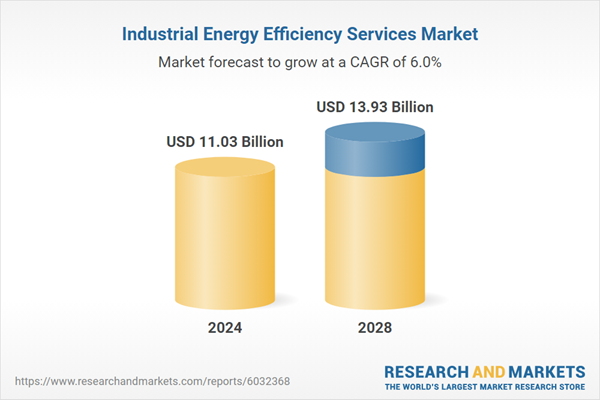

The industrial energy efficiency services market size is expected to see strong growth in the next few years. It will grow to $13.93 billion in 2028 at a compound annual growth rate (CAGR) of 6%. The anticipated growth in the forecast period can be attributed to factors such as rising energy prices, increased awareness of climate change, government energy policies, energy efficiency standards, and enhanced industrial competitiveness. Key trends expected during this period include technological advancements, a growing demand for energy management solutions, the emergence of smart cities, the formation of partnerships and collaborations, and the adoption of distributed energy resources (DER).

The increasing emphasis on decarbonization is expected to drive the growth of the industrial energy efficiency services market in the future. Decarbonization refers to the process of reducing or eliminating carbon dioxide (CO₂) emissions across various sectors of the economy, particularly in energy production, transportation, and industry. This focus on decarbonization is fueled by the urgent need to combat climate change and the rising regulatory pressures requiring lower greenhouse gas emissions. Industrial energy efficiency services are vital to this effort, assisting industries in reducing their energy consumption, decreasing greenhouse gas (GHG) emissions, and transitioning to cleaner, more sustainable practices. For example, in April 2024, the United States Department of Energy reported on a blueprint aimed at decarbonizing U.S. buildings, which targets a 65% reduction in greenhouse gas emissions by 2035 and a 90% reduction by 2050. Thus, the growing focus on decarbonization is propelling the industrial energy efficiency services market.

Leading companies in the industrial energy efficiency services market are concentrating on developing innovative solutions, such as industrial energy-efficient manufacturing technologies, to enhance their offerings and meet the increasing demand for sustainable solutions. These technologies refer to advanced methods and systems aimed at reducing energy consumption and improving efficiency in manufacturing processes. For instance, in August 2024, VTT Technical Research Centre of Finland, a limited liability company based in Finland, launched the Energy First initiative, a collaborative project aimed at developing sustainable, energy-efficient, and recyclable fiber-based products for the forestry and textile sectors. This initiative seeks to address major challenges related to energy and resource consumption in these industries, with primary goals of reducing water use by up to 90% and energy consumption by 50%, while also creating viable alternatives for cardboard packaging, hygiene products, and non-woven fabrics. The initiative aligns with EU sustainability directives, enhancing resource efficiency and promoting recyclable materials in the forestry and textile sectors.

In July 2023, EMCOR Group Inc., a U.S.-based mechanical and electrical construction company, acquired ECM Holding Group LLC for an undisclosed amount. This acquisition aims to strengthen EMCOR Group's energy efficiency specialty services and expand its sustainability solutions by utilizing ECM's expertise and client relationships, thus providing a more comprehensive range of services. ECM Holding Group LLC is a U.S.-based cleantech contractor specializing in industrial energy efficiency services.

Major companies operating in the industrial energy efficiency services market are Enel Spa, Electricite de France SA, Tata Group, Engie SA, Siemens AG, Schneider Electric, Mitsubishi Electric Corporation, Honeywell International Inc., KPMG International Limited, Johnson Controls, Trane Technologies plc, AECOM Technology Corporation, Bain & Company, DuPont de Nemours Inc., WSP Global Inc., Dalkia, DNV Group AS, Ameresco Inc., Voltas Limited, SGS Group, Getec, Alien Energy Private Limited, Smart Joules Private Limited, Econoler Inc.

North America was the largest region in the industrial energy efficiency services market in 2023. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the industrial energy efficiency services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the industrial energy efficiency services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Industrial energy efficiency services encompass a variety of solutions and practices designed to assist industries in reducing their energy consumption and enhancing overall energy efficiency. These services enable companies to lower operating costs, decrease carbon emissions, and meet environmental regulations by pinpointing areas of energy waste and implementing strategies to mitigate it.

The primary types of industrial energy efficiency services include energy auditing or consulting, product and system optimization, monitoring and verification, and energy management software. Energy auditing or consulting involves assessing a facility's energy usage to identify inefficiencies and suggest improvements. This service includes various formats, such as outsourced and in-house options, and caters to a broad range of applications across industries such as petrochemical, chemical, electric power, textiles, building materials, mining, manufacturing, and food and beverages. Additionally, it serves a diverse array of end-users in both commercial and industrial sectors.

The industrial energy efficiency services market research report is one of a series of new reports that provides industrial energy efficiency services market statistics, including industrial energy efficiency services industry global market size, regional shares, competitors with an industrial energy efficiency services market share, detailed industrial energy efficiency services market segments, market trends and opportunities, and any further data you may need to thrive in the industrial energy efficiency services industry. This industrial energy efficiency services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The industrial energy efficiency services market includes revenues earned by entities by providing services such as energy audits and assessments, process optimization, equipment upgrades, waste heat recovery, and power factor correction. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Industrial Energy Efficiency Services Global Market Report 2024 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on industrial energy efficiency services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the COVID-19 and how it is responding as the impact of the virus abates.

- Assess the Russia - Ukraine war’s impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for industrial energy efficiency services? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The industrial energy efficiency services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The impact of sanctions, supply chain disruptions, and altered demand for goods and services due to the Russian Ukraine war, impacting various macro-economic factors and parameters in the Eastern European region and its subsequent effect on global markets.

- The impact of higher inflation in many countries and the resulting spike in interest rates.

- The continued but declining impact of COVID-19 on supply chains and consumption patterns.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Energy Auditing Or Consulting; Product And System Optimization; Monitoring And Verification; Energy Management Software2) By Service Type: Outsourced; In-House

3) By Application: Petrochemical; Chemical Industry; Electric Power; Textile; Building Materials; Mining; Manufacturing; Food And Beverage

4) By End-User: Commercial; Industrial

Key Companies Mentioned: Enel Spa; Electricite de France SA; Tata Group; Engie SA; Siemens AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies profiled in this Industrial Energy Efficiency Services market report include:- Enel Spa

- Electricite de France SA

- Tata Group

- Engie SA

- Siemens AG

- Schneider Electric

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- KPMG International Limited

- Johnson Controls

- Trane Technologies plc

- AECOM Technology Corporation

- Bain & Company

- DuPont de Nemours Inc.

- WSP Global Inc.

- Dalkia

- DNV Group AS

- Ameresco Inc.

- Voltas Limited

- SGS Group

- Getec

- Alien Energy Private Limited

- Smart Joules Private Limited

- Econoler Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | December 2024 |

| Forecast Period | 2024 - 2028 |

| Estimated Market Value ( USD | $ 11.03 Billion |

| Forecasted Market Value ( USD | $ 13.93 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |