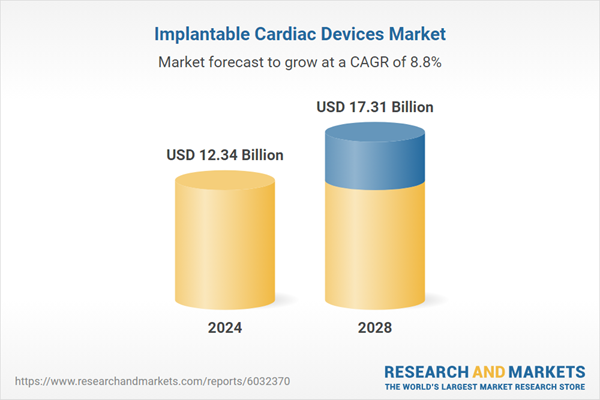

The implantable cardiac devices market size is expected to see strong growth in the next few years. It will grow to $17.31 billion in 2028 at a compound annual growth rate (CAGR) of 8.8%. The anticipated growth during the forecast period is expected to stem from advancements in device functionality, a rising demand for minimally invasive procedures, an aging population, increasing healthcare spending, and the development of healthcare infrastructure in emerging markets. Key trends for this period include the integration of digital health and remote monitoring, the creation of next-generation devices with improved features, a rise in personalized and patient-centered cardiac solutions, a focus on cost-effectiveness and value-driven healthcare, an emphasis on preventive cardiology, and early interventions.

The increasing prevalence of heart diseases is expected to drive the growth of the implantable cardiac devices market. This rise can be linked to several risk factors, including unhealthy diets, sedentary lifestyles, obesity, and chronic conditions such as diabetes and hypertension. Furthermore, aging populations and elevated stress levels contribute to the higher incidence of cardiovascular issues. Implantable cardiac devices are essential for managing and treating conditions such as heart failure, arrhythmias, and coronary artery disease. The growing need for these devices fosters innovation and investment in the development of new and improved solutions to meet the demands of an expanding patient population and enhance treatment outcomes. For example, in May 2024, the Singapore Heart Foundation (SHF) reported that ischemic heart disease led to 5,302 deaths, a slight increase from 5,290 deaths in 2022. Consequently, the rising incidence of heart disease is propelling the growth of the implantable cardiac devices market.

Key companies in the implantable cardiac devices market are concentrating on improving compatibility with diagnostic tools, such as AutoMRI, to extend device lifespan and enhance patient safety. The AutoMRI feature in implantable cardiac defibrillators automatically adjusts device settings to ensure safe operation during MRI scans, thereby facilitating access to advanced imaging technology while enhancing patient care. For instance, in October 2023, MicroPort CRM, a France-based medical device company, launched the ULYS implantable cardioverter defibrillator (ICD) and INVICTA defibrillation leads in Japan. These products incorporate advanced technology with low current consumption for extended device lifespan and MRI compatibility. The ULYS ICD features the PARAD+ arrhythmia discrimination algorithm and AutoMRI functionality, while the INVICTA lead provides precise pacing and defibrillation therapy, boasting a 100% implantation success rate and a 97.4% complication-free rate in clinical trials.

In February 2022, Genesis MedTech Group, a Singapore-based medical device manufacturer, acquired JC Medical (JCM) for an undisclosed amount. This acquisition aims to enhance Genesis’s product portfolio by adding the J-Valve, a minimally invasive transcatheter aortic valve replacement (TAVR) device designed for patients with aortic regurgitation and stenosis. JC Medical (JCM) is a U.S.-based manufacturer specializing in structural heart devices and cardiac implants.

Major companies operating in the implantable cardiac devices market are Johnson & Johnson, Abbott Laboratories, Medtronic plc, Koninklijke Philips N.V., Stryker Corporation, Boston Scientific Corporation, B. Braun Melsungen AG, Edwards Lifesciences Corporation, Biotronik SE & Co. KG, Zoll Medical Corporation, Nihon Kohden Corporation, LivaNova plc, Lepu Medical Technology, MicroPort Scientific Corporation, AtriCure Inc., LifeTech Scientific Corporation, Berlin Heart GmbH, EBR Systems Inc., Defibtech LLC, CVRx Inc., Progetti Srl, Endotronix Inc., Jarvik Heart Inc., Xeltis AG, Carmat SA, Windmill Cardiovascular Systems Inc.

North America was the largest region in the implantable cardiac devices market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the implantable cardiac devices market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the implantable cardiac devices market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Implantable cardiac devices are medical instruments that are surgically inserted into the body to assist in the management of heart disorders, especially those associated with irregular heart rhythms (arrhythmias) or heart failure. These devices monitor cardiac activity and often provide electrical impulses to regulate or correct abnormal heartbeats.

The primary categories of implantable cardiac devices consist of pacemakers, implantable cardioverter defibrillators (ICDs), and biventricular implantable cardioverter defibrillators (BI-V ICDs). A pacemaker is a compact medical device positioned beneath the skin in the chest area, designed to manage irregular heartbeats by delivering electrical impulses that prompt the heart to maintain a normal rhythm when its natural pacemaker is inadequate. This device is essential in treating conditions such as bradycardia and various arrhythmias. Applications for these devices encompass bradycardia, tachycardia, heart failure, among others, catering to end users such as hospitals, specialty clinics, and more.

The implantable cardiac devices market research report is one of a series of new reports that provides implantable cardiac devices market statistics, including implantable cardiac devices industry global market size, regional shares, competitors with an implantable cardiac devices market share, detailed implantable cardiac devices market segments, market trends and opportunities, and any further data you may need to thrive in the implantable cardiac devices industry. This implantable cardiac devices market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The implantable cardiac devices market consists of sales of products including cardiac resynchronization therapy (CRT) devices, ventricular assist devices (VADs), and implantable heart monitors. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Implantable Cardiac Devices Global Market Report 2024 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on implantable cardiac devices market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50+ geographies.

- Understand how the market has been affected by the COVID-19 and how it is responding as the impact of the virus abates.

- Assess the Russia - Ukraine war’s impact on agriculture, energy and mineral commodity supply and its direct and indirect impact on the market.

- Measure the impact of high global inflation on market growth.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for implantable cardiac devices? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The implantable cardiac devices market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The impact of sanctions, supply chain disruptions, and altered demand for goods and services due to the Russian Ukraine war, impacting various macro-economic factors and parameters in the Eastern European region and its subsequent effect on global markets.

- The impact of higher inflation in many countries and the resulting spike in interest rates.

- The continued but declining impact of COVID-19 on supply chains and consumption patterns.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Pacemaker; Implantable Cardioverter Defibrillator (ICD); Biventricular Implantable Cardioverter Defibrillator (BI-V ICD)2) By Application: Bradycardia; Tachycardia; Heart Failure; Other Applications

3) By End User: Hospitals; Specialty Clinics; Other End Users

Key Companies Mentioned: Johnson & Johnson; Abbott Laboratories; Medtronic plc; Koninklijke Philips N.V.; Stryker Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies profiled in this Implantable Cardiac Devices market report include:- Johnson & Johnson

- Abbott Laboratories

- Medtronic plc

- Koninklijke Philips N.V.

- Stryker Corporation

- Boston Scientific Corporation

- B. Braun Melsungen AG

- Edwards Lifesciences Corporation

- Biotronik SE & Co. KG

- Zoll Medical Corporation

- Nihon Kohden Corporation

- LivaNova plc

- Lepu Medical Technology

- MicroPort Scientific Corporation

- AtriCure Inc.

- LifeTech Scientific Corporation

- Berlin Heart GmbH

- EBR Systems Inc.

- Defibtech LLC

- CVRx Inc.

- Progetti Srl

- Endotronix Inc.

- Jarvik Heart Inc.

- Xeltis AG

- Carmat SA

- Windmill Cardiovascular Systems Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | December 2024 |

| Forecast Period | 2024 - 2028 |

| Estimated Market Value ( USD | $ 12.34 Billion |

| Forecasted Market Value ( USD | $ 17.31 Billion |

| Compound Annual Growth Rate | 8.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |