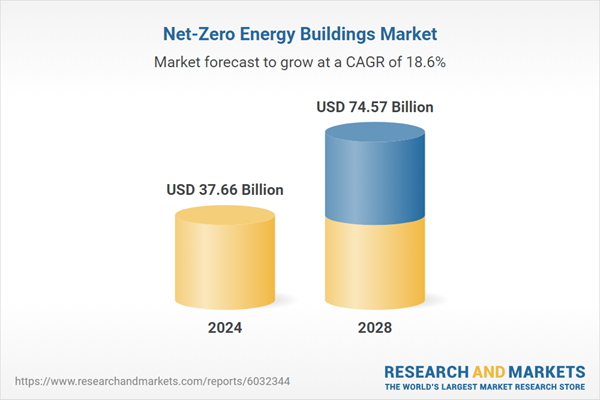

The net-zero energy buildings market size is expected to see rapid growth in the next few years. It will grow to $74.57 billion in 2028 at a compound annual growth rate (CAGR) of 18.6%. The anticipated growth during the forecast period can be attributed to several factors, including a growing emphasis on sustainability and environmental protection, an increase in environmentally friendly construction solutions, rising government initiatives aimed at reducing carbon emissions, increasing temperatures, and a rising population. Key trends expected in this period include innovations in energy-efficient building techniques, advancements in renewable energy technology, new developments in sustainable building practices, the adoption of green technologies, and the integration of advanced building design concepts.

The growing demand for renewable energy sources is anticipated to drive the expansion of the net-zero energy buildings market in the future. Renewable energy sources, including solar, wind, and hydropower, are naturally replenished over time. The rising demand for these sources is influenced by factors such as social contagion, decentralized energy generation, corporate commitments, public health awareness, and efforts to mitigate climate change. Net-zero energy buildings are designed to minimize energy consumption through efficient construction and design while generating renewable energy on-site to meet their energy needs. These buildings serve as a benchmark for energy efficiency and environmental responsibility, playing a crucial role in the transition to a more sustainable future. For example, a report from the Department of Energy, a US government agency, projected that domestic solar energy generation would increase by 75%, rising from 163 billion kilowatt-hours (kWh) in 2023 to 286 billion kWh in 2025. Thus, the growing adoption of renewable energy sources is fueling the net-zero energy buildings market.

Leading companies in the net-zero energy buildings sector are focusing on creating innovative solutions, such as open AI-enabled suites, to enhance energy efficiency, optimize building management, and reduce carbon emissions. These open AI-enabled suites are integrated systems that leverage open AI technologies to optimize and manage different aspects of buildings targeting net-zero energy consumption. Typically, these suites utilize artificial intelligence and machine learning algorithms to improve energy efficiency, sustainability, and overall building performance. For instance, in June 2022, Siemens AG, a German automation company, launched Building X, a groundbreaking open AI-enabled suite designed to support the development of net-zero buildings. This suite is part of the Siemens Xcelerator initiative, which aims to simplify digital transformation across various sectors, including building management. Its modular and scalable design facilitates the seamless integration of different building systems, helping to simplify the management of building operations and advance the transition toward net-zero emissions.

In May 2023, Vantem Global Inc., a US-based company known for its innovative construction technologies, acquired Affinity Building Systems LLC for an undisclosed amount. This acquisition represents Vantem's strategic initiative to expand its portfolio by integrating Affinity Building's expertise in developing net-zero energy buildings. Affinity Building Systems LLC specializes in providing innovative solutions for constructing net-zero energy buildings.

Major companies operating in the net-zero energy buildings market are Hitachi Ltd., Siemens AG, General Electric Company, Panasonic Corporation, Schneider Electric SE, Mitsubishi Electric Corporation, Honeywell International Inc., Deutsche Bank AG, Daikin Industries Ltd., Johnson Controls Inc., Carrier Global Corporation, Trane Technologies PLC, Skanska AB, Mahindra Group, Kingspan Group PLC, Lendlease Corp, Rockwool Group, CannonDesign Inc., Integral Group Inc., GI Quo Vadis Inc.

North America was the largest region in the net-zero energy buildings market in 2023. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the net-zero energy buildings market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the net-zero energy buildings market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A net-zero energy building (NZEB) is designed to produce as much energy as it consumes over the course of a year. This energy balance is achieved through a combination of energy efficiency measures and the use of renewable energy sources, such as solar panels and wind turbines. The primary goal of a net-zero energy building is to minimize greenhouse gas emissions and reduce dependence on non-renewable energy, thereby supporting sustainable building practices.

The main types of equipment used in net-zero energy buildings include lighting, walls and roofs, heating, ventilation, and air conditioning (HVAC) systems, among others. Lighting involves the use of artificial light sources to illuminate spaces, enhancing visibility and creating an inviting atmosphere. The various services offered encompass software solutions, consulting, and design across different construction phases, including new construction, renovation or retrofitting, and hybrid approaches. Additionally, the integration of various technologies includes passive design strategies, energy-efficient systems, and renewable energy sources. These solutions are utilized by a range of end-users, including residential and non-residential sectors.

The net-zero energy buildings market research report is one of a series of new reports that provides net-zero energy buildings market statistics, including net-zero energy buildings industry global market size, regional shares, competitors with a net-zero energy buildings market share, detailed net-zero energy buildings market segments, market trends, and opportunities, and any further data you may need to thrive in the net-zero energy buildings industry. This net-zero energy buildings market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The net-zero energy buildings market consists of revenues earned by entities by providing energy generation services, energy storage services, energy efficiency services, smart building technologies and related water conservation and management services. The market value includes the value of related goods sold by the service provider or included within the service offering. The net-zero energy buildings market also includes sales of high-performance insulation, energy-efficient windows, led lighting, and smart thermostats. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Net-Zero Energy Buildings Global Market Report 2024 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on net-zero energy buildings market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the COVID-19 and how it is responding as the impact of the virus abates.

- Assess the Russia - Ukraine war’s impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for net-zero energy buildings? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The net-zero energy buildings market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The impact of sanctions, supply chain disruptions, and altered demand for goods and services due to the Russian Ukraine war, impacting various macro-economic factors and parameters in the Eastern European region and its subsequent effect on global markets.

- The impact of higher inflation in many countries and the resulting spike in interest rates.

- The continued but declining impact of COVID-19 on supply chains and consumption patterns.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Equipment: Lighting; Walls And Roofs; Heating, Ventilation, And Air Conditioning (HVAC) Systems; Other Equipment2) By Service: Software; Consulting And Designing

3) By Construction Phase: New Construction; Renovation Or Retrofit; Hybrid Approach

4) By Technology Integration: Passive Design Strategies; Energy-Efficient Systems; Renewable Energy Sources

5) By End-User: Residential; Non-Residential

Key Companies Mentioned: Hitachi Ltd.; Siemens AG; General Electric Company; Panasonic Corporation; Schneider Electric SE

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies profiled in this Net-Zero Energy Buildings market report include:- Hitachi Ltd.

- Siemens AG

- General Electric Company

- Panasonic Corporation

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Deutsche Bank AG

- Daikin Industries Ltd.

- Johnson Controls Inc.

- Carrier Global Corporation

- Trane Technologies PLC

- Skanska AB

- Mahindra Group

- Kingspan Group PLC

- Lendlease Corp

- Rockwool Group

- CannonDesign Inc.

- Integral Group Inc.

- GI Quo Vadis Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | December 2024 |

| Forecast Period | 2024 - 2028 |

| Estimated Market Value ( USD | $ 37.66 Billion |

| Forecasted Market Value ( USD | $ 74.57 Billion |

| Compound Annual Growth Rate | 18.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |