities. Enzymes optimized for specific applications, such as cheese-making or yogurt production, streamline operations by ensuring consistent product quality and minimizing production variability. Novel enzyme formulations allow dairy manufacturers to achieve desired textures and flavors in products like cheese, yogurt, and desserts. This capability not only meets consumer preferences but also enables the creation of premium and differentiated dairy offerings.Technological advancements in enzyme technology enable fortification of dairy products with beneficial nutrients. Enzymes can be used to enhance protein digestibility, reduce lactose content for lactose-intolerant consumers, or improve the bioavailability of vitamins and minerals, aligning with growing demand for functional foods. Advanced enzymes contribute to more efficient utilization of raw materials by optimizing milk protein and fat breakdown during processing. This reduces waste and improves overall resource efficiency in dairy production. Innovations in enzyme technology often lead to processes that require less energy and water, thereby lowering operational costs and environmental impact. This sustainability aspect is increasingly important as consumers and regulators prioritize eco-friendly practices.

Modern enzyme technologies comply with stringent regulatory requirements for food safety and quality. Manufacturers adopting these technologies benefit from enhanced compliance and credibility in both domestic and international markets. Companies leveraging advanced enzyme solutions gain a competitive edge by offering superior product consistency, nutritional benefits, and sustainability credentials. This differentiation is crucial in capturing market share amid intensifying competition within the dairy industry. Continued investment in research and development is expected to drive further innovation in enzyme technology for dairy applications in India. As consumer preferences evolve towards healthier, more sustainable food choices, technological advancements will play a pivotal role in shaping the future growth trajectory of the Indian dairy enzymes market, fostering a dynamic environment for innovation and market expansion.

Health and Wellness Trends

Growing awareness of health benefits associated with dairy consumption, such as protein enrichment, digestive health improvement, and reduced lactose content, drives demand for dairy products enhanced with enzymes. Enzymes like lactase cater to lactose-intolerant consumers, expanding market reach.Consumers increasingly seek natural and minimally processed food options. Enzymes derived from natural sources, used to fortify dairy products or improve their nutritional profiles, align with these preferences and enhance product appeal. Enzyme technologies enable the fortification of dairy products with essential nutrients like vitamins, minerals, and probiotics. This enhances the nutritional value of dairy offerings, meeting the demand for functional foods that support overall health and well-being. Enzymes play a role in modifying dairy products to reduce fat and sugar content while maintaining taste and texture. Products catering to health-conscious consumers benefit from these innovations, driving market growth.

Enzyme technologies comply with regulatory standards for food safety and quality assurance. This ensures consumer confidence in the safety and efficacy of enzyme-enhanced dairy products, supporting market expansion. Effective communication of the health benefits associated with enzyme-enhanced dairy products reinforces consumer perception and encourages adoption. Brands that successfully convey these messages gain competitive advantage in the market.

Enzyme-enhanced dairy products often command premium pricing due to their added health benefits and nutritional value. This supports market growth by catering to a segment of consumers willing to pay more for health-oriented products. Companies investing in health-driven innovations and transparent communication build strong brand loyalty and trust among health-conscious consumers.

This enhances market penetration and sustains growth momentum. As health and wellness trends continue to evolve, the Indian dairy enzymes market is poised for further expansion. Continued innovation in enzyme technologies, coupled with strategic product positioning aligned with consumer health preferences, will be crucial in driving growth and differentiation within the competitive dairy industry landscape. Meeting these evolving consumer demands presents opportunities for market players to capitalize on and foster sustainable business growth in the coming years.

Key Market Challenges

Cost Constraints

The adoption of advanced enzyme technologies requires significant initial investment in research, development, and implementation. This upfront cost can be prohibitive for smaller dairy processors or new entrants in the market, limiting their ability to leverage enzyme-driven innovations.Enzymes themselves can be costly, particularly specialized enzymes used for specific dairy applications such as cheese-making or lactose reduction. Price sensitivity among consumers and manufacturers alike poses a challenge in achieving widespread adoption, especially in a price-sensitive market like India.

Regulatory Hurdles

Enzyme products used in dairy processing must comply with stringent regulatory standards for safety, efficacy, and labeling. Obtaining necessary approvals from regulatory authorities can be a lengthy and complex process, delaying product launches and market entry.Changes in regulatory requirements or delays in approvals can disrupt supply chains and affect market strategies. Navigating these uncertainties requires dedicated resources and expertise in regulatory affairs, adding complexity to market operations.

Infrastructure and Logistics

Enzyme products often require specific storage conditions, including temperature control, to maintain efficacy and stability. Inadequate cold chain infrastructure in certain regions of India can pose logistical challenges and impact product quality during storage and transportation.Efficient distribution networks are essential for timely delivery of enzyme products to dairy processors across diverse geographical areas. Poor infrastructure, including road connectivity and logistics services, can hinder distribution efficiency and increase operational costs.

Key Market Trends

Sustainability Initiatives

Enzyme technologies contribute to sustainable dairy production by reducing energy consumption, water usage, and waste generation. As environmental concerns become more prominent, the adoption of enzyme-based solutions offers dairy processors a way to improve sustainability credentials and meet consumer preferences for eco-friendly products.Enzymes optimize the utilization of raw materials, such as milk proteins and fats, leading to reduced production waste and improved resource efficiency. This not only lowers operational costs but also supports sustainable practices throughout the dairy supply chain.

Market Expansion and Consumer Education

With increasing urbanization and changing dietary habits, there is a widening consumer base for dairy products in India. Enzyme-enhanced dairy products appeal to a diverse demographic seeking convenient, nutritious, and high-quality food options, thereby expanding market opportunities.Educating consumers about the benefits of enzyme-enhanced dairy products will be crucial for driving market adoption. Marketing efforts that highlight the health benefits, improved taste, and sustainability advantages of these products can help build consumer trust and loyalty in the long term.

Segmental Insights

Type Insights

Based on the category of type, the Chymosin segment emerged as the dominant in the market for India Dairy Enzymes in 2024. Chymosin plays a critical role in the coagulation of milk proteins, specifically casein, during the cheese-making process. It acts on κ-casein, a milk protein, to form a stable curd structure necessary for cheese formation. This process is essential for achieving desired texture, flavor, and consistency in various types of cheese. Traditionally, chymosin was sourced from the stomach lining of young calves (rennet). However, due to ethical concerns and supply limitations, microbial chymosin produced through biotechnological methods has gained prominence. This microbial chymosin offers advantages such as consistency, purity, and suitability for vegetarian and halal cheese production, aligning with diverse consumer preferences in India.The Indian cheese market has been expanding due to increasing urbanization, rising disposable incomes, and changing dietary preferences. Consumers are incorporating cheese into their diets for culinary purposes, as well as for its perceived nutritional benefits, driving demand for efficient and reliable cheese-making enzymes like chymosin. Advances in enzyme engineering have led to the development of highly efficient and cost-effective microbial chymosin variants. These enzymes offer superior coagulation properties, reduce processing time, and enhance yield and product consistency, thereby appealing to cheese manufacturers seeking to optimize production processes and meet growing market demands.

Chymosin enzymes used in cheese production must comply with stringent regulatory standards for food safety and quality. Regulatory approval processes ensure that enzyme products meet specified criteria for efficacy, purity, and consumer safety, which are crucial for market acceptance and commercialization. Chymosin dominates the cheese-making segment of the Indian dairy enzymes market due to its established role in traditional cheese production methods and its adaptation to modern technological advancements. The availability of microbial chymosin variants has further facilitated its widespread adoption across various cheese types, including soft cheeses like paneer and hard cheeses like cheddar and mozzarella. These factors collectively contribute to the growth of this segment.

Regional Insights

North India emerged as the dominant in the India Dairy Enzymes market in 2024, holding the largest market share in terms of value. The northern states of India, including Punjab, Haryana, Uttar Pradesh, and Delhi, exhibit significant consumption of dairy products, particularly cheese. This region has a strong culinary tradition that includes various types of paneer (Indian cheese) and other dairy-based dishes. Traditional cheese-making practices, such as using chymosin (originally sourced from animal rennet), have historical roots in these areas. Although there's a shift towards microbial chymosin due to ethical concerns and regulatory preferences, the northern region continues to value traditional methods, influencing market dynamics.Key Market Players

- DuPont de Nemours, Inc

- Novonesis Group

- Kerry Group plc

- Koninklijke DSM N.V.

- Advanced Enzyme Technologies Limited

- Phytozymes Biotech (PB)

- Caldic B.V.

Report Scope:

In this report, the India Dairy Enzymes Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Dairy Enzymes Market, By Type:

- Lactase

- Chymosin

- Rennet

- Lipase

- Others

India Dairy Enzymes Market, By Application:

- Milk

- Cheese

- Ice-Cream & Desserts

- Yogurt

- Whey

- Infant Formula

- Others

India Dairy Enzymes Market, By Source:

- Plant

- Animal Microorganisms

India Dairy Enzymes Market, By Region:

- North India

- South India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Dairy Enzymes Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- DuPont de Nemours, Inc

- Novonesis Group

- Kerry Group plc

- Koninklijke DSM N.V.

- Advanced Enzyme Technologies Limited

- Phytozymes Biotech (PB)

- Caldic B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | December 2024 |

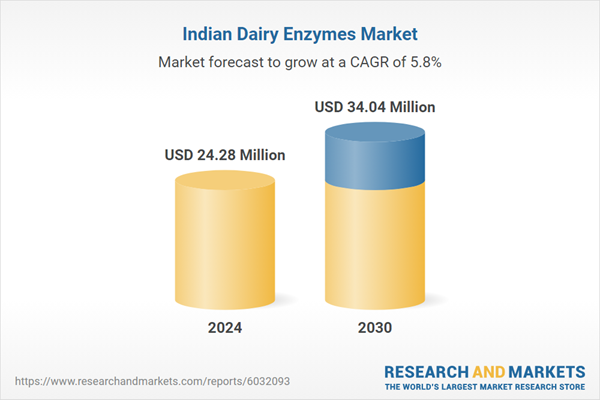

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 24.28 Million |

| Forecasted Market Value ( USD | $ 34.04 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 7 |